Credit Builder Review

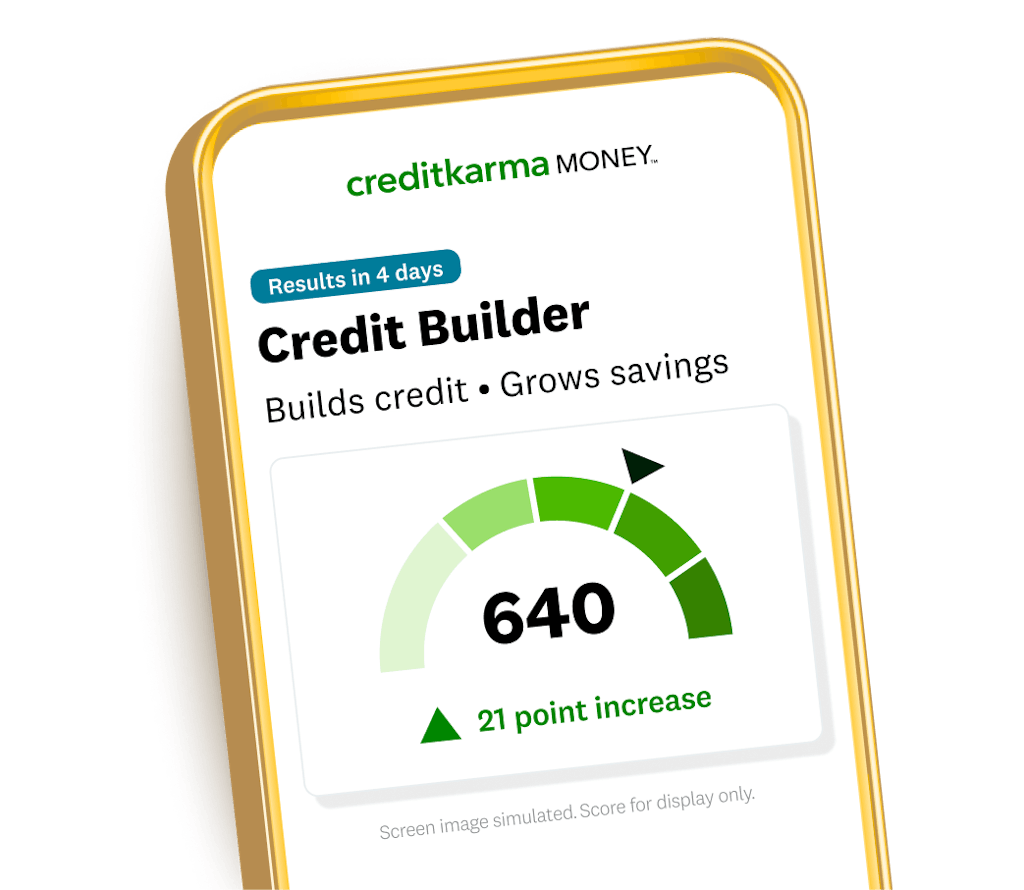

Credit Builder Review - Discover our 2024 review of credit karma credit builder, a tool meant to help users build their credit score without a traditional credit card. The chime credit builder visa secured credit card can help you build credit. The credit builder costs $5/mo, giving you access to a $750 credit line. When you apply for a credit builder loan, we will perform a soft credit pull to review certain financial information. Credit karma credit builder is a credit builder that lets you build credit and savings simultaneously. With the chime credit builder card, your chime checking account is linked to the card, lowering your risk of exceeding your credit limit. You get to open a savings account and a $1,000 line of credit with it. With few fees and no minimum security deposit, the chime credit builder secured visa is a simple, accessible, and inexpensive way to get a credit card and begin building or. Our creditcards.com experts reviewed hundreds of credit building card offers based on several factors. Do you want to improve your credit score without having to spend? With few fees and no minimum security deposit, the chime credit builder secured visa is a simple, accessible, and inexpensive way to get a credit card and begin building or. Users then use this line of credit. You get to open a savings account and a $1,000 line of credit with it. But there are some things to know about it before signing up. Annual fees, deposit and credit score requirements, interest rates,. The credit builder costs $5/mo, giving you access to a $750 credit line. Self offers a full suite of credit building tools and services. Read our 2025 review of self credit builder to learn about its features, benefits, and how it can help improve your credit score. Check out our chime credit builder review to learn if this site can help you. Ava credit builder review jobs. Credit karma credit builder is a credit builder that lets you build credit and savings simultaneously. Do you want to improve your credit score without having to spend? Discover our 2024 review of credit karma credit builder, a tool meant to help users build their credit score without a traditional credit card. The credit builder costs $5/mo, giving you access. See how we rate credit score services to help you make smart decisions with your money. Read our 2025 review of self credit builder to learn about its features, benefits, and how it can help improve your credit score. Users then use this line of credit. Self offers a full suite of credit building tools and services. But there are. Read our 2025 review of self credit builder to learn about its features, benefits, and how it can help improve your credit score. Users then use this line of credit. You get to open a savings account and a $1,000 line of credit with it. Self offers a full suite of credit building tools and services. Credit karma credit builder. Check out our chime credit builder review to learn if this site can help you. You get to open a savings account and a $1,000 line of credit with it. With the chime credit builder card, your chime checking account is linked to the card, lowering your risk of exceeding your credit limit. Credit karma credit builder is a credit. Our chime credit builder review can help you determine if this secured credit card is the right solution for you. Users then use this line of credit. With few fees and no minimum security deposit, the chime credit builder secured visa is a simple, accessible, and inexpensive way to get a credit card and begin building or. Ava credit builder. Building an excellent credit score allows you to borrow money, secure rental leases, and pay lower insurance. Our creditcards.com experts reviewed hundreds of credit building card offers based on several factors. But there are some things to know about it before signing up. Self offers a full suite of credit building tools and services. Do you want to improve your. Check out our chime credit builder review to learn if this site can help you. You get to open a savings account and a $1,000 line of credit with it. Do you want to improve your credit score without having to spend? Kikoff is a credit builder that offers a credit line you can use to purchase items from the. Self offers a full suite of credit building tools and services. With few fees and no minimum security deposit, the chime credit builder secured visa is a simple, accessible, and inexpensive way to get a credit card and begin building or. But there are some things to know about it before signing up. Discover our 2024 review of credit karma. Building an excellent credit score allows you to borrow money, secure rental leases, and pay lower insurance. Our chime credit builder review can help you determine if this secured credit card is the right solution for you. The credit builder costs $5/mo, giving you access to a $750 credit line. You get to open a savings account and a $1,000. But there are some things to know about it before signing up. You get to open a savings account and a $1,000 line of credit with it. Our creditcards.com experts reviewed hundreds of credit building card offers based on several factors. Credit karma credit builder is a credit builder that lets you build credit and savings simultaneously. Users then use. Users then use this line of credit. Credit karma credit builder is a credit builder that lets you build credit and savings simultaneously. With the chime credit builder card, your chime checking account is linked to the card, lowering your risk of exceeding your credit limit. The credit builder costs $5/mo, giving you access to a $750 credit line. Do you want to improve your credit score without having to spend? Our chime credit builder review can help you determine if this secured credit card is the right solution for you. Annual fees, deposit and credit score requirements, interest rates,. See how we rate credit score services to help you make smart decisions with your money. This soft inquiry has no impact to your credit score and may or may not. Building an excellent credit score allows you to borrow money, secure rental leases, and pay lower insurance. Discover our 2024 review of credit karma credit builder, a tool meant to help users build their credit score without a traditional credit card. With few fees and no minimum security deposit, the chime credit builder secured visa is a simple, accessible, and inexpensive way to get a credit card and begin building or. When you apply for a credit builder loan, we will perform a soft credit pull to review certain financial information. The chime credit builder visa secured credit card can help you build credit. You get to open a savings account and a $1,000 line of credit with it. Kikoff is a credit builder that offers a credit line you can use to purchase items from the kikoff store.Credit Karma Credit Builder Review 2025 The Essential Guide

Chime Credit Builder Review Can It Really Improve Your Credit?

Creditup Credit Builder Review! THE QUICK, EASY WAY TO GET THE CREDIT

Chime Credit Builder Review Is This Service Worth Using?

Self Credit Builder Review For 2023 Your Money Ratios

No Hard Pull Easy Credit Builder Account For 25/Month Mission Lane

Cheese Credit Builder Review 2023 Build Credit and Savings

Chime Credit Builder Review 2023 Best Secured Credit Card?

Self.inc Credit Builder Review

Chime Credit Builder Review 2023 My Honest Pros and Cons YouTube

Check Out Our Chime Credit Builder Review To Learn If This Site Can Help You.

Self Offers A Full Suite Of Credit Building Tools And Services.

Read Our 2025 Review Of Self Credit Builder To Learn About Its Features, Benefits, And How It Can Help Improve Your Credit Score.

Ava Credit Builder Review Jobs.

Related Post: