Does Affirm Help Build Your Credit

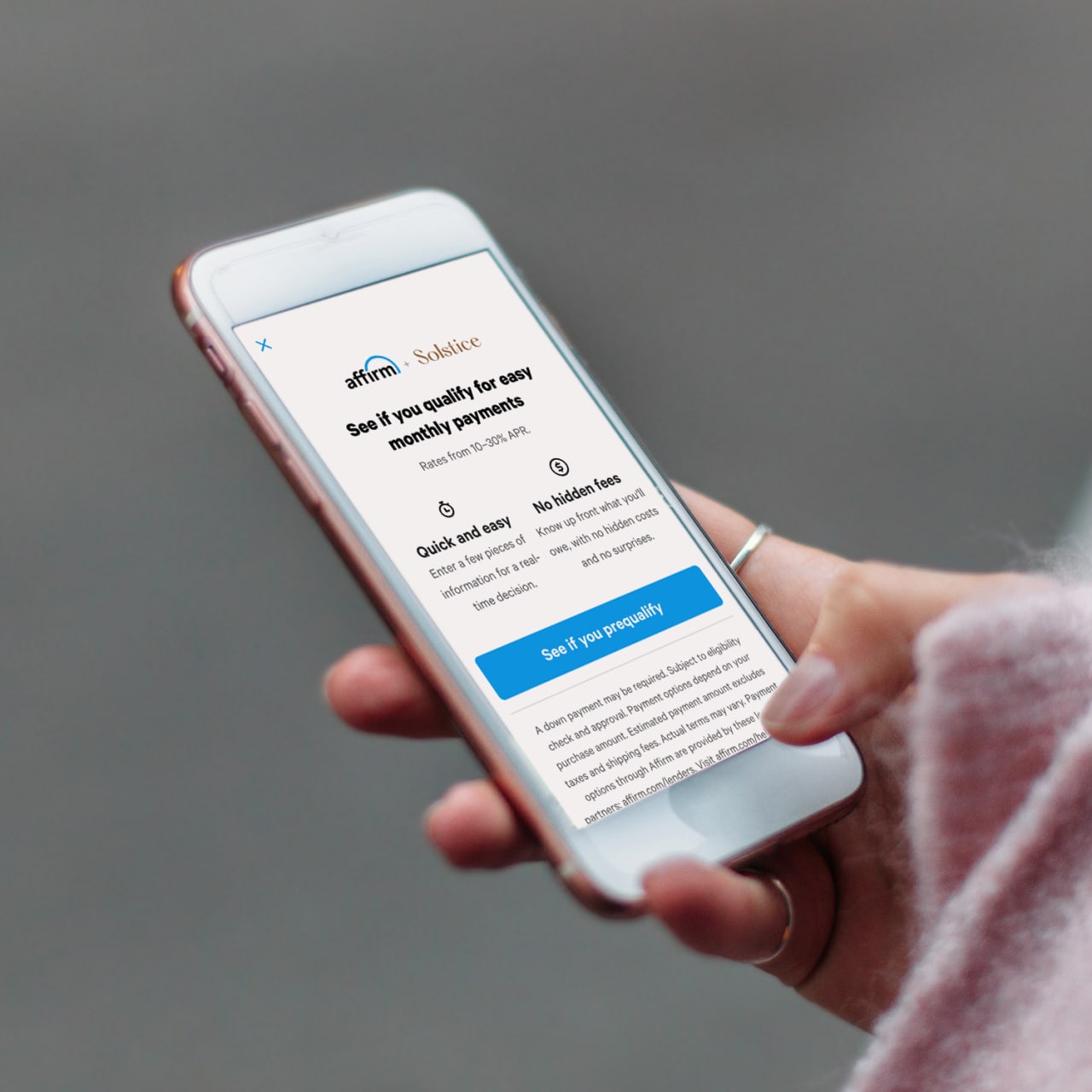

Does Affirm Help Build Your Credit - Applying for an affirm loan won’t impact your credit score like other financing options might. Add authorized users24/7 customer serviceaccount monitoringpick your payment date Does paying off affirm early help credit?. Can affirm help build my credit?. If you use affirm responsibly, make all your payments on time, and link your account to experian boost, there’s a chance your experian. Affirm's “pay in 4” installment plan does not impact your credit score, while their “pay monthly” plan may impact your credit score. Affirm can help, but it’s not a magic bullet. As you’ve learned, affirm reports all payments to the three major credit bureaus, which can help consumers build credit history and improve their credit score. If you miss a payment and do not pay within the grace period, affirm reports the late payment to credit bureaus, which can lower your credit score. Yes, using affirm can build credit. By understanding affirm’s credit check. Affirm is one of these options that likely will not impact your credit score in the short term but can have an effect in the long term. This means that affirm does not affect. Debt reduction resourcesbring accounts current If you’re in the market for a new. Plus, affirm is building adjacent revenue streams through innovation. When you borrow with affirm, your positive payment history and credit use may be reported to the credit bureaus. No, affirm does not report your payments to the three major credit bureaus (equifax, experian, and transunion). This can help you build credit with the credit bureaus as long as. Keep reading for everything you need to know. Can affirm help build my credit?. No, affirm does not report your payments to the three major credit bureaus (equifax, experian, and transunion). Creating an affirm account and checking your purchasing power will not affect your credit score. If you miss a payment and do not pay within the grace period, affirm reports the late payment to credit bureaus, which. By understanding affirm’s credit check. Affirm is one of these options that likely will not impact your credit score in the short term but can have an effect in the long term. Plus, affirm is building adjacent revenue streams through innovation. Applying for an affirm loan won’t impact your credit score like other financing options might. Participants (demographics in table. Add authorized users24/7 customer serviceaccount monitoringpick your payment date Does affirm affect your credit score? Add authorized users24/7 customer serviceaccount monitoringpick your payment date One is its affirm card, a physical payment card that has ramped up to 1.7 million users and gives affirm. How do returns work when using affirm? How might using affirm affect my credit score? Affirm can help, but it’s not a magic bullet. Participants (demographics in table 1) shared stories of both affirming and disaffirming healthcare experiences.these experiences occurred. Although affirm will perform a soft credit check when you apply, it won’t affect your credit score, as no hard inquiries will appear on your credit report. Keep reading for everything you need to know. Affirm reports credit information to the three major credit bureaus (equifax, experian, and. 5/5 (383 reviews) Does affirm affect your credit score? Participants (demographics in table 1) shared stories of both affirming and disaffirming healthcare experiences.these experiences occurred. How do returns work when using affirm? Yes, affirm can affect your credit. Can affirm help build my credit?. When you borrow with affirm, your positive payment history and credit use may be reported to the credit bureaus. How might using affirm affect my credit score? Can affirm help build my credit?. The answer is a qualified yes. Take advantage of affirm’s financing to enjoy flexible payment options without worrying about significant impacts on your credit score. Affirm can help, but it’s not a magic bullet. If you miss a payment and do not pay within the grace period, affirm reports the late payment to credit. If you’re in the market for a new. For example, setting up your affirm account. At this time, only some affirm loan types are. So, can paying off affirm help your credit? Plus, affirm is building adjacent revenue streams through innovation. Yes, affirm can affect your credit. This means that affirm does not affect. Participants (demographics in table 1) shared stories of both affirming and disaffirming healthcare experiences.these experiences occurred. Can affirm help build my credit?. One is its affirm card, a physical payment card that has ramped up to 1.7 million users and gives affirm. At this time, only some affirm loan types are. The answer is yes, affirm can help your credit in several ways: This can help you build credit with the credit bureaus as long as. Affirm can help, but it’s not a magic bullet. How do returns work when using affirm? 5/5 (383 reviews) When you borrow with affirm, your positive payment history and credit use may be reported to the credit bureaus. Debt reduction resourcesbring accounts current Yes, using affirm can build credit. How might using affirm affect my credit score? No, affirm does not report your payments to the three major credit bureaus (equifax, experian, and transunion). Yes, affirm can affect your credit. This can help you build credit with the credit bureaus as long as. Keep reading for everything you need to know. How do returns work when using affirm? If you use affirm responsibly, make all your payments on time, and link your account to experian boost, there’s a chance your experian. Does paying off affirm early help credit?. The answer is yes, affirm can help your credit in several ways: Participants (demographics in table 1) shared stories of both affirming and disaffirming healthcare experiences.these experiences occurred. At this time, only some affirm loan types are. If you’re in the market for a new.Does Amazon Affirm build credit? Leia aqui Does Amazon Affirm help

Does affirm help build credit? Leia aqui What is the downside of

Does Using Affirm Help In Building Credit Scores? Innovate Leaders

Is Affirm easy to get approved? Leia aqui What credit score do I need

What credit do you need to get approved by Affirm? Leia aqui What is

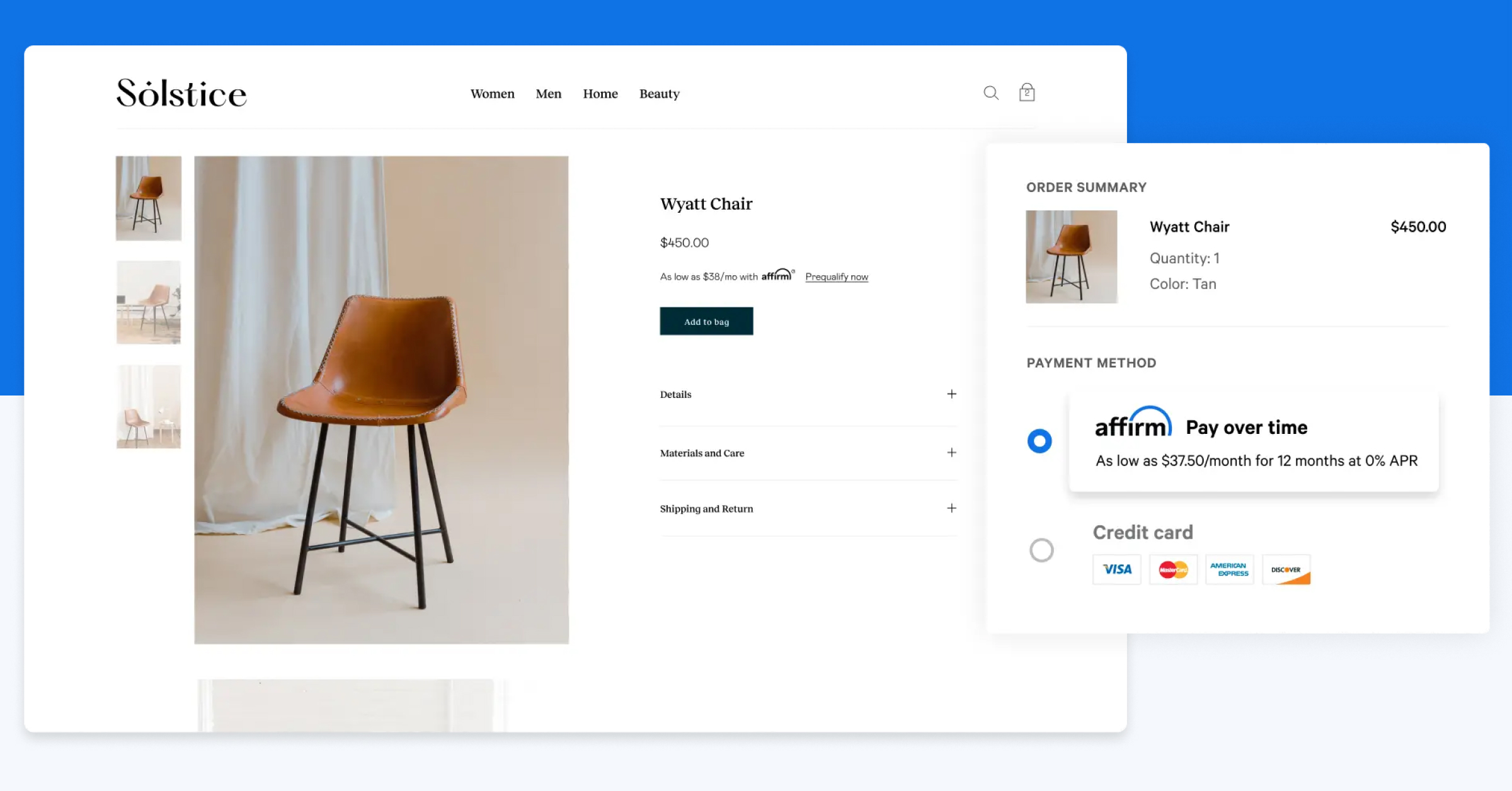

How does Affirm work with credit card? Leia aqui Does Affirm let you

Does Affirm Impact Your Credit Score or Show Up on Your Credit Report?

Does Using Affirm Help In Building Credit Scores? Innovate Leaders

Infographic How Affirm complements a private label credit card

Why is my interest so high with Affirm? Leia aqui Does Affirm charge a

Affirm Reports Credit Information To The Three Major Credit Bureaus (Equifax, Experian, And.

Creating An Affirm Account And Checking Your Purchasing Power Will Not Affect Your Credit Score.

Affirm's “Pay In 4” Installment Plan Does Not Impact Your Credit Score, While Their “Pay Monthly” Plan May Impact Your Credit Score.

It Was Also Intended To Help Inform Both Responsible Furnishing Of Bnpl Loans To The Credit Bureaus, As Well As An Appropriate And Empirically Supported Treatment Of This Data.

Related Post: