Does A Car Lease Build Credit

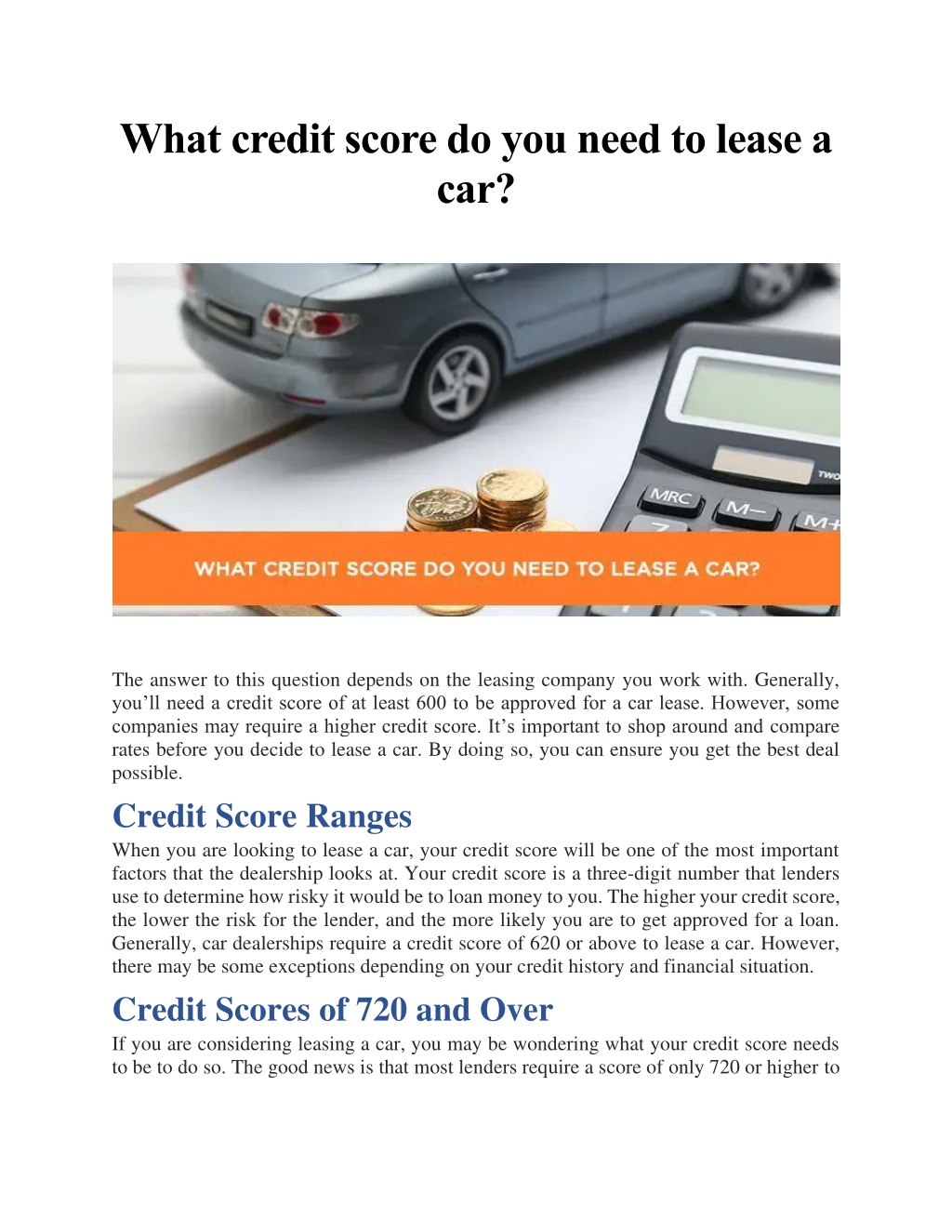

Does A Car Lease Build Credit - Yes, leasing a car does impact your credit, and in turn, your credit score. But this comes at the price of a higher interest rate, of course. The cost of leasing a used vehicle is likely to start around $100 a month and go up from there. As with new car leasing, it. On your credit report, it will look like the creditor. You make monthly payments based on the vehicle’s depreciation during. When you apply for a car lease, the leasing company will perform a hard inquiry into your credit history. To get credit, you need to have established credit. To anyone asking, ”does leasing a car build credit?” the answer is that leasing a vehicle can positively impact your credit score and even help you rebuild your credit. This initial credit check is essential for the company to determine your. When your car lease is paid off, it does affect your credit score by being reported to the credit bureaus as a closed account. If your leasing company reports to all. You make monthly payments based on the vehicle’s depreciation during. It requires you to make monthly payments, expanding your payment history. However, while auto loans are accessible to consumers across the credit spectrum, it can be difficult to get approved for a lease if your credit score is less than stellar. When you apply for a car lease, the leasing company will perform a hard inquiry into your credit history. Your payment history has a big impact on your credit scores. Leasing a car is similar to renting it for a fixed period, usually between 2 to 4 years. To anyone asking, ”does leasing a car build credit?” the answer is that leasing a vehicle can positively impact your credit score and even help you rebuild your credit. New york fed consumer credit panel/equifax, using philadelphia fed auto loan tradeline data. Denial due to credit score: When you apply for a car lease, the leasing company will perform a hard inquiry into your credit history. To anyone asking, ”does leasing a car build credit?” the answer is that leasing a vehicle can positively impact your credit score and even help you rebuild your credit. Your payment history has a big impact. To anyone asking, ”does leasing a car build credit?” the answer is that leasing a vehicle can positively impact your credit score and even help you rebuild your credit. When it’s time to put yourself in a new car, you certainly have. Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. This initial credit check is. Leasing a car is similar to renting it for a fixed period, usually between 2 to 4 years. When you apply for a car lease, the leasing company will perform a hard inquiry into your credit history. Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. New york fed consumer credit panel/equifax, using philadelphia fed auto. Leasing a car responsibly can contribute to building credit, provided that payments are made on time and in full. Timely payments and a diverse credit mix are key factors that contribute to an improved credit history. To benefit from a federal tax credit of up to $7,500 for qualifying new. But this comes at the price of a higher interest. It requires you to make monthly payments, expanding your payment history. This initial credit check is essential for the company to determine your. As surprising as it is, you’ll have an easier time securing a car loan than a lease, experian explains. Leasing a car is similar to renting it for a fixed period, usually between 2 to 4 years.. As such, you might have trouble getting approved for several types of loans and potentially even for an apartment lease. Leasing a car can help you build credit just as an auto loan can. When it’s time to put yourself in a new car, you certainly have. To get credit, you need to have established credit. Financing a car can. When your car lease is paid off, it does affect your credit score by being reported to the credit bureaus as a closed account. As with new car leasing, it. What does it mean to lease a car? On your credit report, it will look like the creditor. How much does it cost to lease a used car? When it’s time to put yourself in a new car, you certainly have. Leasing a car gives you the opportunity to build credit. Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. As with new car leasing, it. To benefit from a federal tax credit of up to $7,500 for qualifying new. Leasing a car responsibly can contribute to building credit, provided that payments are made on time and in full. In the quest to build credit, leasing a car can positively impact if managed responsibly. You can gain credit by taking out an auto lease. When it’s time to put yourself in a new car, you certainly have. Your payment history. When it’s time to put yourself in a new car, you certainly have. If your leasing company reports to all. In the quest to build credit, leasing a car can positively impact if managed responsibly. Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. Leasing a car may help you build your credit, but only if. Leasing a car gives you the opportunity to build credit. It requires you to make monthly payments, expanding your payment history. However, while auto loans are accessible to consumers across the credit spectrum, it can be difficult to get approved for a lease if your credit score is less than stellar. Between the car’s initial value and its. Timely payments and a diverse credit mix are key factors that contribute to an improved credit history. Leasing a car responsibly can contribute to building credit, provided that payments are made on time and in full. Denial due to credit score: Leasing a car may help you build your credit, but only if you make your monthly payments on time and in full. To benefit from a federal tax credit of up to $7,500 for qualifying new. As such, you might have trouble getting approved for several types of loans and potentially even for an apartment lease. You can gain credit by taking out an auto lease. Leasing a car can help you build credit just as an auto loan can. The cost of leasing a used vehicle is likely to start around $100 a month and go up from there. How much does it cost to lease a used car? As surprising as it is, you’ll have an easier time securing a car loan than a lease, experian explains. But this comes at the price of a higher interest rate, of course.how to lease a car with bad credit and no money down Tiffaney Schofield

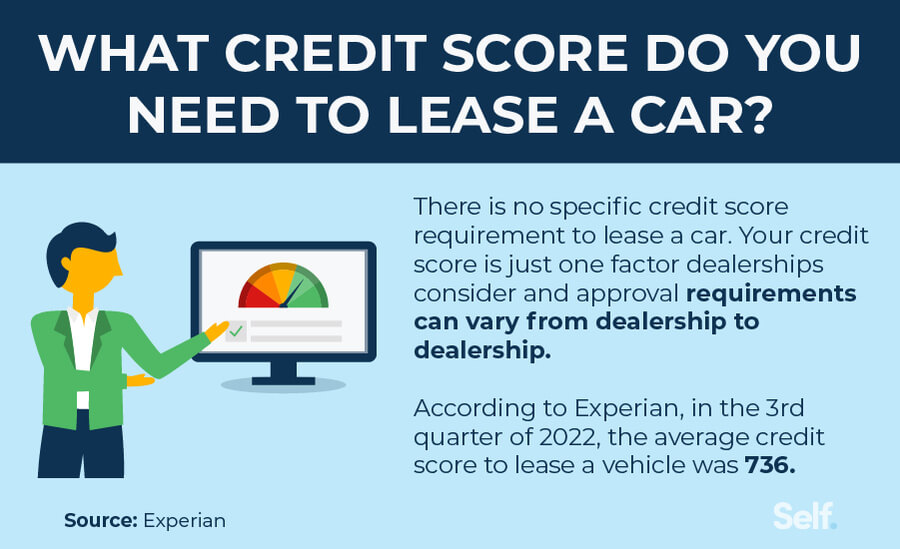

What Credit Score Do You Need to Lease A Car? Self. Credit Builder.

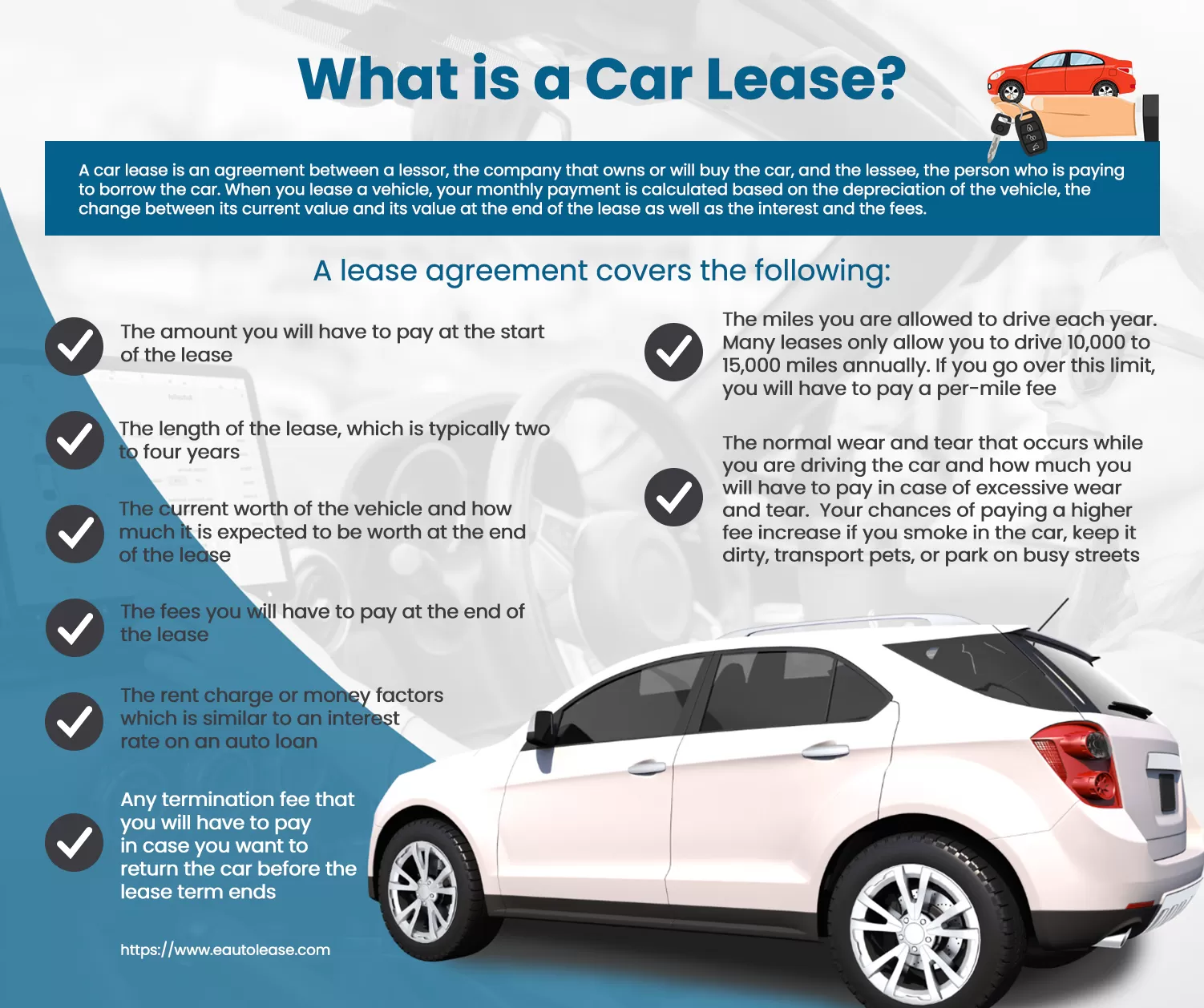

What Is a Car Lease and How Does It Work? eAutoLease

Does Leasing a Car Build Credit? Self. Credit Builder.

Does Leasing a Car Build Credit? Credello

What Credit Score Do You Need to Lease A Car? Self. Credit Builder.

Does Leasing a Car Build Credit? Self. Credit Builder.

Does Leasing a Car Build Credit? Self. Credit Builder.

PPT What credit score do you need to lease a car? PowerPoint

Do You Need Great Credit To Lease A Car Car Retro

You Make Monthly Payments Based On The Vehicle’s Depreciation During.

Car Leasing Agreements Are Reported To Credit Bureaus Similarly To Traditional Auto Loans.

In The Quest To Build Credit, Leasing A Car Can Positively Impact If Managed Responsibly.

Leasing A Car Is Similar To Renting It For A Fixed Period, Usually Between 2 To 4 Years.

Related Post: