Does A Car Payment Build Credit

Does A Car Payment Build Credit - The good news is financing a car will build credit. The good news is that a car loan can help you boost your credit in the long term. Taking out a car loan can affect your credit in several ways. As mentioned previously, a hard inquiry appears on your report every time a lender. 2 points per $1 on car loan, lease or insurance payments from a linked account (on up to $1,000 in spending per. Will paying monthly for my car insurance affect my credit score? A good place to start is to get serious about paying your bills on time. New inquiries:the first ding to your credit rating happens before you even open a credit account. One of the primary factors that determines your credit score is your payment history. Having a loan itself doesn’t help build your credit. 2 points per $1 on car loan, lease or insurance payments from a linked account (on up to $1,000 in spending per. When you make a timely payment to your auto loan each month, you'll see a boost in your score at key milestones like six months, one year, and eighteen months. Financing a car can help you to improve your credit score, but there’s no guarantee. Elon musk, the world’s richest man, is widely known for amassing his fortune through tesla, his electric car company, and spacex, the rocket ship company he founded. The cfpb published a report showing that u.s. When you finance a car, most of the time it will appear on your. Establishing a strong payment history is key in utilizing a car loan to help improve your credit score in the long run. Your score will increase as it satisfies all of the factors the contribute to a credit score, adding to your payment history, amounts owed,. New fasten credit card to earn rewards on car payments. Does a car loan build credit? The good news is financing a car will build credit. The cfpb published a report showing that u.s. In fact, the loan will lower your credit score initially because you’ve taken on extra debt. Elon musk, the world’s richest man, is widely known for amassing his fortune through tesla, his electric car company, and spacex, the rocket ship company he. Buyers in the city need an average of £510 a month to meet mortgage payments for a one or two bedroom home, which cost an average of £119,350, it said. Does a car loan build credit? Does buying a car with cash help your credit score? As mentioned previously, a hard inquiry appears on your report every time a lender.. When you sign up for a new car loan, it may probably hurt your credit score at first. Here’s what happens to your credit when you get a new car loan: Does buying a car with cash help your credit score? Read more to understand how car loans affect your credit score. Taking out a car loan can affect your. Yes, they can, but only if you make timely payments consistently. Buyers in the city need an average of £510 a month to meet mortgage payments for a one or two bedroom home, which cost an average of £119,350, it said. Establishing a strong payment history is key in utilizing a car loan to help improve your credit score in. Your score will increase as it satisfies all of the factors the contribute to a credit score, adding to your payment history, amounts owed,. However, for auto loans, higher car prices combined with higher interest rates have driven monthly payments upward and have put pressure on consumers across the. A car loan does build credit, only if you make the. Using a travel credit card to earn rewards for purchases you'd be making anyway is a great way to defray the cost of your next vacation, as long as you pay off your balance in. The cfpb published a report showing that u.s. Do car payments build credit? Here’s what happens to your credit when you get a new car. Buyers in the city need an average of £510 a month to meet mortgage payments for a one or two bedroom home, which cost an average of £119,350, it said. The good news is financing a car will build credit. Reliably repaying your auto loan demonstrates your trustworthiness to credit. Establishing a strong payment history is key in utilizing a. No one wants an auto. Other lines of credit you have. Learn how you can get an auto loan even if you have bad credit so you can take advantage. A car loan does build credit, only if you make the monthly payments on time. But that negative impact may be only temporary. Financing a car can help you to improve your credit score, but there’s no guarantee. Using a travel credit card to earn rewards for purchases you'd be making anyway is a great way to defray the cost of your next vacation, as long as you pay off your balance in. 2 points per $1 on car loan, lease or insurance. Buyers in the city need an average of £510 a month to meet mortgage payments for a one or two bedroom home, which cost an average of £119,350, it said. Your score will increase as it satisfies all of the factors the contribute to a credit score, adding to your payment history, amounts owed,. When you finance a car, most. The good news is that a car loan can help you boost your credit in the long term. Financing a car can help you to improve your credit score, but there’s no guarantee. Taking out a car loan can affect your credit in several ways. Here’s what happens to your credit when you get a new car loan: Your score will increase as it satisfies all of the factors the contribute to a credit score, adding to your payment history, amounts owed,. One of the primary factors that determines your credit score is your payment history. A car loan does build credit, only if you make the monthly payments on time. A good place to start is to get serious about paying your bills on time. New inquiries:the first ding to your credit rating happens before you even open a credit account. When you finance a car, most of the time it will appear on your. Learn how you can get an auto loan even if you have bad credit so you can take advantage. New fasten credit card to earn rewards on car payments. Reliably repaying your auto loan demonstrates your trustworthiness to credit. Will paying monthly for my car insurance affect my credit score? In fact, the loan will lower your credit score initially because you’ve taken on extra debt. Do car payments build credit?Self News and Blog

Does Financing a Car Build Credit? Voss Honda

Does Leasing a Car Build Credit? Self. Credit Builder.

Check out average auto loan rates according to credit score RoadLoans

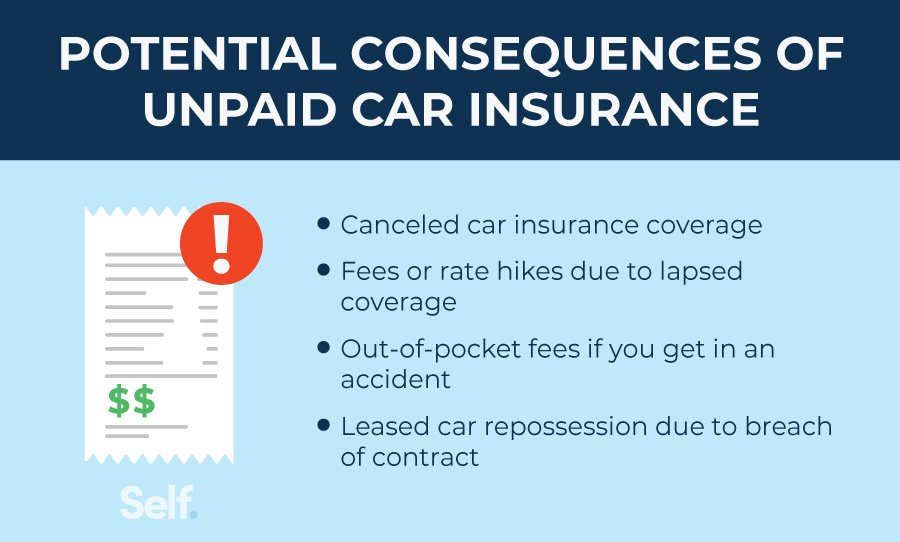

Does Paying Car Insurance Build Credit? Self. Credit Builder.

Does a Car Loan Build Credit?

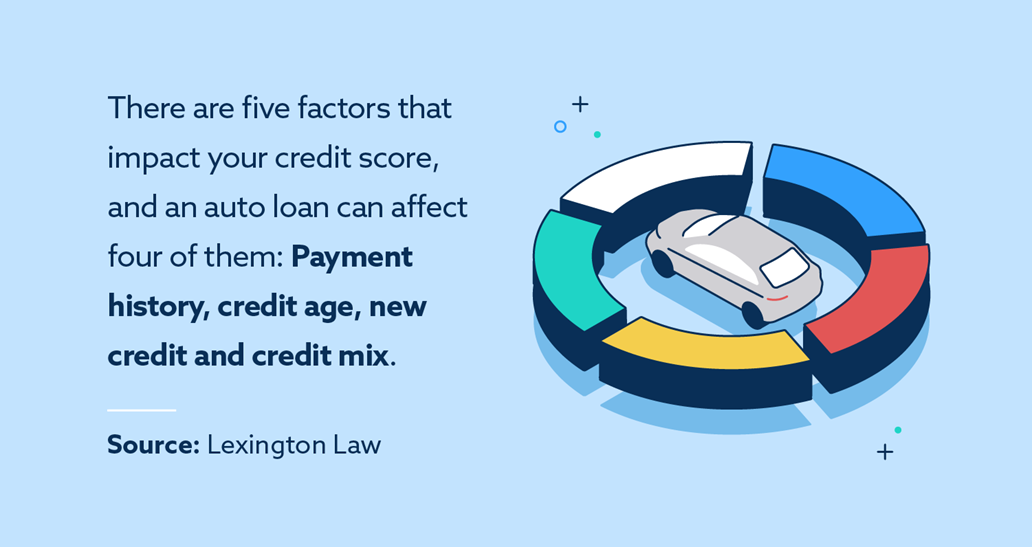

Does a Car Loan Build Your Credit Score? Lexington Law

Does a Car Loan Build Your Credit Score? Lexington Law

What Credit Score Is Used for Car Loans? Self. Credit Builder.

Does Leasing a Car Build Credit? Self. Credit Builder.

Build Credit Without The Debt.

As Mentioned Previously, A Hard Inquiry Appears On Your Report Every Time A Lender.

Buyers In The City Need An Average Of £510 A Month To Meet Mortgage Payments For A One Or Two Bedroom Home, Which Cost An Average Of £119,350, It Said.

A Car Loan Can Help You Rebuild Your Credit Because It Adds Weight To Certain Factors In Your Credit.

Related Post: