Digital Federal Credit Union Credit Builder Loan

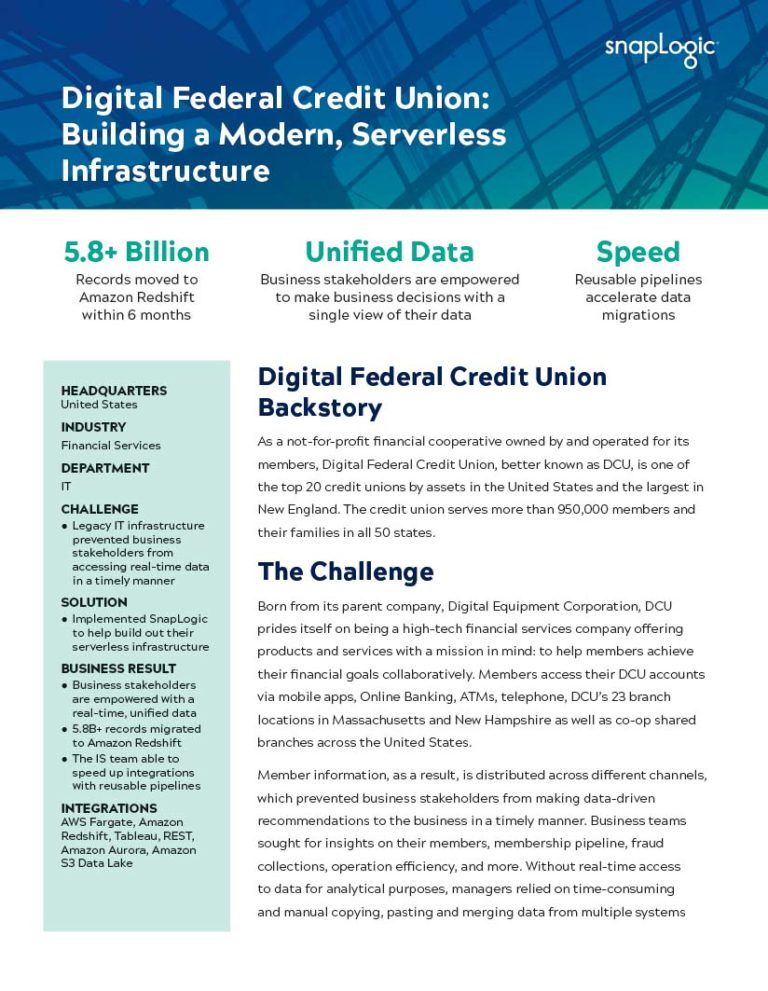

Digital Federal Credit Union Credit Builder Loan - They have an apr of 5%, which is lower than other. Read on to find out. Pay off debt or make a major purchase. Dcu's credit builder loan aims to give your credit a boost in just 12 to 24 months. Digital federal credit union (dcu) offers a good amount of flexibility with its credit builder loans, with loan amounts ranging from $500 to $3,000 over 12 to 24 months. Our fresh start loan can help you establish new credit or add a positive record to your existing credit history. Credit builder loans have two advantages: A digital credit union credit builder loan can help you build credit. The loan in the locked savings account is available at the end of the loan term. Manage your finances easily online with confidence and protection. Digital federal credit union (dcu) offers a good amount of flexibility with its credit builder loans, with loan amounts ranging from $500 to $3,000 over 12 to 24 months. Credit builder loans save $1000s when. Dcu's credit builder loan aims to give your credit a boost in just 12 to 24 months. Amount ≥ negative accounts (if you have any) apr < 36%; You can borrow up to $3,000, and your loan is locked in a savings account until you’ve paid it in full. Dcu's credit builder loans are flexible loans that range from $500 to $3,000, with repayment terms from 12 to 24 months. The loan in the locked savings account is available at the end of the loan term. Read our dcu review to see if it's right for you. Get the full story from fellow consumers' unbiased digital federal credit union reviews. Our fresh start loan can help you establish new credit or add a positive record to your existing credit history. Read on to find out. Digital federal credit union reviews, contact info, products & faq. Digital federal credit union (dcu) offers a good amount of flexibility with its credit builder loans, with loan amounts ranging from $500 to $3,000 over 12 to 24 months. Credit builder loans have two advantages: Manage your finances easily online with confidence and protection. Our fresh start loan can help you establish new credit or add a positive record to your existing credit history. A credit builder loan is specifically designed to help you build or rebuild your credit history as you build up to $3,000 in savings plus dividends. Read on to find out. Pay off debt or make a major purchase. As. They have an apr of 5%, which is lower than other. Get the full story from fellow consumers' unbiased digital federal credit union reviews. Amount ≥ negative accounts (if you have any) apr < 36%; Dcu's credit builder loans are flexible loans that range from $500 to $3,000, with repayment terms from 12 to 24 months. How does digital federal. Pay off debt or make a major purchase. Get the full story from fellow consumers' unbiased digital federal credit union reviews. As an added bonus, you earn dividends as you pay off the loan. Access your digital federal credit union account securely with the dcu login. How does digital federal credit union's cbl measure up? A digital credit union credit builder loan can help you build credit. You can borrow up to $3,000, and your loan is locked in a savings account until you’ve paid it in full. Dcu's credit builder loan aims to give your credit a boost in just 12 to 24 months. Credit builder loans have two advantages: Manage your finances easily. Dcu's credit builder loan aims to give your credit a boost in just 12 to 24 months. Digital federal credit union (dcu) offers a good amount of flexibility with its credit builder loans, with loan amounts ranging from $500 to $3,000 over 12 to 24 months. Boost credit score and build your savings. How does digital federal credit union's cbl. Digital federal credit union reviews, contact info, products & faq. How does digital federal credit union's cbl measure up? Digital credit union (dcu) offers low rates on its credit builder loan, but is only open to members. Dcu's credit builder loans are flexible loans that range from $500 to $3,000, with repayment terms from 12 to 24 months. Credit builder. How does digital federal credit union's cbl measure up? Our fresh start loan can help you establish new credit or add a positive record to your existing credit history. Pay off debt or make a major purchase. Amount ≥ negative accounts (if you have any) apr < 36%; Digital federal credit union reviews, contact info, products & faq. Amount ≥ negative accounts (if you have any) apr < 36%; Our fresh start loan can help you establish new credit or add a positive record to your existing credit history. Dcu's credit builder loans are flexible loans that range from $500 to $3,000, with repayment terms from 12 to 24 months. Read our dcu review to see if it's. They have an apr of 5%, which is lower than other. Get the full story from fellow consumers' unbiased digital federal credit union reviews. Manage your finances easily online with confidence and protection. Our fresh start loan can help you establish new credit or add a positive record to your existing credit history. Access your digital federal credit union account. Boost credit score and build your savings. Digital credit union (dcu) offers low rates on its credit builder loan, but is only open to members. Read on to find out. How does digital federal credit union's cbl measure up? A credit builder loan is specifically designed to help you build or rebuild your credit history as you build up to $3,000 in savings plus dividends. Manage your finances easily online with confidence and protection. Dcu's credit builder loans are flexible loans that range from $500 to $3,000, with repayment terms from 12 to 24 months. Pay off debt or make a major purchase. Pay off existing debt, make a major purchase, dcu offers low rates and flexible terms for your next personal loan. Digital federal credit union reviews, contact info, products & faq. Get the full story from fellow consumers' unbiased digital federal credit union reviews. Credit builder loans save $1000s when. Read our dcu review to see if it's right for you. A digital credit union credit builder loan can help you build credit. Credit builder loans have two advantages: Amount ≥ negative accounts (if you have any) apr < 36%;9 Best Loans like Seedfi & Seedfi Alternatives [2024] ViralTalky

The Ultimate Guide to CreditBuilder Loans in 2023!

6 Best Credit Builder Loans for 2022 [No Credit Check, Online, Unsecured]

Best Credit Builder Loans 2025 Investing Basic Rules

3k DCU CREDIT BUILDER LOANS EASY APPROVALS 2k Quick Loan (DIGITAL

Financial Health Federal Credit Union Credit Builder Loan SAERWO

Digital Federal Credit Union , Quick Loans YouTube

25,000 DCU Credit Builder and Personal Loan Digital Credit Union

Digital Federal Credit Union Hudson Nh Digital World

The Ultimate Guide to CreditBuilder Loans in 2023!

Dcu's Credit Builder Loan Aims To Give Your Credit A Boost In Just 12 To 24 Months.

They Have An Apr Of 5%, Which Is Lower Than Other.

Access Your Digital Federal Credit Union Account Securely With The Dcu Login.

Our Fresh Start Loan Can Help You Establish New Credit Or Add A Positive Record To Your Existing Credit History.

Related Post:

![9 Best Loans like Seedfi & Seedfi Alternatives [2024] ViralTalky](https://viraltalky.com/wp-content/uploads/2023/06/Digital-Federal-Credit-Union-1024x536.jpg.webp)

![6 Best Credit Builder Loans for 2022 [No Credit Check, Online, Unsecured]](https://digitalhoney.money/wp-content/uploads/2021/08/image-5.png)