Does A Lease Build Credit

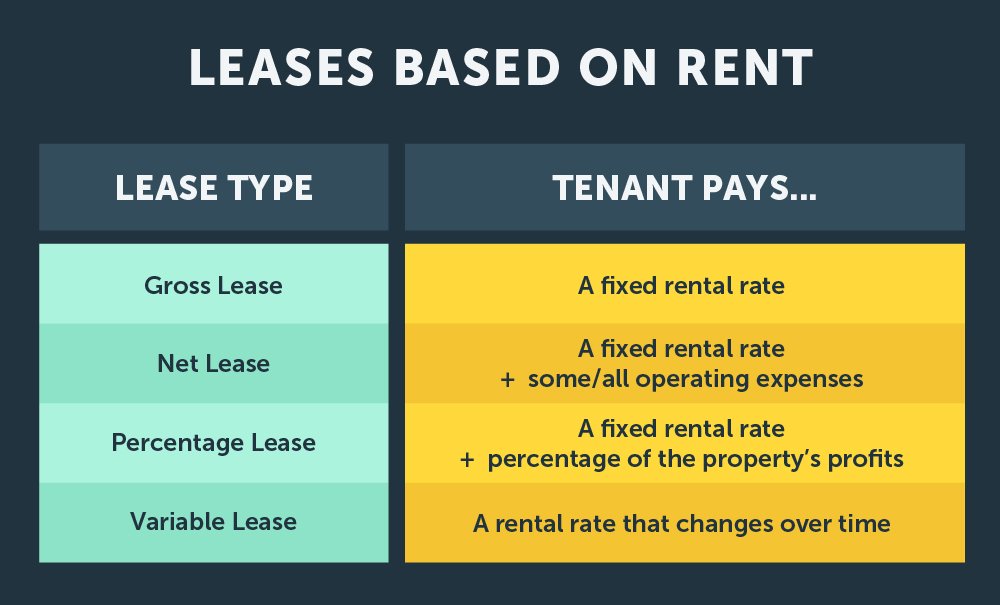

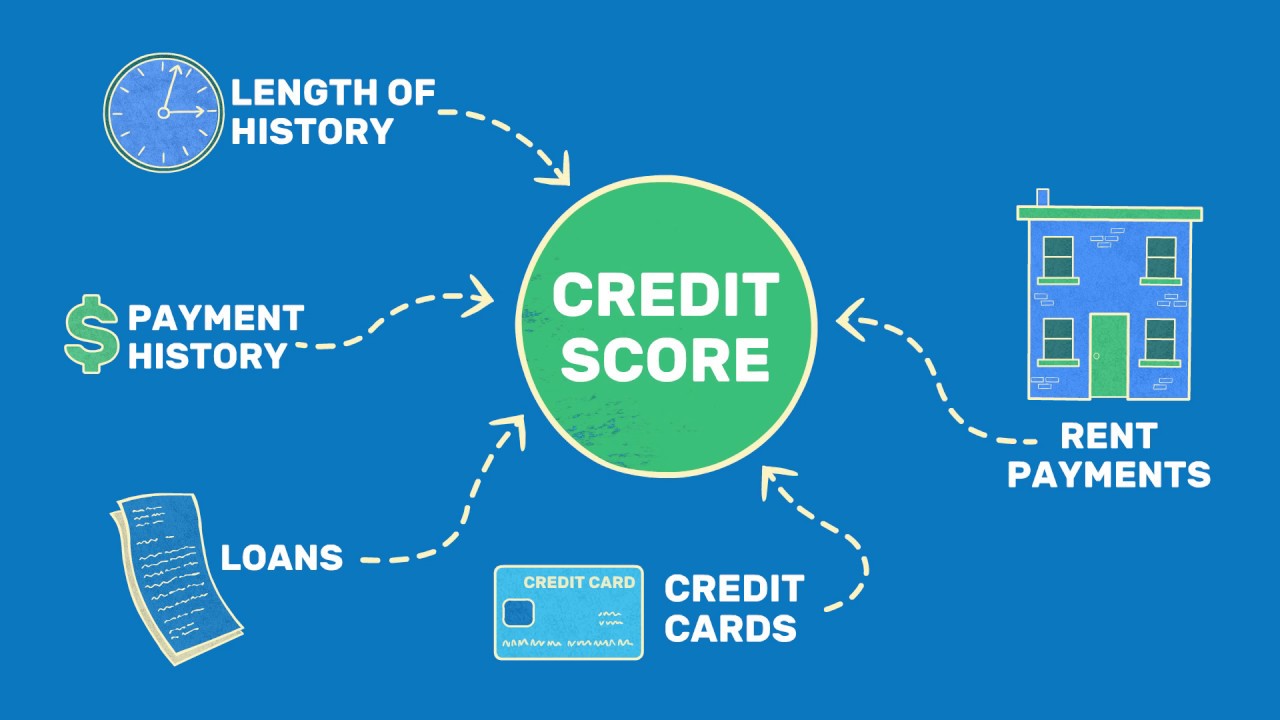

Does A Lease Build Credit - Making timely payments can positively impact your credit. Building credit is a crucial aspect of financial health, influencing everything from loan approvals to interest rates. It requires you to make monthly payments, expanding your payment history. Can car leasing improve my credit score? A lease will be reported as an. In 2025, it goes up to $184,250. To anyone asking, ”does leasing a car build credit?” the answer is that leasing a vehicle can positively impact your credit score. Does leasing build your credit? On your credit report, it will look like the creditor. The good news is that leasing a car can build your credit score just like financing. Does leasing a car build credit? Your payment history is the most important factor in determining your credit score, so if. Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. A lease will be reported as an. After 2031, the rent will increase by 5% every five. Many people wonder whether having their name on a lease. Credit scores play a pivotal role in the leasing process, profoundly impacting lease approval and terms. It requires a large cash. Leasing a car can help build credit if your lease payments are reported to the major credit bureaus. To anyone asking, ”does leasing a car build credit?” the answer is that leasing a vehicle can positively impact your credit score. Does leasing build your credit? In 2025, it goes up to $184,250. Then until 2031 the rent will be $275,000. It requires you to make monthly payments, expanding your payment history. The good news is that leasing a car can build your credit score just like financing. Your payment history is the most important factor in determining your credit score, so if. Does leasing a car build credit? A lease will be reported as an. On your credit report, it will look like the creditor. Leasing a car can help build credit if your lease payments are reported to the major credit bureaus. Some people who want to lease a car but have no credit or poor credit may take advantage of another way to lease. Leasing a car can help build credit if your lease payments are reported to the major credit bureaus. Yes, leasing a car does impact your credit, and in turn, your credit score. Leasing a car could also. Under the lease, the rent for 2024 will be $30,250. The good news is that leasing a car can build your credit score just like financing. To anyone asking, ”does leasing a car build credit?” the answer is that leasing a vehicle can positively impact your credit score. Leasing a car could also help you build your credit if you. Does leasing a car build credit? Then until 2031 the rent will be $275,000. Credit scores play a pivotal role in the leasing process, profoundly impacting lease approval and terms. To anyone asking, ”does leasing a car build credit?” the answer is that leasing a vehicle can positively impact your credit score. It requires a large cash. Learn about how to build credit by leasing a car and what credit score you'll need to qualify, plus the pros and cons of owning versus leasing a car. When your car lease is paid off, it does affect your credit score by being reported to the credit bureaus as a closed account. Leasing a car gives you the opportunity. It requires a large cash. On your credit report, it will look like the creditor. To anyone asking, ”does leasing a car build credit?” the answer is that leasing a vehicle can positively impact your credit score. Leasing a car can help build credit if your lease payments are reported to the major credit bureaus. A higher credit score significantly. Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. Under the lease, the rent for 2024 will be $30,250. A lease will be reported as an. On your credit report, it will look like the creditor. The good news is that leasing a car can build your credit score just like financing. Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. Leasing a car could also help you build your credit if you make your payments on time. Learn about how to build credit by leasing a car and what credit score you'll need to qualify, plus the pros and cons of owning versus leasing a car. Then. Making timely payments can positively impact your credit. Does leasing a car build credit? Leasing a car could also help you build your credit if you make your payments on time. Leasing a car can help build your credit, but it also can hurt your credit score if you default on the loan. Building credit is a crucial aspect of. Your payment history is the most important factor in determining your credit score, so if. Leasing a car gives you the opportunity to build credit. Many people wonder whether having their name on a lease. Some people who want to lease a car but have no credit or poor credit may take advantage of another way to lease. Does leasing build your credit? Credit scores play a pivotal role in the leasing process, profoundly impacting lease approval and terms. Leasing a car can help build your credit, but it also can hurt your credit score if you default on the loan. Learn about how to build credit by leasing a car and what credit score you'll need to qualify, plus the pros and cons of owning versus leasing a car. A lease will be reported as an. Leasing a car can help build credit if your lease payments are reported to the major credit bureaus. After 2031, the rent will increase by 5% every five. Making timely payments can positively impact your credit. Your payment history has a big impact on your credit scores. Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. Then until 2031 the rent will be $275,000. When your car lease is paid off, it does affect your credit score by being reported to the credit bureaus as a closed account.Which Type of Credit Is Used to Lease a Building DesiraehasFisher

Does Leasing a Car Build Credit? The Answer Might Surprise You… — Grow

Does Leasing a Car Build Credit? Self. Credit Builder.

Does Leasing a Car Build Credit? Self. Credit Builder.

Does Leasing Furniture Build Credit? An Authentic Guide

How To Build Credit Quickly By Reporting Your Rent YouTube

Finance Lease vs Contract Hire What Van Buyers Need To Know

Does Leasing a Car Build Credit? Self. Credit Builder.

Does Leasing a Car Build Credit? Credello

Understanding Letters of Credit A Commercial Leasing Guide Occupier

Can Car Leasing Improve My Credit Score?

Leasing A Car Could Also Help You Build Your Credit If You Make Your Payments On Time.

In 2025, It Goes Up To $184,250.

To Anyone Asking, ”Does Leasing A Car Build Credit?” The Answer Is That Leasing A Vehicle Can Positively Impact Your Credit Score.

Related Post: