Depreciation Life Commercial Building

Depreciation Life Commercial Building - When applied to commercial property, it denotes the gradual wear and tear that a. To determine yearly depreciation, divide the cost of the asset by its useful life. What is depreciation in commercial real estate? Commercial buildings and improvements are depreciated over 39 years, but there are tax breaks that allow deductions to be taken more quickly for certain real estate investments. Commercial and residential buildings can be depreciated over a certain number of years based on the type of property. Understanding the depreciation life of a commercial roof is essential for businesses to manage assets effectively and optimize tax benefits. The irs places assets and capital improvements into classes of useful lives. Ive got a client replacing the roof and hvac ducting on a commercial building this year. You can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment. Land is never depreciable, although buildings and certain land improvements may be. Land is never depreciable, although buildings and certain land improvements may be. Commercial real estate depreciation is a key tax deduction that allows property owners to recover the cost of their investment over time. In commercial real estate, depreciation refers to the gradual decline in a property’s value due to wear and tear, obsolescence, or other causes. There are several types of capital assets that can be depreciated when you use them in your business. What is depreciation in commercial real estate? If you know the equipment isn't going to last 39 years, do you have the option to depreciate it for a lesser amount of time? Commercial and residential buildings can be depreciated over a certain number of years based on the type of property. Commercial buildings are typically depreciated over 39 years, allowing owners to spread out the property's cost and reduce. You then deduct the depreciation from income every year of the useful life. If you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you must use the depreciation method used for the multiple property. The lifespan of a roof impacts financial. Commercial buildings are typically depreciated over 39 years, allowing owners to spread out the property's cost and reduce. When applied to commercial property, it denotes the gradual wear and tear that a. Understanding the concept of building depreciation and its useful life is pivotal in the realm of real estate, accounting, and asset. There are several types of capital assets that can be depreciated when you use them in your business. Land is never depreciable, although buildings and certain land improvements may be. If you know the equipment isn't going to last 39 years, do you have the option to depreciate it for a lesser amount of time? You can depreciate most types. Commercial buildings and improvements are depreciated over 39 years, but there are tax breaks that allow deductions to be taken more quickly for certain real estate investments. Understanding the concept of building depreciation and its useful life is pivotal in the realm of real estate, accounting, and asset management. Understanding the depreciation life of a commercial roof is essential for. The lifespan of a roof impacts financial. If you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you must use the depreciation method used for the multiple property. If you know the equipment isn't going to last 39 years, do you have the option to depreciate it for a lesser. Commercial buildings are typically depreciated over 39 years, allowing owners to spread out the property's cost and reduce. The irs places assets and capital improvements into classes of useful lives. If you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you must use the depreciation method used for the multiple. The lifespan of a roof impacts financial. To be depreciable, the property must meet all the. For tax purposes in the united states, the irs assigns a useful life of 39 years to commercial properties, meaning the building's value can be deducted in equal portions (using. Understanding the concept of building depreciation and its useful life is pivotal in the. You may depreciate property that meets all the following requirements: You can also depreciate certain intangible property, such as patents, copyrights, and computer software. In commercial real estate, depreciation refers to the gradual decline in a property’s value due to wear and tear, obsolescence, or other causes. Depreciation of a building is the. [3] can i depreciate the cost of. Commercial real estate depreciation is a key tax deduction that allows property owners to recover the cost of their investment over time. You may depreciate property that meets all the following requirements: To be depreciable, the property must meet all the. [3] can i depreciate the cost of land? You can depreciate most types of tangible property (except land), such. [3] can i depreciate the cost of land? To determine yearly depreciation, divide the cost of the asset by its useful life. Depreciation of a building is the. You can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment. If you know the equipment isn't going to last 39 years, do you have. In its simplest form, depreciation represents the reduction in the value of an asset over time. For tax purposes in the united states, the irs assigns a useful life of 39 years to commercial properties, meaning the building's value can be deducted in equal portions (using. Understanding the depreciation life of a commercial roof is essential for businesses to manage. Commercial and residential buildings can be depreciated over a certain number of years based on the type of property. When applied to commercial property, it denotes the gradual wear and tear that a. If you figured depreciation using the maximum expected useful life of the longest lived item of property in the account, you must use the depreciation method used for the multiple property. Commercial buildings are typically depreciated over 39 years, allowing owners to spread out the property's cost and reduce. Depreciation of a building is the. The lifespan of a roof impacts financial. Land can never be depreciated. You may depreciate property that meets all the following requirements: What is depreciation in commercial real estate? Calculating depreciation for commercial property involves a systematic approach that incorporates various factors and decisions. In its simplest form, depreciation represents the reduction in the value of an asset over time. The process begins by determining the asset’s. You can also depreciate certain intangible property, such as patents, copyrights, and computer software. Land is never depreciable, although buildings and certain land improvements may be. If you know the equipment isn't going to last 39 years, do you have the option to depreciate it for a lesser amount of time? You can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment.Depreciation for Building Definition, Formula, and Excel Examples

Depreciation for Building Definition, Formula, and Excel Examples

Commercial Building Carpet Depreciation Life Two Birds Home

Popular Depreciation Methods To Calculate Asset Value Over The Years

What Is the Depreciation of the Roof on a Commercial Building?

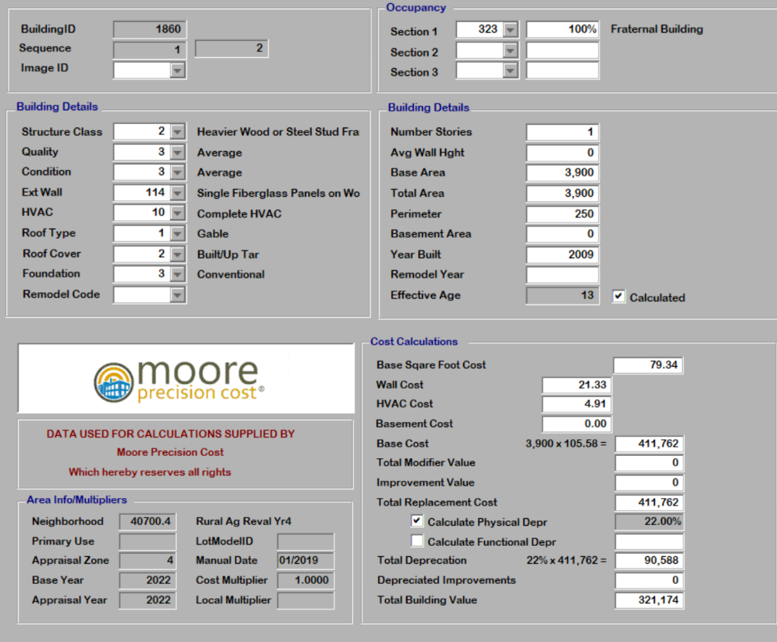

Commercial Building Depreciation Commercial Appraisal File 1

Depreciable Life Of Commercial Flooring Viewfloor.co

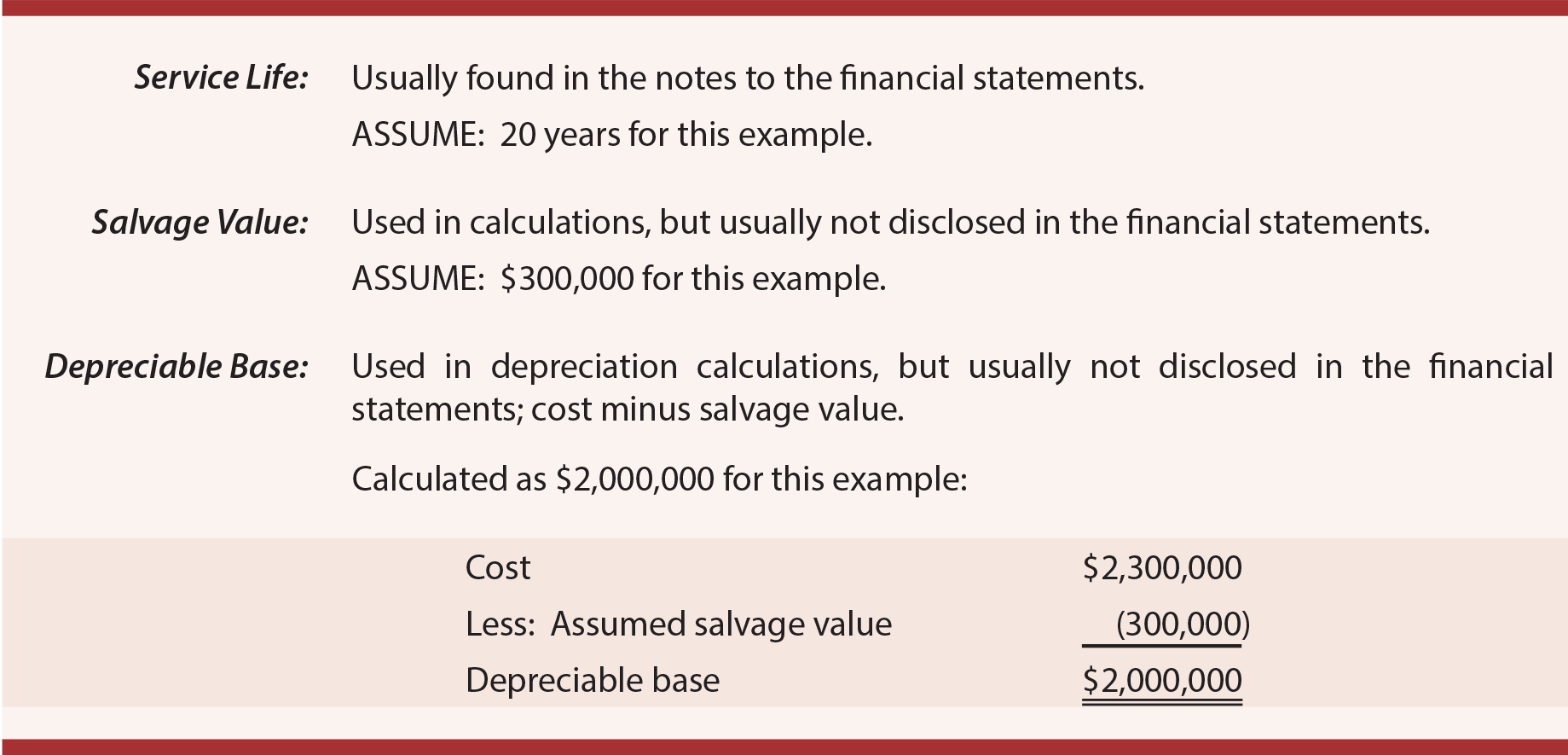

Depreciation Concepts

Understanding the Depreciation of a Commercial Building

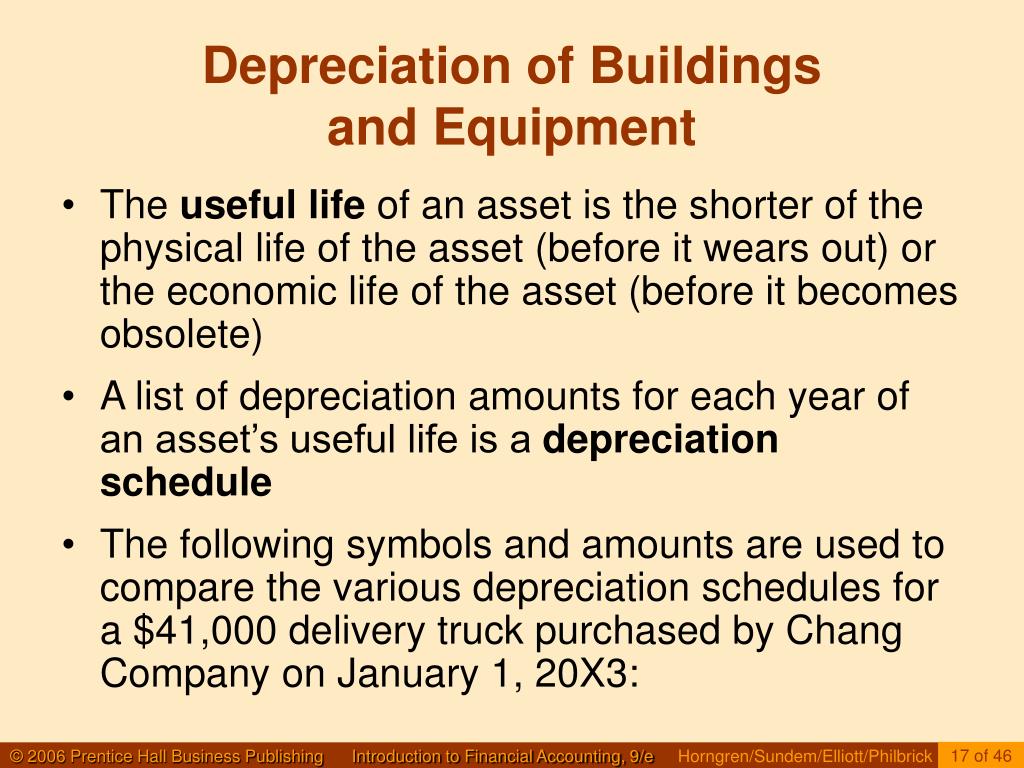

PPT LongLived Assets and Depreciation PowerPoint Presentation ID

[3] Can I Depreciate The Cost Of Land?

There Are Several Types Of Capital Assets That Can Be Depreciated When You Use Them In Your Business.

Commercial Buildings And Improvements Are Depreciated Over 39 Years, But There Are Tax Breaks That Allow Deductions To Be Taken More Quickly For Certain Real Estate Investments.

The Irs Places Assets And Capital Improvements Into Classes Of Useful Lives.

Related Post: