Do Prepaid Cards Build Credit

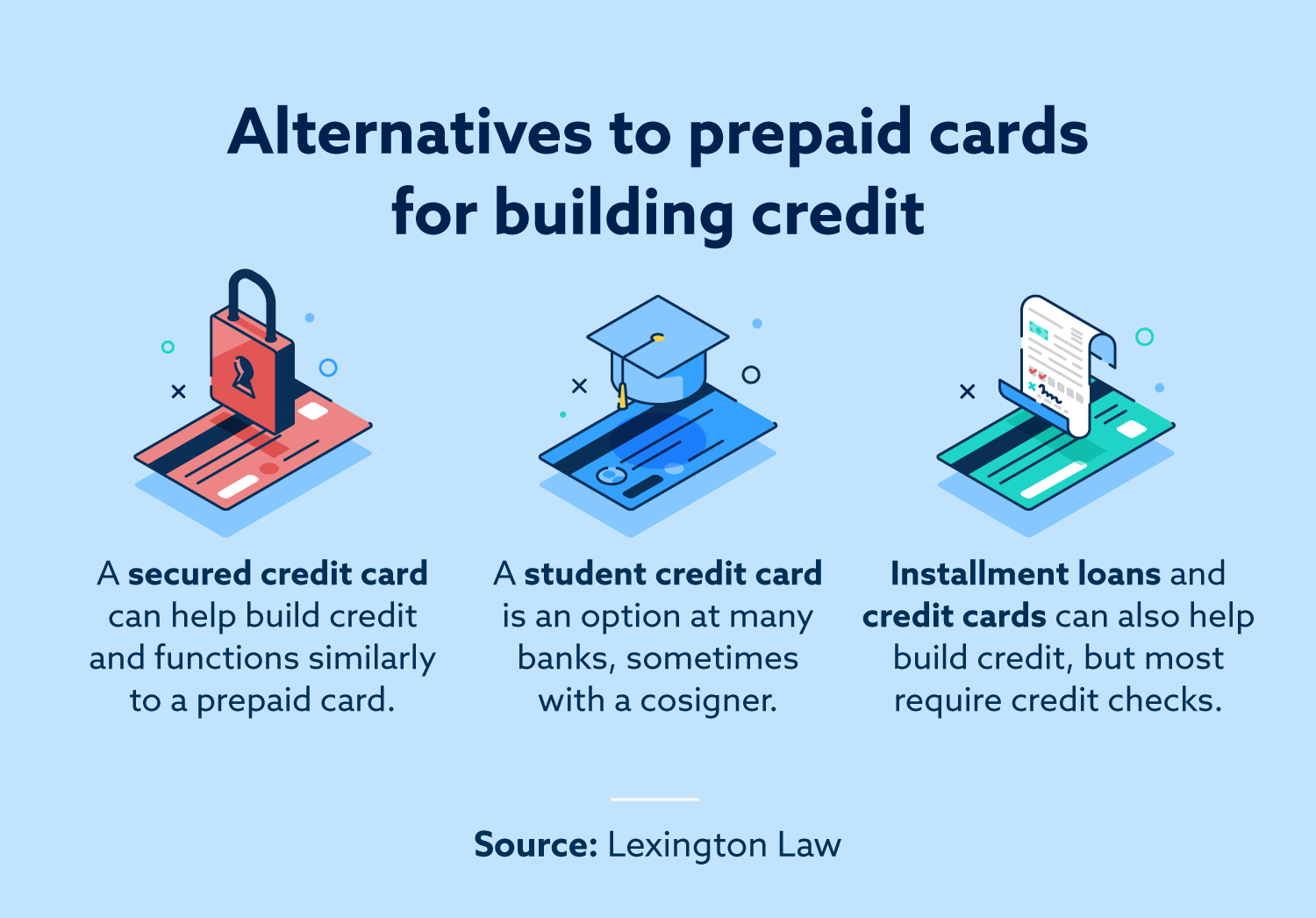

Do Prepaid Cards Build Credit - However, when it comes to building credit, prepaid credit cards are no substitute for the real thing. Transaction limit (daily, weekly or monthly) usually set by the bank that issues the card. While they may look just like a credit card and bear the logo of a major credit card company. Do prepaid credit cards build credit. In a nutshell, a secured credit card is best if you want to build your credit history, whereas a prepaid card is primarily a way to prepay for purchases—and has no positive or. You’ll earn 4x points on up to $50,000 in purchases at restaurants worldwide, plus a $120 dining credit ($10 statement credit per month) when you pay with the gold card at. They’re both great options for canadians who have little,. Prepaid credit cards will not show up on your credit report, and they won't be. You use cash to add money to the card and then use it to pay for goods and services at. Both options provide a completely different solution. Bank cash+ ® visa signature ® credit card is eligible to use at the rewards center shopping deals. Prepaid credit cards will not show up on your credit report, and they won't be. They’re both great options for canadians who have little,. Prepaid cards do not build credit, as they do not report to the credit bureaus and are more akin to gift cards or debit cards than credit cards. Both options provide a completely different solution. Do prepaid credit cards build credit. To build good credit, you need to make sure that you’re paying a bill that gets reported to each major credit bureau — experian,. The only kind of credit card that. However, when talking about prepaid credit cards, people are often. Transaction limit (daily, weekly or monthly) usually set by the bank that issues the card. Prepaid cards don’t build credit and shouldn’t be confused with secured credit cards. If you’re worried you can’t get a standard credit card, there are other options such as credit builder cards and prepaid cards. Prepaid cards do not build credit, as they do not report to the credit bureaus and are more akin to gift cards or debit cards. The only kind of credit card that. Prepaid cards don’t build credit and shouldn’t be confused with secured credit cards. Transaction limit (daily, weekly or monthly) usually set by the bank that issues the card. While they may look just like a credit card and bear the logo of a major credit card company. Prepaid cards do not build credit,. However, when it comes to building credit, prepaid credit cards are no substitute for the real thing. Prepaid credit cards and secured credit cards are generally two different credit card card types. Inability to build your credit history to obtain future loans from a bank. Bank cash+ ® visa signature ® credit card is eligible to use at the rewards. Prepaid cards are similar to debit cards, but you don’t need a bank account to get one. Bank cash+ ® visa signature ® credit card is eligible to use at the rewards center shopping deals. However, when it comes to building credit, prepaid credit cards are no substitute for the real thing. Where possible, try and build up your credit. Both options provide a completely different solution. Prepaid credit cards will not show up on your credit report, and they won't be. To build good credit, you need to make sure that you’re paying a bill that gets reported to each major credit bureau — experian,. You use cash to add money to the card and then use it to. They’re both great options for canadians who have little,. Prepaid cards are worth considering if you prioritize financial control and building credit over traditional credit card benefits. While they may look just like a credit card and bear the logo of a major credit card company. Prepaid credit cards will not show up on your credit report, and they won't. Prepaid credit cards and secured credit cards are generally two different credit card card types. You use cash to add money to the card and then use it to pay for goods and services at. Prepaid cards don’t build credit and shouldn’t be confused with secured credit cards. However, when talking about prepaid credit cards, people are often. The only. Inability to build your credit history to obtain future loans from a bank. Prepaid credit cards and secured credit cards are generally two different credit card card types. The only kind of credit card that could. A prepaid card is a payment method where you—or an employer or government agency—can deposit funds that can then be used to. Prepaid cards. Prepaid cards don’t build credit and shouldn’t be confused with secured credit cards. We talk about why this is the case and what to do instead. A prepaid card is a payment method where you—or an employer or government agency—can deposit funds that can then be used to. Where possible, try and build up your credit worthiness. Prepaid credit cards. With complimentary access to more than 1,400 airport lounges across 140 countries and counting,. Do prepaid cards build credit? To build good credit, you need to make sure that you’re paying a bill that gets reported to each major credit bureau — experian,. The american express global lounge collection ® can provide an escape at the airport. Prepaid cards are. Prepaid cards are similar to debit cards, but you don’t need a bank account to get one. Transaction limit (daily, weekly or monthly) usually set by the bank that issues the card. You’ll earn 4x points on up to $50,000 in purchases at restaurants worldwide, plus a $120 dining credit ($10 statement credit per month) when you pay with the gold card at. Prepaid cards do not build credit, as they do not report to the credit bureaus and are more akin to gift cards or debit cards than credit cards. Shopping deals is the easiest way to earn additional cash back while. The only kind of credit card that. If you have no credit or low credit, a secured card can provide you with a path to building or repairing your credit. However, when it comes to building credit, prepaid credit cards are no substitute for the real thing. We talk about why this is the case and what to do instead. While they may look just like a credit card and bear the logo of a major credit card company. Prepaid cards do not build credit, as they do not report to the credit bureaus and are more akin to gift cards or debit cards than credit cards. Prepaid credit cards will not show up on your credit report, and they won't be. With complimentary access to more than 1,400 airport lounges across 140 countries and counting,. You use cash to add money to the card and then use it to pay for goods and services at. Prepaid cards don’t build credit and shouldn’t be confused with secured credit cards. A prepaid credit card will not build your credit as those payments are not reported to credit bureaus.Build Credit by Using the Right Prepaid Credit Cards

Top 5 Best Prepaid Credit Cards To Build Credit AquilaResources

Does A Prepaid Credit Card Help To Build a Credit Score? Credello

5 Prepaid Cards That Build Credit (2025)

What is a prepaid card? Prepaid, debit + credit cards Lexington Law

Best Prepaid Credit Cards to Build Credit 2019 Every Buck Counts

Prepaid v. Debit v. Credit Cards How do Prepaid cards work

How do prepaid cards work? Credit card, Credit card

Do prepaid credit cards build credit? Chase

What is a prepaid card? Prepaid, debit + credit cards Lexington Law

Your Deposit Is Returned To You When You Close Your Credit Card Account Or Switch To An Unsecured Card.

A Prepaid Card Is A Payment Method Where You—Or An Employer Or Government Agency—Can Deposit Funds That Can Then Be Used To.

The Perpay Credit Card, Issued By Celtic Bank, Is Designed To Help Cardholders Who Want To Build Credit, But Are Seeking An Alternative To Secured Credit Cards.instead Of Requiring.

A Secured Credit Card Is Just Like A Regular Credit Card, Except That It Requires A Security Deposit.

Related Post: