Do Credit Unions Build Credit

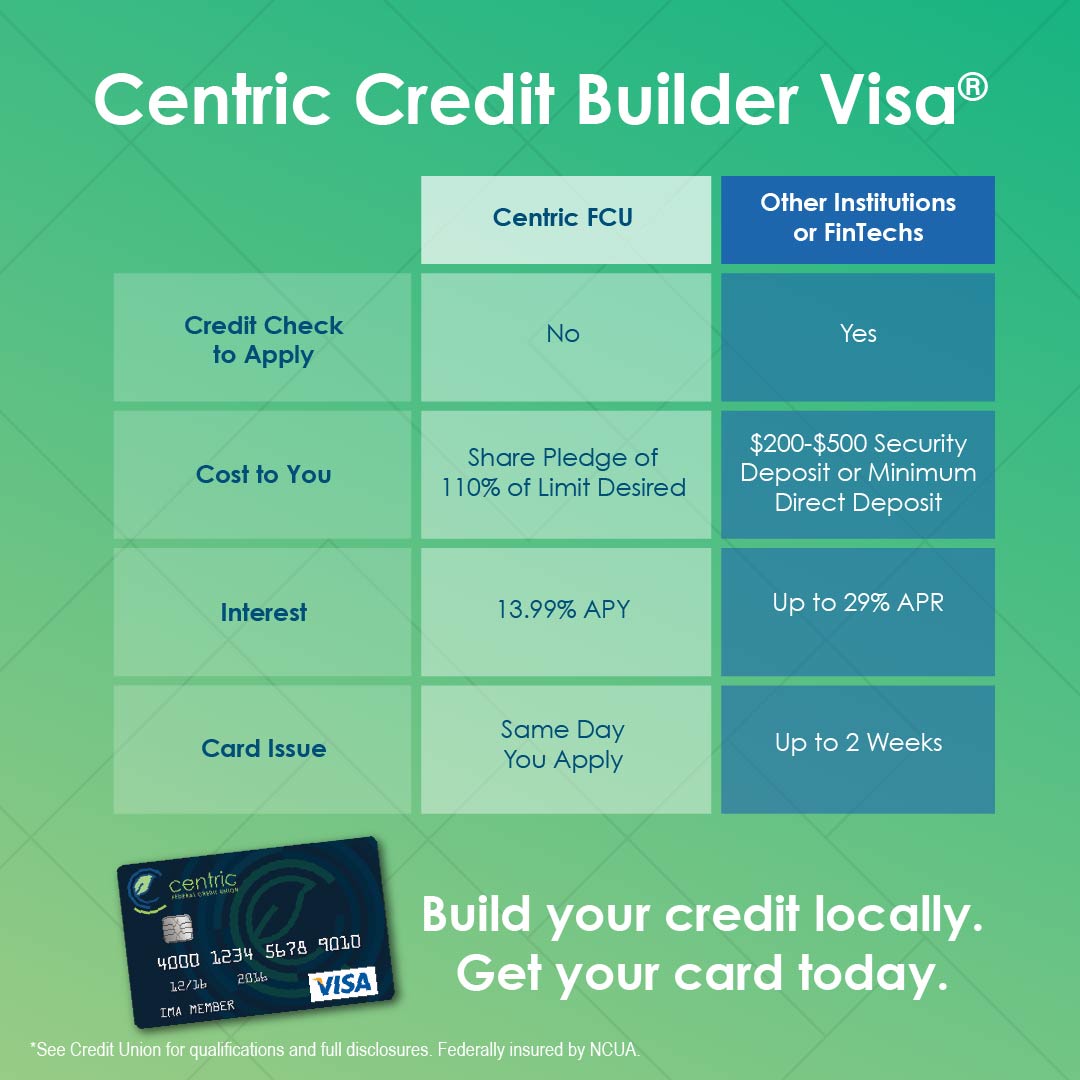

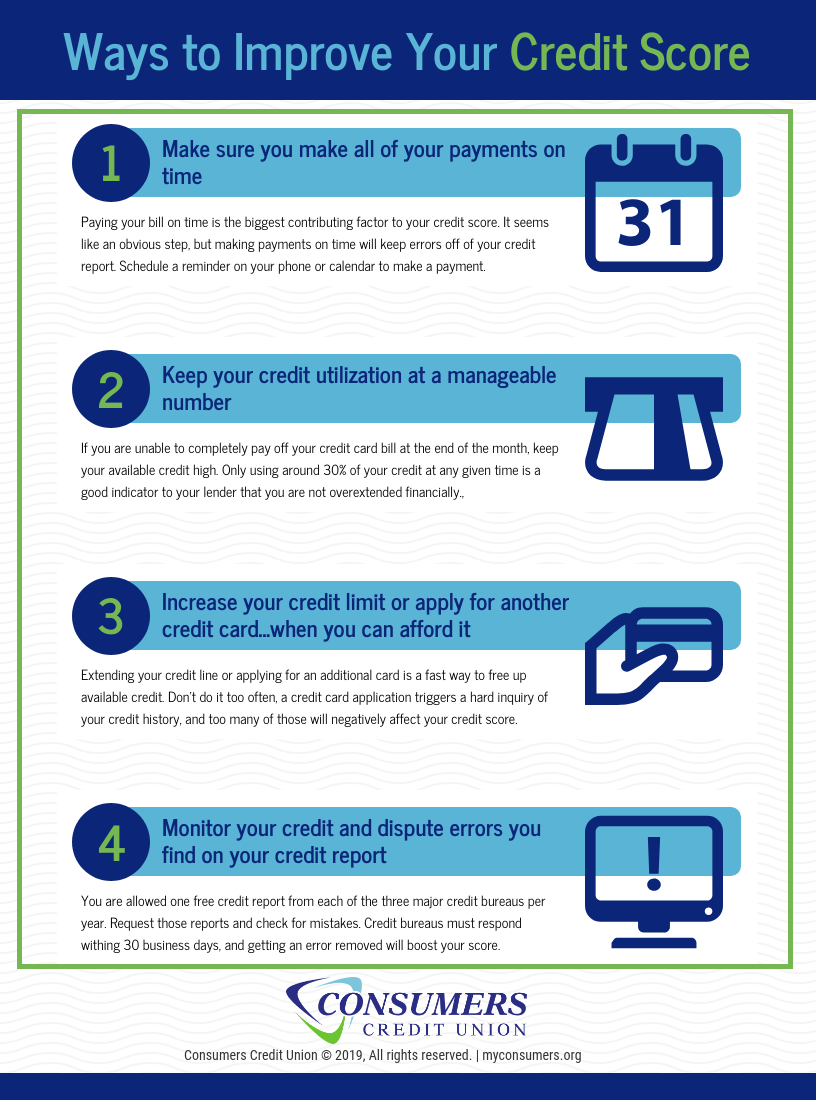

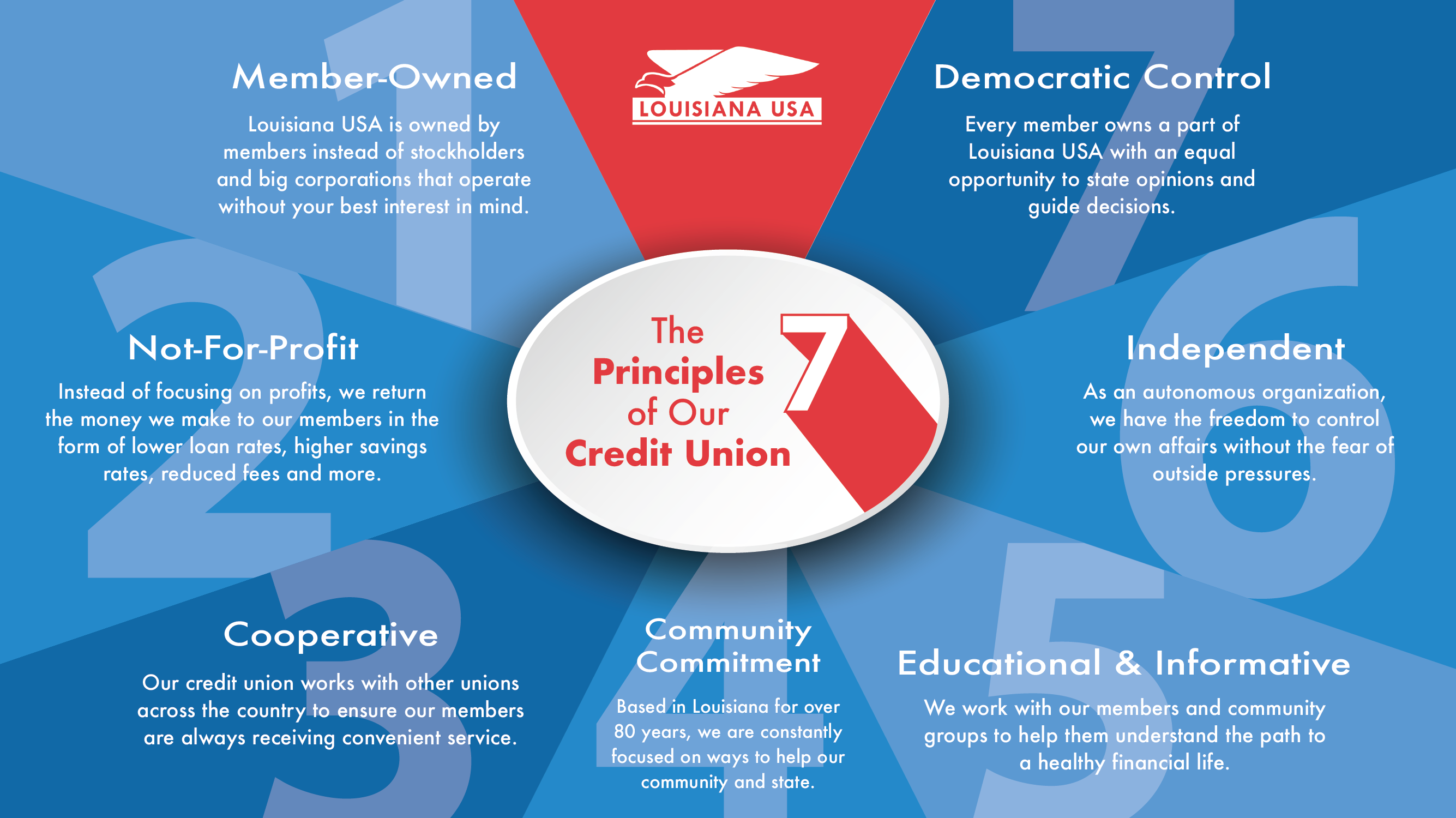

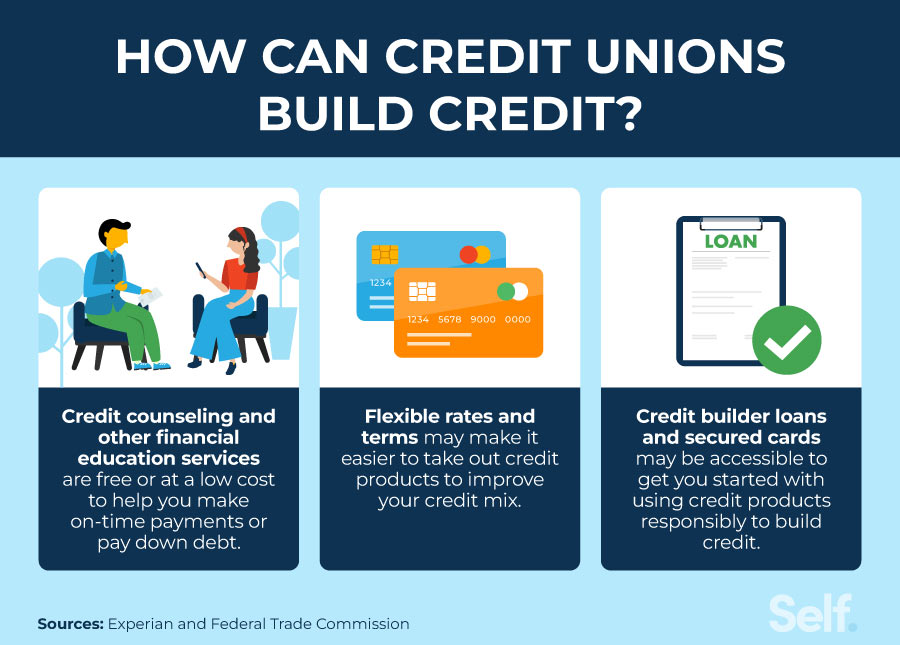

Do Credit Unions Build Credit - Creditors don't know if they can trust you with a line of credit yet. Credit unions are owned and controlled by their members. Credit unions are different from banks in a few major ways. Get a secured credit card, like those. Using a credit card responsibly is a great way to build credit without taking on too much risk. So you basically offer to make it safer for them. Encourage your freshman to keep their credit utilization low, ideally under 30% of. Read on to find out why we picked each institution, the pros and cons and how. While it sounds crazy, you must build credit by getting credit. Backed by the full faith and credit of the united states, the share insurance fund insures the accounts of millions of account holders in all federal credit unions and the vast majority of state. Marine credit union can help you build your credit score with get credit. Encourage your freshman to keep their credit utilization low, ideally under 30% of. Creditors don't know if they can trust you with a line of credit yet. Start rebuilding your credit after financial hardship with our secured loan option, ranging from $250 to $1,000. Credit unions return their profits to members via lower interest rates on loans, reduced fees and higher savings. Credit unions provide critically needed financial services to their members, such as savings and checking. Credit unions are different from banks in a few major ways. Here's how you can build it with these three smart money strategies. Don’t let your credit score get in the way of where you want to go. You want to get a loan or open a line of credit to improve your credit score, but you have to have a good credit. Marine credit union can help you build your credit score with get credit. Get a secured credit card, like those. So you basically offer to make it safer for them. Start rebuilding your credit after financial hardship with our secured loan option, ranging from $250 to $1,000. Don’t let your credit score get in the way of where you want. If you do these things, your credit. Credit unions are different from banks in a few major ways. Backed by the full faith and credit of the united states, the share insurance fund insures the accounts of millions of account holders in all federal credit unions and the vast majority of state. You want to get a loan or open. You want to get a loan or open a line of credit to improve your credit score, but you have to have a good credit. Credit unions are owned and controlled by their members. Using a credit card responsibly is a great way to build credit without taking on too much risk. Read on to learn why you. Marine credit. Marine credit union can help you build your credit score with get credit. You want to get a loan or open a line of credit to improve your credit score, but you have to have a good credit. Backed by the full faith and credit of the united states, the share insurance fund insures the accounts of millions of account. Credit unions are owned and controlled by their members. We compared over 50 credit unions to find out which ones were the best nationwide. Encourage your freshman to keep their credit utilization low, ideally under 30% of. Credit unions are different from banks in a few major ways. Get a secured credit card, like those. We compared over 50 credit unions to find out which ones were the best nationwide. You want to get a loan or open a line of credit to improve your credit score, but you have to have a good credit. So you basically offer to make it safer for them. This can be tough when you’re just starting out, but. Read on to learn why you. Credit unions are owned and controlled by their members. Credit unions return their profits to members via lower interest rates on loans, reduced fees and higher savings. This can be tough when you’re just starting out, but here are three easy ways to begin: So you basically offer to make it safer for them. Backed by the full faith and credit of the united states, the share insurance fund insures the accounts of millions of account holders in all federal credit unions and the vast majority of state. Credit unions return their profits to members via lower interest rates on loans, reduced fees and higher savings. Marine credit union can help you build your. Read on to find out why we picked each institution, the pros and cons and how. Get a secured credit card, like those. Credit unions provide critically needed financial services to their members, such as savings and checking. Here's how you can build it with these three smart money strategies. If you do these things, your credit. So you basically offer to make it safer for them. Credit unions provide critically needed financial services to their members, such as savings and checking. Start rebuilding your credit after financial hardship with our secured loan option, ranging from $250 to $1,000. Using a credit card responsibly is a great way to build credit without taking on too much risk.. Marine credit union can help you build your credit score with get credit. Credit unions provide critically needed financial services to their members, such as savings and checking. Here's how you can build it with these three smart money strategies. Start rebuilding your credit after financial hardship with our secured loan option, ranging from $250 to $1,000. Encourage your freshman to keep their credit utilization low, ideally under 30% of. If you do these things, your credit. So you basically offer to make it safer for them. Credit unions are different from banks in a few major ways. We compared over 50 credit unions to find out which ones were the best nationwide. Backed by the full faith and credit of the united states, the share insurance fund insures the accounts of millions of account holders in all federal credit unions and the vast majority of state. Get a secured credit card, like those. While it sounds crazy, you must build credit by getting credit. Don’t let your credit score get in the way of where you want to go. You want to get a loan or open a line of credit to improve your credit score, but you have to have a good credit. Creditors don't know if they can trust you with a line of credit yet. This can be tough when you’re just starting out, but here are three easy ways to begin:Self News and Blog

Do credit unions help build credit? Leia aqui Can you build a credit

Do credit unions help build credit? Leia aqui Can you build a credit

Do Credit Unions Help You Build Your Credit? SoFi

Do credit unions build your credit? Leia aqui What are 3 pros to using

Do credit unions help build credit? Leia aqui Can you build a credit

Does credit union build your credit? Leia aqui Do credit unions help

How do credit unions work? Leia aqui Why use a credit union instead of

Do credit unions build your credit? Leia aqui What are 3 pros to using

Do Credit Unions Help Build Credit? Self. Credit Builder.

Read On To Learn Why You.

Credit Unions Return Their Profits To Members Via Lower Interest Rates On Loans, Reduced Fees And Higher Savings.

Credit Unions Are Owned And Controlled By Their Members.

Using A Credit Card Responsibly Is A Great Way To Build Credit Without Taking On Too Much Risk.

Related Post:

.png?width=752&name=alt lending comparison infographic (1).png)