Depreciation Of A Building

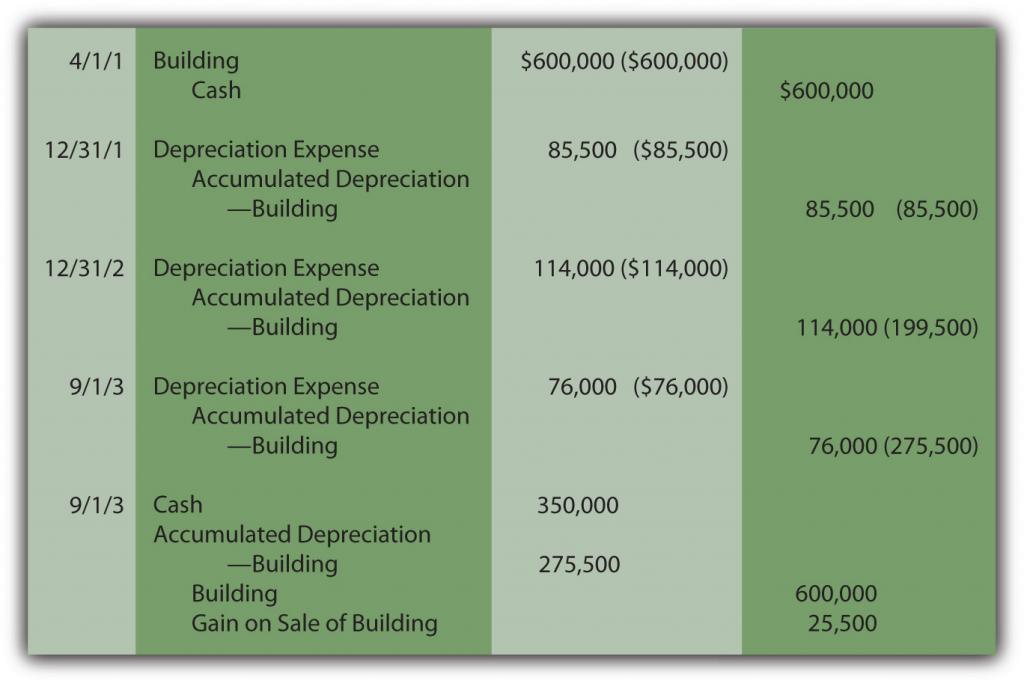

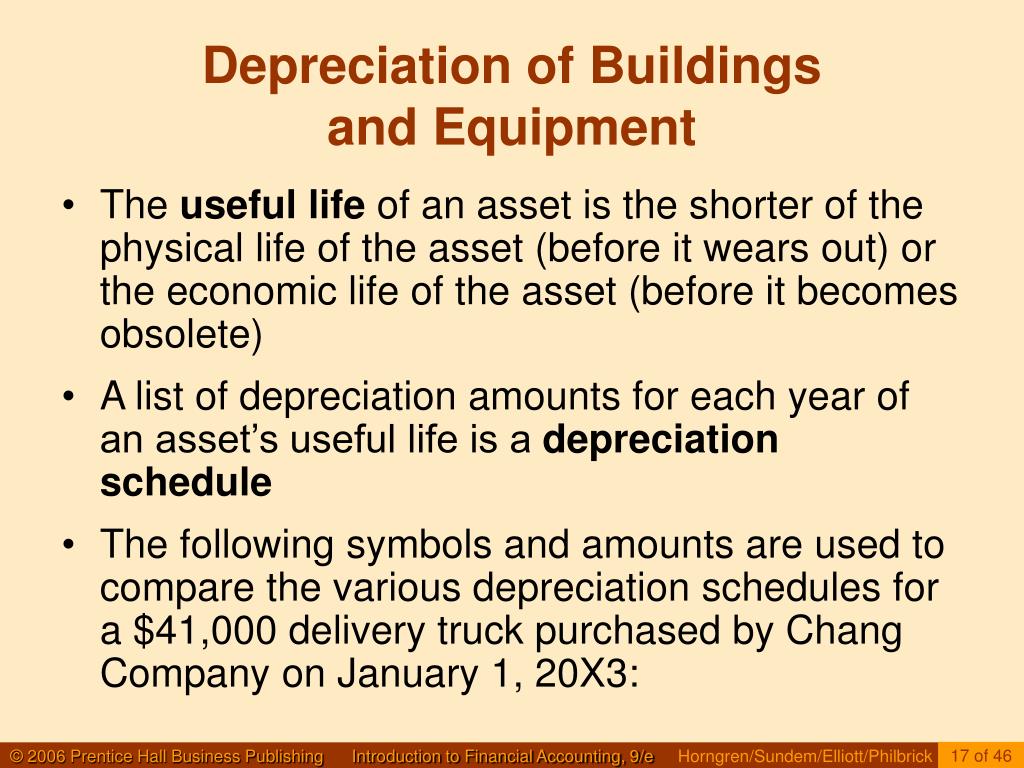

Depreciation Of A Building - These methods are crucial for. In most cases, when you buy a building, the. But, under irs cost segregation guidelines, a significant portion of a building’s cost can. Depreciation on real property, like an office building, begins in the month the building is placed in service. Depreciation for buildings refers to the gradual reduction in the value of a building till it reaches the final value, also known as salvage value, due to wear and tear, age, or. Land is never depreciable, although buildings and certain land improvements may be. You can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment. Depreciation accounts for the wear and tear, aging, and potential obsolescence of the asset. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life. Depreciation can be defined as the amount an asset or building loses in value over the course of time due to inevitable factors such as deterioration. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life. Whether you’re investing in office space, apartment buildings, or retail properties, depreciation. You can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment. These methods are crucial for. Capital assets such as buildings, machinery, and equipment are. It accounts for wear and tear, deterioration, or. Depreciation methods for commercial property vary, each offering a different approach to expense allocation over the asset’s useful life. Land is never depreciable, although buildings and certain land improvements may be. Depreciation for buildings refers to the gradual reduction in the value of a building till it reaches the final value, also known as salvage value, due to wear and tear, age, or. Depreciation is an annual tax deduction that allows small businesses to recover the cost or other basis of certain property over the time they use the property. Depreciation on real property, like an office building, begins in the month the building is placed in service. Depreciation simulates a building's gradual loss of value. It accounts for wear and tear, deterioration, or. But, under irs cost segregation guidelines, a significant portion of a building’s cost can. Because commercial real estate is considered an asset rather than an expense,. It accounts for wear and tear, deterioration, or. Depreciation accounts for the wear and tear, aging, and potential obsolescence of the asset. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life. You may depreciate property that meets all the following requirements: In most cases, when you buy a building, the. Commercial real estate depreciation is a major tax benefit that every investor should understand. These methods are crucial for. Whether you’re investing in office space, apartment buildings, or retail properties, depreciation. But, under irs cost segregation guidelines, a significant portion of a building’s cost can. To be depreciable, the property must meet all the. Capital assets such as buildings, machinery, and equipment are. Understanding depreciation in rental property. These methods are crucial for. You may depreciate property that meets all the following requirements: Depreciation accounts for the wear and tear, aging, and potential obsolescence of the asset. But, under irs cost segregation guidelines, a significant portion of a building’s cost can. Commercial real estate depreciation is a major tax benefit that every investor should understand. Depreciation on real property, like an office building, begins in the month the building is placed in service. Capital assets such as buildings, machinery, and equipment are. You can also depreciate certain. You can also depreciate certain intangible property, such as patents, copyrights, and computer software. Depreciation can be defined as the amount an asset or building loses in value over the course of time due to inevitable factors such as deterioration. When you get rid of the building, you credit the building account and debit accumulated depreciation, wiping the building out. Capital assets such as buildings, machinery, and equipment are. You may depreciate property that meets all the following requirements: Whether you’re investing in office space, apartment buildings, or retail properties, depreciation. Depreciation accounts for the wear and tear, aging, and potential obsolescence of the asset. In most cases, when you buy a building, the. Depreciation is an annual tax deduction that allows small businesses to recover the cost or other basis of certain property over the time they use the property. Depreciation can be defined as the amount an asset or building loses in value over the course of time due to inevitable factors such as deterioration. Depreciation accounts for the wear and tear,. Depreciation on real property, like an office building, begins in the month the building is placed in service. Understanding depreciation in rental property. You may depreciate property that meets all the following requirements: Whether you’re investing in office space, apartment buildings, or retail properties, depreciation. This decrease in value is due to factors like physical. Depreciation can be defined as the amount an asset or building loses in value over the course of time due to inevitable factors such as deterioration. Depreciation for buildings refers to the gradual reduction in the value of a building till it reaches the final value, also known as salvage value, due to wear and tear, age, or. Depreciation simulates. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life. Building depreciation is the process by which the value of a building decreases over time. You may depreciate property that meets all the following requirements: Depreciation accounts for the wear and tear, aging, and potential obsolescence of the asset. Whether you’re investing in office space, apartment buildings, or retail properties, depreciation. Land is never depreciable, although buildings and certain land improvements may be. When you get rid of the building, you credit the building account and debit accumulated depreciation, wiping the building out of your ledgers. Depreciation is an annual tax deduction that allows small businesses to recover the cost or other basis of certain property over the time they use the property. Rental property depreciation is the process of deducting the cost of your rental property over time. Depreciation for buildings refers to the gradual reduction in the value of a building till it reaches the final value, also known as salvage value, due to wear and tear, age, or. Depreciation methods for commercial property vary, each offering a different approach to expense allocation over the asset’s useful life. Capital assets such as buildings, machinery, and equipment are. These methods are crucial for. Understanding depreciation in rental property. This decrease in value is due to factors like physical. But, under irs cost segregation guidelines, a significant portion of a building’s cost can.Methods of Depreciation Formulas, Problems, and Solutions Owlcation

Difference between Depreciation and Obsolescence Value of Building

Depreciation for Building Definition, Formula, and Excel Examples

Understanding the Depreciation of a Commercial Building

Depreciation Recapture Definition ⋆ Accounting Services

Depreciation for Building Definition, Formula, and Excel Examples

Popular Depreciation Methods To Calculate Asset Value Over The Years

Best Practices for Optimizing Building Depreciation Components

Solved BUILDING StraightLine Depreciation Schedule

PPT LongLived Assets and Depreciation PowerPoint Presentation ID

Depreciation Simulates A Building's Gradual Loss Of Value.

Depreciation Can Be Defined As The Amount An Asset Or Building Loses In Value Over The Course Of Time Due To Inevitable Factors Such As Deterioration.

You Can Also Depreciate Certain Intangible Property, Such As Patents, Copyrights, And Computer Software.

To Be Depreciable, The Property Must Meet All The.

Related Post: