Do Car Loans Build Credit

Do Car Loans Build Credit - It's essential to make timely payments and. In this comprehensive guide, we’ll explore. What is a personal loan to buy a car? A car loan can help you rebuild your credit because it adds weight to certain factors in your credit. When you apply for a car loan, the lender will perform a credit check (also called a ‘hard search’) to better understand your financial history and behaviour. Like any form of credit, an auto loan offers both. Having a loan itself doesn’t help build your credit. There is no guarantee that you can build your credit score by 100 points in 30 days, and you should not buy a car with a loan in order to try and do this. A car loan does build credit, only if you make the monthly payments on time. So if you earn a gross income of $4,000 per month and pay a total of $1,500 a month toward student loans, a mortgage, a car loan and minimum. Yes, financing a car with bad credit can still contribute to building credit. However, for auto loans, higher car prices combined with higher interest rates have driven monthly payments upward and have put pressure on consumers across the. Applying for a car loan can hurt your credit temporarily, but your credit can recover and even improve in time. A car loan does build credit, only if you make the monthly payments on time. The answer is yes—taking out a car loan can positively affect your credit score, but only if you manage it responsibly. You can actually build your credit with a car loan. When you apply for a car loan, the lender needs to run a hard. Ultimately, they want to know how. A car loan can help you rebuild your credit because it adds weight to certain factors in your credit. In a review of anonymized and aggregated consumer data, experian found that credit profiles of auto loan borrowers do not differ significantly from those who don't have an. Taking out a loan and paying it back on time and in full can do wonders for. A car loan can help you rebuild your credit because it adds weight to certain factors in your credit. When you apply for a car loan, the lender will perform a credit check (also called a ‘hard search’) to better understand your financial. A car loan does build credit, only if you make the monthly payments on time. Among consumers with a credit record, 21.2 percent financed at least one purchase with a bnpl loan, up from 17.6 percent in. So if you earn a gross income of $4,000 per month and pay a total of $1,500 a month toward student loans, a. In fact, the loan will lower your credit score initially because you’ve taken on extra debt. A car loan can potentially increase your credit score by diversifying your credit mix and demonstrating responsible repayment behavior, such as making timely monthly payments. Among consumers with a credit record, 21.2 percent financed at least one purchase with a bnpl loan, up from. A car loan can potentially increase your credit score by diversifying your credit mix and demonstrating responsible repayment behavior, such as making timely monthly payments. However, for auto loans, higher car prices combined with higher interest rates have driven monthly payments upward and have put pressure on consumers across the. However, individuals with lower credit scores might face higher interest. A car loan does build credit, only if you make the monthly payments on time. Like any form of credit, an auto loan offers both. Learn how you can get an auto loan even if you have bad credit so you can take advantage. Taking out a loan and paying it back on time and in full can do wonders. In a review of anonymized and aggregated consumer data, experian found that credit profiles of auto loan borrowers do not differ significantly from those who don't have an. It's essential to make timely payments and. However, individuals with lower credit scores might face higher interest rates. What is a personal loan to buy a car? Read more to understand how. Having a loan itself doesn’t help build your credit. Do car loans build credit? Taking out a loan and paying it back on time and in full can do wonders for. Looking to help your credit and in the market for a car? Yes, financing a car with bad credit can still contribute to building credit. You can actually build your credit with a car loan. What is a personal loan to buy a car? Yes, financing a car with bad credit can still contribute to building credit. However, for auto loans, higher car prices combined with higher interest rates have driven monthly payments upward and have put pressure on consumers across the. There is no. In a review of anonymized and aggregated consumer data, experian found that credit profiles of auto loan borrowers do not differ significantly from those who don't have an. When you apply for a car loan, the lender will perform a credit check (also called a ‘hard search’) to better understand your financial history and behaviour. Read more to understand how. The answer is yes—taking out a car loan can positively affect your credit score, but only if you manage it responsibly. Like any form of credit, an auto loan offers both. Applying for a car loan can hurt your credit temporarily, but your credit can recover and even improve in time. You can actually build your credit with a car. A car loan does build credit, only if you make the monthly payments on time. Read more to understand how car loans affect your credit score. However, individuals with lower credit scores might face higher interest rates. Applying for a car loan can hurt your credit temporarily, but your credit can recover and even improve in time. It's essential to make timely payments and. Do car loans build credit? Does a car loan build credit? To a large degree, your credit score reflects how well you repay your debt, so timely payments on a car loan can be an effective way to build. Like any form of credit, an auto loan offers both. Taking out a loan and paying it back on time and in full can do wonders for. What is a personal loan to buy a car? Build credit without the debt. Among consumers with a credit record, 21.2 percent financed at least one purchase with a bnpl loan, up from 17.6 percent in. Ultimately, they want to know how. Having a loan itself doesn’t help build your credit. When you apply for a car loan, the lender needs to run a hard.Does a Car Loan Build Credit?

Does a Car Loan Build Your Credit Score? Lexington Law

Does a Car Loan Build Your Credit Score? Lexington Law

Does a Car Loan Build Your Credit Score? Lexington Law

What Credit Score Is Used for Car Loans? Self. Credit Builder.

Using Your Car Loan to Build Up Credit Ottawa Honda

Good Credit Auto Loans Made Speedy Loanry

Does a Car Loan Build Your Credit Score? Lexington Law

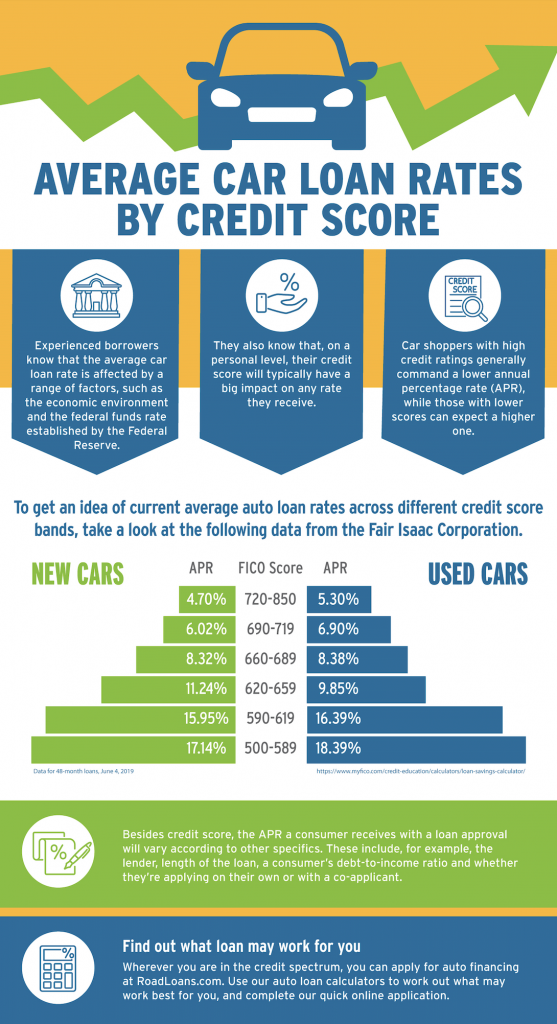

Average Credit Score Needed For Car Loan Loan Walls

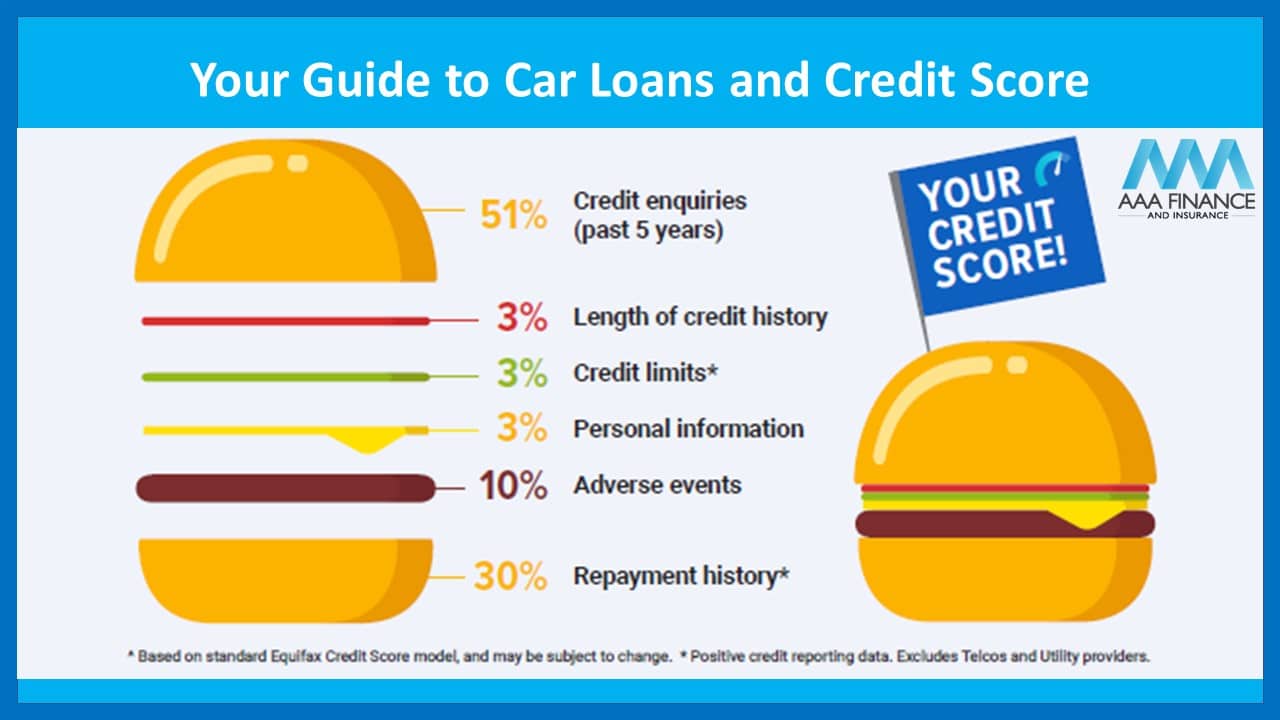

Your Guide to Car Loans and Credit Score AAA Finance

So If You Earn A Gross Income Of $4,000 Per Month And Pay A Total Of $1,500 A Month Toward Student Loans, A Mortgage, A Car Loan And Minimum.

There Is No Guarantee That You Can Build Your Credit Score By 100 Points In 30 Days, And You Should Not Buy A Car With A Loan In Order To Try And Do This.

Do Car Payments Build Credit?

However, For Auto Loans, Higher Car Prices Combined With Higher Interest Rates Have Driven Monthly Payments Upward And Have Put Pressure On Consumers Across The.

Related Post: