Do Klarna Build Credit

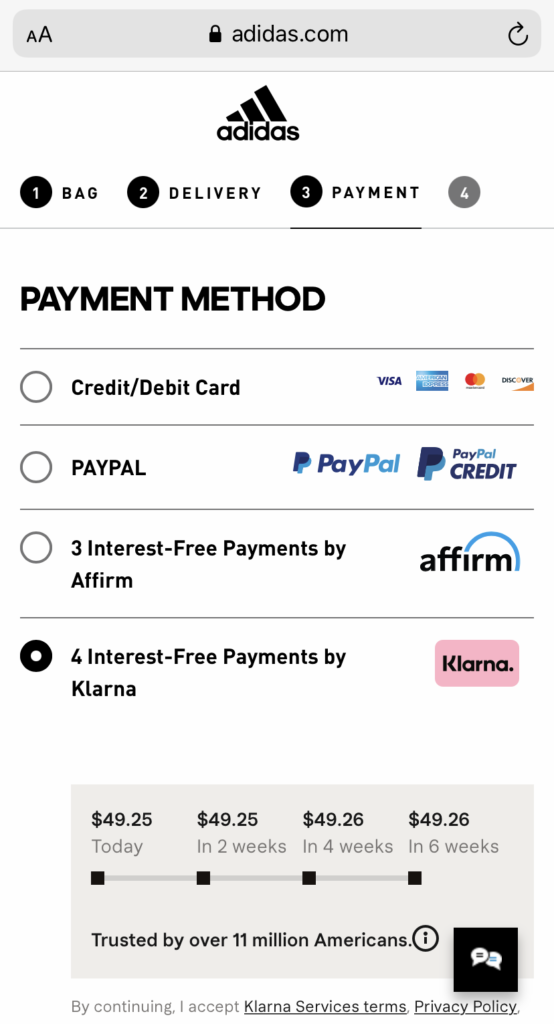

Do Klarna Build Credit - Referrals to build trust, drive traffic, and increase conversion, with yotpo in place. However, klarna may look at your credit report as a whole before making a decision. If you sign up for klarna in the u.s. There's a way that using klarna might help build your credit. Is it right for you? As with any form of credit or financing, how. Credit card number, address, and password over and over again. Does using klarna affect your credit score? Bnpl provider klarna brings its pay in 4 program to a credit card. However, lenders you apply to for credit in the future could see. A political odd couple is joining forces to lower credit card interest rates. Klarna evaluates your ability to pay by assessing available data to ensure responsible lending. Using klarna’s payment options won’t affect your credit score in itself. Klarna can help build credit if used responsibly by maintaining a positive payment history. Although your credit score won’t automatically be affected if you use klarna, the payment method you choose can have an impact. This blog post delves into. By using klarna responsibly and making timely payments, you can build a positive credit history and potentially improve your score. Klarna doesn’t set a minimum credit score to qualify for its finance products. If you sign up for klarna in the u.s. Klarna performs credit checks through transunion and experian, which can. Credit card number, address, and password over and over again. Klarna can help build credit if used responsibly by maintaining a positive payment history. If you sign up for klarna in the u.s. Using klarna’s payment options won’t affect your credit score in itself. As with any form of credit or financing, how. Pay flexibly with klarna choose how you want to pay and spread the cost over time, securely with. Does klarna perform a credit check and will this affect my credit score? Using klarna’s payment options won’t affect your credit score in itself. By using klarna responsibly and making timely payments, you can build a positive credit history and potentially improve. Choose klarna at checkout click on the pink badge and pay with klarna at credit. Pay flexibly with klarna choose how you want to pay and spread the cost over time, securely with. Although your credit score won’t automatically be affected if you use klarna, the payment method you choose can have an impact. However, klarna may look at your. A political odd couple is joining forces to lower credit card interest rates. If you sign up for klarna in the u.s. As with many bnpl options, using this type of financing won't help you build credit. Klarna can help build credit if used responsibly by maintaining a positive payment history. That means there would be no impact to. Let’s dig a bit deeper into the klarna. Read more with forbes advisor’s expert card review. Although your credit score won’t automatically be affected if you use klarna, the payment method you choose can have an impact. However, lenders you apply to for credit in the future could see. Is it right for you? This blog post delves into. Credit card number, address, and password over and over again. However, lenders you apply to for credit in the future could see. Referrals to build trust, drive traffic, and increase conversion, with yotpo in place. Does klarna perform a credit check and will this affect my credit score? However, lenders you apply to for credit in the future could see. Choose klarna at checkout click on the pink badge and pay with klarna at credit. As with many bnpl options, using this type of financing won't help you build credit. Is it right for you? Credit card number, address, and password over and over again. Klarna can help build credit if used responsibly by maintaining a positive payment history. That means there would be no impact to. Credit card number, address, and password over and over again. As with many bnpl options, using this type of financing won't help you build credit. Klarna reports to credit reference agencies like experian and transunion, which means your. Credit card number, address, and password over and over again. However, neglecting your klarna obligations. As with any form of credit or financing, how. Doesn't help you build credit: Klarna doesn’t set a minimum credit score to qualify for its finance products. There's a way that using klarna might help build your credit. Does klarna perform a credit check and will this affect my credit score? However, neglecting your klarna obligations. Bnpl provider klarna brings its pay in 4 program to a credit card. Pay flexibly with klarna choose how you want to pay and spread the cost over time, securely with. Although your credit score won’t automatically be affected if you use klarna, the payment method you choose can have an impact. As with many bnpl options, using this type of financing won't help you build credit. Klarna doesn’t set a minimum credit score to qualify for its finance products. By using klarna responsibly and making timely payments, you can build a positive credit history and potentially improve your score. Credit card number, address, and password over and over again. A political odd couple is joining forces to lower credit card interest rates. As with any form of credit or financing, how. That means there would be no impact to. Referrals to build trust, drive traffic, and increase conversion, with yotpo in place. However, neglecting your klarna obligations. Klarna evaluates your ability to pay by assessing available data to ensure responsible lending. Does using klarna affect your credit score? There's a way that using klarna might help build your credit. While it doesn't build credit, it can harm a person's score. Klarna reports to credit reference agencies like experian and transunion, which means your interactions with klarna can influence your credit score. Choose klarna at checkout click on the pink badge and pay with klarna at credit.Does BuyNowPayLater Solution Klarna Build Credit?

Does Klarna Build Credit? Cleo

Does Klarna affect your credit score? Leia aqui Is Klarna going to

Does the Klarna Shopping Platform Help Build Your Credit?

Does Klarna run credit every time? Leia aqui What credit score is

Did Klarna help build credit? Leia aqui Is Klarna good for building

Does the Klarna Shopping Platform Help Build Your Credit?

Why does Klarna not show on my credit report? Leia aqui Does Klarna

Does Klarna build my credit? Leia aqui Is Klarna good for building

How do I get a high Klarna limit? Leia aqui How do I increase my limit

Bnpl Provider Klarna Brings Its Pay In 4 Program To A Credit Card.

This Blog Post Delves Into.

If You Sign Up For Klarna In The U.s.

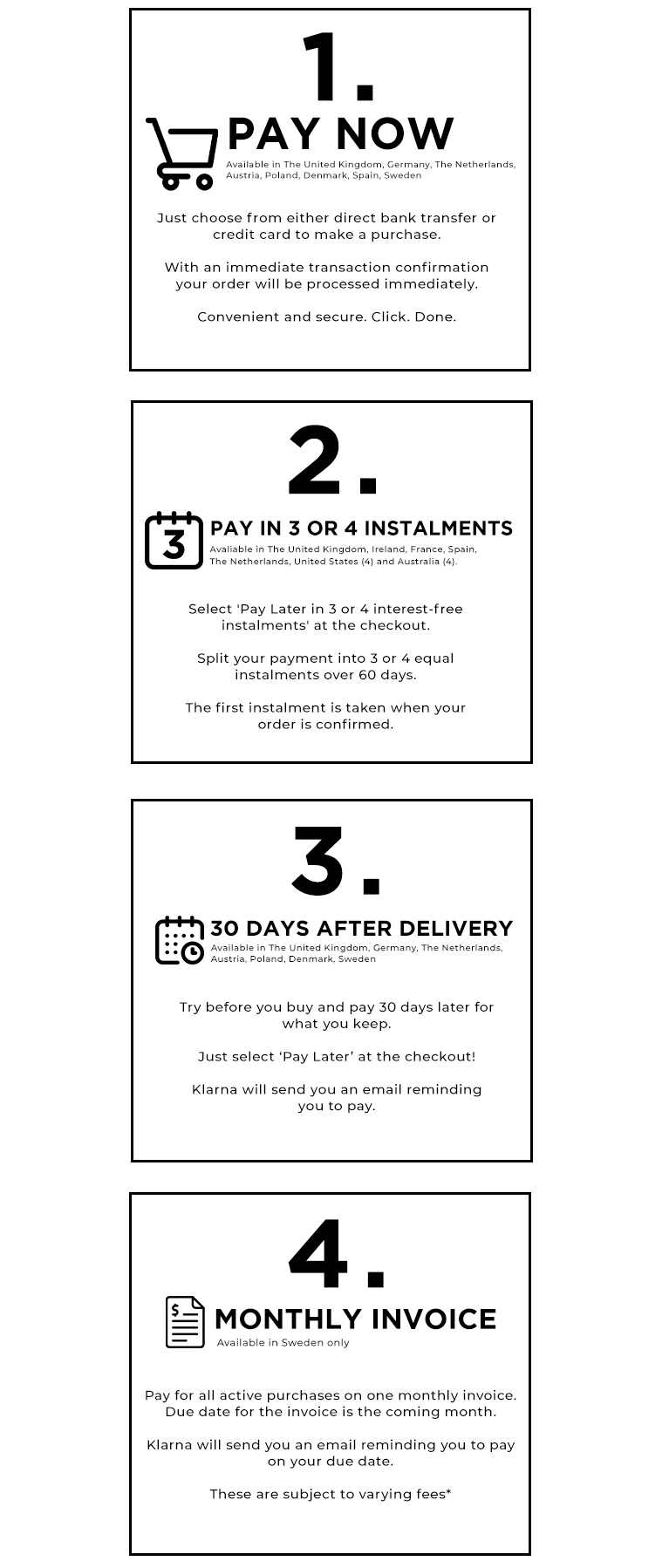

Pay Flexibly With Klarna Choose How You Want To Pay And Spread The Cost Over Time, Securely With.

Related Post:

.png)