Credit Building Programs

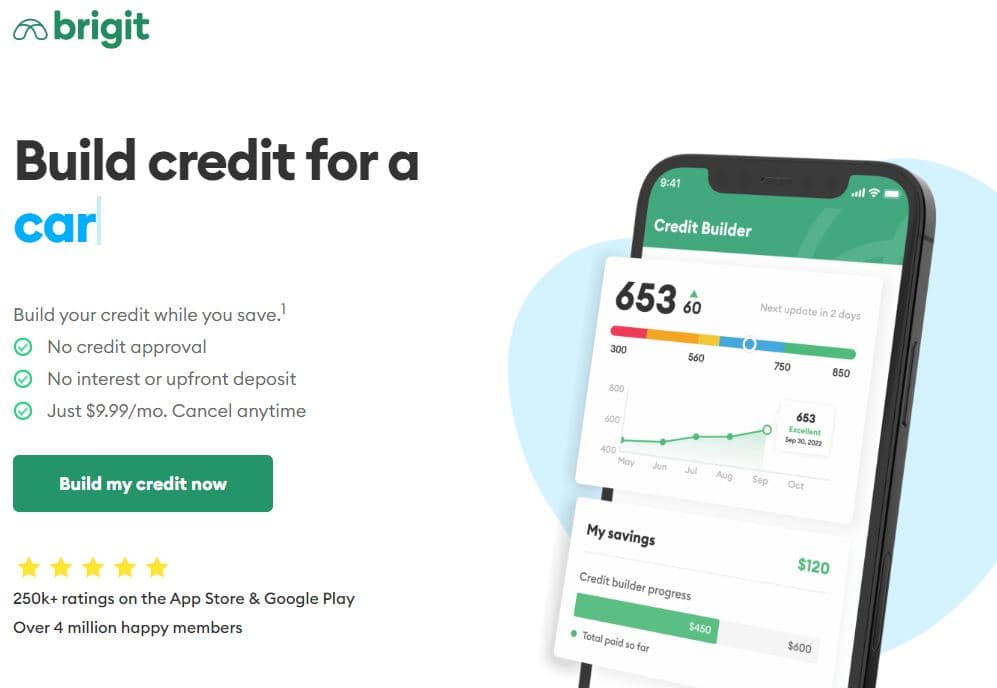

Credit Building Programs - About the money basics guide serieswelcome to the ncua’s money basics guide to building and maintaining credit! Provides flexible, custom debt financing solutions; Here are a few credit builder programs you can compare alongside your bank's programs. Data was sourced from credit score data from over 34,365 members with an active loan between january 1, 2021, and. Credit builder utilizes a line of credit to help you save money. Over the coming decade, the nsf regional innovation engines (nsf engines) program — led by the nsf directorate for technology, innovation and partnerships (tip) —. Every payment you make to pay off the balance on your line of credit is reported as a payment to the credit bureaus. In collaboration with community partners across the u.s., capital one’s credit building program. A dmp helps make debt repayment simple and affordable for anyone feeling. Building credit is a key step toward financial health and independence. Provides flexible, custom debt financing solutions; The average american has a credit score of 717, as reported by the credit scoring service. Every payment you make to pay off the balance on your line of credit is reported as a payment to the credit bureaus. Close exit site if you are in danger, please use a. A dmp helps make debt repayment simple and affordable for anyone feeling. Cook county class 9 program offers a 50% reduction in assessments and taxes to developers who complete major rehab on multifamily buildings and keep rent below certain levels. The money basics guides are a series of learning. What is the capital one credit building program and how does it work? Over the coming decade, the nsf regional innovation engines (nsf engines) program — led by the nsf directorate for technology, innovation and partnerships (tip) —. Credit scores are independently determined by credit bureaus. The average american has a credit score of 717, as reported by the credit scoring service. The money basics guides are a series of learning. What is the capital one credit building program and how does it work? Over the coming decade, the nsf regional innovation engines (nsf engines) program — led by the nsf directorate for technology, innovation and. We also discuss bankruptcy, credit reports, credit scores, budgeting, and identity theft. What is the capital one credit building program and how does it work? Data was sourced from credit score data from over 34,365 members with an active loan between january 1, 2021, and. Close exit site if you are in danger, please use a. Mmi's debt management plan. Provides flexible, custom debt financing solutions; We also discuss bankruptcy, credit reports, credit scores, budgeting, and identity theft. Over the coming decade, the nsf regional innovation engines (nsf engines) program — led by the nsf directorate for technology, innovation and partnerships (tip) —. Building credit is a key step toward financial health and independence. Every payment you make to pay. Close exit site if you are in danger, please use a. The average american has a credit score of 717, as reported by the credit scoring service. The money basics guides are a series of learning. Data was sourced from credit score data from over 34,365 members with an active loan between january 1, 2021, and. Cook county class 9. Over the coming decade, the nsf regional innovation engines (nsf engines) program — led by the nsf directorate for technology, innovation and partnerships (tip) —. What is the capital one credit building program and how does it work? Provides flexible, custom debt financing solutions; In collaboration with community partners across the u.s., capital one’s credit building program. We also discuss. Mmi's debt management plan (dmp) can help you resolve your credit problems and repay your debt. In collaboration with community partners across the u.s., capital one’s credit building program. The average american has a credit score of 717, as reported by the credit scoring service. Data was sourced from credit score data from over 34,365 members with an active loan. About the money basics guide serieswelcome to the ncua’s money basics guide to building and maintaining credit! Close exit site if you are in danger, please use a. Credit builder utilizes a line of credit to help you save money. Building credit is a key step toward financial health and independence. The average american has a credit score of 717,. The money basics guides are a series of learning. Provides flexible, custom debt financing solutions; Mmi's debt management plan (dmp) can help you resolve your credit problems and repay your debt. Over the coming decade, the nsf regional innovation engines (nsf engines) program — led by the nsf directorate for technology, innovation and partnerships (tip) —. What is the capital. Data was sourced from credit score data from over 34,365 members with an active loan between january 1, 2021, and. Credit scores are independently determined by credit bureaus. In collaboration with community partners across the u.s., capital one’s credit building program. Cook county class 9 program offers a 50% reduction in assessments and taxes to developers who complete major rehab. Building credit is a key step toward financial health and independence. In collaboration with community partners across the u.s., capital one’s credit building program. What is the capital one credit building program and how does it work? Provides flexible, custom debt financing solutions; The average american has a credit score of 717, as reported by the credit scoring service. In collaboration with community partners across the u.s., capital one’s credit building program. Building credit is a key step toward financial health and independence. Mmi's debt management plan (dmp) can help you resolve your credit problems and repay your debt. Over the coming decade, the nsf regional innovation engines (nsf engines) program — led by the nsf directorate for technology, innovation and partnerships (tip) —. The average american has a credit score of 717, as reported by the credit scoring service. Credit builder utilizes a line of credit to help you save money. Provides flexible, custom debt financing solutions; Every payment you make to pay off the balance on your line of credit is reported as a payment to the credit bureaus. We also discuss bankruptcy, credit reports, credit scores, budgeting, and identity theft. About the money basics guide serieswelcome to the ncua’s money basics guide to building and maintaining credit! Here are a few credit builder programs you can compare alongside your bank's programs. A dmp helps make debt repayment simple and affordable for anyone feeling. Care presentations focus on the smart use of credit, including both credit cards and student loans. What is the capital one credit building program and how does it work? The money basics guides are a series of learning.6 Best Credit Building Apps [CreditBuilding Loans and DebitAsCredit

Credit Building 101 Consumer Facing Curriculum (Download) CBA

Business Credit Building Program Building Corporate Credit

10 Best Credit Builder Programs to Boost Your Score in 2024

Capital One Credit Building Program Capital One

What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

10 Best Credit Building Apps in 2024 Personally Ranked & Reviewed

Build Your Credit Express Credit Union

How to Build Credit Self. Credit Builder. (2024)

Credit Building App Credit Builder Program MoneyLion

Credit Scores Are Independently Determined By Credit Bureaus.

Data Was Sourced From Credit Score Data From Over 34,365 Members With An Active Loan Between January 1, 2021, And.

Close Exit Site If You Are In Danger, Please Use A.

Cook County Class 9 Program Offers A 50% Reduction In Assessments And Taxes To Developers Who Complete Major Rehab On Multifamily Buildings And Keep Rent Below Certain Levels.

Related Post: