Does A Secured Loan Build Credit

Does A Secured Loan Build Credit - If you’re asking yourself, “is a shared loan good for credit?,” the answer is “yes” you can use a secured loan to build credit. Certain cards are designed to assist people in building their credit. Get it, use it to improve. Once you use a secured. Your deposit is returned to you when you close your credit card account or. Can a secured loan help build credit score? Think of it as the lender asking for a little insurance in case you don’t end up making those monthly payments. You need utilization to be low when the credit is pulled, before and after. As long as you can. Here’s how to use a secured credit card to build credit. Secured loans require collateral, like a car or home, while unsecured loans do not. Complete challenges designed to help you build credit and earn. Your deposit is returned to you when you close your credit card account or. Can a secured loan help build credit score? A secured credit card is just like a regular credit card, except that it requires a security deposit. Utilization doesn't help you in building credit. Home equity loans and home. When these moments occur, a personal loan, can provide access to cash when you need it. In this article, you'll discover how secured loans can. Once you use a secured. You might be able to take out a loan secured by your home equity. However, even though it's the most preferred type of loan for creditors, secured loans can still affect your credit score. Secured debt is backed by collateral or a hard asset and comes in these forms: Instead of using an unsecured credit card, start using a secured. A bump in your credit score from 629 to over 640 could result in a fair credit rating versus bad credit, dropping the average personal loan rate from above 30 percent to below 18. Secured debt is backed by collateral or a hard asset and comes in these forms: Think of it as the lender asking for a little insurance. Utilization doesn't help you in building credit. When these moments occur, a personal loan, can provide access to cash when you need it. Lenders may offer lower interest rates and larger borrowing limits on secured loans. Instead of using an unsecured credit card, start using a secured one to avoid interest and overspending. In this article, you'll discover how secured. Secured loans require collateral, like a car or home, while unsecured loans do not. This helps you establish and build credit. As long as you can. Track your credit health with enhanced credit monitoring and access a credit builder loan to help build credit. When these moments occur, a personal loan, can provide access to cash when you need it. You might be able to take out a loan secured by your home equity. You need utilization to be low when the credit is pulled, before and after. If you would like to borrow money but have a bad credit score, one way to get around it is taking out a secured loan. If you’re asking yourself, “is a shared. Use a secured credit card: Understanding secured debt and its risks. If you’re asking yourself, “is a shared loan good for credit?,” the answer is “yes” you can use a secured loan to build credit. As long as you can. You need utilization to be low when the credit is pulled, before and after. Your credit score is a snapshot at the time it's pulled. If you would like to borrow money but have a bad credit score, one way to get around it is taking out a secured loan. These action steps will help you build healthy credit,. Here’s how to use a secured credit card to build credit. You might be able. Utilization doesn't help you in building credit. Your credit score is a snapshot at the time it's pulled. Instead of using an unsecured credit card, start using a secured one to avoid interest and overspending. Track your credit health with enhanced credit monitoring and access a credit builder loan to help build credit. If you’re asking yourself, “is a shared. Certain cards are designed to assist people in building their credit. Home equity loan requirements include a good credit score, sufficient equity in your home, and more. Choose the right secured card. Home equity loans and home. If you’re asking yourself, “is a shared loan good for credit?,” the answer is “yes” you can use a secured loan to build. You need utilization to be low when the credit is pulled, before and after. Secured loans require collateral, like a car or home, while unsecured loans do not. However, even though it's the most preferred type of loan for creditors, secured loans can still affect your credit score. Your credit score is a snapshot at the time it's pulled. A. Track your credit health with enhanced credit monitoring and access a credit builder loan to help build credit. Your credit score is a snapshot at the time it's pulled. Secured loans require collateral, like a car or home, while unsecured loans do not. Complete challenges designed to help you build credit and earn. Understanding secured debt and its risks. A shared secured loan is a great first step to build or rebuild your. Life happens and there will be times when needing immediate access to additional cash arises. Use a secured credit card: In this article, you'll discover how secured loans can. Secured debt is basically a loan that’s backed by an asset. Utilization doesn't help you in building credit. If you’re asking yourself, “is a shared loan good for credit?,” the answer is “yes” you can use a secured loan to build credit. Get it, use it to improve. Your deposit is returned to you when you close your credit card account or. Think of it as the lender asking for a little insurance in case you don’t end up making those monthly payments. This helps you establish and build credit.How to Build Credit The 7Step Guide for 2024 (2024)

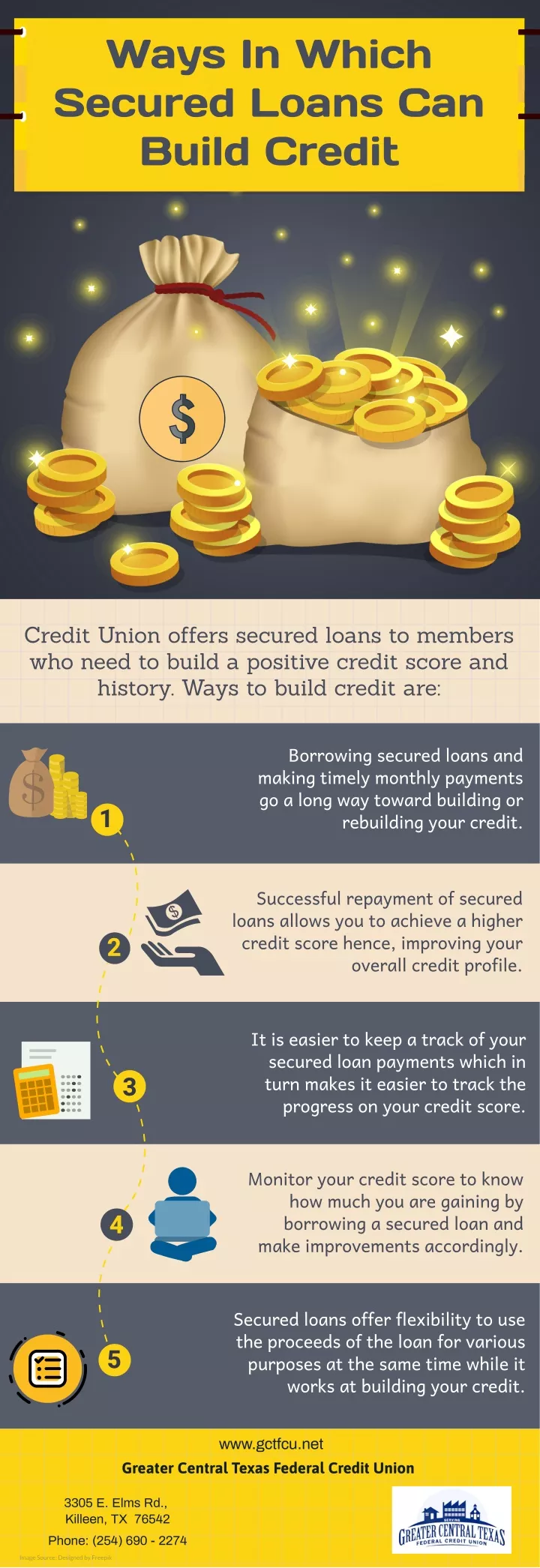

GCTFCU Blog Ways In Which Secured Loans Can Build Credit

What Is a Secured Loan?

Can A Secured Loan Help You Build Credit?

Secured Loans vs. Unsecured Loans The Key Differences Self. Credit

How to use your own money as collateral to build credit Improve

PPT Ways In Which Secured Loans Can Build Credit PowerPoint

Secured Loans vs. Unsecured Loans The Key Differences Self. Credit

44+ which credit report do mortgage lenders use SeyyedSimbiat

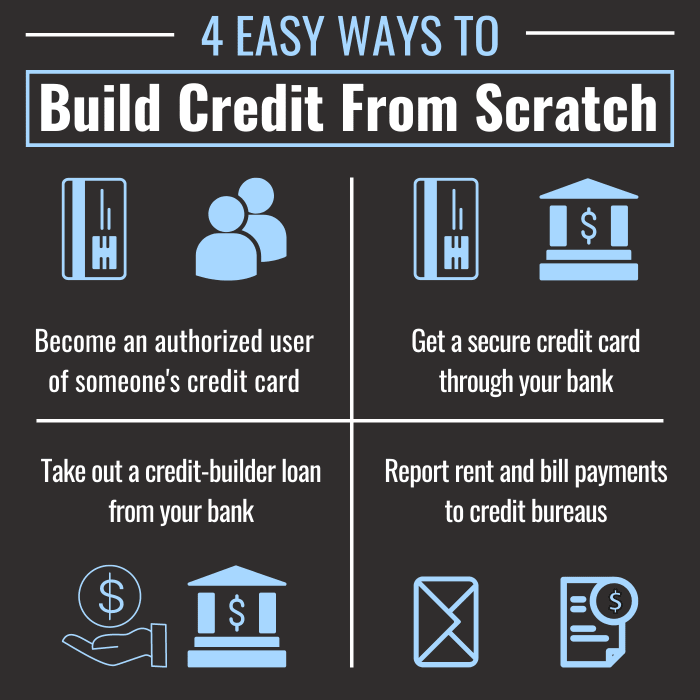

4 Ways to Safely Build Credit When You Have None TheStreet

Secured Debt Is Backed By Collateral Or A Hard Asset And Comes In These Forms:

Choose The Right Secured Card.

However, Even Though It's The Most Preferred Type Of Loan For Creditors, Secured Loans Can Still Affect Your Credit Score.

Here’s How To Use A Secured Credit Card To Build Credit.

Related Post:

/secured-loans-2386169_final-cbd3a613da25474fa240c59185879183.jpg)