Do Car Payments Build Credit

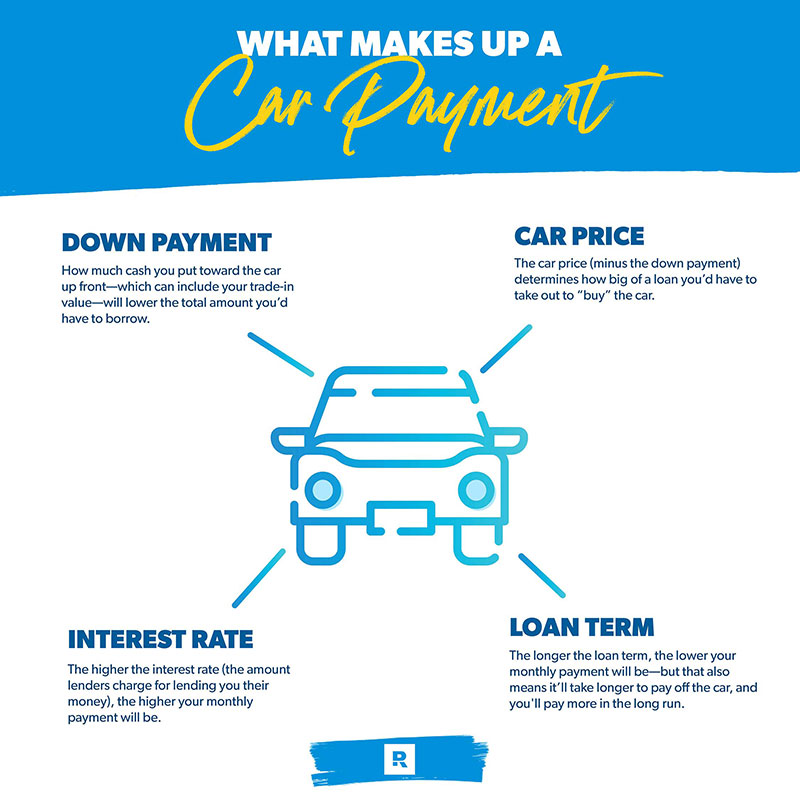

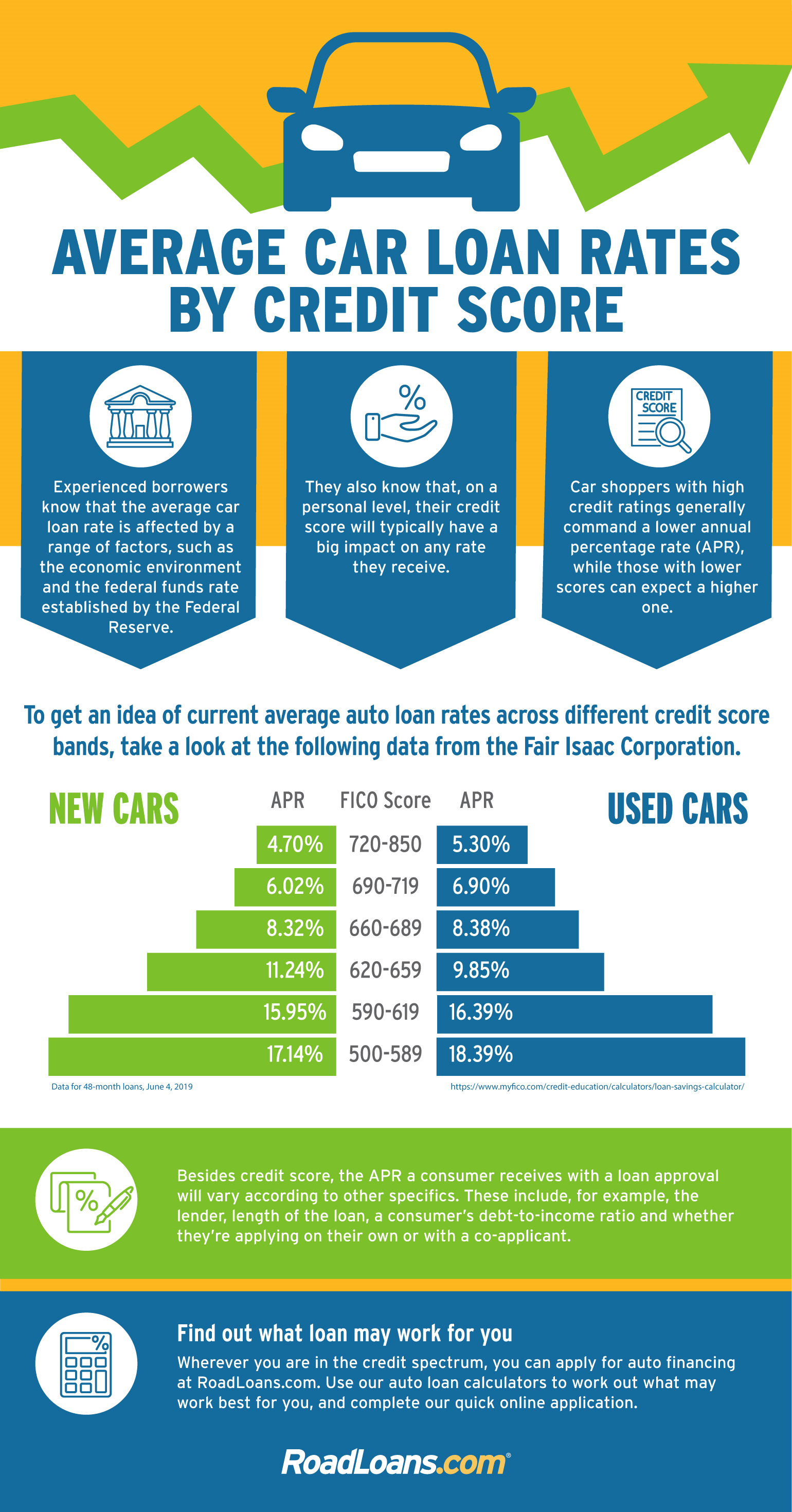

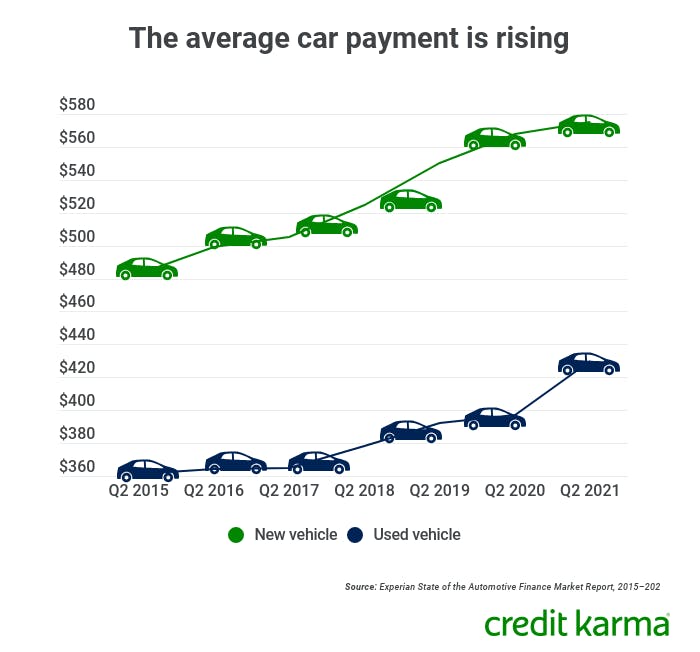

Do Car Payments Build Credit - Having a loan itself doesn’t help build your credit. They not only help improve your payment history but also diversify your credit mix, contributing. Yes, financing a car with bad credit can still contribute to building credit. Does a car loan build credit? Servicemembers faced average annual percentage rates (aprs) 0.6 percentage points above civilian rates and longer. As mentioned previously, a hard inquiry appears on your report every time a lender. Making these payments towards the car loan will also help. Managing your auto loan responsibly can help you take the wheel of your new car and your credit rating. When you sign up for a new car loan, it may probably hurt your credit score at first. Financing a car can help you to improve your credit score, but there’s no guarantee. 2 points per $1 on car loan, lease or insurance payments from a linked account (on up to $1,000 in spending per. Military borrowers pay higher rates over longer terms: Establishing a strong payment history is key in utilizing a car loan to help improve your credit score in the long run. However, for auto loans, higher car prices combined with higher interest rates have driven monthly payments upward and have put pressure on consumers across the. Read more to understand how car loans affect your credit score. As mentioned previously, a hard inquiry appears on your report every time a lender. Using a travel credit card to earn rewards for purchases you'd be making anyway is a great way to defray the cost of your next vacation, as long as you pay off your balance in. In fact, the loan will lower your credit score initially because you’ve taken on extra debt. New fasten credit card to earn rewards on car payments. Do car payments build credit? New inquiries:the first ding to your credit rating happens before you even open a credit account. A car loan can help you raise your credit score for two main reasons that have to do with two of the five factors that make up your fico credit score: Managing your auto loan responsibly can help you take the wheel of your. Servicemembers faced average annual percentage rates (aprs) 0.6 percentage points above civilian rates and longer. Using a travel credit card to earn rewards for purchases you'd be making anyway is a great way to defray the cost of your next vacation, as long as you pay off your balance in. A car loan can help you raise your credit score. Military borrowers pay higher rates over longer terms: A car loan does build credit, only if you make the monthly payments on time. A car loan by itself does not always build credit. Do car payments build credit? Taking out a car loan can affect your credit in several ways. A car loan does build credit, only if you make the monthly payments on time. 2 points per $1 on car loan, lease or insurance payments from a linked account (on up to $1,000 in spending per. As mentioned previously, a hard inquiry appears on your report every time a lender. Does a car loan build credit? However, individuals with. Military borrowers pay higher rates over longer terms: In fact, the loan will lower your credit score initially because you’ve taken on extra debt. Servicemembers faced average annual percentage rates (aprs) 0.6 percentage points above civilian rates and longer. However, individuals with lower credit scores might face higher interest rates. When you sign up for a new car loan, it. Like any credit arrangement, taking out finance to buy a car has the potential to improve your credit score, but if you’re unable to make your. Do car loans build credit? However, for auto loans, higher car prices combined with higher interest rates have driven monthly payments upward and have put pressure on consumers across the. New inquiries:the first ding. But that negative impact may be only temporary. In conclusion, car payments can indeed build credit when managed wisely. But, if you keep up with your monthly payments, an auto loan can definitely help you improve your credit over time. When you sign up for a new car loan, it may probably hurt your credit score at first. Yes, financing. New fasten credit card to earn rewards on car payments. Military borrowers pay higher rates over longer terms: But that negative impact may be only temporary. The impact that car finance has on your credit report depends on several factors: Making these payments towards the car loan will also help. Servicemembers faced average annual percentage rates (aprs) 0.6 percentage points above civilian rates and longer. But, if you keep up with your monthly payments, an auto loan can definitely help you improve your credit over time. Making these payments towards the car loan will also help. Establishing a strong payment history is key in utilizing a car loan to help. A car loan does build credit, only if you make the monthly payments on time. As mentioned previously, a hard inquiry appears on your report every time a lender. But, if you keep up with your monthly payments, an auto loan can definitely help you improve your credit over time. A car loan by itself does not always build credit.. Does a car loan build credit? Financing a car can help you to improve your credit score, but there’s no guarantee. Do car payments build credit? The impact that car finance has on your credit report depends on several factors: A car loan by itself does not always build credit. Using a travel credit card to earn rewards for purchases you'd be making anyway is a great way to defray the cost of your next vacation, as long as you pay off your balance in. They not only help improve your payment history but also diversify your credit mix, contributing. Having a loan itself doesn’t help build your credit. Military borrowers pay higher rates over longer terms: A car loan can help you raise your credit score for two main reasons that have to do with two of the five factors that make up your fico credit score: Establishing a strong payment history is key in utilizing a car loan to help improve your credit score in the long run. Making these payments towards the car loan will also help. It's essential to make timely payments and. Here’s what happens to your credit when you get a new car loan: 2 points per $1 on car loan, lease or insurance payments from a linked account (on up to $1,000 in spending per. However, for auto loans, higher car prices combined with higher interest rates have driven monthly payments upward and have put pressure on consumers across the.Car Payment Calculator Ramsey

Check out average auto loan rates according to credit score RoadLoans

How to Pay Car Loan Payments from Your Credit Card YouTube

How Do Car Payments Work Follow This Lane Loanry

Does Paying Car Insurance Build Credit? Self.

Self News and Blog

What Is the Average Car Payment? Credit Karma

How Do Car Payments Work Follow This Lane Loanry

Do car payments build credit? My Own Auto

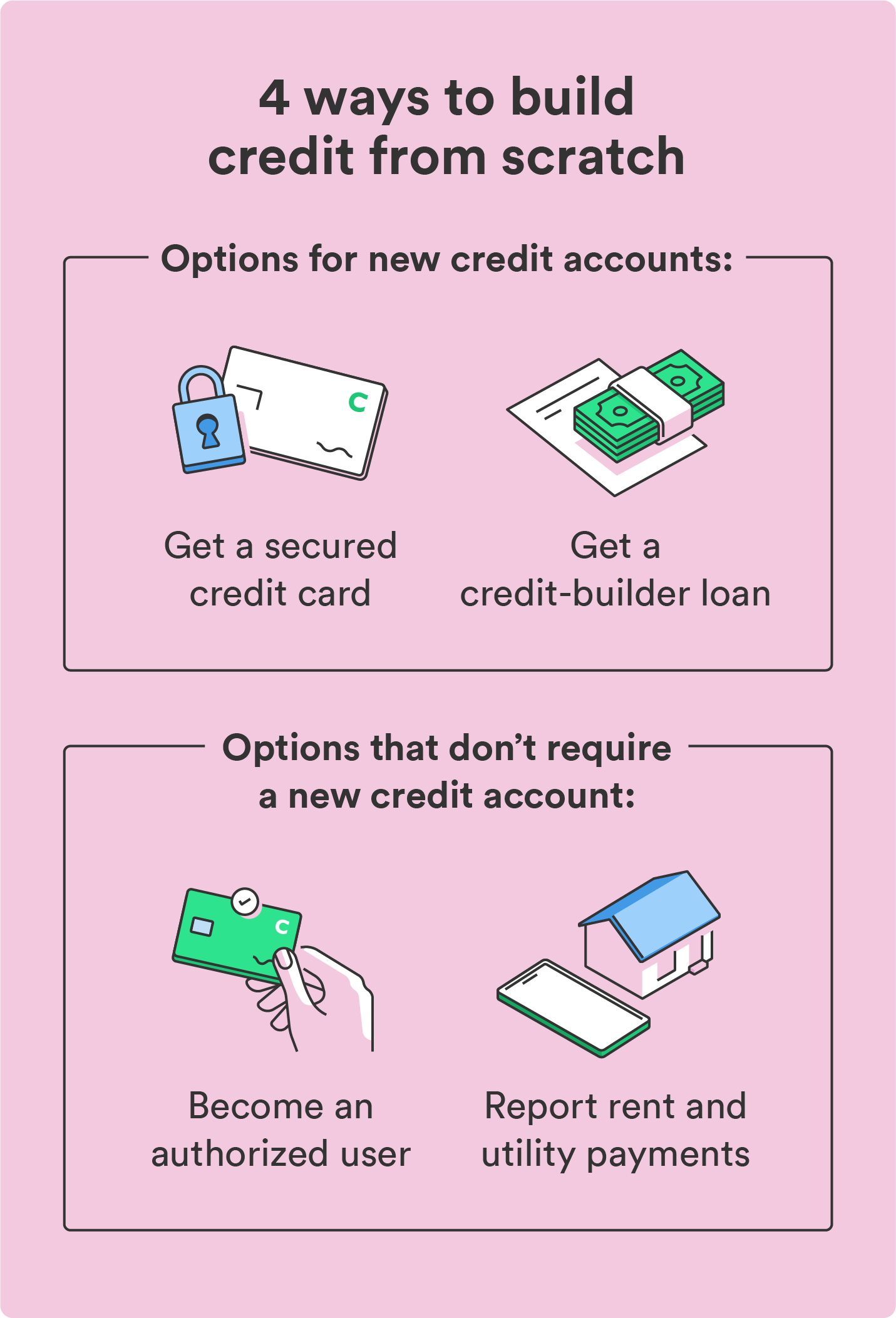

How to Build Credit The 7Step Guide Chime

New Inquiries:the First Ding To Your Credit Rating Happens Before You Even Open A Credit Account.

Yes, Financing A Car With Bad Credit Can Still Contribute To Building Credit.

Do Car Loans Build Credit?

But That Negative Impact May Be Only Temporary.

Related Post: