Depreciation Of Building

Depreciation Of Building - You can also depreciate certain intangible property, such as patents, copyrights, and computer software. Accounting for building assets is a critical aspect of financial. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life. For example, a commercial building has a useful life of 39 years, while machinery often has a shorter lifespan and higher depreciation using accelerated methods like the. Land can never be depreciated. Understanding the concept of building depreciation and its useful life is pivotal in the realm of real estate, accounting, and asset management. It helps businesses make informed decisions about. You also credit the same figure to accumulated depreciation. Each year that you depreciate a building, you debit the amount to depreciation expense. These methods are crucial for. It helps businesses make informed decisions about. There are three main methods of depreciation: You can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment. Understanding depreciation in rental property. Because commercial real estate is considered an asset rather than an expense, the internal revenue service won't let you write. Understanding the concept of building depreciation and its useful life is pivotal in the realm of real estate, accounting, and asset management. To be depreciable, the property must meet all the. The figure in the latter account increases. Depreciation is an annual tax deduction that allows small businesses to recover the cost or other basis of certain property over the time they use the property. Equipment depreciation is a crucial concept for businesses that rely on machinery, tools, and technology. Capital assets such as buildings, machinery, and equipment are. It applies to commercial buildings, residential. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life. The company can choose which method it wants to use for depreciating. There are several types of capital assets that can be depreciated when you use them. Understanding depreciation in rental property. The company can choose which method it wants to use for depreciating. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life. To be depreciable, the property must meet all the. You then deduct the depreciation from income every year of the useful life. Depreciation simulates a building's gradual loss of value. Building depreciation is the process by which the value of a building decreases over time. It applies to commercial buildings, residential. Depreciation is an annual tax deduction that allows small businesses to recover the cost or other basis of certain property over the time they use the property. These methods are crucial. This decrease in value is due to factors like physical wear, age, environmental. There are several types of capital assets that can be depreciated when you use them in your business. Depreciation simulates a building's gradual loss of value. Depreciation methods for commercial property vary, each offering a different approach to expense allocation over the asset’s useful life. Understanding depreciation. Each year that you depreciate a building, you debit the amount to depreciation expense. There are several types of capital assets that can be depreciated when you use them in your business. For example, a commercial building has a useful life of 39 years, while machinery often has a shorter lifespan and higher depreciation using accelerated methods like the. Depreciation. Accounting for building assets is a critical aspect of financial. Land can never be depreciated. The company can choose which method it wants to use for depreciating. Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. Understanding depreciation in rental property. The irs places assets and capital. Understanding depreciation in rental property. [3] can i depreciate the cost of land? It helps businesses make informed decisions about. You also credit the same figure to accumulated depreciation. Understanding the concept of building depreciation and its useful life is pivotal in the realm of real estate, accounting, and asset management. Each year that you depreciate a building, you debit the amount to depreciation expense. Depreciation is an annual tax deduction that allows small businesses to recover the cost or other basis of certain property over the time they. Each year that you depreciate a building, you debit the amount to depreciation expense. These methods are crucial for. [3] can i depreciate the cost of land? Depreciation of a building is the. This decrease in value is due to factors like physical wear, age, environmental. This decrease in value is due to factors like physical wear, age, environmental. Capital assets such as buildings, machinery, and equipment are. You can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment. You can also depreciate certain intangible property, such as patents, copyrights, and computer software. Understanding the concept of building depreciation. Accounting for building assets is a critical aspect of financial. Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. To be depreciable, the property must meet all the. It applies to commercial buildings, residential. You also credit the same figure to accumulated depreciation. It helps businesses make informed decisions about. Capital assets such as buildings, machinery, and equipment are. Depreciation is an annual tax deduction that allows small businesses to recover the cost or other basis of certain property over the time they use the property. There are several types of capital assets that can be depreciated when you use them in your business. Depreciation of a building is the. Understanding depreciation in rental property. There are three main methods of depreciation: For example, a commercial building has a useful life of 39 years, while machinery often has a shorter lifespan and higher depreciation using accelerated methods like the. The company can choose which method it wants to use for depreciating. Depreciation methods for commercial property vary, each offering a different approach to expense allocation over the asset’s useful life. [3] can i depreciate the cost of land?Difference between Depreciation and Obsolescence Value of Building

Solved BUILDING StraightLine Depreciation Schedule

Depreciation for Building Definition, Formula, and Excel Examples

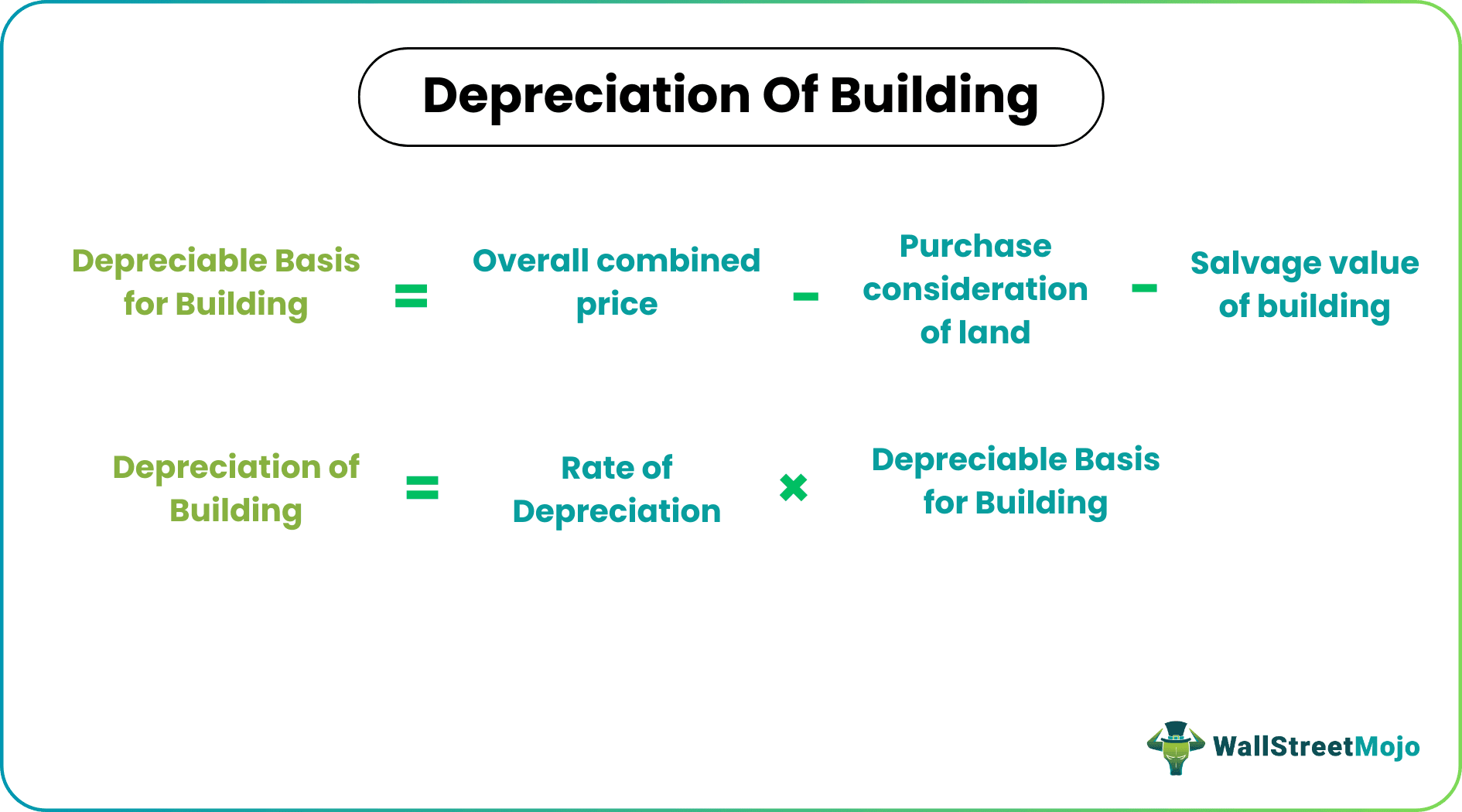

Depreciation of Building (Definition, Examples) How to Calculate?

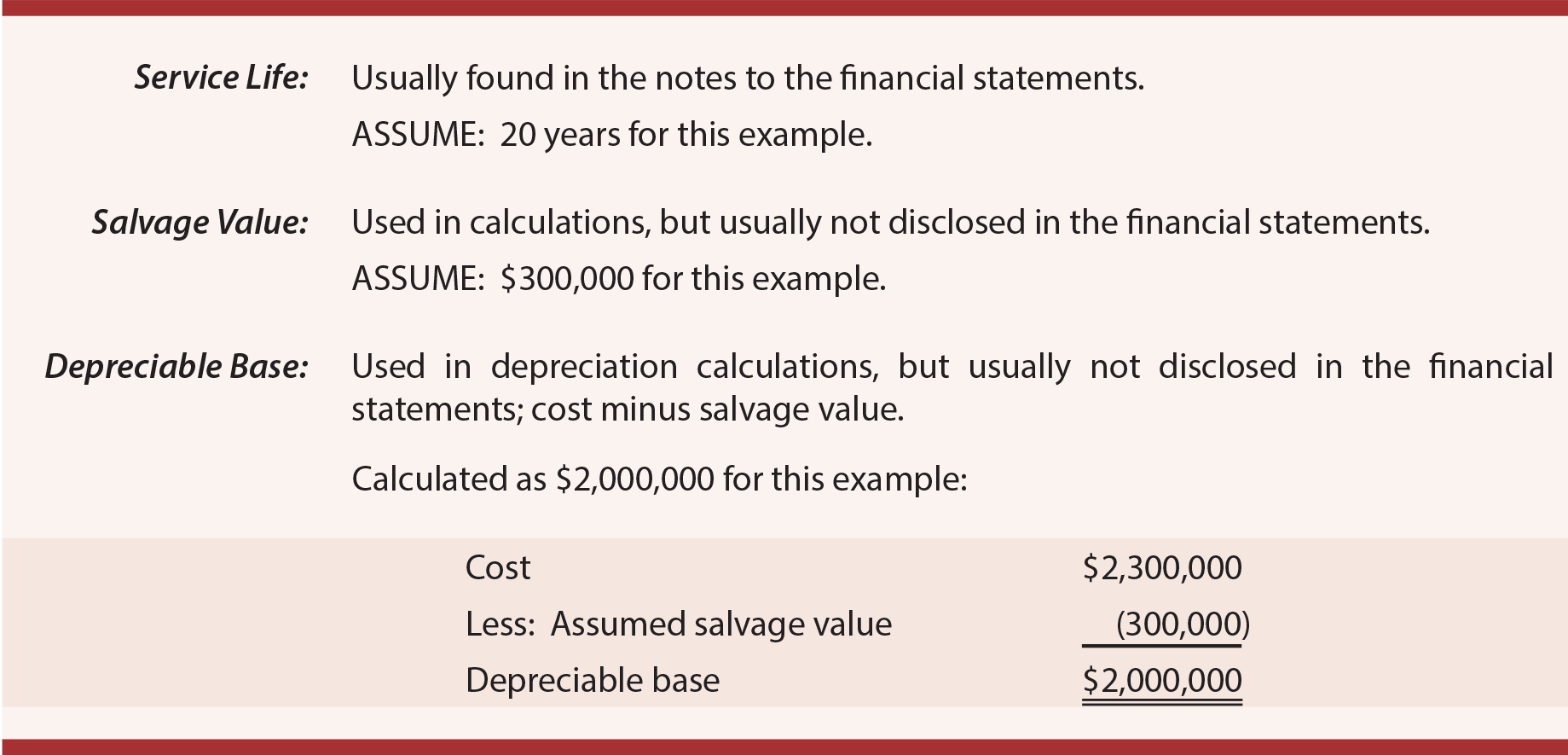

Depreciation Concepts

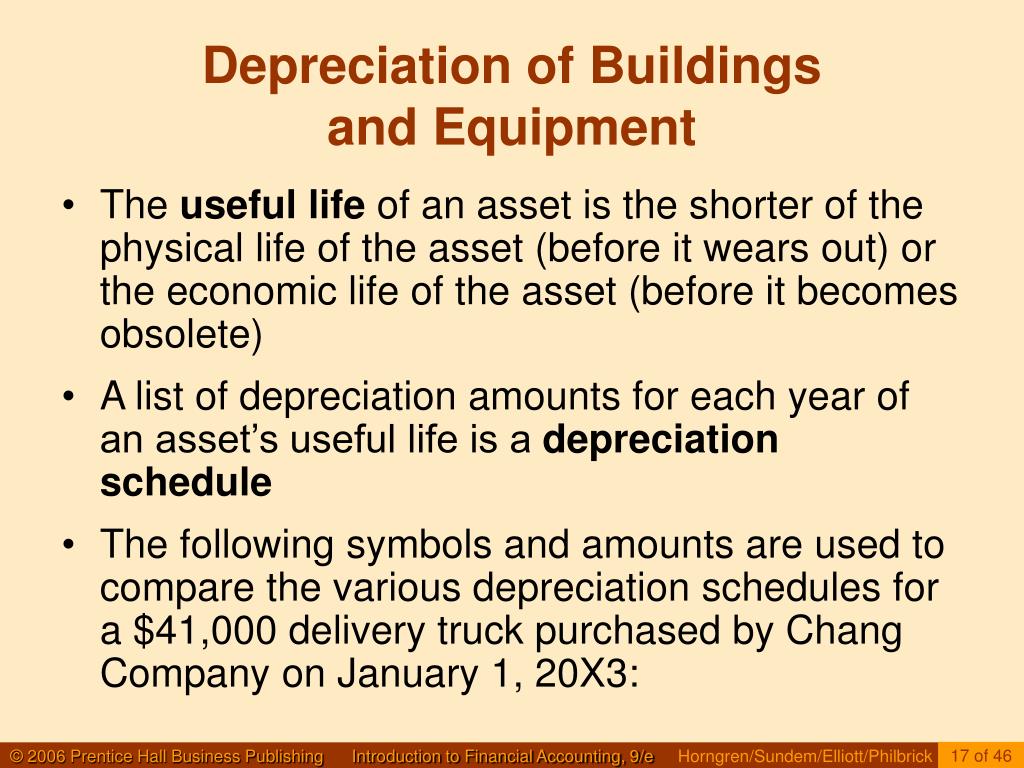

PPT LongLived Assets and Depreciation PowerPoint Presentation ID

Methods of Depreciation Formulas, Problems, and Solutions Owlcation

Understanding the Depreciation of a Commercial Building

Depreciation for Building Definition, Formula, and Excel Examples

Popular Depreciation Methods To Calculate Asset Value Over The Years

To Determine Yearly Depreciation, Divide The Cost Of The Asset By Its Useful Life.

You Can Also Depreciate Certain Intangible Property, Such As Patents, Copyrights, And Computer Software.

Land Can Never Be Depreciated.

Depreciation Is A Systematic Procedure For Allocating The Acquisition Cost Of A Capital Asset Over Its Useful Life.

Related Post: