Does Afterpay Build Credit

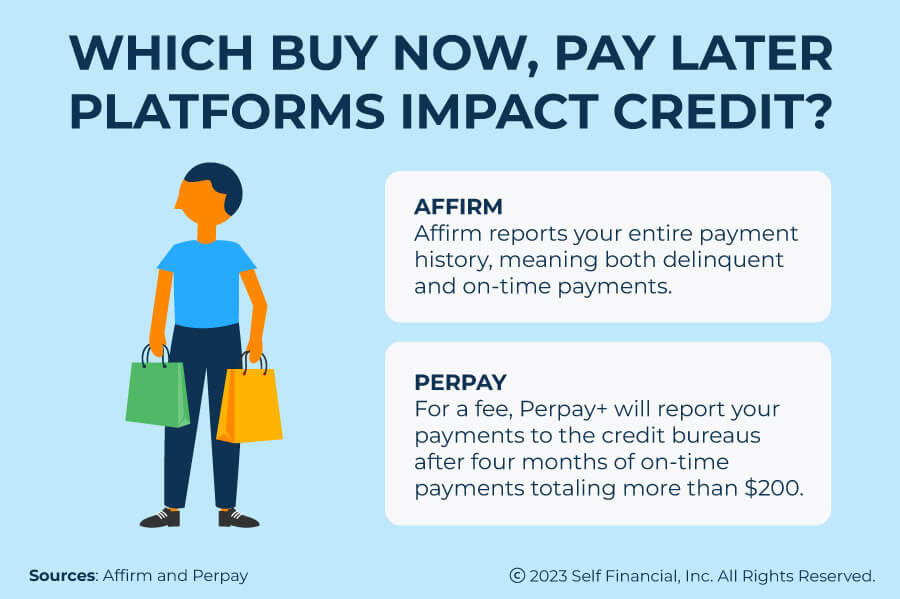

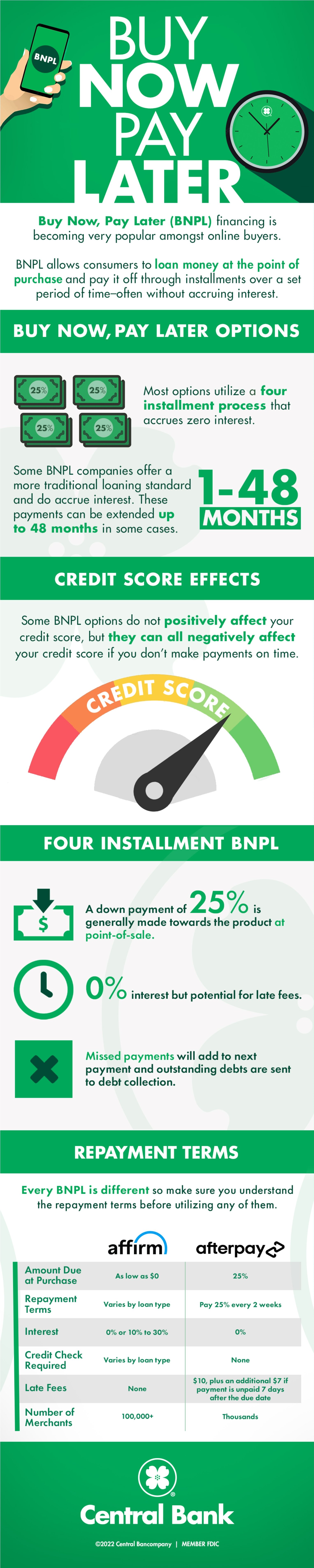

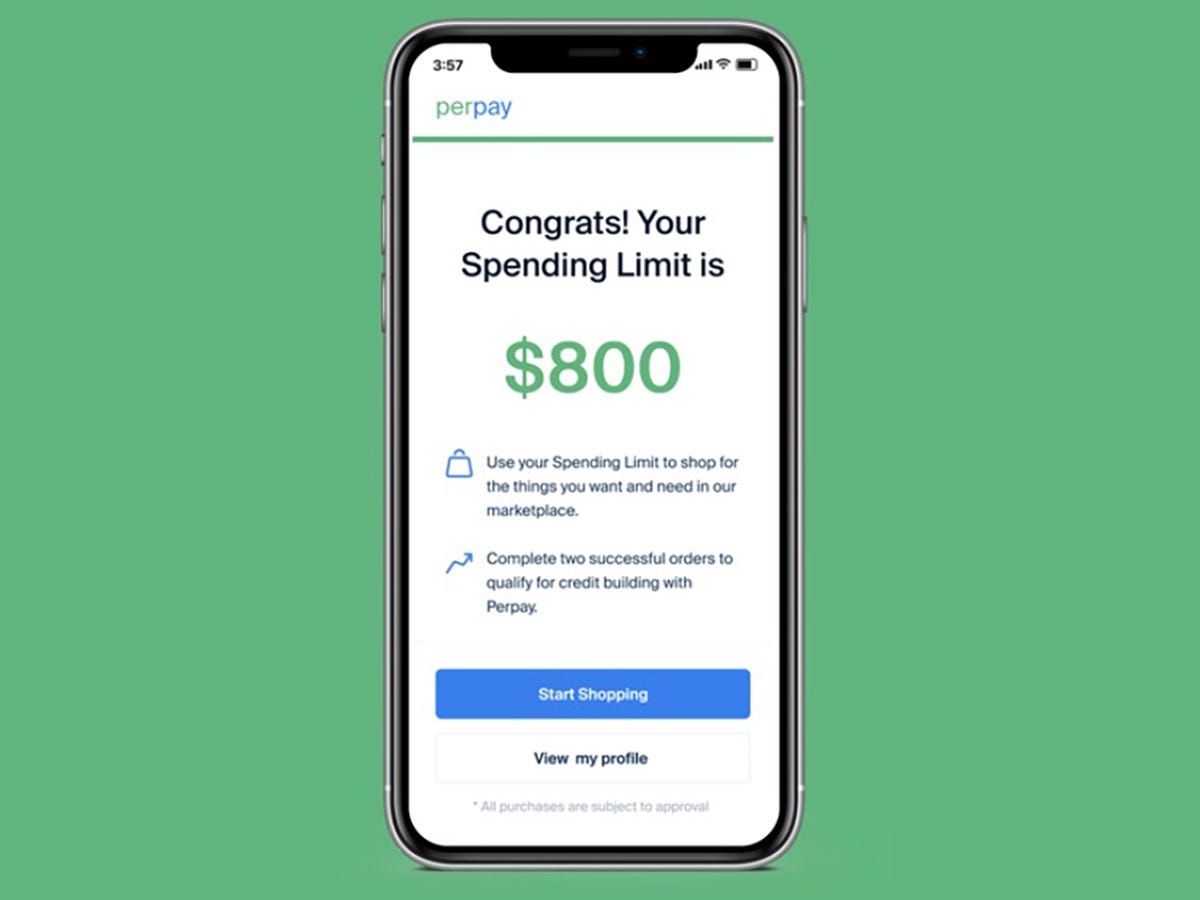

Does Afterpay Build Credit - In some cases, where you miss payments, you may indirectly negatively affect your credit score. Unlike other forms of credit, afterpay doesn’t report to the credit bureaus. While afterpay doesn't directly affect credit scores, its usage can indirectly influence credit utilization. Afterpay does not run credit checks or disclose late payments, two factors that might have a negative effect on a. Credit cards are convenient and secure, they help build credit, they make budgeting easier, and they earn rewards. Learn how afterpay works, what retailers accept it, and. Afterpay indeed performs a soft credit check, but it does not affect credit scores. This is due to the fact that they don’t perform a hard credit check when going through. It does not run a credit check or report to credit bureaus, but it. In a nutshell, afterpay does not build credit. As of february 2024, using afterpay doesn’t have any impact on your credit score. And no, you don't have to go into debt, and you don't have to. While afterpay doesn't directly affect credit scores, its usage can indirectly influence credit utilization. Afterpay is a service that lets you shop online or in stores and pay in installments over six weeks with no interest or fees. While it offers a convenient way to make purchases and manage payments, afterpay doesn’t report payment. Afterpay is a buy now, pay later service that lets you pay for goods in four installments every two weeks. Afterpay does not run credit checks or disclose late payments, two factors that might have a negative effect on a. Afterpay indeed performs a soft credit check, but it does not affect credit scores. Using afterpay won’t have any effect on your credit rating. Unlike other forms of credit, afterpay doesn’t report to the credit bureaus. When signing up for an. Afterpay indeed performs a soft credit check, but it does not affect credit scores. In a nutshell, afterpay does not build credit. As of february 2024, using afterpay doesn’t have any impact on your credit score. While afterpay doesn't directly affect credit scores, its usage can indirectly influence credit utilization. When signing up for an. Using afterpay won’t have any effect on your credit rating. It does not run a credit check or report to credit bureaus, but it. Leveraging tools like coolcredit can help individuals navigate bnpl. Afterpay is a service that lets you shop online or in stores and pay in installments over six weeks with no interest. Fortunately, the answer is no, at least not in the traditional sense. Afterpay is a buy now, pay later service that lets you pay for goods in four installments every two weeks. Learn how afterpay works, its. Leveraging tools like coolcredit can help individuals navigate bnpl. This is due to the fact that they don’t perform a hard credit check. Afterpay is a service that lets you shop online or in stores and pay in installments over six weeks with no interest or fees. Using afterpay won’t have any effect on your credit rating. Afterpay is a buy now, pay later service that lets you pay for goods in four installments every two weeks. This is due to the fact. The short answer is no, afterpay itself does not build your credit. Leveraging tools like coolcredit can help individuals navigate bnpl. This is due to the fact that they don’t perform a hard credit check when going through. Afterpay and the credit bureaus. Credit cards are convenient and secure, they help build credit, they make budgeting easier, and they earn. Unlike other forms of credit, afterpay doesn’t report to the credit bureaus. While it offers a convenient way to make purchases and manage payments, afterpay doesn’t report payment. This is due to the fact that they don’t perform a hard credit check when going through. When signing up for an. Afterpay indeed performs a soft credit check, but it does. This means your credit score will likely not be affected, and no minimum credit score requirement exists. While it offers a convenient way to make purchases and manage payments, afterpay doesn’t report payment. Afterpay does not run credit checks or disclose late payments, two factors that might have a negative effect on a. Afterpay is a service that lets you. Leveraging tools like coolcredit can help individuals navigate bnpl. As of february 2024, using afterpay doesn’t have any impact on your credit score. In a nutshell, afterpay does not build credit. Fortunately, the answer is no, at least not in the traditional sense. When signing up for an. Unlike other forms of credit, afterpay doesn’t report to the credit bureaus. Afterpay is a service that lets you shop online or in stores and pay in installments over six weeks with no interest or fees. Leveraging tools like coolcredit can help individuals navigate bnpl. Credit cards are convenient and secure, they help build credit, they make budgeting easier, and. Afterpay is a buy now, pay later service that lets you pay for goods in four installments every two weeks. The short answer is no, afterpay itself does not build your credit. Using afterpay won’t have any effect on your credit rating. Afterpay and the credit bureaus. Afterpay indeed performs a soft credit check, but it does not affect credit. This is due to the fact that they don’t perform a hard credit check when going through. Fortunately, the answer is no, at least not in the traditional sense. In some cases, where you miss payments, you may indirectly negatively affect your credit score. Using afterpay won’t have any effect on your credit rating. In a nutshell, afterpay does not build credit. Unlike other forms of credit, afterpay doesn’t report to the credit bureaus. And no, you don't have to go into debt, and you don't have to. This means your credit score will likely not be affected, and no minimum credit score requirement exists. Leveraging tools like coolcredit can help individuals navigate bnpl. It does not run a credit check or report to credit bureaus, but it. While afterpay doesn't directly affect credit scores, its usage can indirectly influence credit utilization. Afterpay and the credit bureaus. When signing up for an. Learn how afterpay works, what retailers accept it, and. Afterpay indeed performs a soft credit check, but it does not affect credit scores. Afterpay is a buy now, pay later service that lets you pay for goods in four installments every two weeks.Does Afterpay Build Credit? Understanding Buy Now, Pay Later Self

Does Afterpay hurt your credit score? Leia aqui Is Afterpay bad for

Can I build credit with Afterpay? Leia aqui Can Afterpay contribute to

Do Afterpay build your credit? Leia aqui How much credit does Afterpay

Does Afterpay build credit? YouTube

How does Afterpay work? USA Help Center

Do Afterpay build your credit? Leia aqui How much credit does Afterpay

Do Afterpay build your credit? Leia aqui How much credit does Afterpay

What is the highest Afterpay level? Leia aqui Can you get more than

How does the Afterpay credit work? Leia aqui How does Afterpay credit

Credit Cards Are Convenient And Secure, They Help Build Credit, They Make Budgeting Easier, And They Earn Rewards.

While It Offers A Convenient Way To Make Purchases And Manage Payments, Afterpay Doesn’t Report Payment.

Learn How Afterpay Works, Its.

The Short Answer Is No, Afterpay Itself Does Not Build Your Credit.

Related Post: