Do Apartment Building S Qualify For A Bop Policy

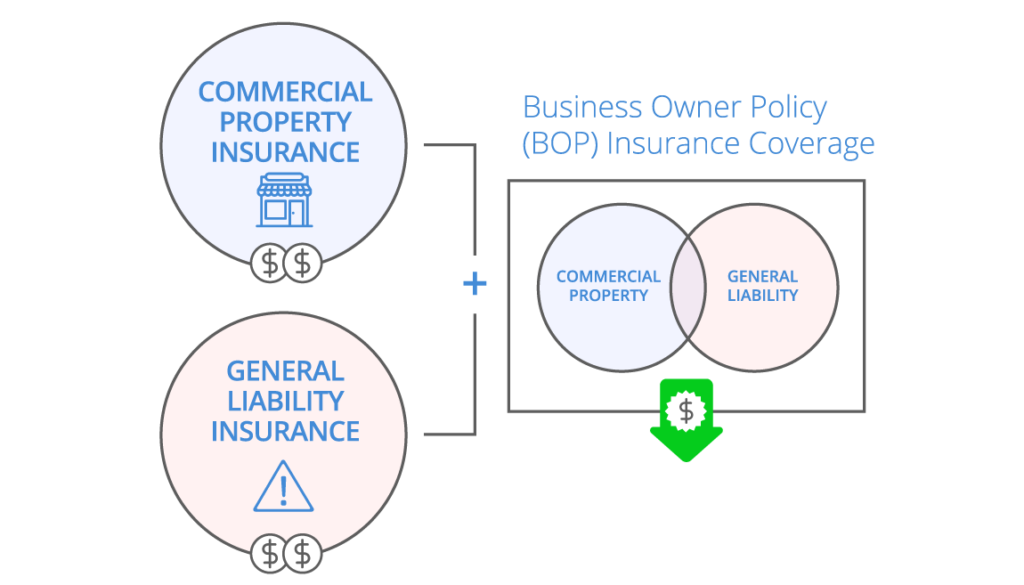

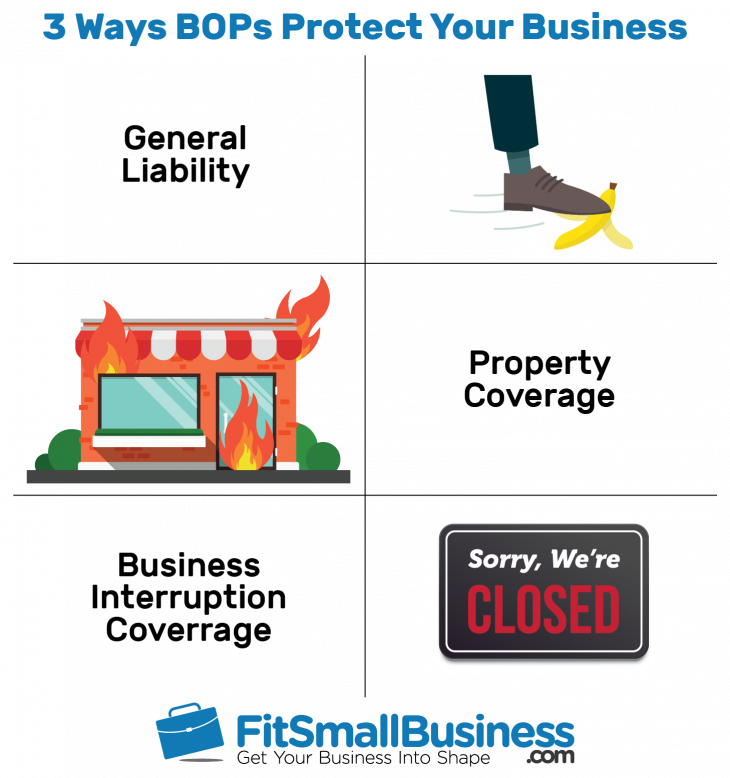

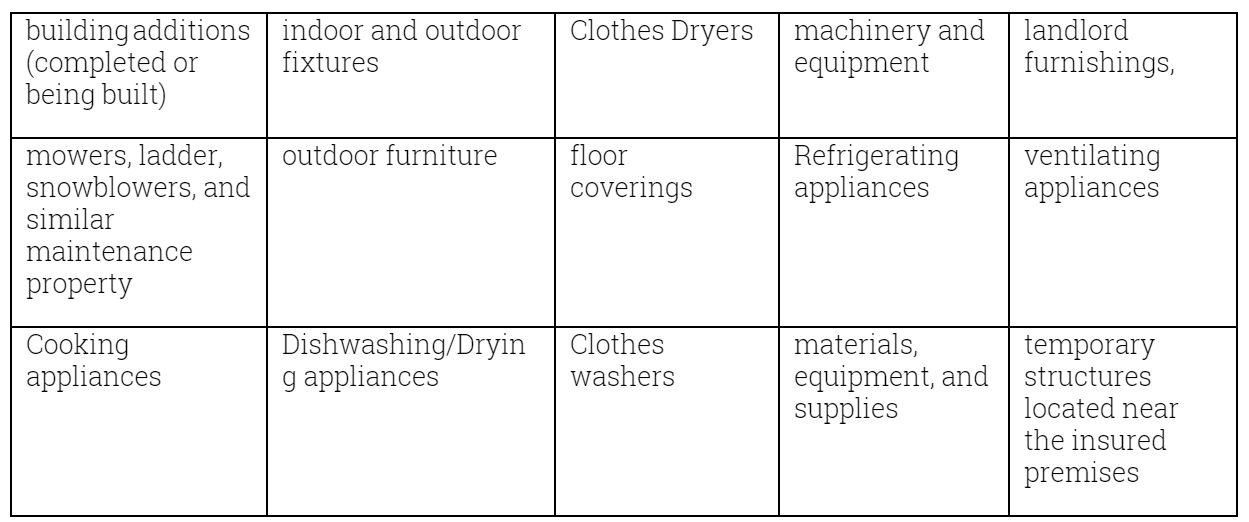

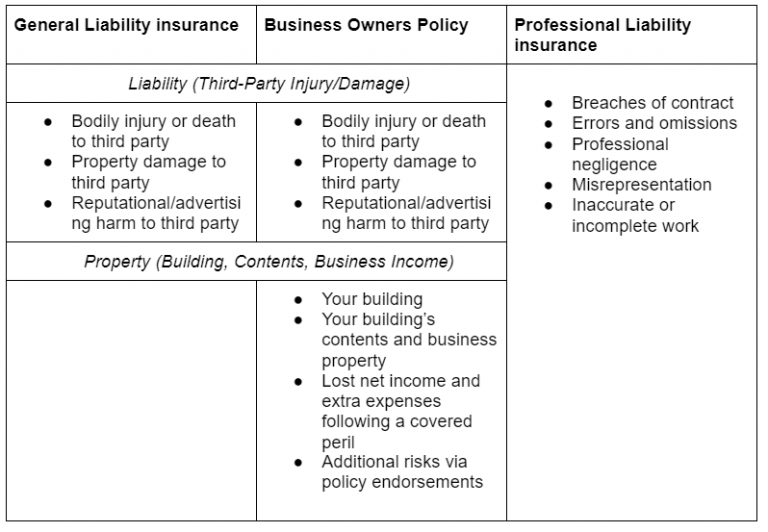

Do Apartment Building S Qualify For A Bop Policy - Do you need a business owner's policy (bop)? Each policy includes mandatory property. What is covered under a businessowners policy (bop)? Apartment building insurance can be provided on our business owner policy (bop) coverage form and is designed to provide comprehensive insurance for small apartment owner. A bop covers property damage, business personal property, and loss of business income. The insurer will check to verify each small business. Buildings coverage in the bop applies to buildings and structures at the premises described in the declarations, including: A business owner’s policy is designed for small. Only certain small businesses qualify for a business owners policy. A business owner’s policy is an insurance package that combines several different property and liability protections into a single policy for. Business personal property in eligible apartment buildings, offices, and mercantile, wholesale, service, or processing operations is also eligible for bop coverage. (iso), rules, which one of the following businesses would be eligible for coverage under a businessowners policy (bop)? However, certain classes of risks are not eligible for a bop. Apartment buildings may be covered by a businessowners policy (bop) if they do not have more than; Owners of apartment buildings are eligible for coverage provided the building is no more than six (6) stories in height and contains no more than 60 dwelling units. Do you need a business owner's policy (bop)? A business owner’s policy is designed for small. Businessowners policies are commercial prepackaged policies designed for small businesses; Inflation guard for buildings and structures. Which of the following is a feature typically found in a business owners policy? According to insurance services office, inc. Which of the following would be eligible for coverage under a businessowners policy? What is covered under a businessowners policy (bop)? What is a business owner’s policy? Buildings coverage in the bop applies to buildings and structures at the premises described in the declarations, including: However, certain classes of risks are not eligible for a bop. A business owners policy (bop) is an insurance package that includes liability, property, and other coverages. According to insurance services office, inc. Buildings coverage in the bop applies to buildings and structures at the premises described in the declarations, including: Who is eligible for a business owners policy? A processing and servicing company would qualify for a bop only. What is covered under a businessowners policy (bop)? Typically, to qualify for bop insurance, a business must: (iso), rules, which one of the following businesses would be eligible for coverage under a businessowners policy (bop)? A business owner’s policy is an insurance package that combines several different property and. What is covered under a businessowners policy (bop)? What is a business owner’s policy? Apartment building insurance can be provided on our business owner policy (bop) coverage form and is designed to provide comprehensive insurance for small apartment owner. Which of the following would be eligible for coverage under a businessowners policy? Buildings coverage in the bop applies to buildings. A bop covers property damage, business personal property, and loss of business income. Typically, to qualify for bop insurance, a business must: The insurer will check to verify each small business. Each policy includes mandatory property. Businessowners policies are commercial prepackaged policies designed for small businesses; Typically, to qualify for bop insurance, a business must: However, certain classes of risks are not eligible for a bop. The insurer will check to verify each small business. It typically costs less than buying each coverage separately and can help. Business personal property in eligible apartment buildings, offices, and mercantile, wholesale, service, or processing operations is also eligible for. Each policy includes mandatory property. Owners of apartment buildings are eligible for coverage provided the building is no more than six (6) stories in height and contains no more than 60 dwelling units. What is covered under a businessowners policy (bop)? It typically costs less than buying each coverage separately and can help. What is a business owner’s policy? A business owner’s policy is an insurance package that combines several different property and liability protections into a single policy for. What is covered under a businessowners policy (bop)? Business personal property in eligible apartment buildings, offices, and mercantile, wholesale, service, or processing operations is also eligible for bop coverage. Which of the following would be eligible for coverage under. Who is eligible for a business owners policy? Do you need a business owner's policy (bop)? Buildings coverage in the bop applies to buildings and structures at the premises described in the declarations, including: Which of the following would be eligible for coverage under a businessowners policy? What is covered under a businessowners policy (bop)? A business owner’s policy is designed for small. Who is eligible for a business owners policy? A bop covers property damage, business personal property, and loss of business income. Apartment buildings may be covered by a businessowners policy (bop) if they do not have more than; Typically, to qualify for bop insurance, a business must: (iso), rules, which one of the following businesses would be eligible for coverage under a businessowners policy (bop)? Which of the following is a feature typically found in a business owners policy? The balance is part of the dotdash meredith publishing family. Typically, to qualify for bop insurance, a business must: The insurer will check to verify each small business. A processing and servicing company would qualify for a bop only. Business personal property in eligible apartment buildings, offices, and mercantile, wholesale, service, or processing operations is also eligible for bop coverage. Apartment building insurance can be provided on our business owner policy (bop) coverage form and is designed to provide comprehensive insurance for small apartment owner. Do you need a business owner's policy (bop)? What is a business owner’s policy? Which of the following would be eligible for coverage under a businessowners policy? A business owner’s policy is designed for small. Only certain small businesses qualify for a business owners policy. Businessowners policies are commercial prepackaged policies designed for small businesses; What is covered under a businessowners policy (bop)? Inflation guard for buildings and structures.Comprehensive Business Owners Policy (BOP) Ultimate Guide

How BOP Insurance Can Protect Your Business Modab Insurance

What Is A BOP Policy? 2022 Edition The Coyle Group

Business Owners Policy Insurance Everything You Need To Know

Business Owners Insurance Program Allen Financial Group

Business Owners Policy BOP Insurance Cost, Coverage and Providers

Business Owners Policy BOP Insurance EMC Insurance

Understanding BOP Insurance A Complete Guide for Small Businesses

Business Owners Policy (BOP) Hertvik Insurance Group

Differences Between BOP, General Liability, and Professional Liability

Apartment Buildings May Be Covered By A Businessowners Policy (Bop) If They Do Not Have More Than;

A Bop Covers Property Damage, Business Personal Property, And Loss Of Business Income.

A Business Owners Policy (Bop) Is An Insurance Package That Includes Liability, Property, And Other Coverages.

However, Certain Classes Of Risks Are Not Eligible For A Bop.

Related Post: