Dividend Builder Portfolio

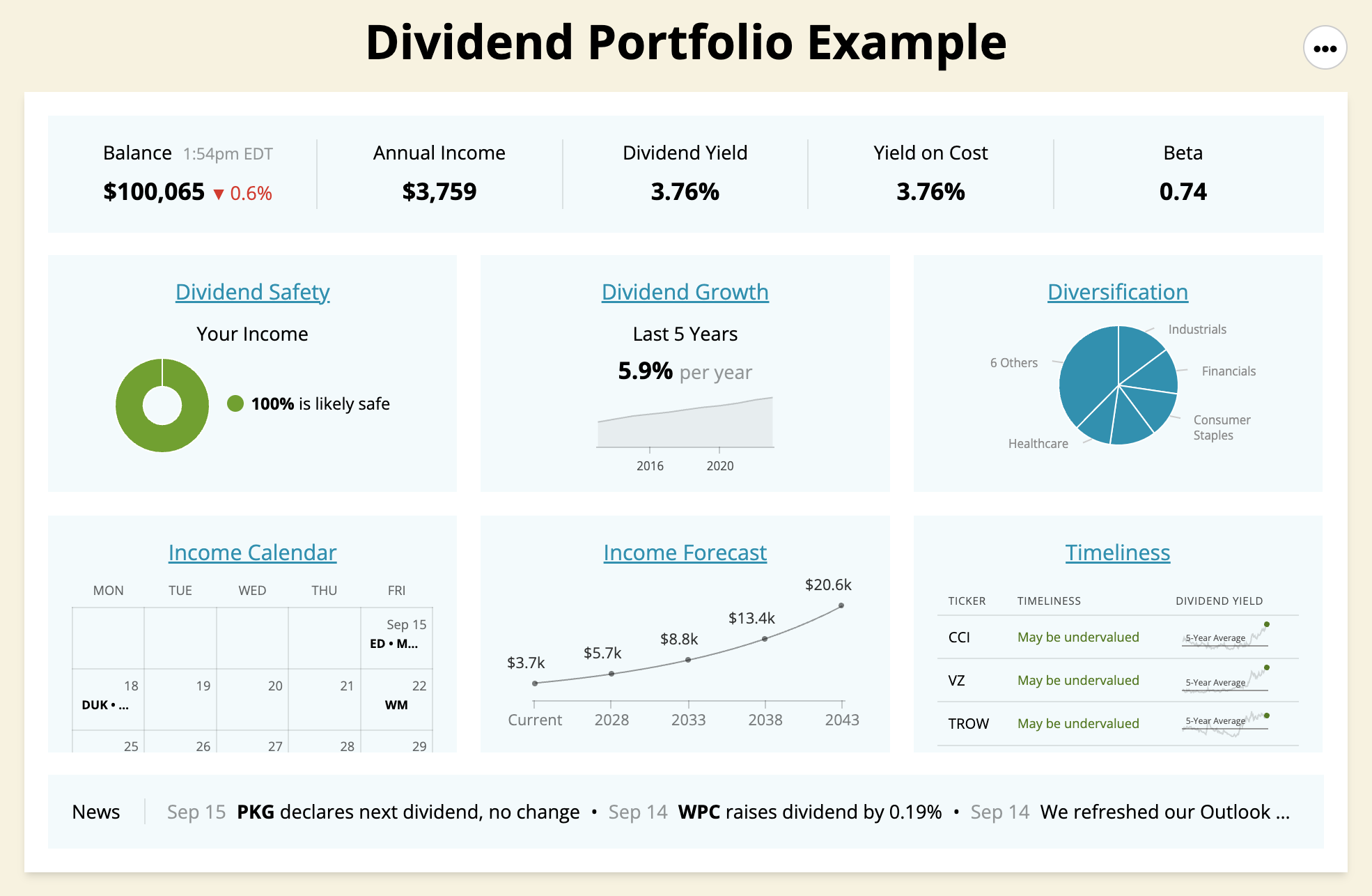

Dividend Builder Portfolio - Investing early allows for strategic, exciting choices in a market that often rewards consistency over high. Build a robust dividend portfolio through careful research and analysis. What separates dividend growth investing from other types of investing is its unique focus on businesses that compound wealth over. Today i want to review how to put together a starter dividend portfolio. Having such a portfolio allows you to earn some passive income and generate wealth for the long term. Building a dividend portfolio starts with an understanding of. Select your dividend goals below, and a suggested portfolio will be instantly generated for you. Here's what you need to know to build a dividend portfolio. Properly constructed portfolios can help us find the right balance to diversify risk and get closer to our objectives. Identifying your income goals as a dividend investor is a crucial first step in building a successful portfolio. With an annualized dividend of $1.80, we see that the payout ratio for 2025 would come out to around 20% if they can hit the eps target. By building a strong dividend stock portfolio, investors can enjoy steady, passive income while potentially growing their wealth over time. Building a dividend stock portfolio couldn’t be easier with our dividend portfolio generator! Properly constructed portfolios can help us find the right balance to diversify risk and get closer to our objectives. Here's what you need to know to build a dividend portfolio. Building a dividend portfolio brings joy, especially during its initial phase. Having such a portfolio allows you to earn some passive income and generate wealth for the long term. Build a robust dividend portfolio through careful research and analysis. It is called dividend growth investing. Perfect for a new dividend investor. Investing early allows for strategic, exciting choices in a market that often rewards consistency over high. You can adjust your dividend portfolio strategy to suit your own. Building a dividend portfolio starts with an understanding of. In other words, it is the balance of. By building a strong dividend stock portfolio, investors can enjoy steady, passive income while potentially growing. Perfect for a new dividend investor. It is called dividend growth investing. Properly constructed portfolios can help us find the right balance to diversify risk and get closer to our objectives. Portfolio construction is how you blend your investments together to give you the greatest potential to meet your objectives while managing your risk. Voya earnings history and future. Perfect for a new dividend investor. Select your dividend goals below, and a suggested portfolio will be instantly generated for you. Your goals should reflect both your cash flow needs and broader life. Here's what you need to know to build a dividend portfolio. The portfolio should consist of 80% dividend aristocrats or dividend kings, with the remaining 20% in. Voya earnings history and future. Building a dividend stock portfolio couldn’t be easier with our dividend portfolio generator! Your goals should reflect both your cash flow needs and broader life. It is called dividend growth investing. Investing early allows for strategic, exciting choices in a market that often rewards consistency over high. First, i will introduce a sample dividend portfolio of 7 dividend stocks. Having such a portfolio allows you to earn some passive income and generate wealth for the long term. Building a dividend portfolio brings joy, especially during its initial phase. It is called dividend growth investing. Investing early allows for strategic, exciting choices in a market that often rewards. Today i want to review how to put together a starter dividend portfolio. Build a robust dividend portfolio through careful research and analysis. Properly constructed portfolios can help us find the right balance to diversify risk and get closer to our objectives. Investing early allows for strategic, exciting choices in a market that often rewards consistency over high. It is. Voya earnings history and future. Building a dividend portfolio starts with an understanding of. To do so, you’ll look for companies with a history of consistent dividend payments and growth. Building a dividend stock portfolio couldn’t be easier with our dividend portfolio generator! What separates dividend growth investing from other types of investing is its unique focus on businesses that. First, i will introduce a sample dividend portfolio of 7 dividend stocks. Identifying your income goals as a dividend investor is a crucial first step in building a successful portfolio. You can adjust your dividend portfolio strategy to suit your own. In other words, it is the balance of. Select your dividend goals below, and a suggested portfolio will be. Building a dividend portfolio brings joy, especially during its initial phase. You can adjust your dividend portfolio strategy to suit your own. Investing early allows for strategic, exciting choices in a market that often rewards consistency over high. Having such a portfolio allows you to earn some passive income and generate wealth for the long term. The portfolio should consist. Building a dividend stock portfolio couldn’t be easier with our dividend portfolio generator! Voya earnings history and future. In other words, it is the balance of. Portfolio construction is how you blend your investments together to give you the greatest potential to meet your objectives while managing your risk. Properly constructed portfolios can help us find the right balance to. What separates dividend growth investing from other types of investing is its unique focus on businesses that compound wealth over. With an annualized dividend of $1.80, we see that the payout ratio for 2025 would come out to around 20% if they can hit the eps target. By building a strong dividend stock portfolio, investors can enjoy steady, passive income while potentially growing their wealth over time. Properly constructed portfolios can help us find the right balance to diversify risk and get closer to our objectives. Here's what you need to know to build a dividend portfolio. Building a dividend portfolio starts with an understanding of. First, i will introduce a sample dividend portfolio of 7 dividend stocks. In other words, it is the balance of. You can adjust your dividend portfolio strategy to suit your own. Voya earnings history and future. To do so, you’ll look for companies with a history of consistent dividend payments and growth. Building a dividend portfolio brings joy, especially during its initial phase. Build a robust dividend portfolio through careful research and analysis. Your goals should reflect both your cash flow needs and broader life. Identifying your income goals as a dividend investor is a crucial first step in building a successful portfolio. This article will explore the key factors to consider while doing so and.How to Build a Dividend Portfolio

Dividend Portfolio What is & How to Create Your Dividend Portfolio

How to Build a Dividend Portfolio

How to Build a Dividend Portfolio

How to Build a Dividend Portfolio

How to Build a Dividend Portfolio Infographic Millionaire Mob

Dividend Portfolio What is & How to Create Your Dividend Portfolio

How to Build a Dividend Portfolio

7 Steps to Building a Successful Dividend Portfolio Under The Radar

How to Build a Dividend Portfolio That Generates Cash Flow GoodWhale

Today I Want To Review How To Put Together A Starter Dividend Portfolio.

Having Such A Portfolio Allows You To Earn Some Passive Income And Generate Wealth For The Long Term.

Select Your Dividend Goals Below, And A Suggested Portfolio Will Be Instantly Generated For You.

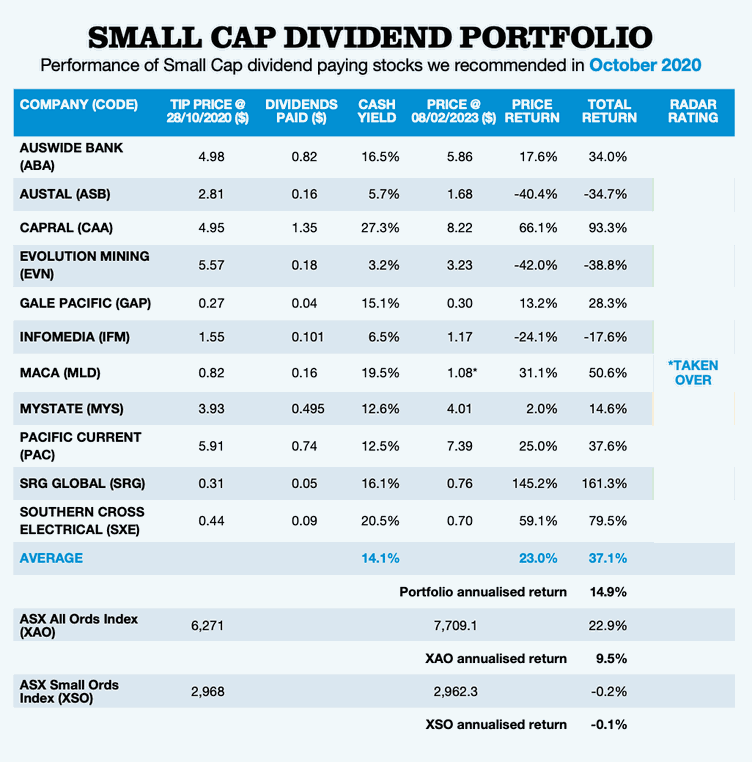

The Portfolio Should Consist Of 80% Dividend Aristocrats Or Dividend Kings, With The Remaining 20% In Reits Or Mlps.

Related Post: