Depreciation Years For Building

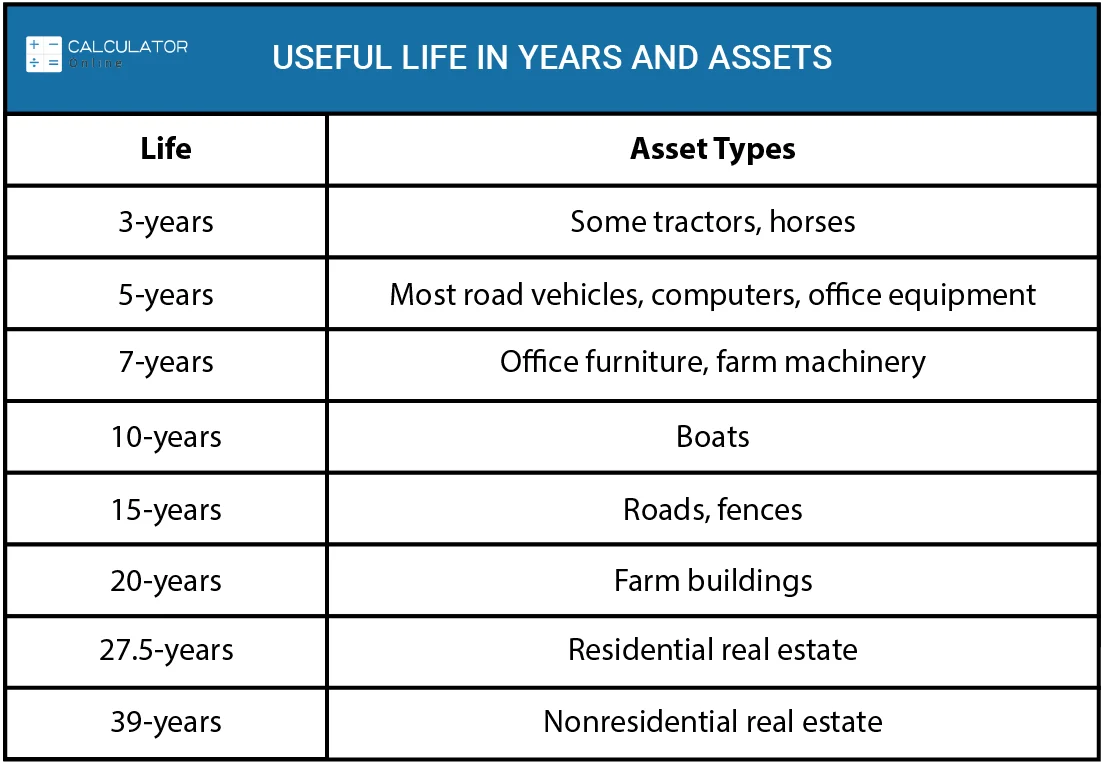

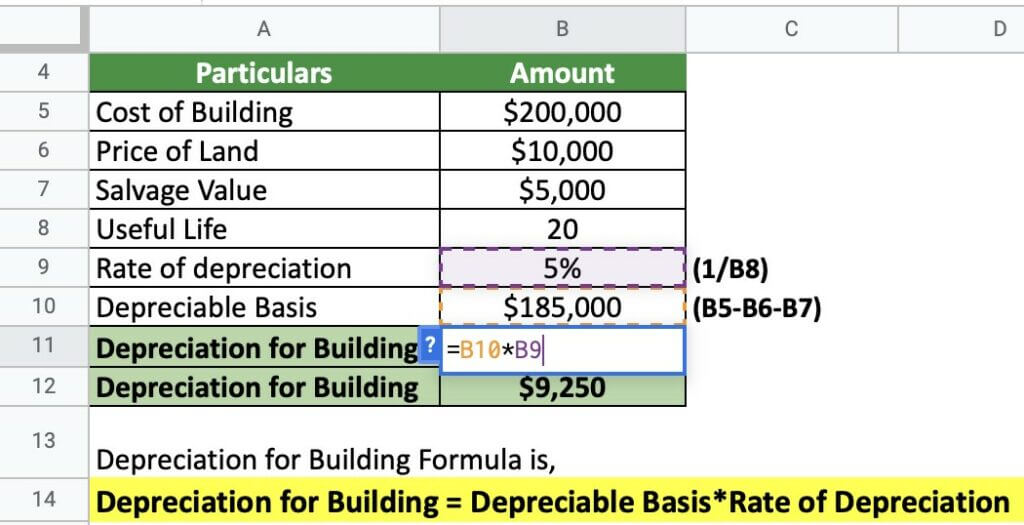

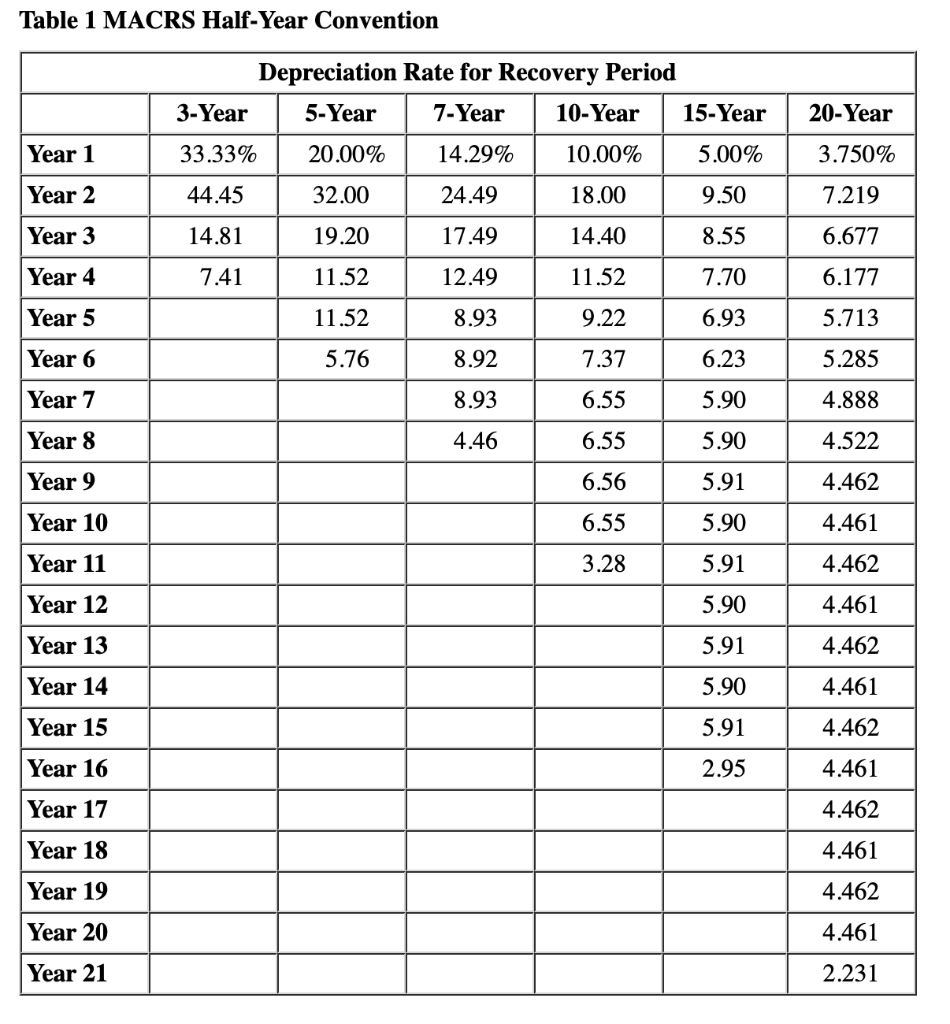

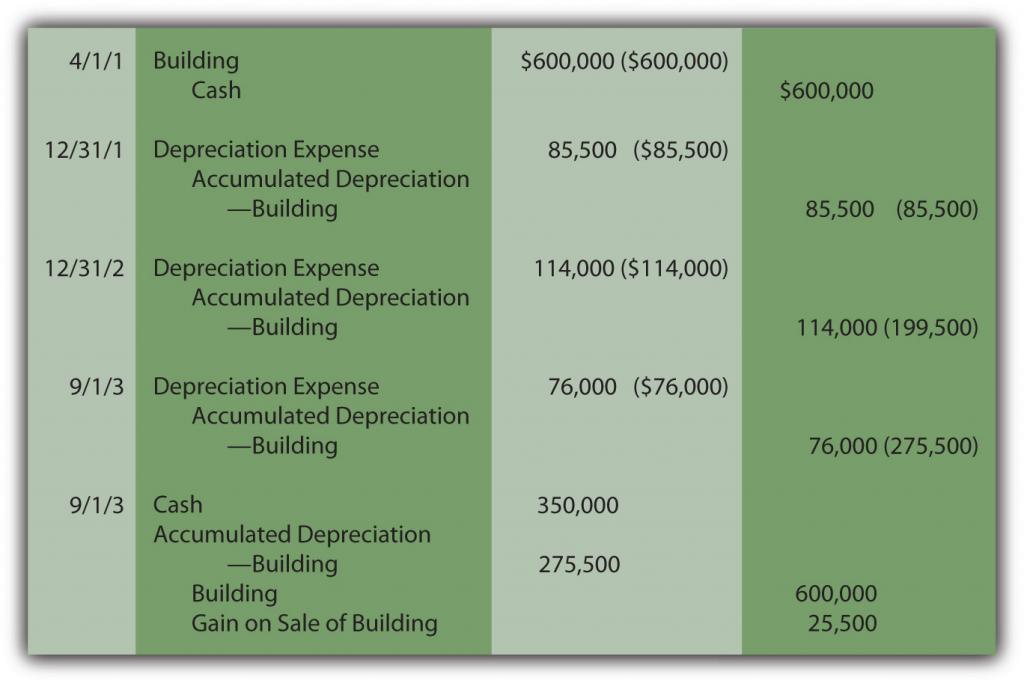

Depreciation Years For Building - Property such as computers, vehicles and office furniture, for example, can be depreciated for periods of three, five, seven or 10 years. A company purchases equipment for $50,000 with a useful life of 10 years and a salvage value of $5,000. It accounts for wear and tear, deterioration, or. To calculate, subtract the salvage value of the property from its initial cost, then divide by the number of years it is expected to be useful. Annual depreciation = (cost of asset − salvage value) / useful life. This method lets you deduct the same amount of depreciation each year over the useful life of the property. You may be able to elect. You deduct a part of the cost every year until you fully recover its cost. For commercial rental real estate and buildings used in a trade or business, the depreciable life is 39 years. Commercial and residential buildings can be depreciated over a certain number of years based on the type of property. You may be able to elect. The internal revenue service (irs) in the united states, for example, permits businesses to depreciate buildings over a specified recovery period, typically 27.5 years for. This method lets you deduct the same amount of depreciation each year over the useful life of the property. Property such as computers, vehicles and office furniture, for example, can be depreciated for periods of three, five, seven or 10 years. The company can choose which method it wants to use for depreciating. Annual depreciation = (cost of asset − salvage value) / useful life. Depreciation on real property, like an office building, begins in the month the building is placed in service. It helps businesses make informed decisions about. In most cases, when you buy a building, the. You deduct a part of the cost every year until you fully recover its cost. For commercial rental real estate and buildings used in a trade or business, the depreciable life is 39 years. This method lets you deduct the same amount of depreciation each year over the useful life of the property. Depreciation is the recovery of the cost of the property over a number of years. According to irs regulations, the standard depreciation. This method lets you deduct the same amount of depreciation each year over the useful life of the property. Subtract the salvage value, if any, from the adjusted basis. You deduct a part of the cost every year until you fully recover its cost. Commercial and residential buildings can be depreciated over a certain number of years based on the. For commercial rental real estate and buildings used in a trade or business, the depreciable life is 39 years. It accounts for wear and tear, deterioration, or. The internal revenue service (irs) in the united states, for example, permits businesses to depreciate buildings over a specified recovery period, typically 27.5 years for. Depreciation on real property, like an office building,. To figure your deduction, first determine the adjusted basis, salvage value, and estimated useful life of your property. Depreciation is the recovery of the cost of the property over a number of years. It helps businesses make informed decisions about. To calculate, subtract the salvage value of the property from its initial cost, then divide by the number of years. You may be able to elect. There are three main methods of depreciation: According to irs regulations, the standard depreciation period for new commercial construction is typically 39 years. To figure your deduction, first determine the adjusted basis, salvage value, and estimated useful life of your property. Depreciation on real property, like an office building, begins in the month the. According to irs regulations, the standard depreciation period for new commercial construction is typically 39 years. Depreciation for buildings refers to the gradual reduction in the value of a building till it reaches the final value, also known as salvage value, due to wear and tear, age, or. Farm buildings and certain improvements to land can. To figure your deduction,. You may be able to elect. A company purchases equipment for $50,000 with a useful life of 10 years and a salvage value of $5,000. It helps businesses make informed decisions about. Commercial and residential buildings can be depreciated over a certain number of years based on the type of property. To figure your deduction, first determine the adjusted basis,. Depreciation is the recovery of the cost of the property over a number of years. It accounts for wear and tear, deterioration, or. In most cases, when you buy a building, the. Depreciation for buildings refers to the gradual reduction in the value of a building till it reaches the final value, also known as salvage value, due to wear. It helps businesses make informed decisions about. The internal revenue service (irs) in the united states, for example, permits businesses to depreciate buildings over a specified recovery period, typically 27.5 years for. The company can choose which method it wants to use for depreciating. For residential rental property, the depreciable life is 27.5 years. This method lets you deduct the. Depreciation on real property, like an office building, begins in the month the building is placed in service. To figure your deduction, first determine the adjusted basis, salvage value, and estimated useful life of your property. You deduct a part of the cost every year until you fully recover its cost. For example, a building purchased. Farm buildings and certain. According to irs regulations, the standard depreciation period for new commercial construction is typically 39 years. It helps businesses make informed decisions about. Depreciation is the recovery of the cost of the property over a number of years. Commercial and residential buildings can be depreciated over a certain number of years based on the type of property. For example, a building purchased. It accounts for wear and tear, deterioration, or. To calculate, subtract the salvage value of the property from its initial cost, then divide by the number of years it is expected to be useful. There are three main methods of depreciation: The company can choose which method it wants to use for depreciating. You may be able to elect. In most cases, when you buy a building, the. Property such as computers, vehicles and office furniture, for example, can be depreciated for periods of three, five, seven or 10 years. A company purchases equipment for $50,000 with a useful life of 10 years and a salvage value of $5,000. For commercial rental real estate and buildings used in a trade or business, the depreciable life is 39 years. The internal revenue service (irs) in the united states, for example, permits businesses to depreciate buildings over a specified recovery period, typically 27.5 years for. Annual depreciation = (cost of asset − salvage value) / useful life.Depreciation for Building Definition, Formula, and Excel Examples

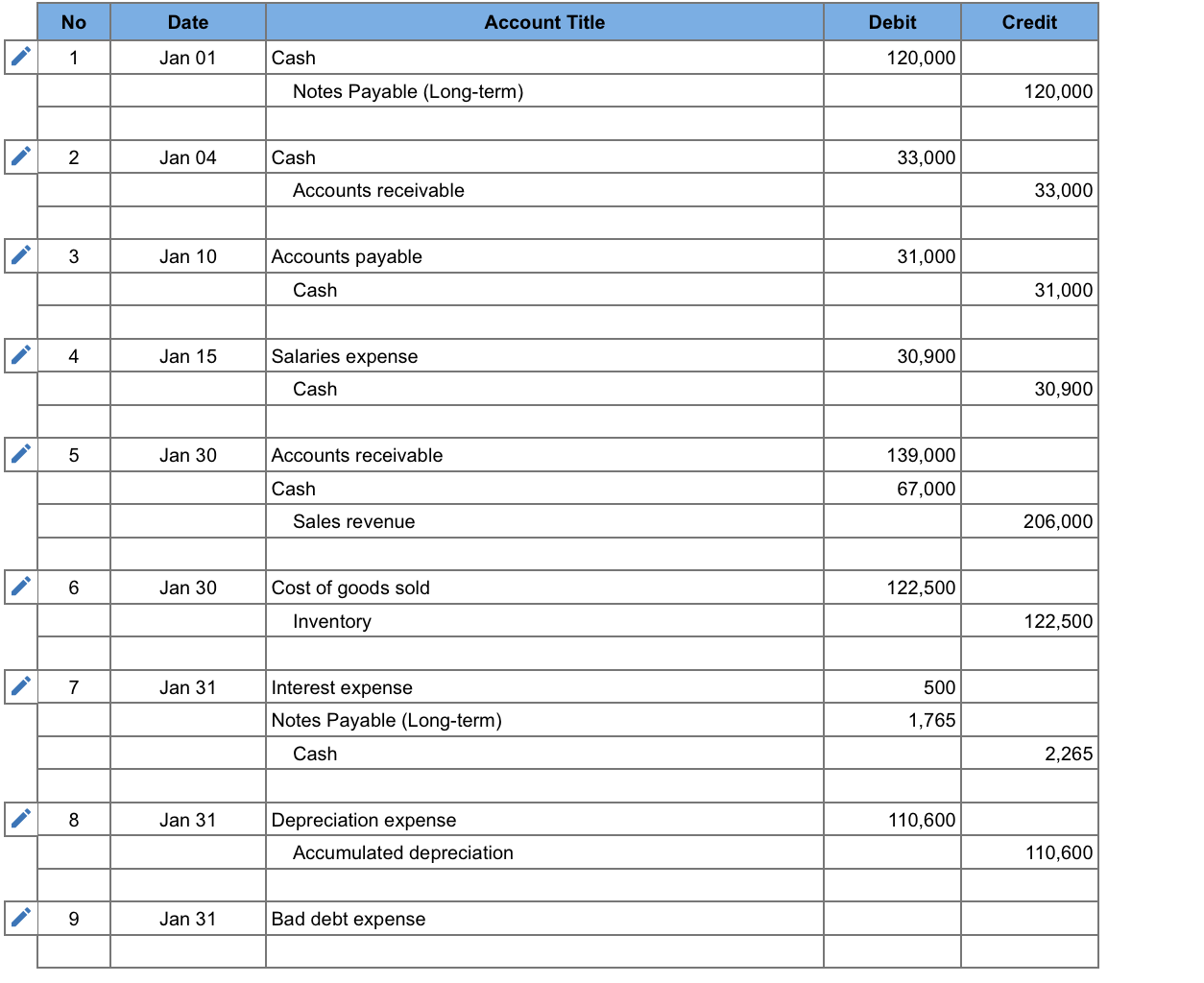

Depreciation Calculation for Table and Calculated Methods (Oracle

MACRS Depreciation Calculator

Popular Depreciation Methods To Calculate Asset Value Over The Years

Solved BUILDING StraightLine Depreciation Schedule

Methods of Depreciation Formulas, Problems, and Solutions Owlcation

Depreciation for Building Definition, Formula, and Excel Examples

A. Using MACRS, what is Javier’s depreciation

Depreciation Recapture Definition ⋆ Accounting Services

Solved JOURNAL ENTRY FOR Depreciation on the building for

Depreciation For Buildings Refers To The Gradual Reduction In The Value Of A Building Till It Reaches The Final Value, Also Known As Salvage Value, Due To Wear And Tear, Age, Or.

You Deduct A Part Of The Cost Every Year Until You Fully Recover Its Cost.

Depreciation On Real Property, Like An Office Building, Begins In The Month The Building Is Placed In Service.

For Residential Rental Property, The Depreciable Life Is 27.5 Years.

Related Post: