Does A Savings Account Build Credit

Does A Savings Account Build Credit - Find out how to improve. The experian smart money™ digital checking account and debit card helps you build. Savings accounts are essentially holding accounts; Online savings accounts are managed exclusively through websites,. To accomplish that, start by opening. Opening a savings account does not directly affect your credit score. In fact, a good rule of thumb is to make sure you keep. Credit scores are primarily influenced by your credit history, which includes credit cards, loans and other forms. A savings account doesn't directly affect your credit score, but it can indirectly help you maintain good credit by reducing your need to borrow. Does a bank account build credit? The saver's credit gives you a tax credit of 50 percent, 20 percent, or 10 percent on the first $2,000 in contributions you make to a retirement account. Does a bank account build credit? Credit builder plan requires you to open a line of credit and a credit builder savings account, both banking services provided by cross river bank, member fdic. Learn how a savings balance can. Here are three ways your current savings account may be falling flat, plus what to look for in your. A savings account does not directly affect your credit score, but you can use it to secure a loan or a credit card and build credit. The experian smart money™ digital checking account and debit card helps you build. Even though having a sizable amount of cash in savings won't cause your credit score to rise, it's a smart thing to have. In most cases, opening a checking or savings account is not reported to the major credit reporting bureaus and will not have an impact on your credit score. Opening a savings account typically won't affect your credit score because savings accounts don't report to credit bureaus. Learn how opening a savings account won't affect your credit score, but it can help you build a banking relationship and manage money responsibly. Even though having a sizable amount of cash in savings won't cause your credit score to rise, it's a smart thing to have. Opening a savings account typically won't affect your credit score because savings accounts. Learn how to take loans against cds in a way that can help build your credit score. A savings account doesn't directly affect your credit score, but it can indirectly help you maintain good credit by reducing your need to borrow. An online savings account is an account held at a financial institution that does not have a physical location.. To accomplish that, start by opening. Opening a savings account does not directly affect your credit score. Online savings accounts are managed exclusively through websites,. An online savings account is an account held at a financial institution that does not have a physical location. In most cases, opening a checking or savings account is not reported to the major credit. Savings accounts are essentially holding accounts; A savings account is a bank account that pays interest on the money you deposit. Even though having a sizable amount of cash in savings won't cause your credit score to rise, it's a smart thing to have. Most banks will pull your chexsystems report to verify. This will not directly establish your credit. Savings accounts are essentially holding accounts; Credit scores are primarily influenced by your credit history, which includes credit cards, loans and other forms. Online savings accounts are managed exclusively through websites,. To accomplish that, start by opening. Opening a savings account usually does not affect your credit. Credit builder plan requires you to open a line of credit and a credit builder savings account, both banking services provided by cross river bank, member fdic. An online savings account is an account held at a financial institution that does not have a physical location. Learn how opening a savings account won't affect your credit score, but it can. Find out how to improve. Opening a savings account typically won't affect your credit score because savings accounts don't report to credit bureaus. Savings accounts are essentially holding accounts; Learn how to take loans against cds in a way that can help build your credit score. Certificates of deposit (cds) are savings account that provides reliable interest. Opening a savings account does not directly affect your credit score. Here are three ways your current savings account may be falling flat, plus what to look for in your. A savings account does not directly affect your credit score, but you can use it to secure a loan or a credit card and build credit. This will not directly. Here are three ways your current savings account may be falling flat, plus what to look for in your. The saver's credit gives you a tax credit of 50 percent, 20 percent, or 10 percent on the first $2,000 in contributions you make to a retirement account. Opening a savings account typically won't affect your credit score because savings accounts. Online savings accounts are managed exclusively through websites,. Though if a bank does a hard inquiry it can lower your credit score by a few points. Opening a savings account typically won't affect your credit score because savings accounts don't report to credit bureaus. Here are three ways your current savings account may be falling flat, plus what to look. Opening a savings account usually does not affect your credit. In most cases, opening a checking or savings account is not reported to the major credit reporting bureaus and will not have an impact on your credit score. Savings accounts are essentially holding accounts; To accomplish that, start by opening. This will not directly establish your credit history, but lenders typically. Credit scores are primarily influenced by your credit history, which includes credit cards, loans and other forms. In fact, a good rule of thumb is to make sure you keep. Building the best credit requires having manageable debt levels and a history of timely payments across a diverse mix of credit accounts. The experian smart money™ digital checking account and debit card helps you build. Does a bank account build credit? Learn how to take loans against cds in a way that can help build your credit score. Opening a savings account typically won't affect your credit score because savings accounts don't report to credit bureaus. Online savings accounts are managed exclusively through websites,. Even though having a sizable amount of cash in savings won't cause your credit score to rise, it's a smart thing to have. A savings account is a bank account that pays interest on the money you deposit. Here are three ways your current savings account may be falling flat, plus what to look for in your.PPT Savings Accounts PowerPoint Presentation, free download ID1715433

Is Your Money Safer in Checking or Savings?

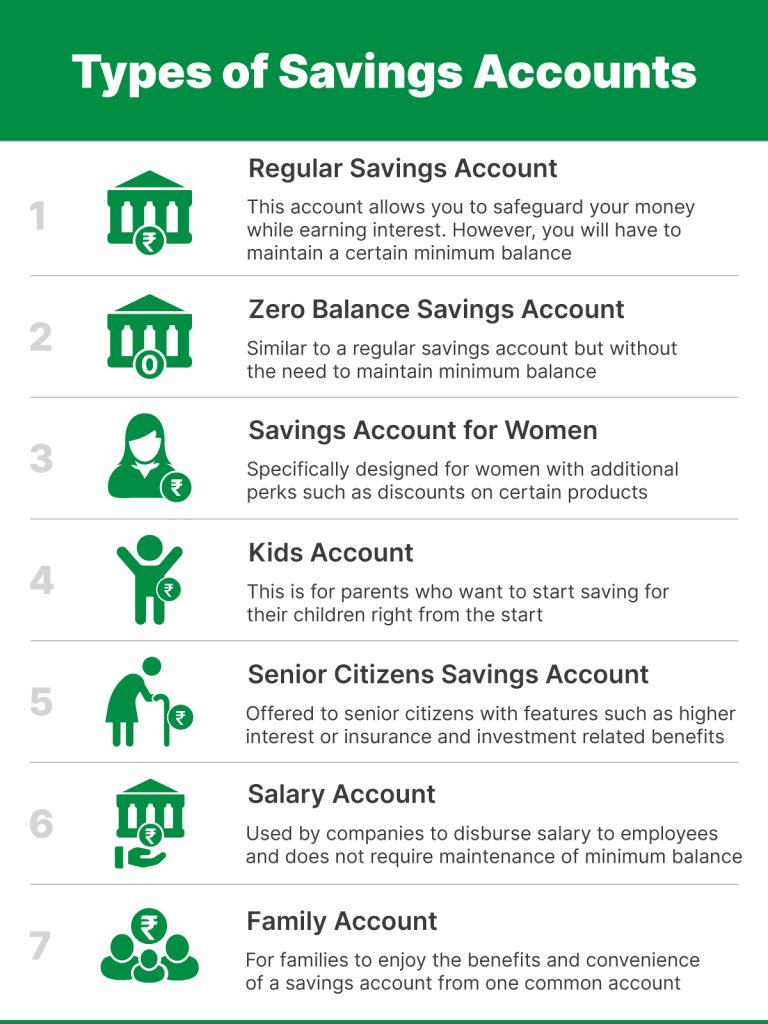

Types Of Bank Accounts

7 Types of Savings Accounts

Best Interest Rates Savings Accounts Credit Unions at Alberta Coker blog

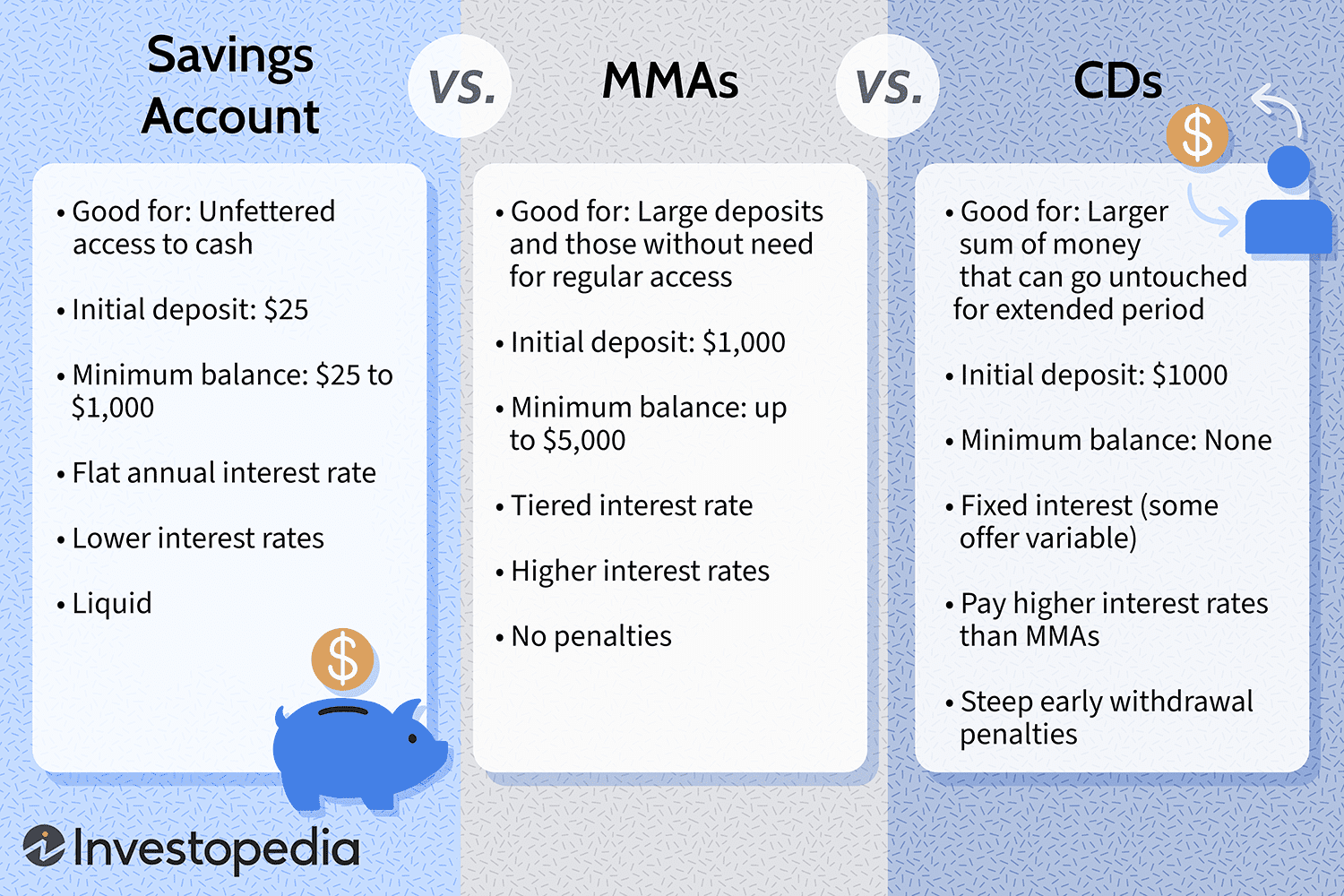

Money Market Accounts, Savings Accounts, and CDs Which One Is the Best

Best Checking And Savings Accounts 2024 Erinna Roanna

How and Why to Build Credit and Begin Your Savings Journey Community

Best Online Savings Accounts for 2021 DollarSprout Online savings

First Savings Credit Card YouTube

Learn How Opening A Savings Account Won't Affect Your Credit Score, But It Can Help You Build A Banking Relationship And Manage Money Responsibly.

A Savings Account Does Not Directly Affect Your Credit Score, But You Can Use It To Secure A Loan Or A Credit Card And Build Credit.

An Online Savings Account Is An Account Held At A Financial Institution That Does Not Have A Physical Location.

Find Out How To Improve.

Related Post:

:max_bytes(150000):strip_icc()/how-interest-rates-work-savings-accounts.asp-3644536378554b9ab3ecab2747aa066c.jpg)