Depreciation Farm Buildings

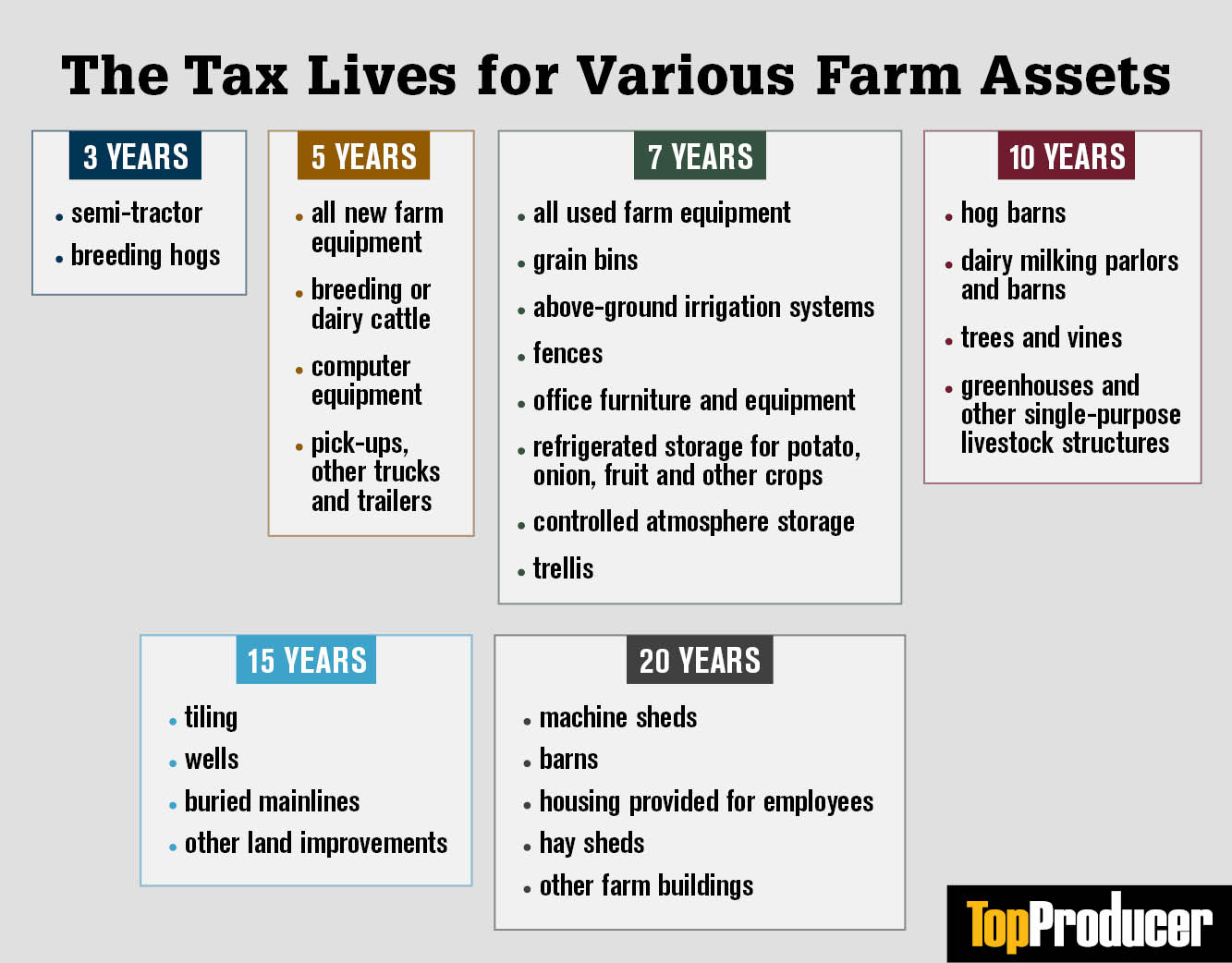

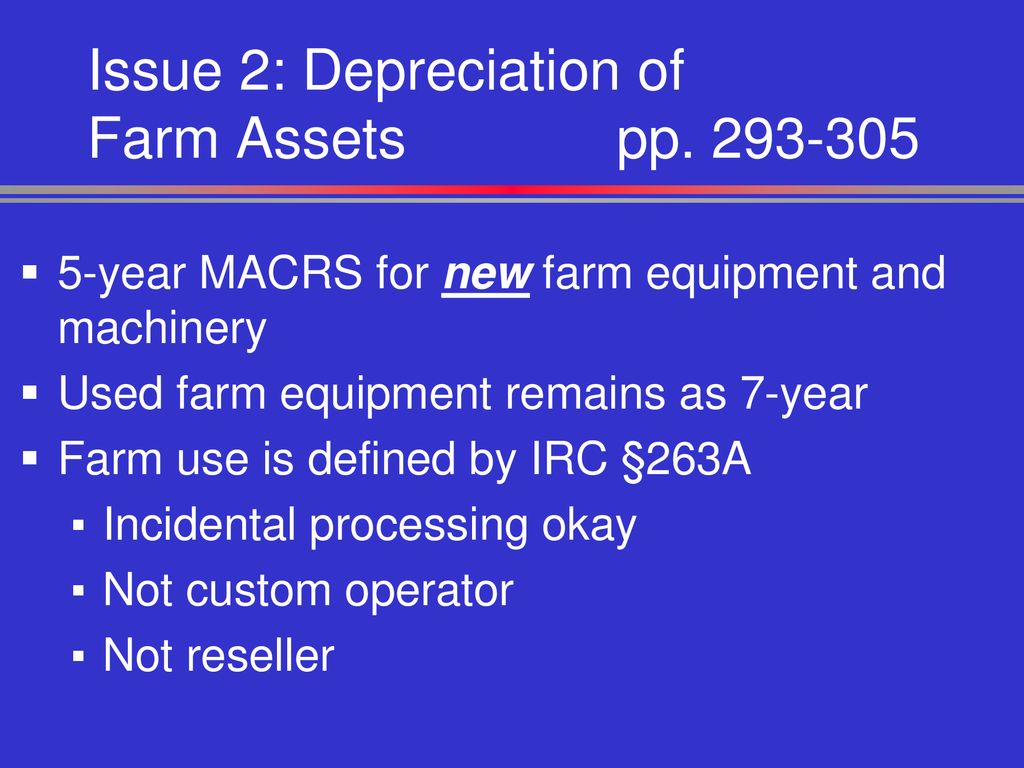

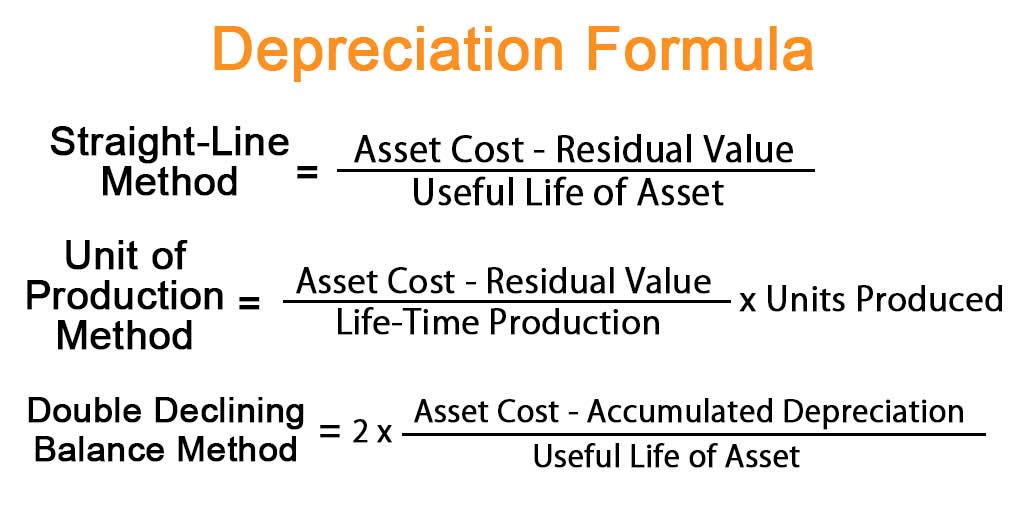

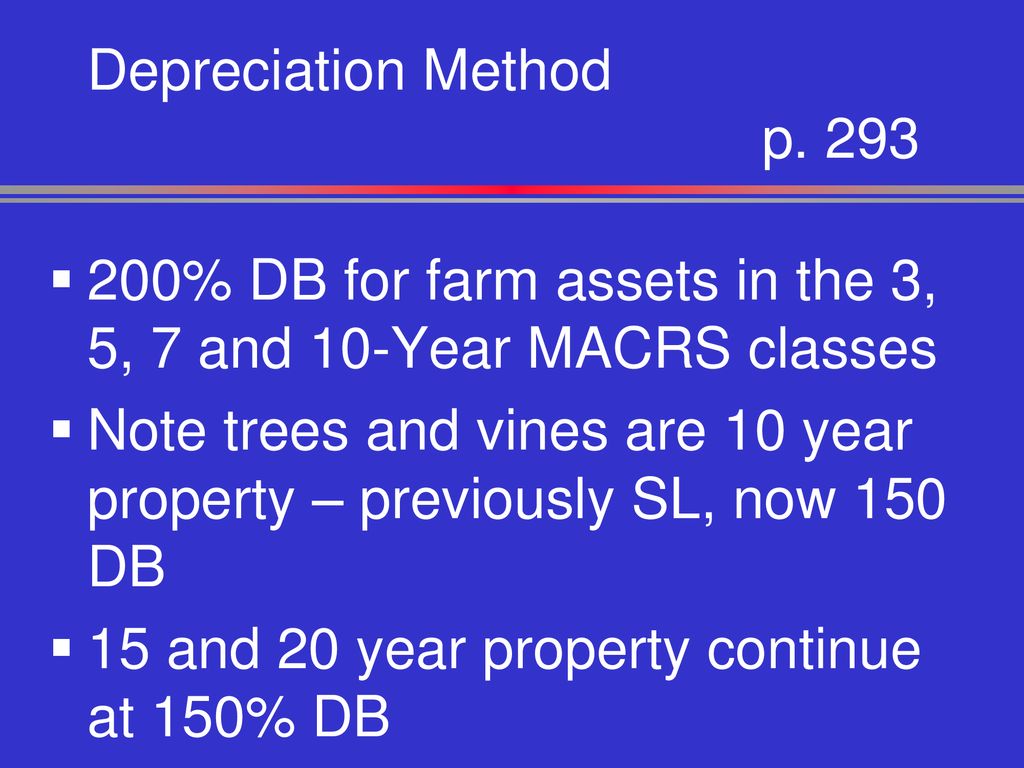

Depreciation Farm Buildings - Modifications to the treatment of certain farm equipment include: Farm buildings can be written off over either 10 or 20 years, depending on what they’re used for. Table 1 illustrates macrs gds and ads recovery periods. Local and state vehicle taxes. Explore our comprehensive guide on understanding depreciation in farm equipment and buildings. Considering the different depreciation methods, section 179 expense deduction, bonus depreciation, and consulting with a tax professional are all essential steps in effectively. Farm equipment is generally depreciated over 7 years, although some may be 5. Land improvements (drain tiles and berms, for example) can be depreciated. Learn how the tax root can help you maximize your agricultural tax. Learn how it affects your finances and the best practices for managing it. Learn how the tax root can help you maximize your agricultural tax. Considering the different depreciation methods, section 179 expense deduction, bonus depreciation, and consulting with a tax professional are all essential steps in effectively. Explore our comprehensive guide on understanding depreciation in farm equipment and buildings. Bonus depreciation of $240,000 (2023) +$2,250 regular. This allocation will be used to determine annual depreciation. Courtney purchased a used hay baler which would be depreciated for 7 years under gds. Unlike buildings or machinery, land has an indefinite useful life, disqualifying it from depreciation. You can use the property tax assessor’s value to compute a ratio. The time horizon for real estate depreciation is established by convention. Table 1 illustrates macrs gds and ads recovery periods. The time horizon for real estate depreciation is established by convention. You can use the property tax assessor’s value to compute a ratio. Land improvements have a cost recovery period of 15 years and are in depreciation class 00.3 (modified accelerated cost recovery system depreciation class). Since land cannot be depreciated, you need to allocate the original purchase price between. Learn how the tax root can help you maximize your agricultural tax. Net income for the three months ended december 31, 2024. Since land cannot be depreciated, you need to allocate the original purchase price between land and building. Land improvements have a cost recovery period of 15 years and are in depreciation class 00.3 (modified accelerated cost recovery system. Table 1 illustrates macrs gds and ads recovery periods for these listed agricultural assets. Learn how it affects your finances and the best practices for managing it. Explore the essentials of depreciation for farm equipment and buildings. The irs sets the class life for farm assets. Table 1 illustrates macrs gds and ads recovery periods. Improvements to land, such as buildings or landscaping, can be depreciated, but. Unlike buildings or machinery, land has an indefinite useful life, disqualifying it from depreciation. Local and state vehicle taxes. Fees like license tags, parking and tolls. This is because the law says you. Learn how it affects your finances and the best practices for managing it. This allocation will be used to determine annual depreciation. Farm buildings can be written off over either 10 or 20 years, depending on what they’re used for. Local and state vehicle taxes. Learn how the tax root can help you maximize your agricultural tax. The irs sets the class life for farm assets. Table 1 illustrates macrs gds and ads recovery periods for these listed agricultural assets. Bonus depreciation of $240,000 (2023) +$2,250 regular. Typically, a residential property will be depreciated over 27.5 years. Modifications to the treatment of certain farm equipment include: Farm equipment is generally depreciated over 7 years, although some may be 5. Using bonus depreciation [irc §168(k)] or the “expense election” under irc section 179 (both discussed in separate articles) can reduce farm income to zero or even (in the case. The time horizon for real estate depreciation is established by convention. This is because the law says you.. Courtney purchased a used hay baler which would be depreciated for 7 years under gds. Explore our comprehensive guide on understanding depreciation in farm equipment and buildings. The irs sets the class life for farm assets. Learn how the tax root can help you maximize your agricultural tax. Unlike buildings or machinery, land has an indefinite useful life, disqualifying it. Table 1 illustrates macrs gds and ads recovery periods for these listed agricultural assets. Table 1 illustrates macrs gds and ads recovery periods. Farm equipment is generally depreciated over 7 years, although some may be 5. You can use the property tax assessor’s value to compute a ratio. Courtney purchased a used hay baler which would be depreciated for 7. Provided they’re used for business more than 50% of the time,. Learn how the tax root can help you maximize your agricultural tax. Explore our comprehensive guide on understanding depreciation in farm equipment and buildings. Net income for the three months ended december 31, 2024. Explore the essentials of depreciation for farm equipment and buildings. The time horizon for real estate depreciation is established by convention. Farm buildings can be written off over either 10 or 20 years, depending on what they’re used for. Improvements to land, such as buildings or landscaping, can be depreciated, but. Considering the different depreciation methods, section 179 expense deduction, bonus depreciation, and consulting with a tax professional are all essential steps in effectively. Courtney purchased a used hay baler which would be depreciated for 7 years under gds. Provided they’re used for business more than 50% of the time,. Table 1 illustrates macrs gds and ads recovery periods. Learn how the tax root can help you maximize your agricultural tax. Calculating land and building values for tax purposes is a critical step toward maximizing your available tax deductions from depreciation. Since land cannot be depreciated, you need to allocate the original purchase price between land and building. Land improvements (drain tiles and berms, for example) can be depreciated. Learn how it affects your finances and the best practices for managing it. Farm buildings are depreciated over a 20 year life. You can use the property tax assessor’s value to compute a ratio. Local and state vehicle taxes. Fees like license tags, parking and tolls.Popular Depreciation Methods To Calculate Asset Value Over The Years

The Farm CPA Depreciation, Depreciation, Depreciation AgWeb

Agricultural and Natural Resource Issues Chapter 9 pp ppt download

Depreciating Farm Property with a FiveYear Recovery Period Center

Straight Line Depreciation Method Online Accounting

Line 14 Depreciation and Section 179 Expense Center for

Agricultural and Natural Resource Issues Chapter 9 pp ppt download

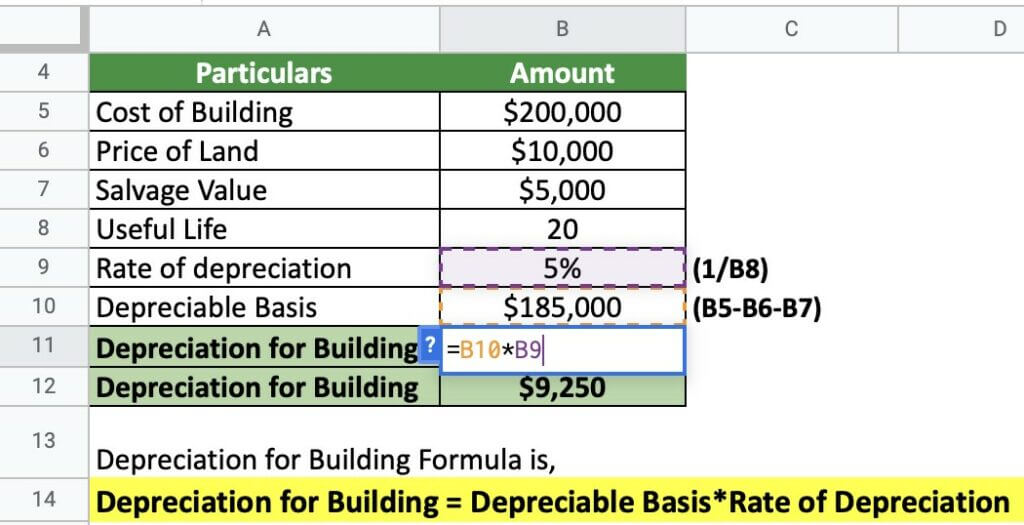

Depreciation for Building Definition, Formula, and Excel Examples

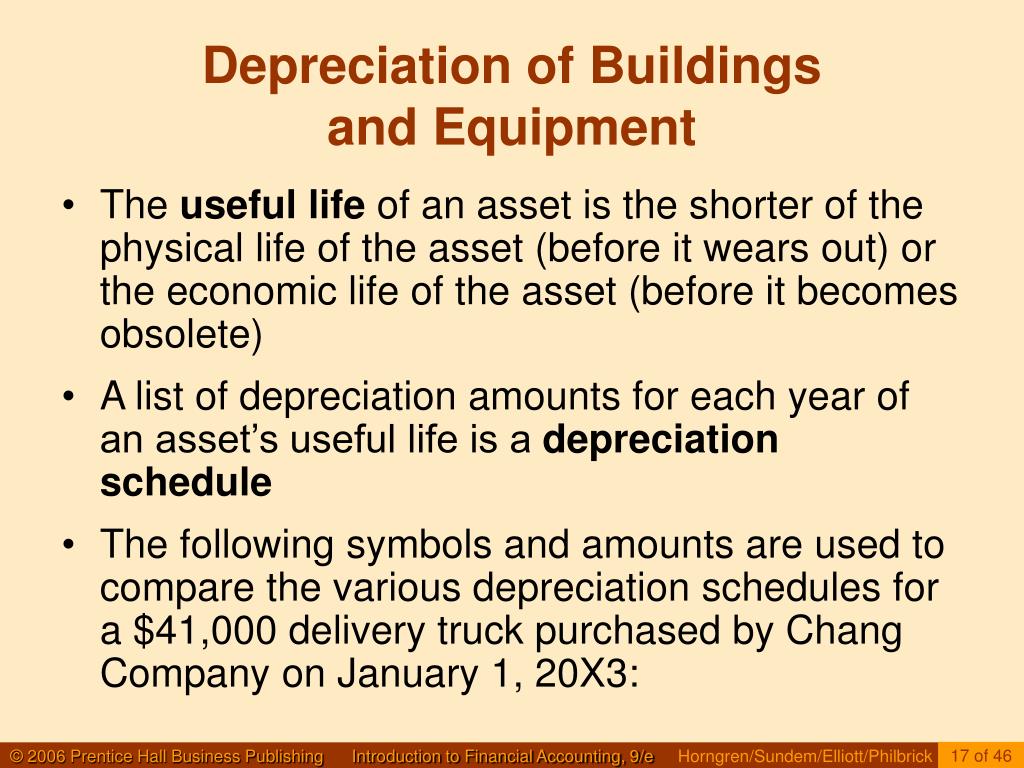

PPT LongLived Assets and Depreciation PowerPoint Presentation ID

Depreciation for Building Definition, Formula, and Excel Examples

Using Bonus Depreciation [Irc §168(K)] Or The “Expense Election” Under Irc Section 179 (Both Discussed In Separate Articles) Can Reduce Farm Income To Zero Or Even (In The Case.

When A Building Is Purchased, An Allocation Of The Purchase Price Between The Land And Building Must Be Made.

Net Income For The Three Months Ended December 31, 2024.

Typically, A Residential Property Will Be Depreciated Over 27.5 Years.

Related Post: