Does Afterpay Build Your Credit

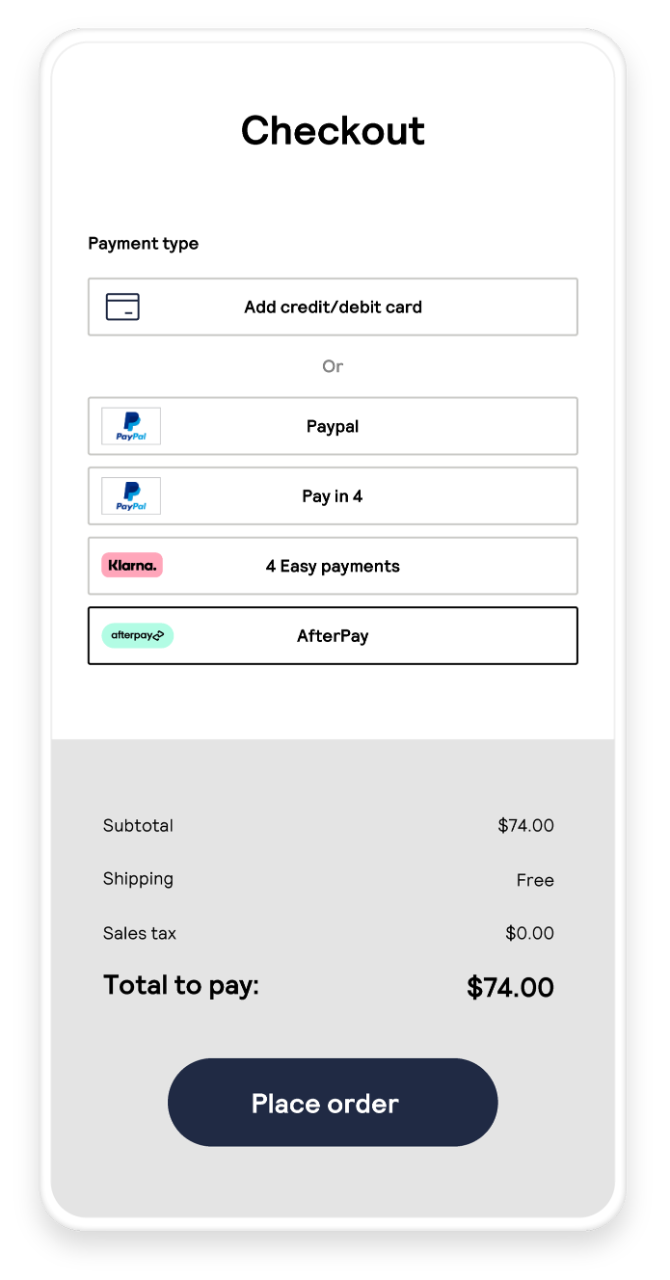

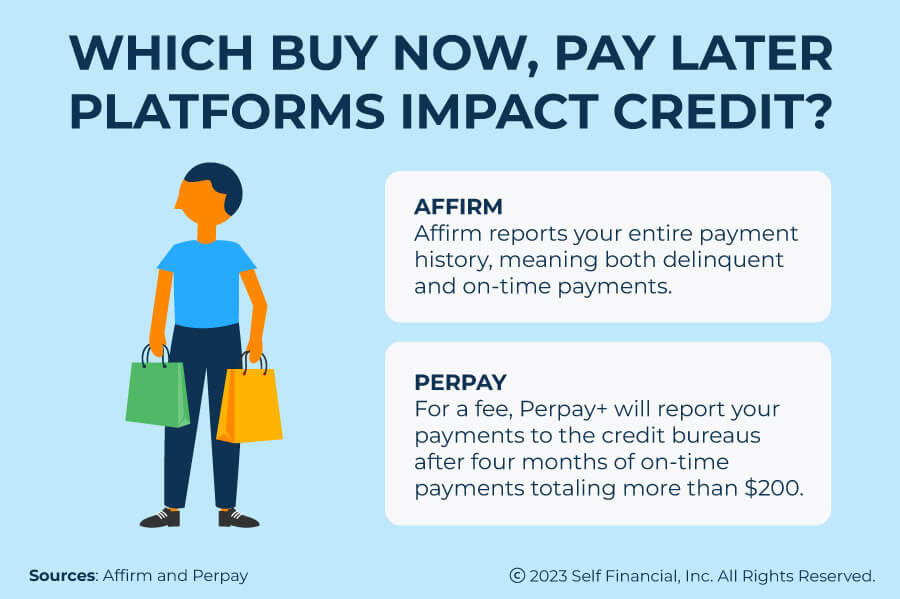

Does Afterpay Build Your Credit - Afterpay indeed performs a soft credit check, but it does not affect credit scores. Afterpay and the credit bureaus. Afterpay doesn’t affect your credit since it doesn’t conduct hard credit pulls or report your payment history to the credit bureaus. Bnpl borrowers were also more likely than other consumers to have higher balances on other unsecured credit lines such as credit cards. When signing up for an. In some cases, where you miss payments, you may indirectly negatively affect your credit score. You’ll also need to make a free account. As of february 2024, using afterpay doesn’t have any impact on your credit score. Unlike other forms of credit, afterpay doesn’t report to the credit bureaus. In a nutshell, afterpay does not build credit. Bnpl borrowers were also more likely than other consumers to have higher balances on other unsecured credit lines such as credit cards. Unlike other forms of credit, afterpay doesn’t report to the credit bureaus. In some cases, where you miss payments, you may indirectly negatively affect your credit score. “at afterpay, we never do credit checks or report late payments,”. When signing up for an. You’ll also need to make a free account. Browse featuresno upfront deposittools that build credit This is due to the fact that they don’t perform a hard credit check when going through. Afterpay does not perform traditional credit checks when approving users. Unlike other credit providers like personal loan and payday loan companies, afterpay doesn’t conduct any. Afterpay doesn’t affect your credit since it doesn’t conduct hard credit pulls or report your payment history to the credit bureaus. Bnpl borrowers were also more likely than other consumers to have higher balances on other unsecured credit lines such as credit cards. In some cases, where you miss payments, you may indirectly negatively affect your credit score. Browse featuresno. In most circumstances, you’ll divide the total cost of the. To use afterpay, your order needs to be more than $35, plus you have to be over 18 and have a debit card or credit card to qualify. Afterpay and the credit bureaus. Afterpay doesn’t affect your credit since it doesn’t conduct hard credit pulls or report your payment history. Bnpl borrowers were also more likely than other consumers to have higher balances on other unsecured credit lines such as credit cards. While afterpay doesn't directly affect credit scores, its usage can indirectly influence credit utilization. Afterpay does not perform traditional credit checks when approving users. Browse featuresno upfront deposittools that build credit In some cases, where you miss payments,. Bnpl borrowers were also more likely than other consumers to have higher balances on other unsecured credit lines such as credit cards. You’ll also need to make a free account. “at afterpay, we never do credit checks or report late payments,”. You can choose afterpay as your payment method, instantly create an afterpay account and make your first payment. Browse. You’ll also need to make a free account. Fortunately, the answer is no, at least not in the traditional sense. While afterpay has the right to check your credit, they typically do not. This means your credit score will likely not be affected, and no minimum credit score requirement exists. This is due to the fact that they don’t perform. Unlike other forms of credit, afterpay doesn’t report to the credit bureaus. The short answer is no, afterpay itself does not build your credit. To use afterpay, your order needs to be more than $35, plus you have to be over 18 and have a debit card or credit card to qualify. You’ll also need to make a free account.. Afterpay does not perform traditional credit checks when approving users. Afterpay indeed performs a soft credit check, but it does not affect credit scores. While afterpay has the right to check your credit, they typically do not. The short answer is no, afterpay itself does not build your credit. To use afterpay, your order needs to be more than $35,. This is due to the fact that they don’t perform a hard credit check when going through. The short answer is no, afterpay itself does not build your credit. While it offers a convenient way to make purchases and manage payments, afterpay doesn’t report payment activity to major credit bureaus like experian, equifax, or transunion. Bnpl borrowers were also more. Afterpay indeed performs a soft credit check, but it does not affect credit scores. This means your credit score will likely not be affected, and no minimum credit score requirement exists. While afterpay has the right to check your credit, they typically do not. In its support website, afterpay clarifies that the service does not affect customers’ credit score or. Afterpay and the credit bureaus. Bnpl borrowers were also more likely than other consumers to have higher balances on other unsecured credit lines such as credit cards. While afterpay has the right to check your credit, they typically do not. You can choose afterpay as your payment method, instantly create an afterpay account and make your first payment. You’ll also. While it offers a convenient way to make purchases and manage payments, afterpay doesn’t report payment activity to major credit bureaus like experian, equifax, or transunion. This is due to the fact that they don’t perform a hard credit check when going through. Afterpay indeed performs a soft credit check, but it does not affect credit scores. In a nutshell, afterpay does not build credit. Fortunately, the answer is no, at least not in the traditional sense. To use afterpay, your order needs to be more than $35, plus you have to be over 18 and have a debit card or credit card to qualify. Afterpay and the credit bureaus. The short answer is no, afterpay itself does not build your credit. The perpay credit card, issued by celtic bank, is designed to help cardholders who want to build credit, but are seeking an alternative to secured credit cards. Safe.apply for a platinum cardpoor credit. Browse featuresno upfront deposittools that build credit In its support website, afterpay clarifies that the service does not affect customers’ credit score or credit rating. When signing up for an. “at afterpay, we never do credit checks or report late payments,”. While afterpay has the right to check your credit, they typically do not. While afterpay doesn't directly affect credit scores, its usage can indirectly influence credit utilization.How does Afterpay work? USA Help Center

Do Afterpay build your credit? Leia aqui How much credit does Afterpay

Do Afterpay build your credit? Leia aqui How much credit does Afterpay

Does Afterpay Help Your Credit?

Do Afterpay build your credit? Leia aqui How much credit does Afterpay

How does the Afterpay credit work? Leia aqui How does Afterpay credit

Afterpay Cybersource

Does Afterpay build credit? YouTube

Do Afterpay boost your credit? Leia aqui Does Afterpay give you credit

Does Afterpay Build Credit? Understanding Buy Now, Pay Later Self

Afterpay Does Not Perform Traditional Credit Checks When Approving Users.

Afterpay Doesn’t Affect Your Credit Since It Doesn’t Conduct Hard Credit Pulls Or Report Your Payment History To The Credit Bureaus.

You Can Choose Afterpay As Your Payment Method, Instantly Create An Afterpay Account And Make Your First Payment.

Unlike Other Credit Providers Like Personal Loan And Payday Loan Companies, Afterpay Doesn’t Conduct Any.

Related Post: