Does Afterpay Help Build Credit

Does Afterpay Help Build Credit - Afterpay and the credit bureaus. The short answer is no, afterpay itself does not build your credit. While not reporting your payment history to a credit bureau can be to your advantage if you miss a payment or two, it won’t help you build your credit if you're good about. And no, you don't have to go into debt, and you don't have to. Bnpl borrowers were also more likely than other consumers to have higher balances on other unsecured credit lines such as credit cards. “at afterpay, we never do credit checks or report late payments,”. While afterpay doesn’t directly build credit, as it performs soft checks and doesn’t report to major bureaus, using it responsibly can indirectly benefit your score by reducing hard. #1 rank & trustedcredit repairlimited offer: A soft credit check allows a lender to see your credit history without impacting your credit score. Unlike other forms of credit, afterpay doesn’t report to the credit bureaus. While it offers a convenient way to make purchases and manage payments, afterpay doesn’t report payment. This is due to the fact that they don’t perform a hard credit check when going through. Unlike other forms of credit, afterpay doesn’t report to the credit bureaus. Afterpay is a service that lets you shop online or in stores and pay in installments over six weeks with no interest or fees. “at afterpay, we never do credit checks or report late payments,”. Afterpay and the credit bureaus. The short answer is no, afterpay itself does not build your credit. While afterpay doesn’t directly build credit, as it performs soft checks and doesn’t report to major bureaus, using it responsibly can indirectly benefit your score by reducing hard. While not reporting your payment history to a credit bureau can be to your advantage if you miss a payment or two, it won’t help you build your credit if you're good about. And no, you don't have to go into debt, and you don't have to. “at afterpay, we never do credit checks or report late payments,”. A soft credit check allows a lender to see your credit history without impacting your credit score. Unlike other forms of credit, afterpay doesn’t report to the credit bureaus. Afterpay may conduct a soft credit check when you sign up for the platform. While it offers a convenient way. In its support website, afterpay clarifies that the service does not affect customers’ credit score or credit rating. Pauses account after missed payment. What bnpl plans does afterpay offer?. While not reporting your payment history to a credit bureau can be to your advantage if you miss a payment or two, it won’t help you build your credit if you're. Compare top 10 brandsreviewed by 1,000sconsumervoice.org pickstrusted reviews This is due to the fact that they don’t perform a hard credit check when going through. Afterpay does not regularly report your payments to the credit bureaus, which means using this service will not help you build credit. Afterpay may conduct a soft credit check when you sign up for the. A soft credit check allows a lender to see your credit history without impacting your credit score. Afterpay may conduct a soft credit check when you sign up for the platform. Credit cards are convenient and secure, they help build credit, they make budgeting easier, and they earn rewards. Afterpay and the credit bureaus. While not reporting your payment history. Afterpay may conduct a soft credit check when you sign up for the platform. Afterpay and the credit bureaus. Pauses account after missed payment. The short answer is no, afterpay itself does not build your credit. And no, you don't have to go into debt, and you don't have to. Offers payment plan with zero interest. Afterpay does not regularly report your payments to the credit bureaus, which means using this service will not help you build credit. #1 rank & trustedcredit repairlimited offer: The company doesn’t pull your credit to approve you for payments either. And no, you don't have to go into debt, and you don't have to. Unlike other forms of credit, afterpay doesn’t report to the credit bureaus. A soft credit check allows a lender to see your credit history without impacting your credit score. While afterpay doesn’t directly build credit, as it performs soft checks and doesn’t report to major bureaus, using it responsibly can indirectly benefit your score by reducing hard. Afterpay does not. Unlike other forms of credit, afterpay doesn’t report to the credit bureaus. “at afterpay, we never do credit checks or report late payments,”. The company doesn’t pull your credit to approve you for payments either. Afterpay does not regularly report your payments to the credit bureaus, which means using this service will not help you build credit. While afterpay doesn't. While it offers a convenient way to make purchases and manage payments, afterpay doesn’t report payment. Afterpay may conduct a soft credit check when you sign up for the platform. Bnpl borrowers were also more likely than other consumers to have higher balances on other unsecured credit lines such as credit cards. And no, you don't have to go into. Afterpay is a service that lets you shop online or in stores and pay in installments over six weeks with no interest or fees. #1 rank & trustedcredit repairlimited offer: “at afterpay, we never do credit checks or report late payments,”. The company doesn’t pull your credit to approve you for payments either. A soft credit check allows a lender. While it offers a convenient way to make purchases and manage payments, afterpay doesn’t report payment. The short answer is no, afterpay itself does not build your credit. Afterpay does not regularly report your payments to the credit bureaus, which means using this service will not help you build credit. And no, you don't have to go into debt, and you don't have to. What bnpl plans does afterpay offer?. Given that afterpay does not report positive payment activity to credit bureaus, it does not directly contribute to building credit. A soft credit check allows a lender to see your credit history without impacting your credit score. This is due to the fact that they don’t perform a hard credit check when going through. While afterpay doesn't directly affect credit scores, its usage can indirectly influence credit utilization. Afterpay is a service that lets you shop online or in stores and pay in installments over six weeks with no interest or fees. Credit cards are convenient and secure, they help build credit, they make budgeting easier, and they earn rewards. Compare top 10 brandsreviewed by 1,000sconsumervoice.org pickstrusted reviews Bnpl borrowers were also more likely than other consumers to have higher balances on other unsecured credit lines such as credit cards. Afterpay may conduct a soft credit check when you sign up for the platform. “at afterpay, we never do credit checks or report late payments,”. Afterpay and the credit bureaus.What Is Afterpay How Does Afterpay Work

Do Afterpay boost your credit? Leia aqui Does Afterpay give you credit

Do Afterpay build your credit? Leia aqui How much credit does Afterpay

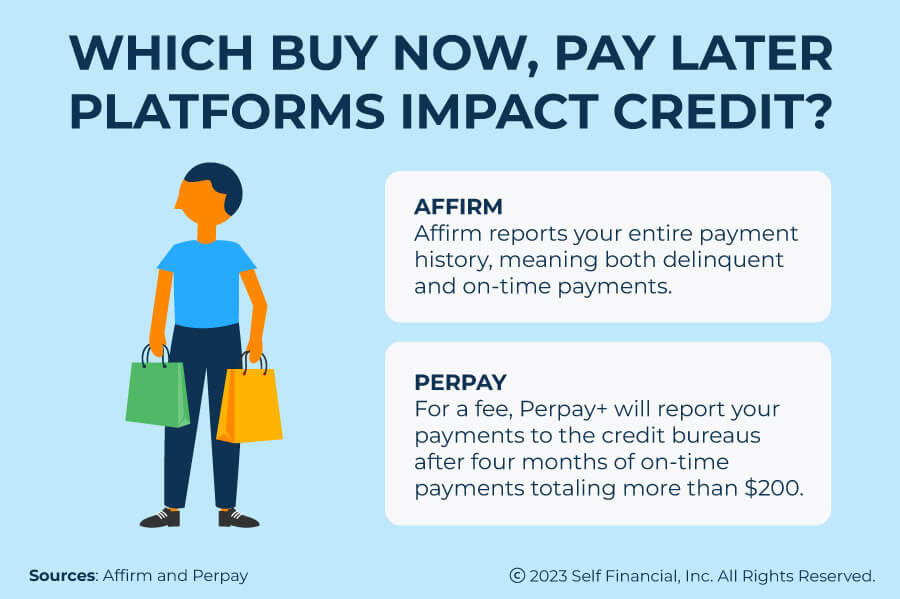

Does Afterpay Build Credit? Understanding Buy Now, Pay Later Self

How does Afterpay work? USA Help Center

Can I build credit with Afterpay? Leia aqui Can Afterpay contribute to

Do Afterpay build your credit? Leia aqui How much credit does Afterpay

How does the Afterpay credit work? Leia aqui How does Afterpay credit

What Credit Bureau Does Afterpay Use? Unveiling Its Credit Reporting

Does Afterpay Help Your Credit?

While Afterpay Doesn’t Directly Build Credit, As It Performs Soft Checks And Doesn’t Report To Major Bureaus, Using It Responsibly Can Indirectly Benefit Your Score By Reducing Hard.

Learn How Afterpay Works, What Retailers Accept It, And.

Unlike Other Forms Of Credit, Afterpay Doesn’t Report To The Credit Bureaus.

Pauses Account After Missed Payment.

Related Post: