Depreciation Building Calculator

Depreciation Building Calculator - Calculate a property's depreciation rate and expense amount using this free online macrs depreciation calculator with printable depreciation schedule. How to calculate fixed asset depreciation. Whether you’re a business owner, accountant, or student, this free online tool. Understanding building depreciation is essential for property investors, business owners, and tax professionals. By knowing the applicable rates and how to calculate. Only the value of the building itself can be depreciated; Utilize our depreciation calculator to determine your allowable annual depreciation for your real estate investment property and find your accumulated depreciation total which will be subject. Building a depreciation dashboard in excel. Methods to calculate depreciation in real estate. This depreciation calculator can use either the straight line or declining balance method to calculate depreciation over the useful life or recovery period. For organizations looking to calculate depreciation, following a structured approach ensures accuracy and compliance. This depreciation calculator can use either the straight line or declining balance method to calculate depreciation over the useful life or recovery period. With this handy calculator, you can calculate the depreciation schedule for depreciable property using modified accelerated cost recovery system (macrs). The calculator supports sl, db, ddb, or syd methods. Macrs offers the general depreciation system (gds) and the alternative. The cares act correction made qip eligible for bonus depreciation, enabling accelerated cost recovery for building improvements. Welcome to our depreciation calculator —your ultimate tool for simplifying depreciation calculations. Use our depreciation calculator to calculate a depreciation schedule for an asset. 10 years, placed in service: How to calculate fixed asset depreciation. Free depreciation calculator using the straight line, declining balance, or sum of the year's digits methods with the option of partial year depreciation. Welcome to our depreciation calculator —your ultimate tool for simplifying depreciation calculations. With this handy calculator, you can calculate the depreciation schedule for depreciable property using modified accelerated cost recovery system (macrs). Building a depreciation dashboard in. The land on which it sits is not eligible for depreciation. Whether you’re a business owner, accountant, or student, this free online tool. This depreciation calculator estimates how fast the value of an asset decreases over time. Only the value of the building itself can be depreciated; There are several methods for calculating equipment depreciation. The cares act correction made qip eligible for bonus depreciation, enabling accelerated cost recovery for building improvements. Utilize our depreciation calculator to determine your allowable annual depreciation for your real estate investment property and find your accumulated depreciation total which will be subject. Free depreciation calculator using the straight line, declining balance, or sum of the year's digits methods with. The tool also estimates the depreciation of a. 10 years, placed in service: Free depreciation calculator using the straight line, declining balance, or sum of the year's digits methods with the option of partial year depreciation. This depreciation calculator estimates how fast the value of an asset decreases over time. Welcome to our depreciation calculator —your ultimate tool for simplifying. Macrs offers the general depreciation system (gds) and the alternative. The land on which it sits is not eligible for depreciation. Choosing the right depreciation method for a bathroom remodel affects financial outcomes. Welcome to our depreciation calculator —your ultimate tool for simplifying depreciation calculations. 10 years, placed in service: With this handy calculator, you can calculate the depreciation schedule for depreciable property using modified accelerated cost recovery system (macrs). Only the value of the building itself can be depreciated; Use our depreciation calculator to calculate a depreciation schedule for an asset. The calculator supports sl, db, ddb, or syd methods. Choosing the right depreciation method for a bathroom remodel. By knowing the applicable rates and how to calculate. Enter the purchase price, number of years, annual depreciation rate, and depreciation method. For organizations looking to calculate depreciation, following a structured approach ensures accuracy and compliance. The calculator supports sl, db, ddb, or syd methods. Utilize our depreciation calculator to determine your allowable annual depreciation for your real estate investment. How to calculate equipment depreciation. Use our depreciation calculator today to accurately assess the depreciation of your assets and ensure your financial statements reflect their true value. With this handy calculator, you can calculate the depreciation schedule for depreciable property using modified accelerated cost recovery system (macrs). Click calculate depreciation to calculate the depreciation schedule. Use our depreciation calculator to. The property depreciation calculator will instantly estimate the depreciation value for your residential, rental, and commercial properties. For organizations looking to calculate depreciation, following a structured approach ensures accuracy and compliance. Building a depreciation dashboard in excel. The tool also estimates the depreciation of a. This depreciation calculator estimates how fast the value of an asset decreases over time. By offering multiple depreciation methods, it provides a detailed depreciation schedule tailored to. Building a depreciation dashboard in excel. For organizations looking to calculate depreciation, following a structured approach ensures accuracy and compliance. How to calculate equipment depreciation. Understanding building depreciation is essential for property investors, business owners, and tax professionals. Our smart depreciation calculator lets you compute the yearly depreciation and determine the value of an asset after a certain amount time has passed. Utilize our depreciation calculator to determine your allowable annual depreciation for your real estate investment property and find your accumulated depreciation total which will be subject. Building a depreciation dashboard in excel. For organizations looking to calculate depreciation, following a structured approach ensures accuracy and compliance. The tool also estimates the depreciation of a. This depreciation calculator can use either the straight line or declining balance method to calculate depreciation over the useful life or recovery period. Use our depreciation calculator to calculate a depreciation schedule for an asset. Use our depreciation calculator today to accurately assess the depreciation of your assets and ensure your financial statements reflect their true value. Free depreciation calculator using the straight line, declining balance, or sum of the year's digits methods with the option of partial year depreciation. By knowing the applicable rates and how to calculate. Macrs offers the general depreciation system (gds) and the alternative. The property depreciation calculator will instantly estimate the depreciation value for your residential, rental, and commercial properties. Whether you’re a business owner, accountant, or student, this free online tool. Methods to calculate depreciation in real estate. The calculator supports sl, db, ddb, or syd methods. The cares act correction made qip eligible for bonus depreciation, enabling accelerated cost recovery for building improvements.Depreciation for Building Definition, Formula, and Excel Examples

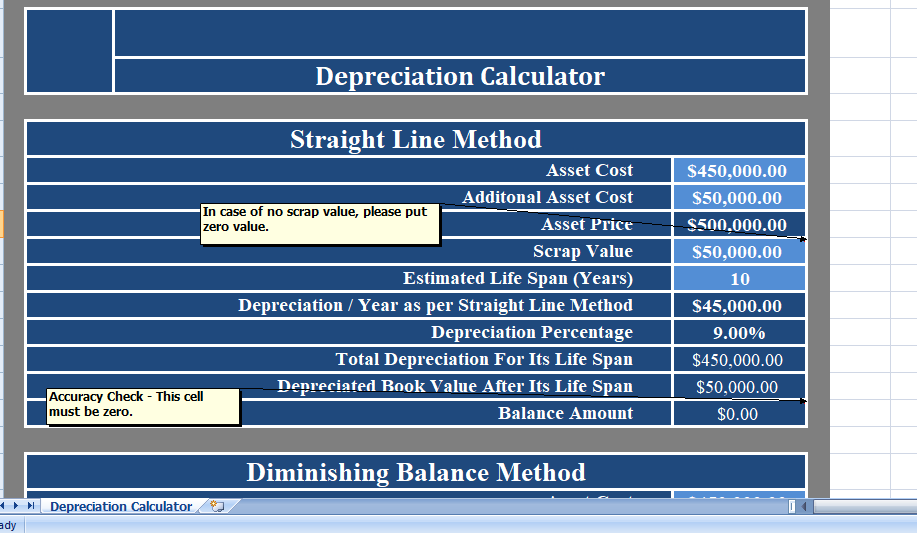

Calculate Depreciation Expense Formula, Examples, Calculator

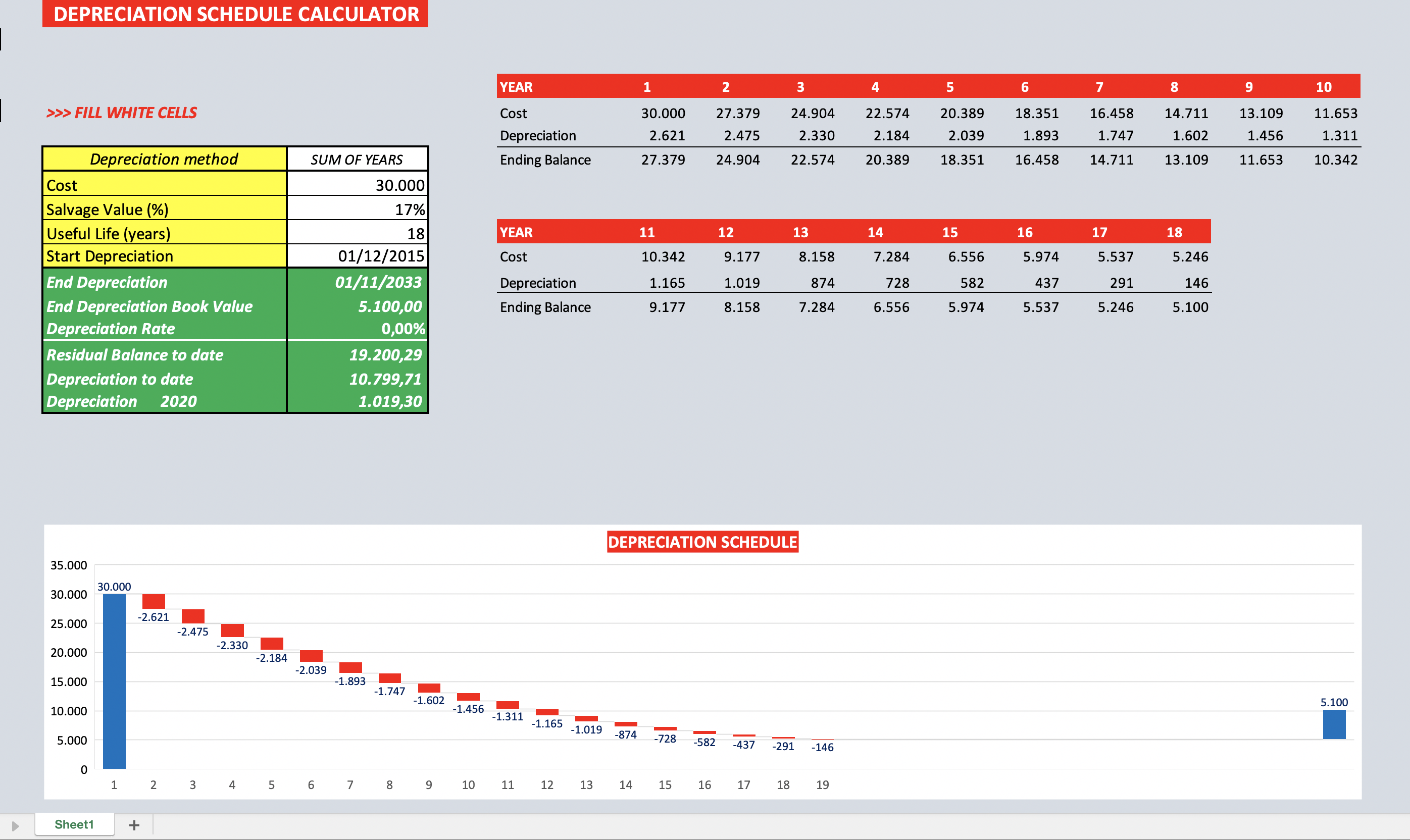

Depreciation Schedule Calculator Eloquens

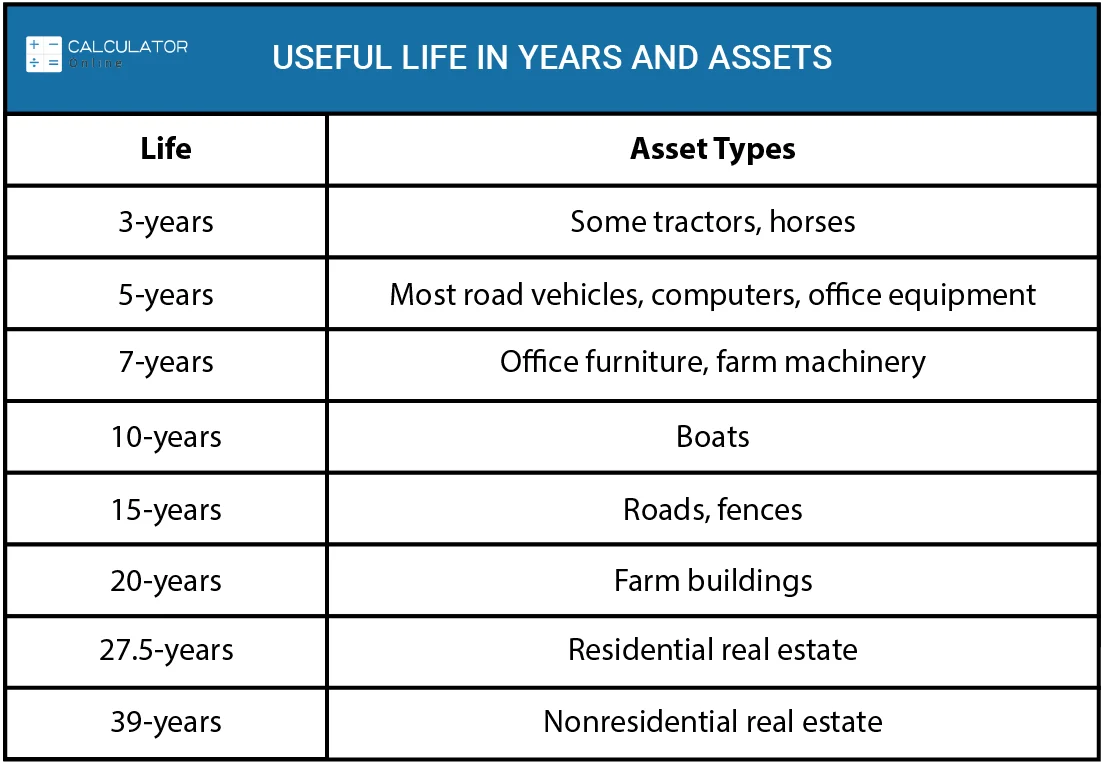

8 ways to calculate depreciation in Excel Journal of Accountancy

Straight Line Depreciation Formula Calculator (Excel template)

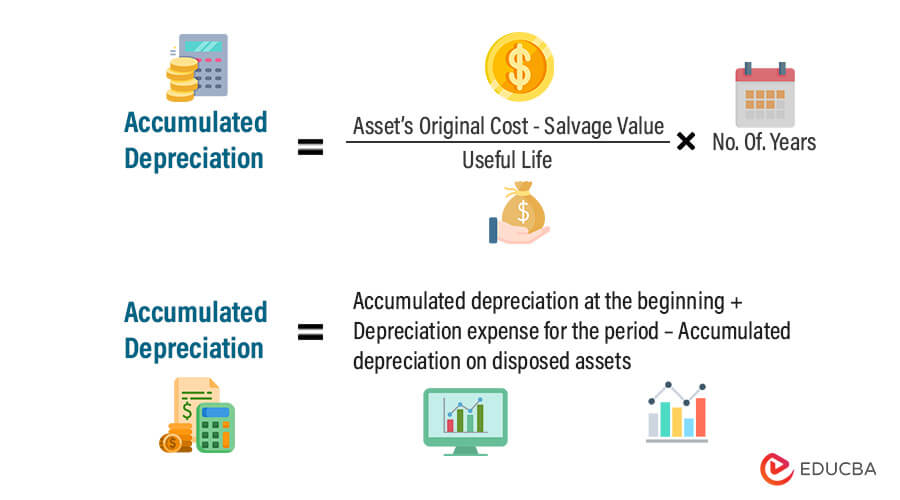

Accumulated Depreciation Formula Calculator (with Excel Template)

MACRS Depreciation Calculator

DepreciationCalculator Excel templates

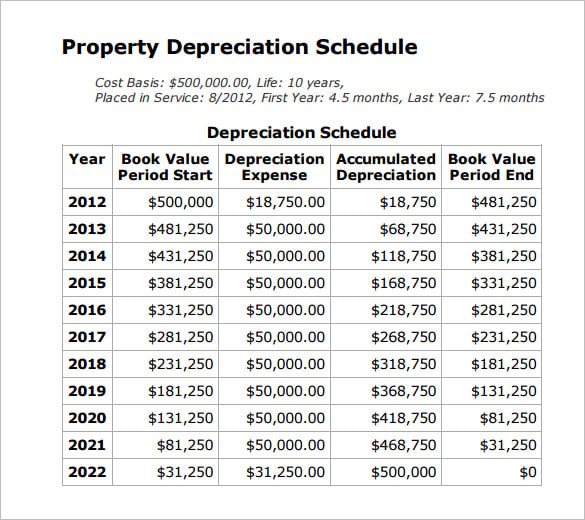

Depreciation Schedule Template 9+ Free Word, Excel, PDF Format Download!

Depreciation for Building Definition, Formula, and Excel Examples

This Depreciation Calculator Estimates How Fast The Value Of An Asset Decreases Over Time.

Welcome To Our Depreciation Calculator —Your Ultimate Tool For Simplifying Depreciation Calculations.

This Accumulated Depreciation Calculator Will Help You Calculate A Fixed Asset's Total Depreciated Value.

Enter The Purchase Price, Number Of Years, Annual Depreciation Rate, And Depreciation Method.

Related Post: