Dividend Yeild Building Block

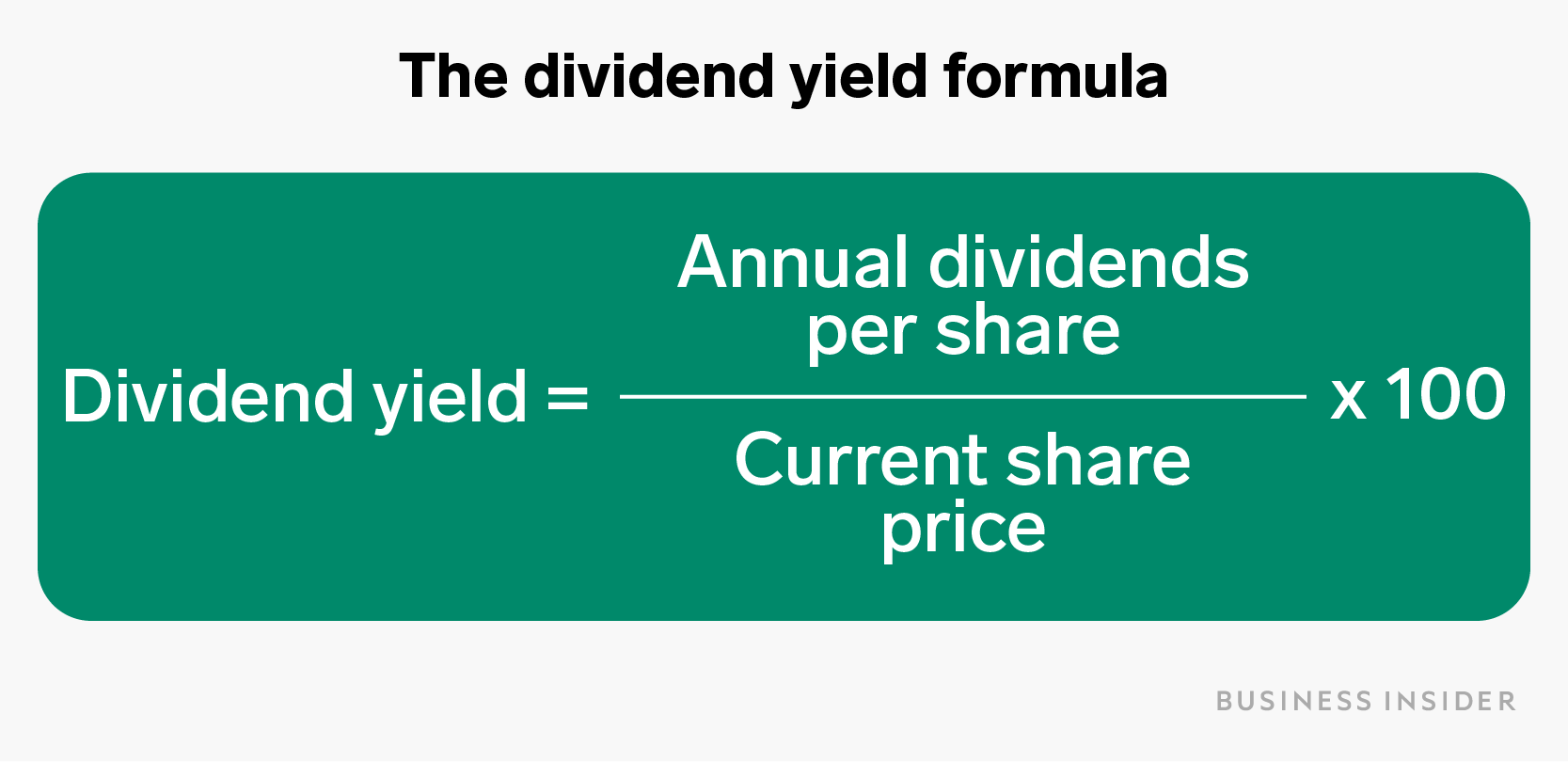

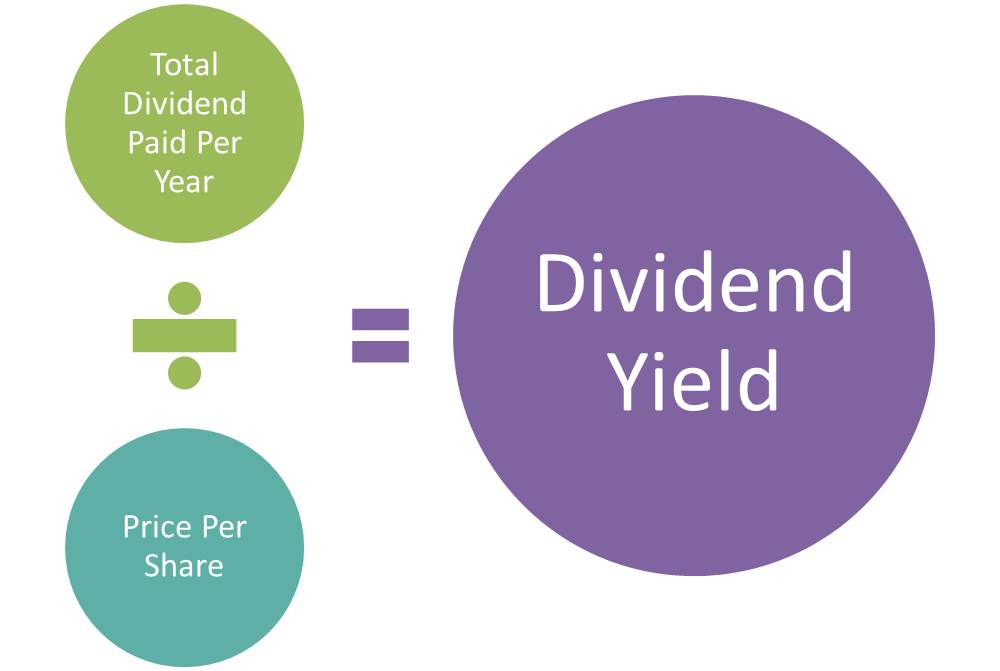

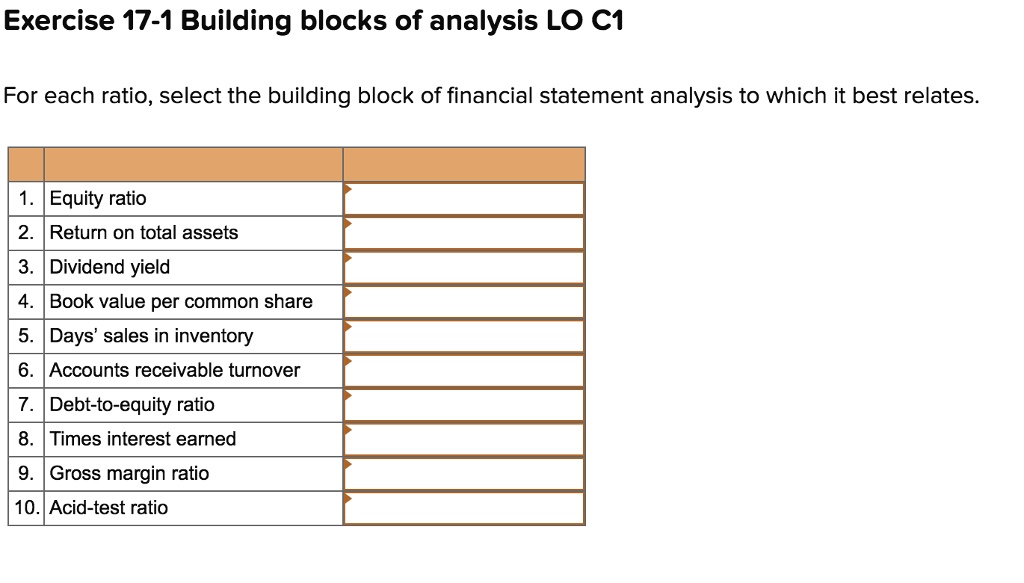

Dividend Yeild Building Block - This can help in selecting stocks that align with their income goals. Knowing your aum will help us build and prioritize features that will suit your management needs. Multiplies the most recent dividend payout amount by its. One can calculate the dividend yield based on the previous year's financial report. An income stream that lasts as long as you do. For each ratio, select the building block of financial statement analysis to which it best relates. It was the company’s 30th consecutive annual dividend increase, reinforcing its status as a dividend aristocrat. For the opportunistic advisor or investor, these sectors represent 11 unique ways to drive dividend yield in a market where yield takes on a significantly different role than it has. If the stock price drops to £32, for example, the dividend. Yet, achieving this requires a careful balance between. To put it simply, the formula for dividend yield is: As you can see in the chart, clorox's dividend yield of 3.3% is at the high end of the range over the last 20 years. Return on total assets 3 equity ratio 4. It was the company’s 30th consecutive annual dividend increase, reinforcing its status as a dividend aristocrat. For the opportunistic advisor or investor, these sectors represent 11 unique ways to drive dividend yield in a market where yield takes on a significantly different role than it has. We suggest you use two basic building. This makes sense, given the consistent raises and that the stock. For each ratio, select the building block of financial statement analysis to which it best relates.dividend yield If you’re looking for a steady income stream from your investments, keeping an eye on the dividend yield is crucial. Knowing your aum will help us build and prioritize features that will suit your management needs. Identify and describe the four areas (building blocks) of financial statement analysis. We suggest you use two basic building. For each ratio, select the building block of financial statement analysis to which it best relates. If the stock price drops to £32, for example, the dividend. In 2025, enbridge will deploy $7 billion in growth capital which. For example, the equity forecast model is based upon assumptions. Dividend yield = price per share/annual dividends per share. If the stock price drops to £32, for example, the dividend. This shows the total amount of shareholders' income in the form of dividends relative to its stock price, indicating potential return for investors. If you’re looking for a steady income. Multiplies the most recent dividend payout amount by its. Knowing your aum will help us build and prioritize features that will suit your management needs. For the opportunistic advisor or investor, these sectors represent 11 unique ways to drive dividend yield in a market where yield takes on a significantly different role than it has. Learn more about dividend stocks,. It was the company’s 30th consecutive annual dividend increase, reinforcing its status as a dividend aristocrat. Return on total assets 3 equity ratio 4. In 2025, enbridge will deploy $7 billion in growth capital which. As you can see in the chart, clorox's dividend yield of 3.3% is at the high end of the range over the last 20 years.. We suggest you use two basic building. Dividend yield = price per share/annual dividends per share. In 2025, enbridge will deploy $7 billion in growth capital which. Yet, achieving this requires a careful balance between. This can help in selecting stocks that align with their income goals. In 2025, enbridge will deploy $7 billion in growth capital which. Knowing your aum will help us build and prioritize features that will suit your management needs. We suggest you use two basic building. Identify and describe the four areas (building blocks) of financial statement analysis. One can calculate the dividend yield based on the previous year's financial report. If the stock price drops to £32, for example, the dividend. Identify and describe the four areas (building blocks) of financial statement analysis. An income stream that lasts as long as you do. The building blocks are specific to each major asset class and represent the primary drivers of future returns. Yet, achieving this requires a careful balance between. To put it simply, the formula for dividend yield is: We suggest you use two basic building. This can help in selecting stocks that align with their income goals. As you can see in the chart, clorox's dividend yield of 3.3% is at the high end of the range over the last 20 years. Learn more about dividend stocks, including. Multiplies the most recent dividend payout amount by its. To put it simply, the formula for dividend yield is: Identify and describe the four areas (building blocks) of financial statement analysis. For the opportunistic advisor or investor, these sectors represent 11 unique ways to drive dividend yield in a market where yield takes on a significantly different role than it. The building blocks are specific to each major asset class and represent the primary drivers of future returns. For each ratio, select the building block of financial statement analysis to which it best relates.dividend yield As you can see in the chart, clorox's dividend yield of 3.3% is at the high end of the range over the last 20 years.. Dividend yield = price per share/annual dividends per share. This makes sense, given the consistent raises and that the stock. When it comes to building a retirement portfolio, the dream is simple: As you can see in the chart, clorox's dividend yield of 3.3% is at the high end of the range over the last 20 years. Learn more about dividend stocks, including information about important dividend dates, the advantages of dividend. For example, the equity forecast model is based upon assumptions. This can help in selecting stocks that align with their income goals. Knowing your aum will help us build and prioritize features that will suit your management needs. In 2025, enbridge will deploy $7 billion in growth capital which. For the opportunistic advisor or investor, these sectors represent 11 unique ways to drive dividend yield in a market where yield takes on a significantly different role than it has. We suggest you use two basic building. Identify and describe the four areas (building blocks) of financial statement analysis. To put it simply, the formula for dividend yield is: An income stream that lasts as long as you do. The building blocks are specific to each major asset class and represent the primary drivers of future returns. If the stock price drops to £32, for example, the dividend.Dividend yield is a key way to evaluate a company and the regular

Building Stocks With High Dividend Yield Best Stocks List

Dividend Yield Defined Formula, Example How to Calculate DY?

Exercise 171 Building Blocks of Analysis LO C1 For each ratio, select

What Is Dividend Yield? Charles Schwab

Dividend Yield Como Calcular e Sua Relevância nos Investimentos

Dividend yeild method ( problem) YouTube

DIVIDEND word made with building blocks, business concept Stock Photo

Dividend Yield Meaning, Formula, Example, and Pros and Cons (2024)

What Is Dividend Yield? Definition, Formula & Explanation TheStreet

This Shows The Total Amount Of Shareholders' Income In The Form Of Dividends Relative To Its Stock Price, Indicating Potential Return For Investors.

Return On Total Assets 3 Equity Ratio 4.

Yet, Achieving This Requires A Careful Balance Between.

If You’re Looking For A Steady Income Stream From Your Investments, Keeping An Eye On The Dividend Yield Is Crucial.

Related Post:

:max_bytes(150000):strip_icc()/Dividendyield-7b535251438e49e082af72aa59706e18.jpg)