Do Car Insurance Payments Build Credit

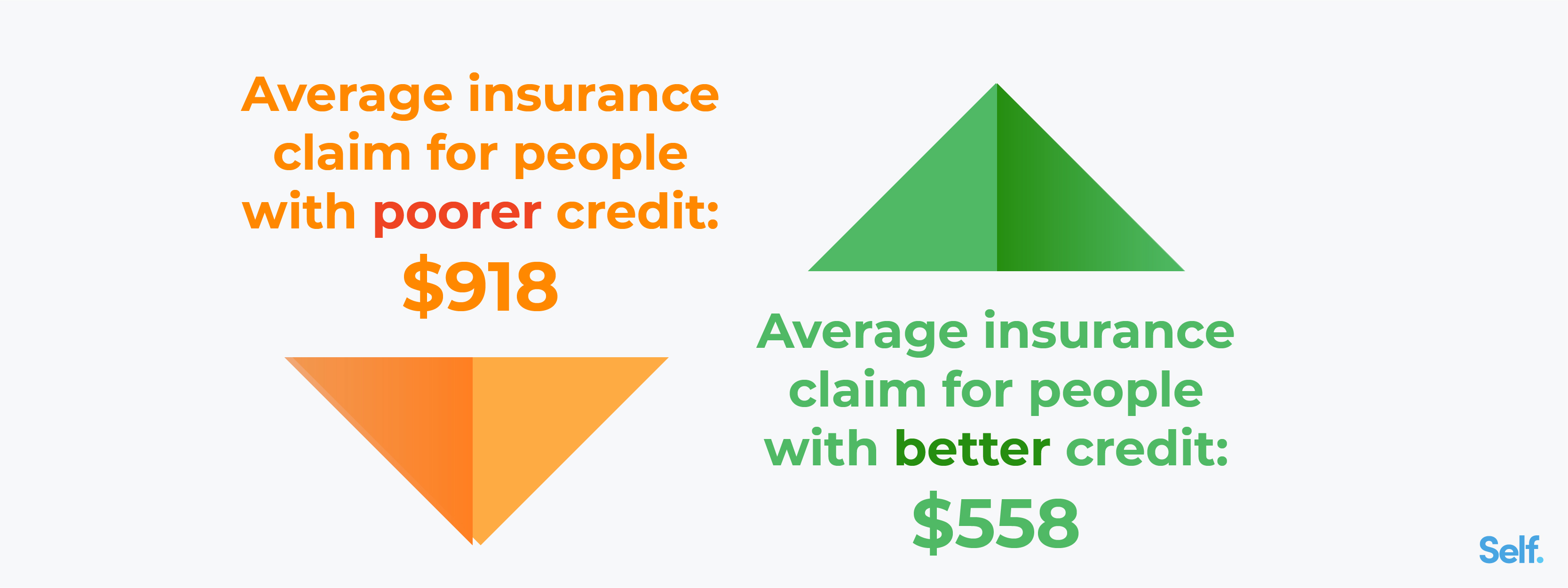

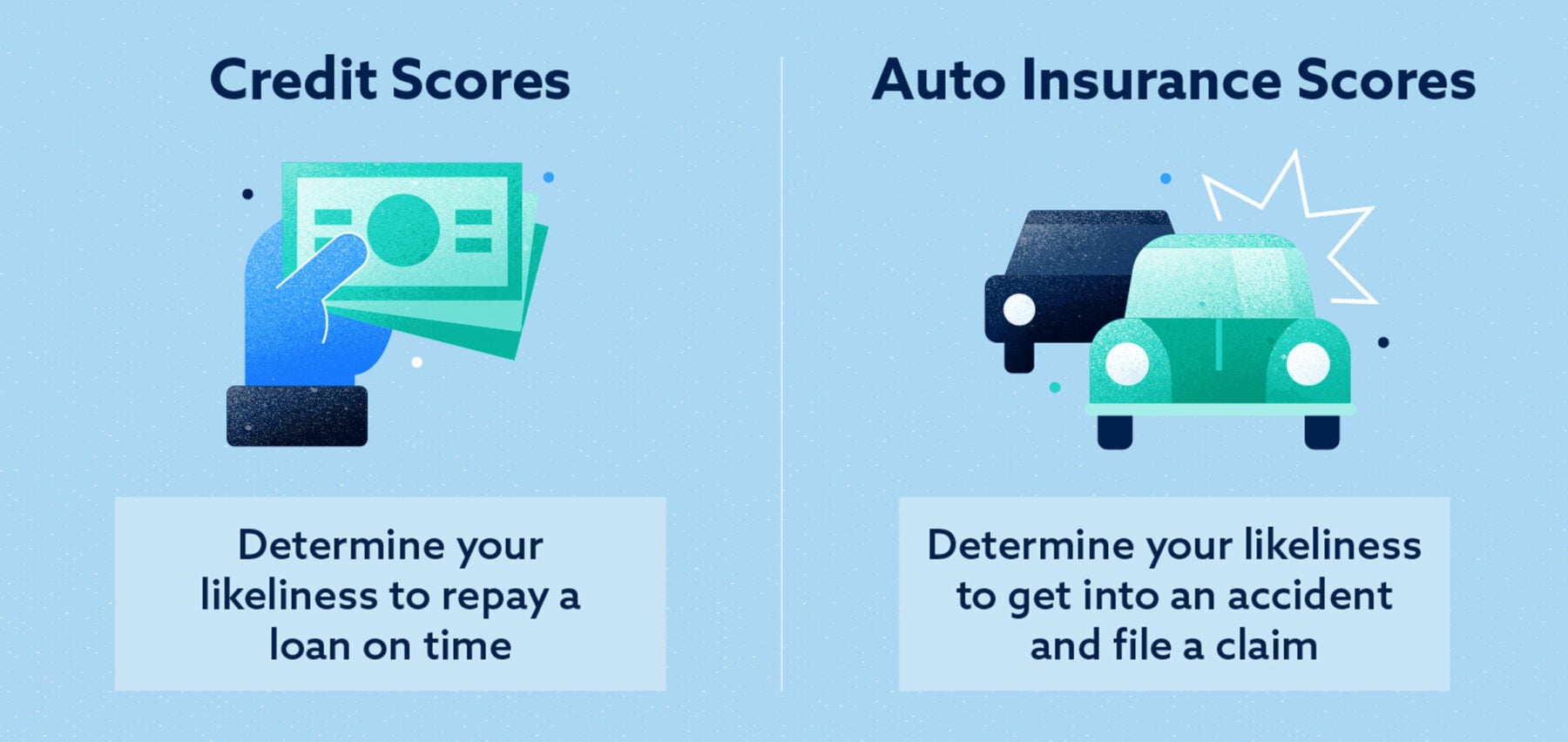

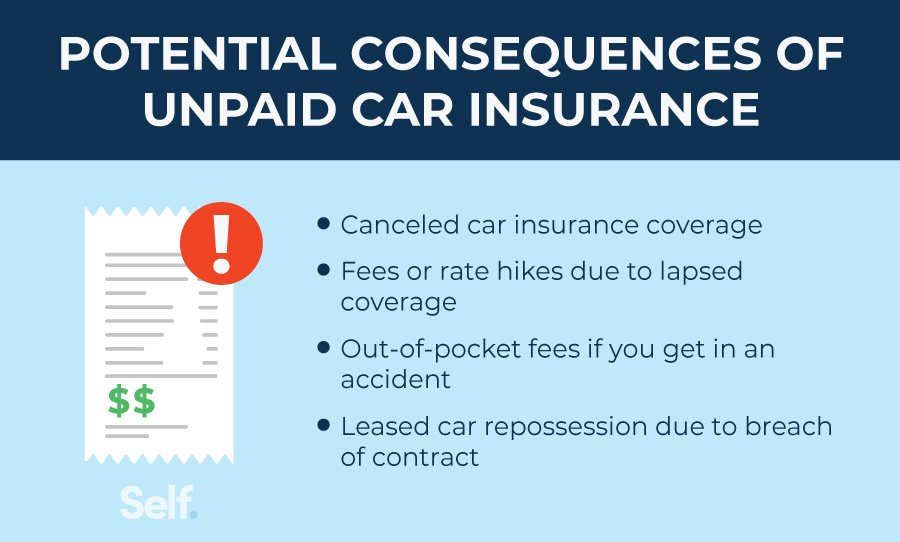

Do Car Insurance Payments Build Credit - Does paying car insurance monthly build credit? No, unfortunately paying your car insurance premiums doesn’t build credit, even if you never miss a payment. But if you pay monthly, it usually. Car insurance companies aren’t extending credit when they charge premiums, so they typically don’t report your payment history to credit bureaus. This may help you improve your credit scores in the long run. Insurance providers may use more than a dozen individual rating factors, like location, zip code, age, gender, credit history, driving record and claims history and coverage. The short answer is no. Buyers in the city need an average of £510 a month to meet mortgage payments for a one or two bedroom home, which cost an average of £119,350, it said. There is no direct affect between car insurance and your credit, paying your insurance bill late or not at all could lead to debt collection reports. There is no direct affect between car insurance and your credit, paying your insurance bill late or not at all could lead to. Does paying car insurance build credit? Car insurance companies aren’t extending credit when they charge premiums, so they typically don’t report your payment history to credit bureaus. There is no direct affect between car insurance and your credit, paying your insurance bill late or not at all could lead to debt. Car insurance doesn't directly affect your credit score because insurance isn't a line of credit. Car insurance payments do not build credit because car insurance companies do not lend money. Credit scores are based on the contents of transunion, equifax and experian. Is car insurance included on your credit report? Although car insurance payments typically aren’t reported to the credit bureaus, you can use a free tool to get credit for paying on time. Make sure that you keep. There is no direct affect between car insurance and your credit, paying your insurance bill late or not at all could lead to. The short answer is no. This is important if you only have one other type of credit, such as credit cards which are revolving credit. Can paying car insurance build credit? While paying your insurance doesn’t help you build your credit, paying other accounts promptly is important to keep your insurance rates low. However, if you fail to pay your. However, if you fail to pay your insurer,. The short answer is no. But if you pay monthly, it usually. No, simply paying for car insurance doesn't help you build credit. Does paying your car insurance build credit? But, if you pay your monthly car insurance premiums on time and with your credit card, it could improve your. Car insurance companies aren’t extending credit when they charge premiums, so they typically don’t report your payment history to credit bureaus. However, this won’t help build your credit as the insurance companies do not. Can paying car insurance build credit?. Car insurance doesn't directly affect your credit score because insurance isn't a line of credit. Is car insurance included on your credit report? Buyers in the city need an average of £510 a month to meet mortgage payments for a one or two bedroom home, which cost an average of £119,350, it said. There is no direct affect between car. No, simply paying for car insurance doesn't help you build credit. Buyers in the city need an average of £510 a month to meet mortgage payments for a one or two bedroom home, which cost an average of £119,350, it said. No, unfortunately paying your car insurance premiums doesn’t build credit, even if you never miss a payment. When you. However, this won’t help build your credit as the insurance companies do not. Can paying car insurance build credit? Although car insurance payments typically aren’t reported to the credit bureaus, you can use a free tool to get credit for paying on time. Will paying monthly for my car insurance affect my credit score? On average, people with a credit. The short answer is no. Can paying car insurance build credit? Yet as the market expands with specialized. There is no direct affect between car insurance and your credit, paying your insurance bill late or not at all could lead to. When you opt to pay for your car insurance every month, you are essentially entering into a credit agreement. Can paying car insurance build credit? Is car insurance included on your credit report? Insurance providers may use more than a dozen individual rating factors, like location, zip code, age, gender, credit history, driving record and claims history and coverage. The short answer is no. This is important if you only have one other type of credit, such as credit. There is no direct affect between car insurance and your credit, paying your insurance bill late or not at all could lead to debt collection reports. No, simply paying for car insurance doesn't help you build credit. Make sure that you keep. Finding the perfect business credit card can improve how your company manages money, tracks expenses, and fuels growth.. Will paying monthly for my car insurance affect my credit score? But if you pay monthly, it usually. The short answer is no. In other words, they are. When you opt to pay for your car insurance every month, you are essentially entering into a credit agreement with your insurance company. There is no direct affect between car insurance and your credit, paying. On average, people with a credit score below 550 will pay close to $3,000 a year on car insurance while people with a credit score over 800 pay less than half that amount. Is car insurance included on your credit report? No, simply paying for car insurance doesn't help you build credit. Does paying your car insurance build credit? But, if you pay your monthly car insurance premiums on time and with your credit card, it could improve your. Does paying car insurance build credit? Yes, paying monthly for car insurance. A higher score could mean better car insurance deals in the future. There is no direct affect between car insurance and your credit, paying your insurance bill late or not at all could lead to debt. The short answer is no. Will paying monthly for my car insurance affect my credit score? But if you pay monthly, it usually. It’s always best to pay your insurance premiums on time and maintain a good payment history. Car insurance doesn't directly affect your credit score because insurance isn't a line of credit. Can paying car insurance build credit?Does Paying Car Insurance Build Credit? Capital One

Does Paying Car Insurance Build Credit? Self. Credit Builder.

Does Paying Car Insurance Build Credit? Self.

Does paying for car insurance build credit?

What is credit life insurance on a car? Leia aqui What is the purpose

Does Paying Car Insurance Build Credit? Self.

How Do Credit Scores Affect Car Insurance? Lexington Law

How do you build credit for insurance? Leia aqui How to build

Does Paying Car Insurance Build Credit? Self. Credit Builder.

Car Insurance Credit Checks Ultimate Guide Comparoo

Does Paying For Car Insurance Build Credit?

One Exception Is When You Pay Your Car Insurance Premiums With A.

Finding The Perfect Business Credit Card Can Improve How Your Company Manages Money, Tracks Expenses, And Fuels Growth.

Car Insurance Companies Aren’t Extending Credit When They Charge Premiums, So They Typically Don’t Report Your Payment History To Credit Bureaus.

Related Post: