Credit Card Builder Reviews

Credit Card Builder Reviews - The chime credit builder secured visa credit card offers a twist on the traditional secured credit card. It’s a secured card with no fees* or minimum security deposit** and. Let’s dig into the details of the chime credit builder visa credit card, including its benefits and drawbacks, to see whether it makes sense for you. With almost no fees and no minimum deposit 1, the card_name can help remove most of the typical barriers to entry for credit builders. And you won’t have to pay any interest or annual fees. We review it and three top alternatives to help you decide if the chime approach makes. Large amounts of debt will hurt your credit score and general finances. Our chime credit builder review can help you determine if this secured credit card is the right solution for you. And while the card is marketed as a student credit card, you can still. Our creditcards.com experts reviewed hundreds of credit building card offers based on several factors. Is the secured chime credit builder visa ® credit card a good card for you? The chime credit builder secured visa® credit card is a relatively new spin on secured cards that has easier access by removing a minimum security deposit, many major credit card fees. One credit card’s budget planner can be a handy tool for this purpose. And you won’t have to pay any interest or annual fees. The secured chime credit builder visa ® credit card may be a good choice if you want to build or repair your credit and you already have a chime checking or savings account. And while the card is marketed as a student credit card, you can still. However, those who want to earn rewards or eventually. Firstcard® secured credit builder card with cashback is an excellent way for students to begin their credit journey. Let’s dig into the details of the chime credit builder visa credit card, including its benefits and drawbacks, to see whether it makes sense for you. Never carry a balance on your card that you can’t afford to pay off in a couple of months. And may be used everywhere visa credit cards are accepted. Our creditcards.com experts reviewed hundreds of credit building card offers based on several factors. Firstcard® secured credit builder card with cashback is an excellent way for students to begin their credit journey. Is the secured chime credit builder visa ® credit card a good card for you? And while the. Our creditcards.com experts reviewed hundreds of credit building card offers based on several factors. And while the card is marketed as a student credit card, you can still. Let’s dig into the details of the chime credit builder visa credit card, including its benefits and drawbacks, to see whether it makes sense for you. The chime credit builder secured visa®. Large amounts of debt will hurt your credit score and general finances. The secured chime credit builder visa® credit card is a secured credit card that doesn’t require a credit check for approval. And may be used everywhere visa credit cards are accepted. The secured chime credit builder credit card is issued by the bancorp bank, n.a. The only requirement. Is the secured chime credit builder visa ® credit card a good card for you? It’s a secured card with no fees* or minimum security deposit** and. Managing debt is crucial when using a credit card to build credit. Its specialized features will help you build credit and unlock more attractive financing on major purchases. Since we first pioneered the. However, those who want to earn rewards or eventually. Never carry a balance on your card that you can’t afford to pay off in a couple of months. People looking to build credit on a budget may appreciate the chime credit builder secured visa credit card. The chime credit builder secured visa® credit card is a relatively new spin on. People looking to build credit on a budget may appreciate the chime credit builder secured visa credit card. Large amounts of debt will hurt your credit score and general finances. And you won’t have to pay any interest or annual fees. One credit card’s budget planner can be a handy tool for this purpose. The secured chime credit builder visa. Since we first pioneered the concept of online credit card reviews in 1998, our. Among your card options, the chime credit builder secured visa® credit card is a noteworthy choice, with unique features that set it apart from the competition. We review it and three top alternatives to help you decide if the chime approach makes. And you won’t have. We review it and three top alternatives to help you decide if the chime approach makes. It’s a secured card with no fees* or minimum security deposit** and. Let’s dig into the details of the chime credit builder visa credit card, including its benefits and drawbacks, to see whether it makes sense for you. Is the secured chime credit builder. It’s a secured card with no fees* or minimum security deposit** and. The chime credit builder secured visa credit card offers a twist on the traditional secured credit card. Among your card options, the chime credit builder secured visa® credit card is a noteworthy choice, with unique features that set it apart from the competition. Since we first pioneered the. With almost no fees and no minimum deposit 1, the card_name can help remove most of the typical barriers to entry for credit builders. The chime credit builder secured visa credit card offers a twist on the traditional secured credit card. We review it and three top alternatives to help you decide if the chime approach makes. The secured chime. Managing debt is crucial when using a credit card to build credit. The chime credit builder³ is a fantastic choice for this as it has no annual fee, doesn’t charge interest¹ and there’s no credit check needed. Never carry a balance on your card that you can’t afford to pay off in a couple of months. But with the right financial product, you can build credit with no credit history or repair bad credit over time. Among your card options, the chime credit builder secured visa® credit card is a noteworthy choice, with unique features that set it apart from the competition. Its specialized features will help you build credit and unlock more attractive financing on major purchases. Firstcard® secured credit builder card with cashback is an excellent way for students to begin their credit journey. We review it and three top alternatives to help you decide if the chime approach makes. The chime credit builder secured visa credit card offers a twist on the traditional secured credit card. The secured chime credit builder credit card is issued by the bancorp bank, n.a. Or stride bank, n.a., pursuant to a license from visa u.s.a. However, those who want to earn rewards or eventually. Let’s dig into the details of the chime credit builder visa credit card, including its benefits and drawbacks, to see whether it makes sense for you. The secured chime credit builder visa® credit card is a secured credit card that doesn’t require a credit check for approval. Our chime credit builder review can help you determine if this secured credit card is the right solution for you. And you won’t have to pay any interest or annual fees.Credit Builder Card Review Reveals Hard Truths (2025)

Chime Credit Builder Review 2023 Best Secured Credit Card?

Chime Credit Builder Credit Card Review LendEDU

Chime Credit Builder Secured Visa® Credit Card Review

Chime Credit Builder Card Review A Secured Card With Guardrails

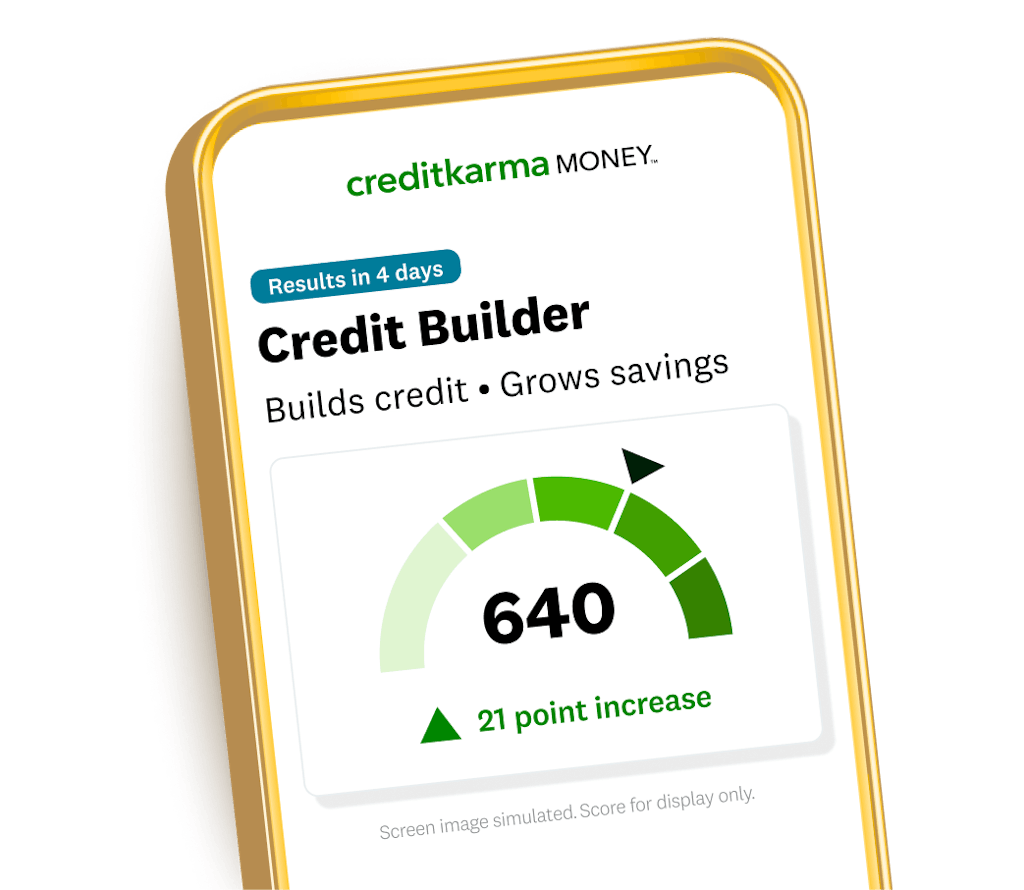

Credit Karma Credit Builder Review 2025 The Essential Guide

Chime Credit Builder Credit Card Review Build Credit

Extra Debit Card Reviews How To Build Credit Fast With Extra Debit

Chime Credit Builder Card Review 2023 Build Credit From ZERO YouTube

Chime Credit Builder Card Review 2022 Build Credit From ZERO YouTube

Our Creditcards.com Experts Reviewed Hundreds Of Credit Building Card Offers Based On Several Factors.

The Secured Chime Credit Builder Visa ® Credit Card May Be A Good Choice If You Want To Build Or Repair Your Credit And You Already Have A Chime Checking Or Savings Account.

It’s A Secured Card With No Fees* Or Minimum Security Deposit** And.

Please See The Back Of Your Card For Its Issuing Bank.

Related Post: