Credit Card For Minors To Build Credit

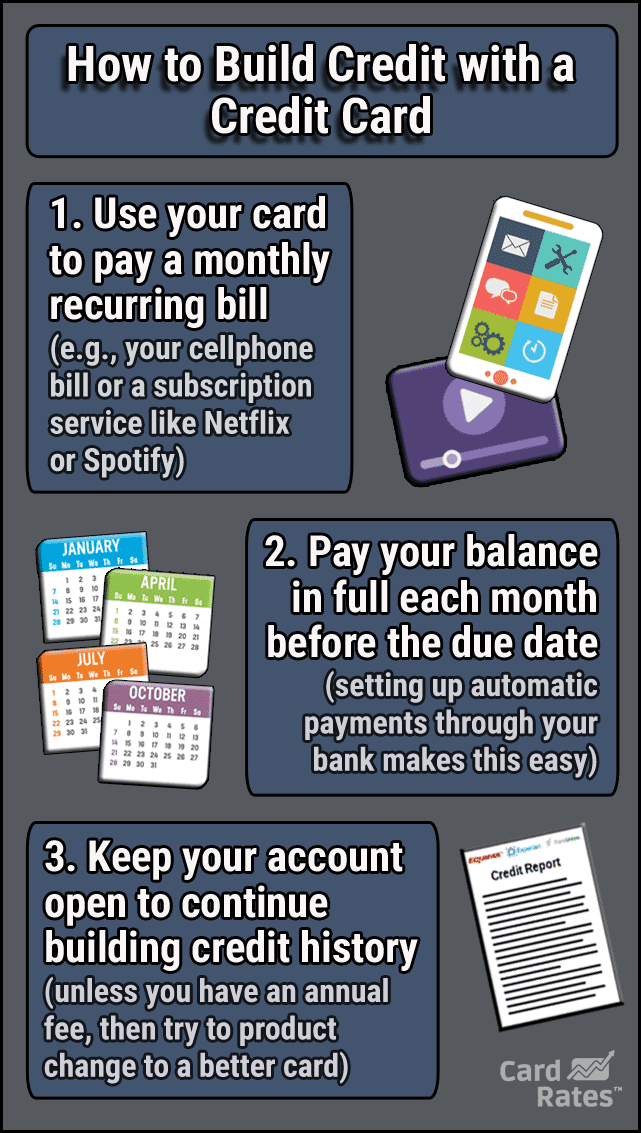

Credit Card For Minors To Build Credit - A credit card is one of the easiest ways to build credit, and it can also be a great way to repair your credit if your score has taken a dip. It’s a fact—you need credit to get credit. Earn up to $500 a year by referring friends and family when they're approved for a capital one credit card. We uncovered which credit cards allow teens 13 and older to be added as authorized users. Any credit card that allows authorized users under the age of 18 can help minors build credit. When you pay off your bill on time each. Choosing the best credit card for minors under 18 involves selecting cards that help build credit, have minimal fees, offer rewards, and include robust parental controls and. It can result in a series of foibles and missteps,. Your deposit is returned to you when you close your credit card account or. I did it with my own teens and lived to tell the tale. But just how old do you have to be to start earning points and miles and building up your credit score with a credit card? A credit card is one of the easiest ways to build credit, and it can also be a great way to repair your credit if your score has taken a dip. When you pay off your bill on time each. Suitable for students at a. It can result in a series of foibles and missteps,. What are the best credit cards for teenagers to build credit? Adding a child as an authorized user is. A student or young adult can only take out a credit card in their own. While minors can’t apply for a credit card on their own, it’s relatively easy for a. Whether rebuilding or trying to establish credit when you have none, falling for a myth can hurt one's effort to build credit. Your deposit is returned to you when you close your credit card account or. A student or young adult can only take out a credit card in their own. How old do you have to be to get a credit. We uncovered which credit cards allow teens 13 and older to be added as authorized users. $6 to $15 a. Because of their typically lower credit limits, a student credit card can be one way to help teens build credit history responsibly and with less risk. One of the best credit cards for teenagers to build credit with is the capital one platinum credit card because it has. It can result in a series of foibles and missteps,. Choosing the. One first step for teenagers to build credit involves riding on the coattails of their parents through becoming an authorized user on an existing credit card. These kinds of cards may also. You can find our picks for the best teen credit cards. Any credit card that allows authorized users under the age of 18 can help minors build credit.. Choosing the best credit card for minors under 18 involves selecting cards that help build credit, have minimal fees, offer rewards, and include robust parental controls and. Any credit card that allows authorized users under the age of 18 can help minors build credit. A student or young adult can only take out a credit card in their own. But. It’s a fact—you need credit to get credit. I did it with my own teens and lived to tell the tale. Any credit card that allows authorized users under the age of 18 can help minors build credit. Choosing the best credit card for minors under 18 involves selecting cards that help build credit, have minimal fees, offer rewards, and. Here’s our selections for the best credit cards for teens in 2025. Getting credit cards for kids can boost their financial literacy and build their credit history. Although you need to be 18 or older to open a credit card account, your child does not have to be 18 to start building their credit. Suitable for students at a. Adding. Because of their typically lower credit limits, a student credit card can be one way to help teens build credit history responsibly and with less risk. I did it with my own teens and lived to tell the tale. Suitable for students at a. When you purchase through links on. Earn up to $500 a year by referring friends and. Although you need to be 18 or older to open a credit card account, your child does not have to be 18 to start building their credit. 1% cash back for purchases, up. Earn up to $500 a year by referring friends and family when they're approved for a capital one credit card. Most credit cards aren’t available to applicants. These kinds of cards may also. How old do you have to be to get a credit. $6 to $15 a month, for up to five children free trial: An additional card is unnecessary if you want to build your child’s credit history or improve their credit score. Build your credit with responsible card use. Although you need to be 18 or older to open a credit card account, your child does not have to be 18 to start building their credit. While minors can’t apply for a credit card on their own, it’s relatively easy for a. It can result in a series of foibles and missteps,. Here’s our selections for the best credit. When you pay off your bill on time each. A credit card is one of the easiest ways to build credit, and it can also be a great way to repair your credit if your score has taken a dip. Teenagers don’t have as many credit card options, but these best credit cards for teens are accessible, rewarding and packed with other benefits. Any credit card that allows authorized users under the age of 18 can help minors build credit. Whether rebuilding or trying to establish credit when you have none, falling for a myth can hurt one's effort to build credit. Getting credit cards for kids can boost their financial literacy and build their credit history. Perhaps the easiest way to help a child build credit is to add him/her onto your existing credit card account as an authorized user. A student or young adult can only take out a credit card in their own. Most credit cards aren’t available to applicants who lack credit. One first step for teenagers to build credit involves riding on the coattails of their parents through becoming an authorized user on an existing credit card. Although you need to be 18 or older to open a credit card account, your child does not have to be 18 to start building their credit. Parents who want to give their teens a head start on credit histories, teach them valuable financial skills, and provide them with other monetary perks, should consider the best. When you purchase through links on. 1% cash back for purchases, up. Build your credit with responsible card use. You can find our picks for the best teen credit cards.The Top 20 Debit Cards For Kids Help Me Build Credit

27 Best “Starter” Credit Cards (2020)

9 Best Credit Cards for Building Credit in 2023

The Best Starter Cards for Building Your Credit U.S. News

Best Credit Cards for Kids [Build Credit & Money Habits Early]

Best Credit Cards for Minors Under 18

The Top 20 Debit Cards For Kids Help Me Build Credit

Credit Cards For Minors Under 18 Flik Eco

7 Best Credit Cards For Building Credit (2024)

Best Credit Cards for Young People to Build Credit

While Minors Can’t Apply For A Credit Card On Their Own, It’s Relatively Easy For A.

Because Of Their Typically Lower Credit Limits, A Student Credit Card Can Be One Way To Help Teens Build Credit History Responsibly And With Less Risk.

I Did It With My Own Teens And Lived To Tell The Tale.

It’s A Fact—You Need Credit To Get Credit.

Related Post:

![Best Credit Cards for Kids [Build Credit & Money Habits Early]](https://youngandtheinvested.com/wp-content/uploads/acorns-early-signup.webp)