Creditscoreiq Vs Credit Builder

Creditscoreiq Vs Credit Builder - With its medium trust score on our chart, we determined it has a low risk. I see no indication anywhere of what scoring model credit. A credit score of 670 may be a good credit score for a credit card, while a credit score of 700 will get you the best interest rates for a mortgage loan. I’ll ask around about credit iq in the meantime while you get back to me. But i'm trying to find out if this credit iq is legit as well. Some might be a better option then. Should i open a credit builder account, get a secure credit card, or both? The average american has a credit score of 717, as reported by the credit scoring service. A good fico credit score. Seems like a waste of time to gamble with that. Seems like a waste of time to gamble with that. It's a $1 subscription for the trial, and freecash is offering $4 something to do it. It won't increase your credit score by more than a few points. The evolving importance of credit at. I see no indication anywhere of what scoring model credit. A credit score of 670 may be a good credit score for a credit card, while a credit score of 700 will get you the best interest rates for a mortgage loan. I've been using it (free version) for years and recommend it to lots of people. But i'm trying to find out if this credit iq is legit as well. I’ll ask around about credit iq in the meantime while you get back to me. The discussion touched on the rise in popularity of credit builder products in recent years and the novel approaches some fintech companies have taken. Seems like a waste of time to gamble with that. Credit builder accounts don’t grow as your credit improves, they offer no rewards, and as they’re usually fintech companies their customer service sucks. A good fico credit score. The discussion touched on the rise in popularity of credit builder products in recent years and the novel approaches some fintech companies. The evolving importance of credit at. Credit builder accounts don’t grow as your credit improves, they offer no rewards, and as they’re usually fintech companies their customer service sucks. But i'm trying to find out if this credit iq is legit as well. Your credit scores can help determine if you qualify for a loan and what interest rates you. Seems like a waste of time to gamble with that. Should i open a credit builder account, get a secure credit card, or both? I’ll ask around about credit iq in the meantime while you get back to me. I see no indication anywhere of what scoring model credit. Your credit scores can help determine if you qualify for a. The average american has a credit score of 717, as reported by the credit scoring service. The evolving importance of credit at. But i'm trying to find out if this credit iq is legit as well. With its medium trust score on our chart, we determined it has a low risk. Some might be a better option then. If you start your account with creditscore.com and experian.com 2 weeks apart. Seems like a waste of time to gamble with that. Credit builder accounts don’t grow as your credit improves, they offer no rewards, and as they’re usually fintech companies their customer service sucks. I see no indication anywhere of what scoring model credit. The evolving importance of credit. It's a $1 subscription for the trial, and freecash is offering $4 something to do it. In my experience, most successful landlords are pretty smart. If you start your account with creditscore.com and experian.com 2 weeks apart. Credit builder accounts don’t grow as your credit improves, they offer no rewards, and as they’re usually fintech companies their customer service sucks.. Should i open a credit builder account, get a secure credit card, or both? The evolving importance of credit at. The discussion touched on the rise in popularity of credit builder products in recent years and the novel approaches some fintech companies have taken. Credit builder accounts don’t grow as your credit improves, they offer no rewards, and as they’re. I see no indication anywhere of what scoring model credit. If you start your account with creditscore.com and experian.com 2 weeks apart. But i'm trying to find out if this credit iq is legit as well. Seems like a waste of time to gamble with that. Your credit scores can help determine if you qualify for a loan and what. But i'm trying to find out if this credit iq is legit as well. Some might be a better option then. I’ll ask around about credit iq in the meantime while you get back to me. A credit score of 670 may be a good credit score for a credit card, while a credit score of 700 will get you. Seems like a waste of time to gamble with that. I’ll ask around about credit iq in the meantime while you get back to me. It's a $1 subscription for the trial, and freecash is offering $4 something to do it. A credit score of 670 may be a good credit score for a credit card, while a credit score. Your credit scores can help determine if you qualify for a loan and what interest rates you receive. I've been using it (free version) for years and recommend it to lots of people. A credit score of 670 may be a good credit score for a credit card, while a credit score of 700 will get you the best interest rates for a mortgage loan. Would a loan on a vehicle help build my credit once it’s high enough to get a good rate? Some might be a better option then. A good fico credit score. It won't increase your credit score by more than a few points. With its medium trust score on our chart, we determined it has a low risk. The average american has a credit score of 717, as reported by the credit scoring service. Credit builder accounts don’t grow as your credit improves, they offer no rewards, and as they’re usually fintech companies their customer service sucks. It's a $1 subscription for the trial, and freecash is offering $4 something to do it. Should i open a credit builder account, get a secure credit card, or both? Seems like a waste of time to gamble with that. If you start your account with creditscore.com and experian.com 2 weeks apart. In my experience, most successful landlords are pretty smart. The credit builder loan is for people that have no credit or bad credit.CreditScoreIQ by IDIQ Credit Management Tools

Credit Rating Vs Credit Score

Credit Report VS Credit Score in 2022 Credit repair business, Credit

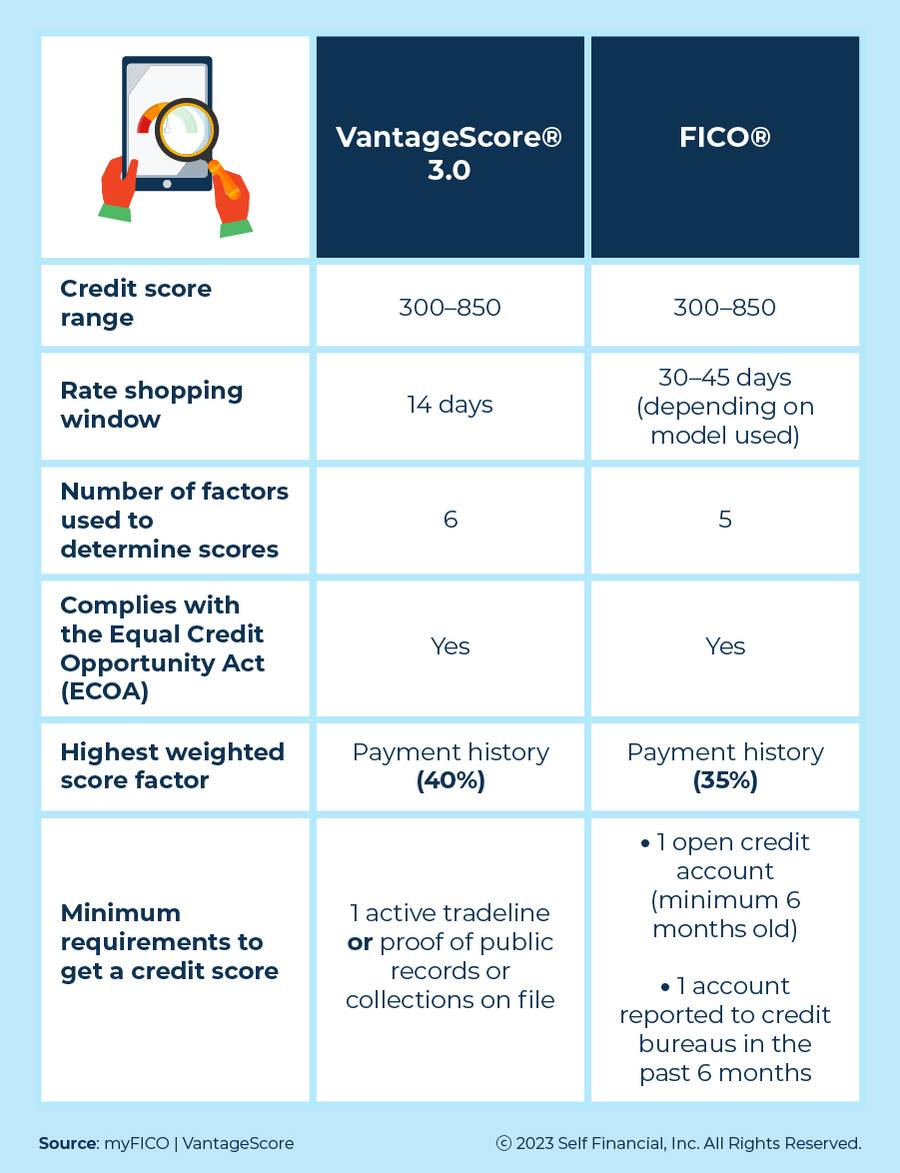

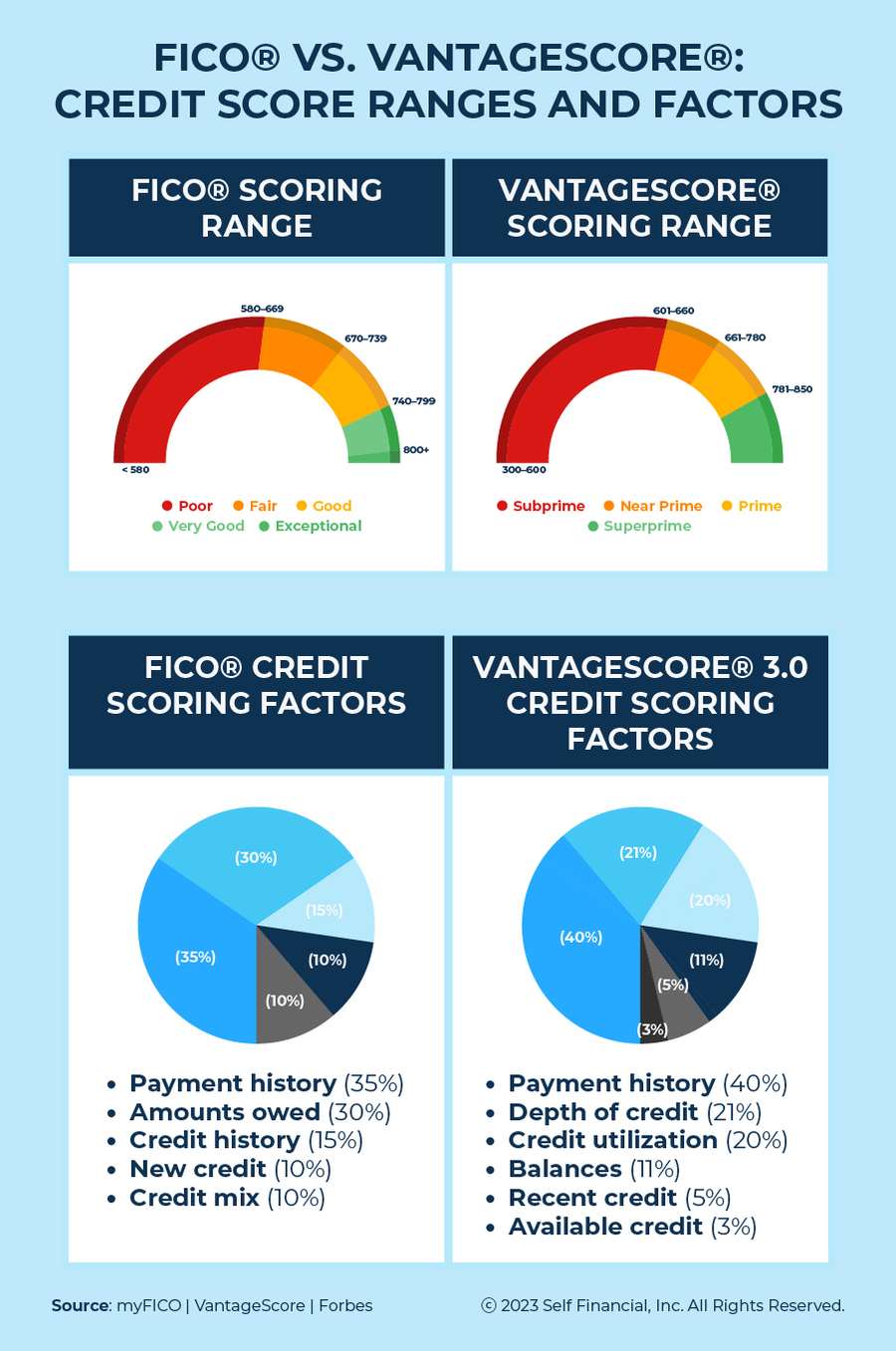

VantageScore® vs. FICO® How Credit Score Models Differ Self. Credit

FICO Score vs. Credit Score What’s the Difference?

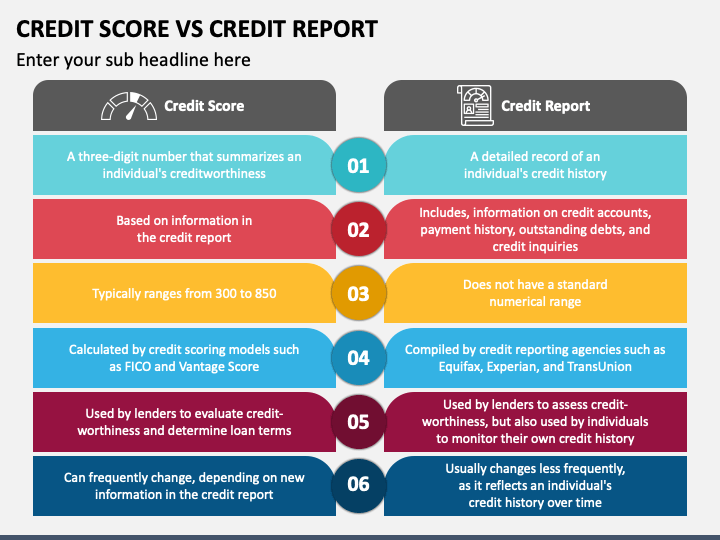

Credit Score vs. Credit Report What to Know Capital One

Credit Rating vs. Credit Score Credello

Credit Score Vs Credit Report PowerPoint and Google Slides Template

Credit Score vs Credit Report Know the difference for financial success

VantageScore® vs. FICO® How Credit Score Models Differ Self. Credit

I See No Indication Anywhere Of What Scoring Model Credit.

I’ll Ask Around About Credit Iq In The Meantime While You Get Back To Me.

The Discussion Touched On The Rise In Popularity Of Credit Builder Products In Recent Years And The Novel Approaches Some Fintech Companies Have Taken.

But I'm Trying To Find Out If This Credit Iq Is Legit As Well.

Related Post: