Credit Building Loans For Bad Credit

Credit Building Loans For Bad Credit - It’s a way to create a good. This loan program kicks your credit building into high gear. You can use these types of loans to build. At republic bank, our credit builder program may help you improve your credit score in. Rise works with individuals with a variety of credit histories, offering a solution that balances flexibility with. This fintech company requires a minimum credit score of. Happy money offers the best personal loan for borrowers with bad credit, earning a moneygeek score of 94 out of 100. People with poor credit scores — or no credit history at all — can and do get qualified for auto loans. Consider these tips when comparing personal loans for bad credit: Get personalized rates in 60 seconds for credit builder loans for bad credit, without affecting your credit score. Rates listed are for this product only and are. ¹apr = annual percentage rate. This fintech company requires a minimum credit score of. Build or rebuild your credit rating as you build savings. Because interest rates largely depend on your qualifying credit. People with poor credit scores — or no credit history at all — can and do get qualified for auto loans. Taking out a loan and paying it back on time and in full can do wonders for. Bad credit loans, aka credit builder loans, help people with a bad credit score build up their credit score. Borrow from $500 to $3,000 for 12 to 24 months. Happy money offers the best personal loan for borrowers with bad credit, earning a moneygeek score of 94 out of 100. Borrow from $500 to $3,000 for 12 to 24 months. Bad credit loans generally come with fixed rates and are offered by lenders willing to loan you funds despite your limiting credit rating. Get personalized rates in 60 seconds for credit builder loans for bad credit, without affecting your credit score. People with poor credit scores — or no credit. Taking out a loan and paying it back on time and in full can do wonders for. Consider these tips when comparing personal loans for bad credit: Because interest rates largely depend on your qualifying credit. Borrow from $500 to $3,000 for 12 to 24 months. Making good financial decisions requires. You can use these types of loans to build. Rates listed are for this product only and are. Instead, the products offered through our platform look beyond your fico credit score to analyze your overall creditworthiness when it comes to. Bad credit loans generally come with fixed rates and are offered by lenders willing to loan you funds despite your. Build or rebuild your credit rating as you build savings. Happy money offers the best personal loan for borrowers with bad credit, earning a moneygeek score of 94 out of 100. This fintech company requires a minimum credit score of. Taking out a loan and paying it back on time and in full can do wonders for. Consider these tips. Taking out a loan and paying it back on time and in full can do wonders for. Bad credit loans generally come with fixed rates and are offered by lenders willing to loan you funds despite your limiting credit rating. Get personalized rates in 60 seconds for credit builder loans for bad credit, without affecting your credit score. In fact,. Instead, the products offered through our platform look beyond your fico credit score to analyze your overall creditworthiness when it comes to. Rise works with individuals with a variety of credit histories, offering a solution that balances flexibility with. Taking out a loan and paying it back on time and in full can do wonders for. Bad credit loans generally. At republic bank, our credit builder program may help you improve your credit score in. Taking out a loan and paying it back on time and in full can do wonders for. Rise works with individuals with a variety of credit histories, offering a solution that balances flexibility with. You can use these types of loans to build. Happy money. This fintech company requires a minimum credit score of. You can use these types of loans to build. This loan program kicks your credit building into high gear. It’s a way to create a good. Get personalized rates in 60 seconds for credit builder loans for bad credit, without affecting your credit score. At republic bank, our credit builder program may help you improve your credit score in. You can use these types of loans to build. Borrow from $500 to $3,000 for 12 to 24 months. Rates listed are for this product only and are. People with poor credit scores — or no credit history at all — can and do get. This fintech company requires a minimum credit score of. This loan program kicks your credit building into high gear. People with poor credit scores — or no credit history at all — can and do get qualified for auto loans. Build or rebuild your credit rating as you build savings. Consider these tips when comparing personal loans for bad credit: But how can you build one if you have experienced poor payment history or have no credit history at all? In fact, there’s no real minimum credit score needed for an auto loan. At republic bank, our credit builder program may help you improve your credit score in. Bad credit loans, aka credit builder loans, help people with a bad credit score build up their credit score. Build or rebuild your credit rating as you build savings. Happy money offers the best personal loan for borrowers with bad credit, earning a moneygeek score of 94 out of 100. Get personalized rates in 60 seconds for credit builder loans for bad credit, without affecting your credit score. Consider these tips when comparing personal loans for bad credit: Bad credit loans generally come with fixed rates and are offered by lenders willing to loan you funds despite your limiting credit rating. Making good financial decisions requires. Among consumers with a credit record, 21.2 percent financed at least one purchase with a bnpl loan, up from 17.6 percent in. How much would you like to finance? People with poor credit scores — or no credit history at all — can and do get qualified for auto loans. Borrow from $500 to $3,000 for 12 to 24 months. ¹apr = annual percentage rate. Opploans does not offer bad credit loans.What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

Credit Builder Loan Money Federal Credit Union bad credit loans

How to Build Credit Self. Credit Builder.

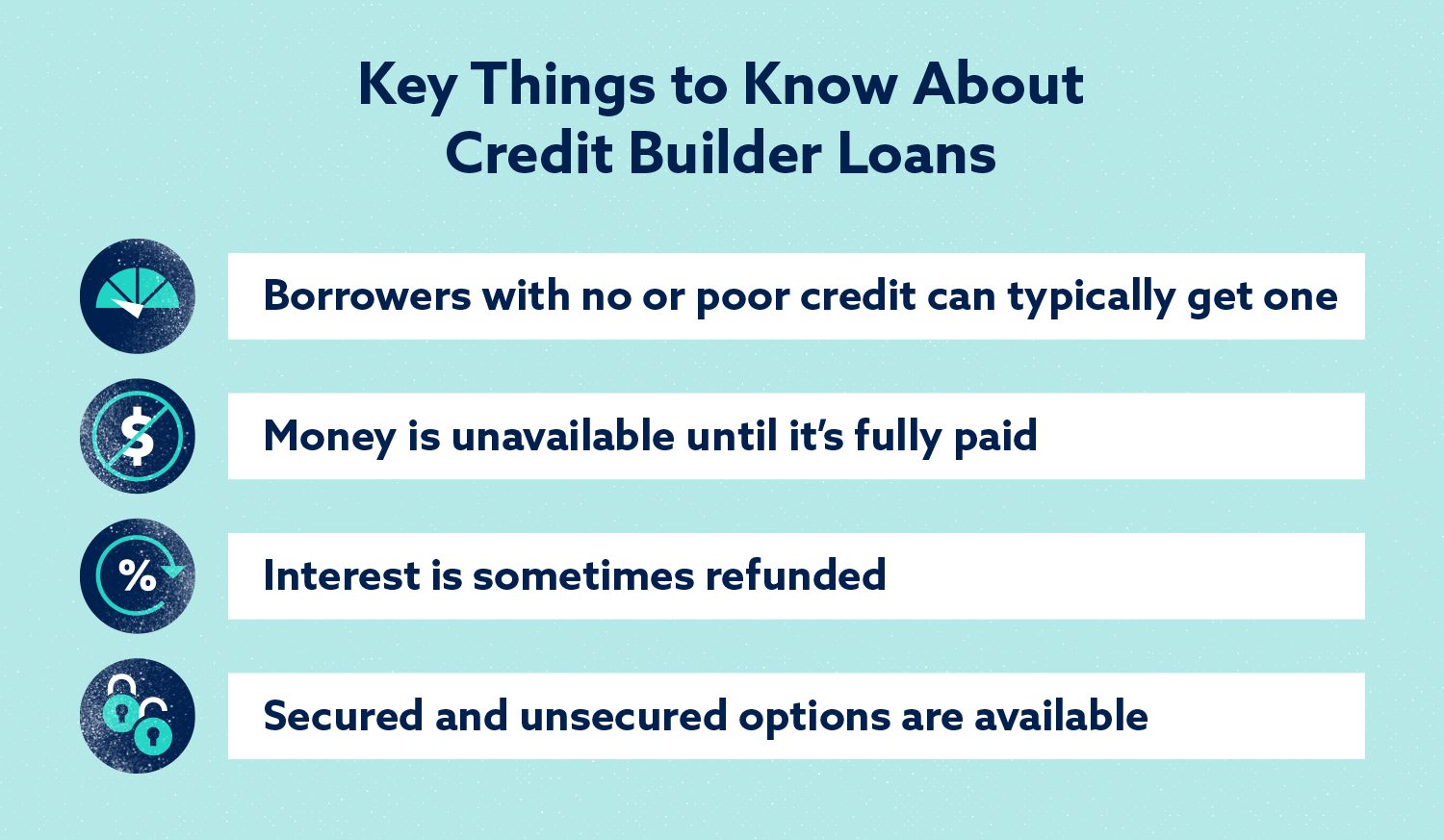

What is a Credit Builder Loan and Do They Work? Lexington Law

Can a Personal Loan Build Your Credit? How Borrowing Can Boost Your

Credit Building Loans — Morehead Community Federal Credit Union

What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

Credit Building Cards for Bad Credit

What is a Credit Builder Loan and How Does it Work?

How to Get a Loan With Bad Credit A Guide CentSai Loans for bad

Rise Works With Individuals With A Variety Of Credit Histories, Offering A Solution That Balances Flexibility With.

Taking Out A Loan And Paying It Back On Time And In Full Can Do Wonders For.

It’s A Way To Create A Good.

You Can Use These Types Of Loans To Build.

Related Post: