Depreciation On Commercial Buildings

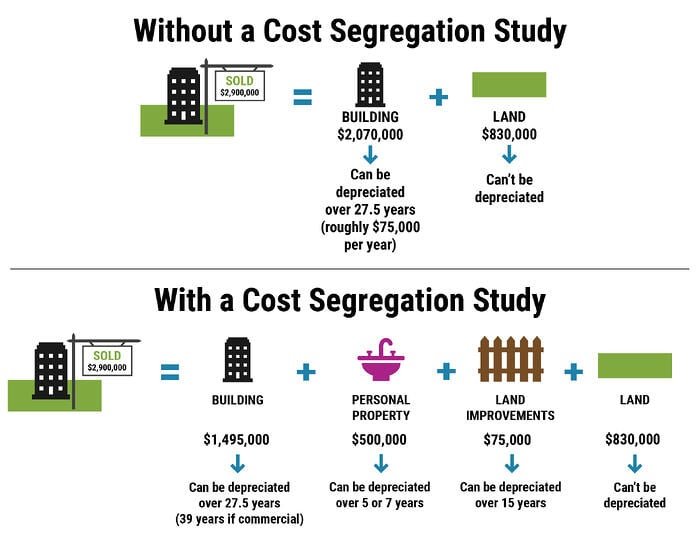

Depreciation On Commercial Buildings - Commercial real estate depreciation is a key tax deduction that allows property owners to recover the cost of their investment over time. When calculating depreciation on real estate, the irs recommends using two methods: Commercial buildings are typically depreciated over 39 years, allowing owners to spread out the property's cost and reduce taxable income through depreciation deductions. You may depreciate property that meets all the following requirements: Increase performanceautomatic calculationssimplify workflowexpert tax software Depreciation stands as a fundamental financial component in multifamily commercial and industrial real estate investments. The general depreciation system (gds) and the alternative depreciation system. Understanding depreciation in rental property. This accounting tool offers substantial tax benefits and helps maximize your cash flow by allowing. For new investors stepping into commercial real estate, understanding depreciation is critical. For new investors stepping into commercial real estate, understanding depreciation is critical. This accounting tool offers substantial tax benefits and helps maximize your cash flow by allowing. Increase performanceautomatic calculationssimplify workflowexpert tax software The process begins by determining the asset’s. The basis used for figuring depreciation is the same as the basis that. When calculating depreciation on real estate, the irs recommends using two methods: Commercial buildings are depreciated over 39 years. To deduct the proper amount of depreciation each year, first determine your basis in the property you intend to depreciate. Depreciation stands as a fundamental financial component in multifamily commercial and industrial real estate investments. For buildings, the standard depreciation rate is 10% for commercial and industrial buildings, while residential properties often have a lower rate. For new investors stepping into commercial real estate, understanding depreciation is critical. Depreciation stands as a fundamental financial component in multifamily commercial and industrial real estate investments. In most cases, when you buy a building, the. To deduct the proper amount of depreciation each year, first determine your basis in the property you intend to depreciate. Mastery of depreciation schedules,. This accounting tool offers substantial tax benefits and helps maximize your cash flow by allowing. When calculating depreciation on real estate, the irs recommends using two methods: The basis used for figuring depreciation is the same as the basis that. In march of 2020, the coronavirus aid, relief, and economic security act (cares act) was passed, including several provisions that. Commercial buildings are typically depreciated over 39 years, allowing owners to spread out the property's cost and reduce taxable income through depreciation deductions. Commercial buildings are depreciated over 39 years. Increase performanceautomatic calculationssimplify workflowexpert tax software Understanding depreciation in rental property. You may depreciate property that meets all the following requirements: 39 years (commercial buildings) land is not depreciable (it doesn't wear out), but land improvements such as roads, sidewalks or landscaping may be written off over periods of. Commercial buildings are depreciated over 39 years. You may depreciate property that meets all the following requirements: Commercial real estate depreciation is a key tax deduction that allows property owners to recover. You may depreciate property that meets all the following requirements: This accounting tool offers substantial tax benefits and helps maximize your cash flow by allowing. Commercial real estate depreciation is a key tax deduction that allows property owners to recover the cost of their investment over time. Commercial buildings are typically depreciated over 39 years, allowing owners to spread out. Calculating depreciation for commercial property involves a systematic approach that incorporates various factors and decisions. Mastery of depreciation schedules, asset. Understanding depreciation in rental property. In most cases, when you buy a building, the. Depreciation on real property, like an office building, begins in the month the building is placed in service. For buildings, the standard depreciation rate is 10% for commercial and industrial buildings, while residential properties often have a lower rate. Commercial real estate depreciation is a key tax deduction that allows property owners to recover the cost of their investment over time. Understanding depreciation in rental property. Calculating depreciation for commercial property involves a systematic approach that incorporates various. 39 years (commercial buildings) land is not depreciable (it doesn't wear out), but land improvements such as roads, sidewalks or landscaping may be written off over periods of. The general depreciation system (gds) and the alternative depreciation system. Understanding depreciation in rental property. Increase performanceautomatic calculationssimplify workflowexpert tax software For new investors stepping into commercial real estate, understanding depreciation is. For new investors stepping into commercial real estate, understanding depreciation is critical. Depreciation on real property, like an office building, begins in the month the building is placed in service. Depreciation stands as a fundamental financial component in multifamily commercial and industrial real estate investments. Calculating depreciation for commercial property involves a systematic approach that incorporates various factors and decisions.. Increase performanceautomatic calculationssimplify workflowexpert tax software Understanding depreciation in rental property. Commercial real estate depreciation is a key tax deduction that allows property owners to recover the cost of their investment over time. When calculating depreciation on real estate, the irs recommends using two methods: The general depreciation system (gds) and the alternative depreciation system. The basis used for figuring depreciation is the same as the basis that. The process begins by determining the asset’s. The general depreciation system (gds) and the alternative depreciation system. For new investors stepping into commercial real estate, understanding depreciation is critical. This accounting tool offers substantial tax benefits and helps maximize your cash flow by allowing. Depreciation stands as a fundamental financial component in multifamily commercial and industrial real estate investments. Mastery of depreciation schedules, asset. Commercial buildings are typically depreciated over 39 years, allowing owners to spread out the property's cost and reduce taxable income through depreciation deductions. Commercial real estate depreciation is a key tax deduction that allows property owners to recover the cost of their investment over time. When calculating depreciation on real estate, the irs recommends using two methods: You may depreciate property that meets all the following requirements: 39 years (commercial buildings) land is not depreciable (it doesn't wear out), but land improvements such as roads, sidewalks or landscaping may be written off over periods of. In most cases, when you buy a building, the. Land is never depreciable, although buildings and certain land improvements may be. Depreciation on real property, like an office building, begins in the month the building is placed in service. Calculating depreciation for commercial property involves a systematic approach that incorporates various factors and decisions.PPT LongLived Assets and Depreciation PowerPoint Presentation ID

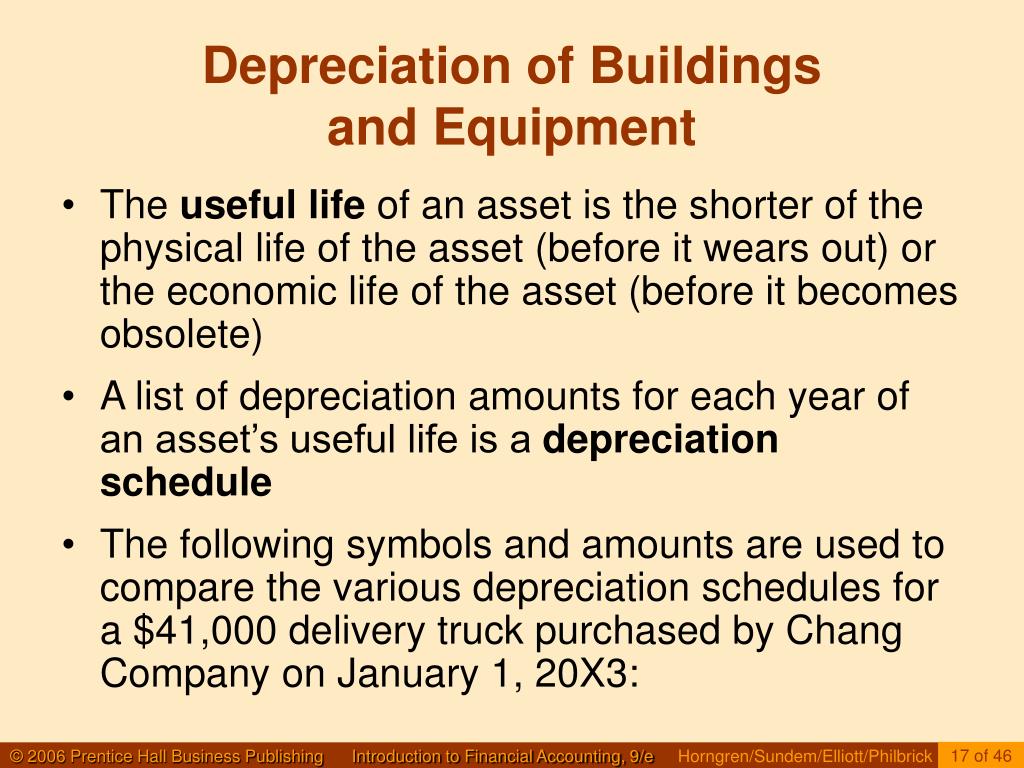

Depreciation Hacks How Cost Segregation Can Give Your Commercial

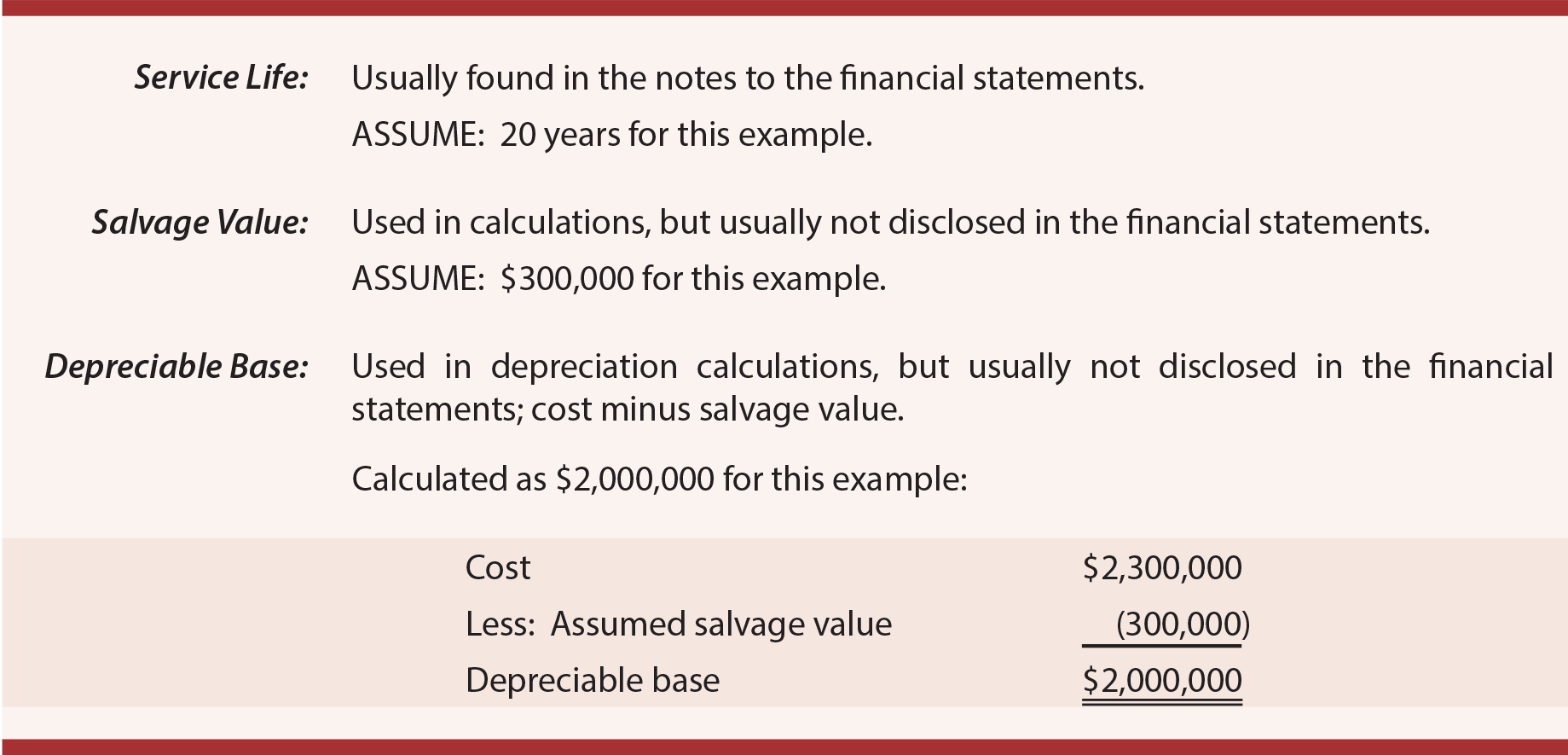

Solved BUILDING StraightLine Depreciation Schedule

Understanding the Depreciation of a Commercial Building

Understanding the Depreciation of a Commercial Building

Depreciation Concepts

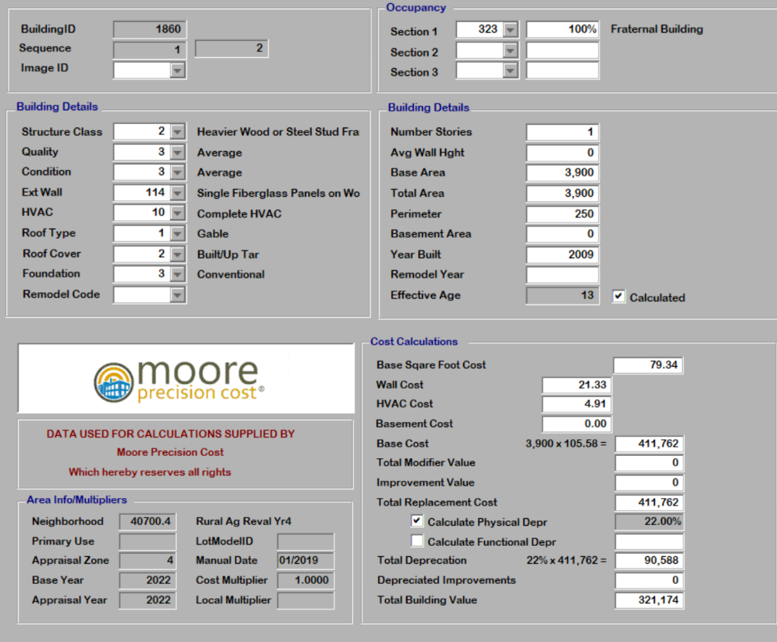

Commercial Building Depreciation Commercial Appraisal File 1

Popular Depreciation Methods To Calculate Asset Value Over The Years

Depreciation for Building Definition, Formula, and Excel Examples

Depreciation for Building Definition, Formula, and Excel Examples

Understanding Depreciation In Rental Property.

For Buildings, The Standard Depreciation Rate Is 10% For Commercial And Industrial Buildings, While Residential Properties Often Have A Lower Rate.

To Deduct The Proper Amount Of Depreciation Each Year, First Determine Your Basis In The Property You Intend To Depreciate.

In March Of 2020, The Coronavirus Aid, Relief, And Economic Security Act (Cares Act) Was Passed, Including Several Provisions That Impact The Treatment Of Depreciable Assets.

Related Post: