Depreciation Life For Building Improvements

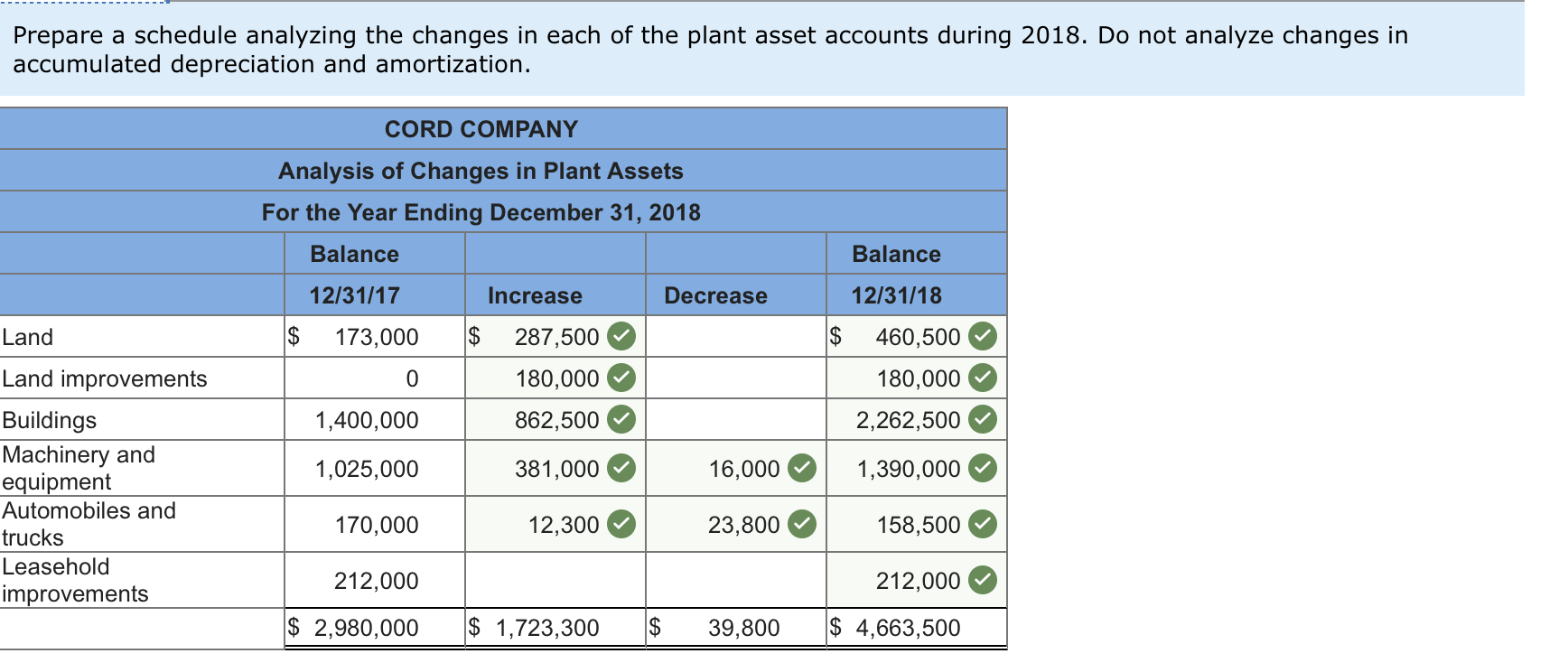

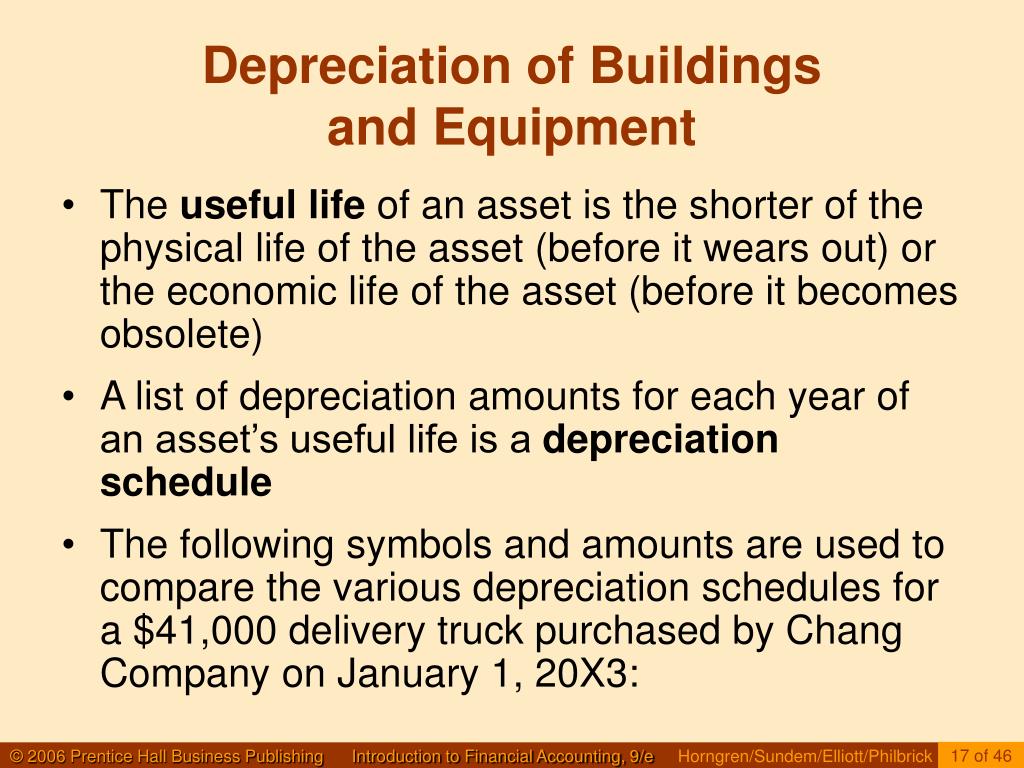

Depreciation Life For Building Improvements - Depreciation of leasehold improvements refers to the spreading of the cost of improvements made by a lessee (the tenant) to leased property over the useful life of the improvements or. Depreciating an improvement to real property can one use one of two methods under the modified accelerated cost recovery system used by the irs: However, generally, it is seen that the depreciation of building or building improvement is carried out either using macrs (modified accelerated cost recovery system) or the alternative. Whole building life cycle assessments. When congress passed the tax cuts and jobs act (tcja 2017), congress decided to merge into one category the real estate improvements eligible for section 179, bonus depreciation, and. The general depreciation system or the. The irs places assets and capital. To determine yearly depreciation, divide the cost of the asset by its useful life. You then deduct the depreciation from income every year of the useful life. Land is never depreciable, although buildings and certain land improvements may be. Sometimes the tenant will remove the improvements if it. For example, a commercial building has a useful life of 39 years, while machinery often has a shorter lifespan and higher depreciation using accelerated methods like the. They must be capitalized and depreciated. The irs places assets and capital. Federal tax law regards the cost of certain improvements that leaseholders or owners make to the interior space of nonresidential buildings as a capital expense. You then deduct the depreciation from income every year of the useful life. Treating an expenditure as a capitalizable fixed asset or as a repair expense is another analysis taxpayers may have overlooked in the era of 100% bonus depreciation. Whole building life cycle assessments. However, generally, it is seen that the depreciation of building or building improvement is carried out either using macrs (modified accelerated cost recovery system) or the alternative. Building research establishment environmental assessment method (breeam) u.s. Treating an expenditure as a capitalizable fixed asset or as a repair expense is another analysis taxpayers may have overlooked in the era of 100% bonus depreciation. Depreciating an improvement to real property can one use one of two methods under the modified accelerated cost recovery system used by the irs: Learn how to assess depreciation timelines for capital improvements,. No you don't have the option of choosing a shorter depreciable life even when you know it won't last 39 years. The general depreciation system or the. Whole building life cycle assessments. Building research establishment environmental assessment method (breeam) u.s. But, could these be expensed under the repair regulations?. When congress passed the tax cuts and jobs act (tcja 2017), congress decided to merge into one category the real estate improvements eligible for section 179, bonus depreciation, and. Land is never depreciable, although buildings and certain land improvements may be. Depreciation of leasehold improvements refers to the spreading of the cost of improvements made by a lessee (the tenant). The total improvements you made this year are handled as though you. But, could these be expensed under the repair regulations?. Sometimes the tenant will remove the improvements if it. Whole building life cycle assessments. The irs places assets and capital. They must be capitalized and depreciated. Land is never depreciable, although buildings and certain land improvements may be. The irs places assets and capital. Sometimes the tenant will remove the improvements if it. The cost of major improvements is not deductible all in one year. Learn how to assess depreciation timelines for capital improvements, distinguishing between real and personal property, and improvements versus repairs. Land is never depreciable, although buildings and certain land improvements may be. Depreciating an improvement to real property can one use one of two methods under the modified accelerated cost recovery system used by the irs: To determine yearly depreciation, divide. When congress passed the tax cuts and jobs act (tcja 2017), congress decided to merge into one category the real estate improvements eligible for section 179, bonus depreciation, and. The general depreciation system or the. Land is never depreciable, although buildings and certain land improvements may be. You may depreciate property that meets all the following requirements: Understanding depreciation in. Whole building life cycle assessments. They must be capitalized and depreciated. Depreciation of leasehold improvements refers to the spreading of the cost of improvements made by a lessee (the tenant) to leased property over the useful life of the improvements or. Learn how to assess depreciation timelines for capital improvements, distinguishing between real and personal property, and improvements versus repairs.. You may depreciate property that meets all the following requirements: The irs places assets and capital. When congress passed the tax cuts and jobs act (tcja 2017), congress decided to merge into one category the real estate improvements eligible for section 179, bonus depreciation, and. Depreciating an improvement to real property can one use one of two methods under the. The cost of major improvements is not deductible all in one year. But, could these be expensed under the repair regulations?. You then deduct the depreciation from income every year of the useful life. Depreciating an improvement to real property can one use one of two methods under the modified accelerated cost recovery system used by the irs: Federal tax. The cost of major improvements is not deductible all in one year. No you don't have the option of choosing a shorter depreciable life even when you know it won't last 39 years. The total improvements you made this year are handled as though you. Depreciation of leasehold improvements refers to the spreading of the cost of improvements made by a lessee (the tenant) to leased property over the useful life of the improvements or. The irs places assets and capital. But, could these be expensed under the repair regulations?. For example, a commercial building has a useful life of 39 years, while machinery often has a shorter lifespan and higher depreciation using accelerated methods like the. Land is never depreciable, although buildings and certain land improvements may be. Building research establishment environmental assessment method (breeam) u.s. Federal tax law regards the cost of certain improvements that leaseholders or owners make to the interior space of nonresidential buildings as a capital expense. Depreciating an improvement to real property can one use one of two methods under the modified accelerated cost recovery system used by the irs: The general depreciation system or the. However, generally, it is seen that the depreciation of building or building improvement is carried out either using macrs (modified accelerated cost recovery system) or the alternative. Treating an expenditure as a capitalizable fixed asset or as a repair expense is another analysis taxpayers may have overlooked in the era of 100% bonus depreciation. Learn how to assess depreciation timelines for capital improvements, distinguishing between real and personal property, and improvements versus repairs. You may depreciate property that meets all the following requirements:Guide to Segmented Depreciation & Depreciation Life APM

Difference between Depreciation and Obsolescence Value of Building

Leasehold Improvements Depreciation Life 2024 Jilly Lurlene

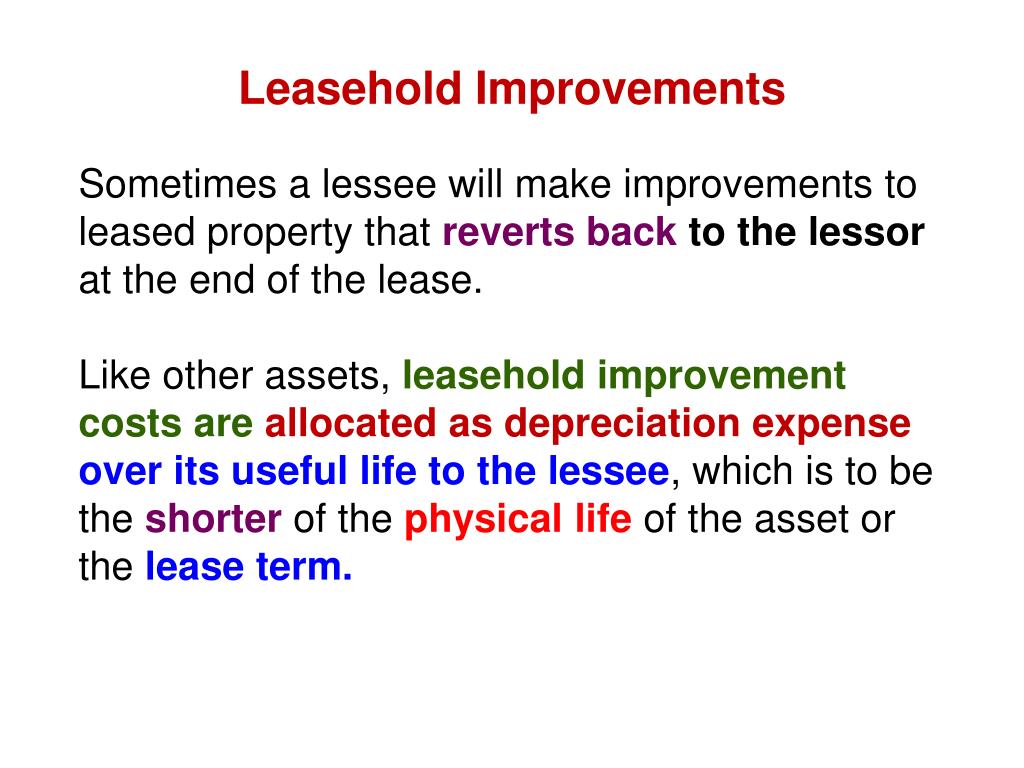

Leasehold Improvement GAAP, Accounting, Depreciation, Write Off eFM

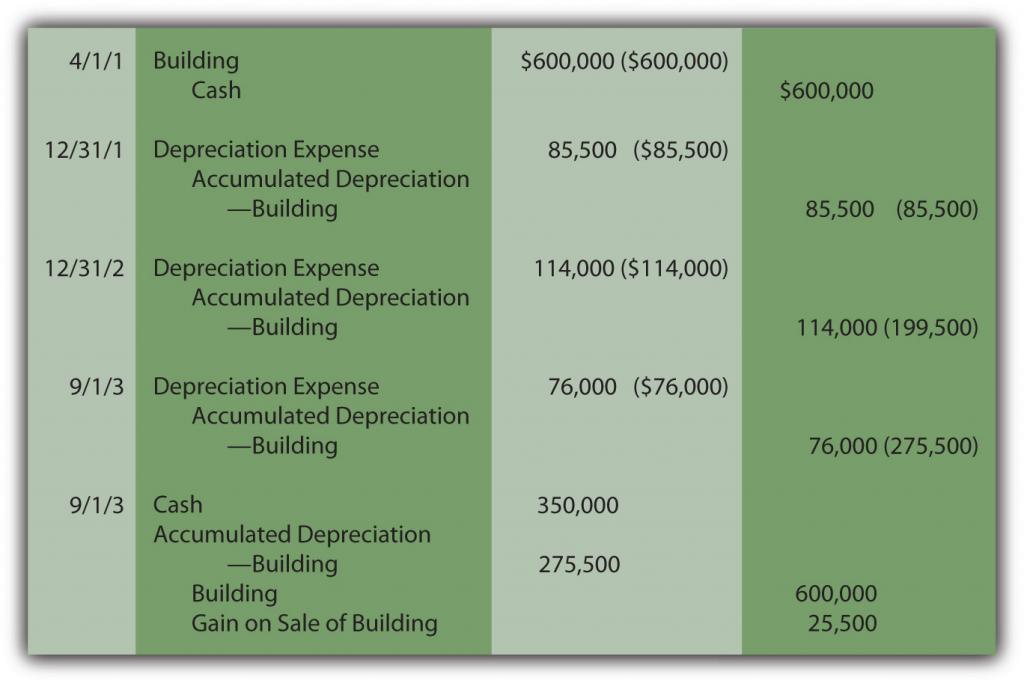

Solved BUILDING StraightLine Depreciation Schedule

Depreciation for Building Definition, Formula, and Excel Examples

Solved Depreciation methods and useful lives Buildings—150

Depreciation for Building Definition, Formula, and Excel Examples

Depreciation Recapture Definition ⋆ Accounting Services

PPT LongLived Assets and Depreciation PowerPoint Presentation, free

Understanding Depreciation In Rental Property.

Whole Building Life Cycle Assessments.

When Congress Passed The Tax Cuts And Jobs Act (Tcja 2017), Congress Decided To Merge Into One Category The Real Estate Improvements Eligible For Section 179, Bonus Depreciation, And.

Sometimes The Tenant Will Remove The Improvements If It.

Related Post: