Debt To Equity Building Block

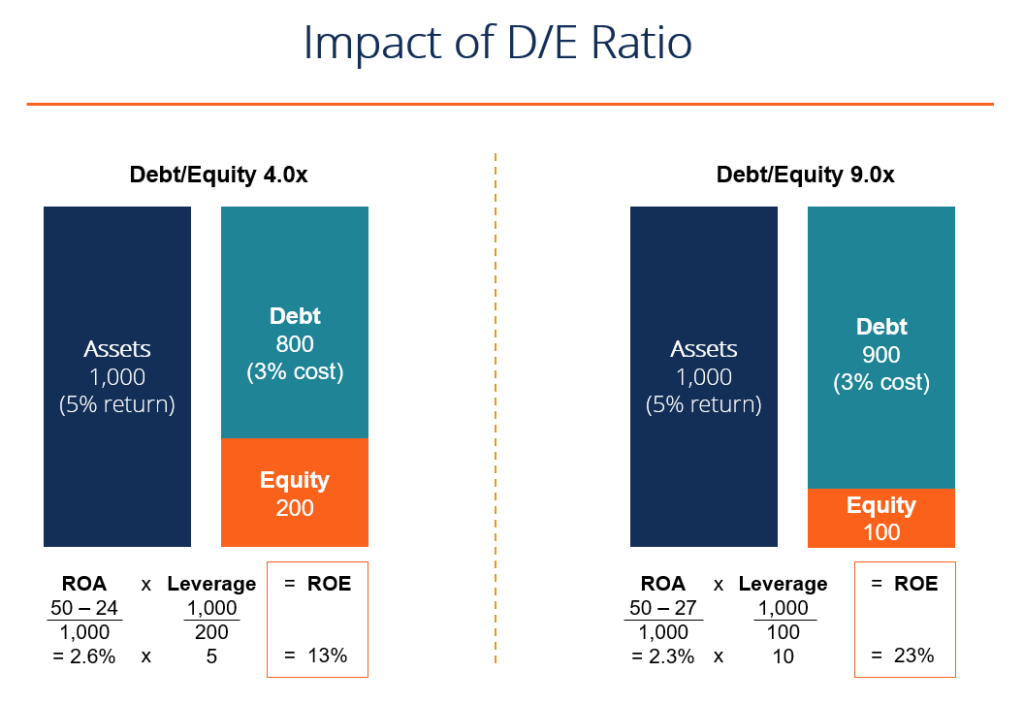

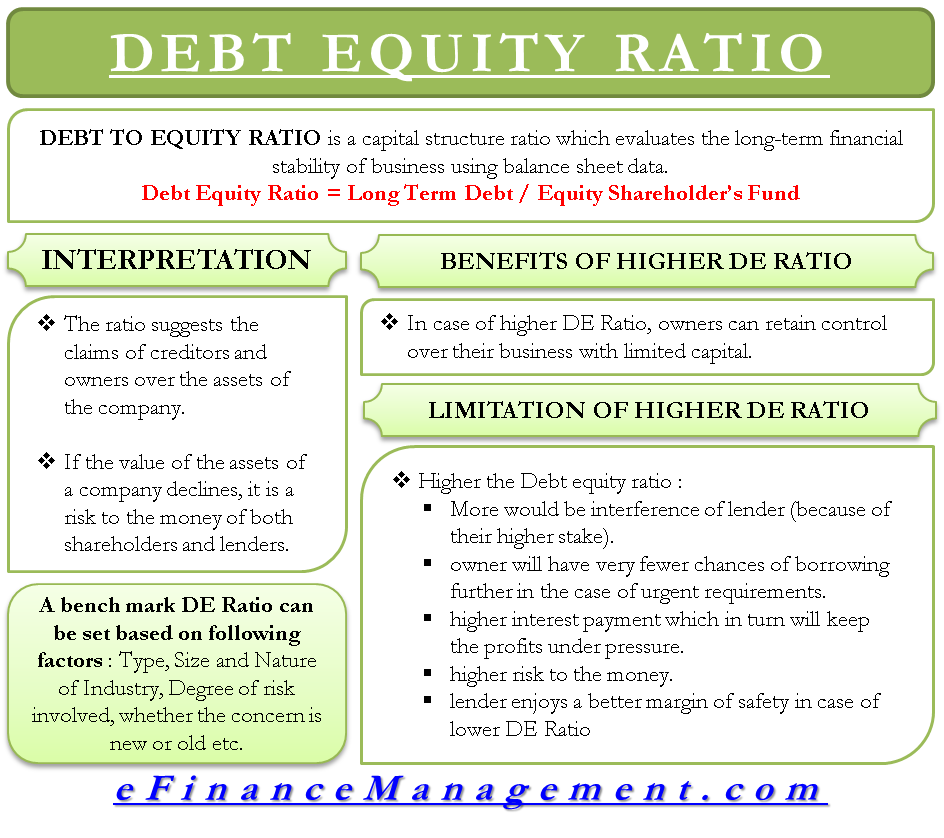

Debt To Equity Building Block - Return on total assets 3. It provides insights into a company's financial. Debt holders have a higher priority than equity holders on the claims of the company’s assets and value, so. Up to 3.2% cash back what is the debt to equity ratio? For each ratio, select the building block of financial statement analysis to which it best relates. Return on total assets 3 equity ratio 4. Understand how to calculate it and interpret the balance between. Learn how businesses structure it to balance risk and returns. The debt/equity ratio is a financial metric that measures the proportion of a company's total debt to its shareholders' equity. The core building blocks of financial theory encompass a wide array of topics, including risk and return, time value of money, capital structure, portfolio theory, market efficiency, and. Return on total assets 3 equity ratio 4. The debt/equity ratio is a financial metric that measures the proportion of a company's total debt to its shareholders' equity. For each ratio, select the building block of financial statement analysis to which it best relates. For each ratio, select the building block of financial statement analysis to which it best relates. Up to 3.2% cash back the capital stack is the hierarchy of debt and equity financing companies use to fund growth. Learn how businesses structure it to balance risk and returns. The core building blocks of financial theory encompass a wide array of topics, including risk and return, time value of money, capital structure, portfolio theory, market efficiency, and. Return on total assets 3. Understand how to calculate it and interpret the balance between. Up to 3.2% cash back what is the debt to equity ratio? Understand how to calculate it and interpret the balance between. The core building blocks of financial theory encompass a wide array of topics, including risk and return, time value of money, capital structure, portfolio theory, market efficiency, and. Return on total assets 3. For each ratio, select the building block of financial statement analysis to which it best relates. In. Up to 3.2% cash back what is the debt to equity ratio? This ratio shows the company’s total debt in relation to its shareholders' equity and helps them understand the company’s financial stability over the long. In the united states, private credit funds grew by 20% annually in the five years to 2023, reaching $1.6 trillion by the middle of. Debt holders have a higher priority than equity holders on the claims of the company’s assets and value, so. It provides insights into a company's financial. Return on total assets 3. Up to 3.2% cash back what is the debt to equity ratio? Up to 3.2% cash back the capital stack is the hierarchy of debt and equity financing companies. Return on total assets 3. It provides insights into a company's financial. Learn how businesses structure it to balance risk and returns. Debt holders have a higher priority than equity holders on the claims of the company’s assets and value, so. Money that has been lent to the company by another person or institution. This ratio shows the company’s total debt in relation to its shareholders' equity and helps them understand the company’s financial stability over the long. For each ratio, select the building block of financial statement analysis to which it best relates. Understand how to calculate it and interpret the balance between. Return on total assets 3 equity ratio 4. Debt holders. The debt/equity ratio is a financial metric that measures the proportion of a company's total debt to its shareholders' equity. Money that has been lent to the company by another person or institution. The core building blocks of financial theory encompass a wide array of topics, including risk and return, time value of money, capital structure, portfolio theory, market efficiency,. Understand how to calculate it and interpret the balance between. In the united states, private credit funds grew by 20% annually in the five years to 2023, reaching $1.6 trillion by the middle of that year, according to the international monetary. For each ratio, select the building block of financial statement analysis to which it best relates. Return on total. Understand how to calculate it and interpret the balance between. For each ratio, select the building block of financial statement analysis to which it best relates. It provides insights into a company's financial. In the united states, private credit funds grew by 20% annually in the five years to 2023, reaching $1.6 trillion by the middle of that year, according. This ratio shows the company’s total debt in relation to its shareholders' equity and helps them understand the company’s financial stability over the long. Up to 3.2% cash back the capital stack is the hierarchy of debt and equity financing companies use to fund growth. In the united states, private credit funds grew by 20% annually in the five years. In the united states, private credit funds grew by 20% annually in the five years to 2023, reaching $1.6 trillion by the middle of that year, according to the international monetary. Learn how businesses structure it to balance risk and returns. For each ratio, select the building block of financial statement analysis to which it best relates. It provides insights. Understand how to calculate it and interpret the balance between. The core building blocks of financial theory encompass a wide array of topics, including risk and return, time value of money, capital structure, portfolio theory, market efficiency, and. In the united states, private credit funds grew by 20% annually in the five years to 2023, reaching $1.6 trillion by the middle of that year, according to the international monetary. Return on total assets 3 equity ratio 4. For each ratio, select the building block of financial statement analysis to which it best relates. Learn how businesses structure it to balance risk and returns. Money that has been lent to the company by another person or institution. The debt/equity ratio is a financial metric that measures the proportion of a company's total debt to its shareholders' equity. This ratio shows the company’s total debt in relation to its shareholders' equity and helps them understand the company’s financial stability over the long. It provides insights into a company's financial. Up to 3.2% cash back the capital stack is the hierarchy of debt and equity financing companies use to fund growth. For each ratio, select the building block of financial statement analysis to which it best relates.How can companies optimize their capital structure with equity

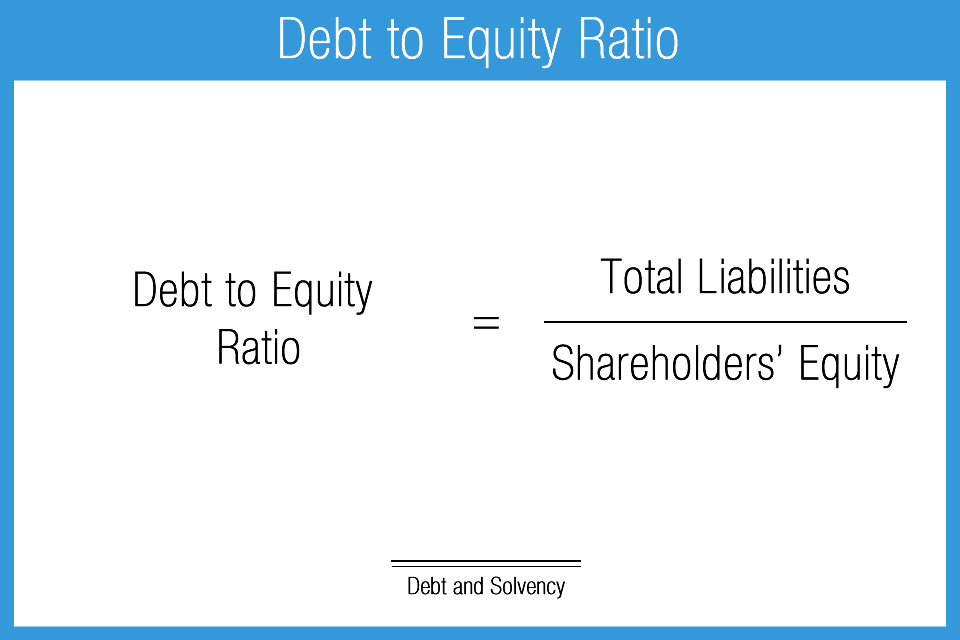

Debt to Equity Ratio How to Calculate Leverage, Formula, Examples

Debt to Equity Ratio Calculation, Interpretation, Pros & Cons

DebttoEquity (D/E) Ratio Formula and How to Interpret It

Debt to equity ratio company fundamental review financial liabilities

Debt to Equity Ratio Formula Calculator (Examples with Excel Template)

What is DebttoEquity (D/E) Ratio and How to Calculate It?

Debt to Equity Ratio, Demystified

DebttoEquity (D/E) Ratio Definition and Formula

Debt to Equity Ratio Accounting Play

Up To 3.2% Cash Back What Is The Debt To Equity Ratio?

Return On Total Assets 3.

Debt Holders Have A Higher Priority Than Equity Holders On The Claims Of The Company’s Assets And Value, So.

Related Post:

:max_bytes(150000):strip_icc()/debtequityratio_final-86f5e125b5a3459db4c19855481f4fc6.png)

:max_bytes(150000):strip_icc()/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)