Does Afterpay Help Build Your Credit

Does Afterpay Help Build Your Credit - Afterpay does not check credit scores, meaning individuals with bad credit can still utilize the service without any hurdles. And no, you don't have to go into debt, and you don't have to. The company doesn’t pull your credit to approve you for payments either. We don’t believe that missing an installment. With afterpay, payment history isn’t reported, so you can’t build credit. Using afterpay won’t have any effect on your credit rating. Buy now, pay later (bnpl) options allow consumers to split purchases into manageable installments, often without interest. The company does not have a minimum purchase requirement, but certain retailers. Afterpay does not affect your credit score. Afterpay does not perform traditional credit checks when approving users. Afterpay does not perform traditional credit checks when approving users. As of february 2024, using afterpay doesn’t have any impact on your credit score. Buy now, pay later (bnpl) options allow consumers to split purchases into manageable installments, often without interest. Unpaid loans may go to collections,. While not reporting your payment history to a credit bureau can be to your advantage if you miss a payment or two, it won’t help you build your credit if you're good about. The company does not have a minimum purchase requirement, but certain retailers. Afterpay does not affect your credit score. We don’t believe that missing an installment. And no, you don't have to go into debt, and you don't have to. Afterpay does not run credit checks or disclose late payments, two factors that might have a negative effect on a. Afterpay does not check credit scores, meaning individuals with bad credit can still utilize the service without any hurdles. Unpaid loans may go to collections,. Buy now, pay later (bnpl) options allow consumers to split purchases into manageable installments, often without interest. The account even comes with a card to help you build credit with everyday purchases and earn points. Bnpl borrowers were also more likely than other consumers to have higher balances on other unsecured credit lines such as credit cards. That said, though, it also means that they won’t report your monthly. The short answer is no, afterpay itself does not build your credit. We don’t believe that missing an installment. And no, you don't have to go. Bnpl borrowers were also more likely than other consumers to have higher balances on other unsecured credit lines such as credit cards. With afterpay, payment history isn’t reported, so you can’t build credit. Afterpay does not perform traditional credit checks when approving users. Afterpay does not affect your credit score. We don’t believe that missing an installment. As of february 2024, using afterpay doesn’t have any impact on your credit score. We don’t do credit checks or report late payments, so there is no impact on your credit score or rating. Building credit is important because the better your credit score, the more likely you can qualify for other. Afterpay does not perform traditional credit checks when. While this doesn’t provide as much information, it’s enough to let afterpay know if you meet their requirements or not. Buy now, pay later (bnpl) options allow consumers to split purchases into manageable installments, often without interest. While not reporting your payment history to a credit bureau can be to your advantage if you miss a payment or two, it. Afterpay does not check credit scores, meaning individuals with bad credit can still utilize the service without any hurdles. The account even comes with a card to help you build credit with everyday purchases and earn points on swipes for cash back. While this doesn’t provide as much information, it’s enough to let afterpay know if you meet their requirements. We don’t do credit checks or report late payments, so there is no impact on your credit score or rating. While afterpay doesn’t directly build credit, as it performs soft checks and doesn’t report to major bureaus, using it responsibly can indirectly benefit your score by reducing hard. Afterpay does not regularly report your payments to the credit bureaus, which. While not reporting your payment history to a credit bureau can be to your advantage if you miss a payment or two, it won’t help you build your credit if you're good about. Unpaid loans may go to collections,. The account even comes with a card to help you build credit with everyday purchases and earn points on swipes for. The account even comes with a card to help you build credit with everyday purchases and earn points on swipes for cash back. The company does not have a minimum purchase requirement, but certain retailers. While afterpay doesn’t directly build credit, as it performs soft checks and doesn’t report to major bureaus, using it responsibly can indirectly benefit your score. Buy now, pay later (bnpl) options allow consumers to split purchases into manageable installments, often without interest. What bnpl plans does afterpay offer?. And no, you don't have to go into debt, and you don't have to. Afterpay does not affect your credit score. That said, though, it also means that they won’t report your monthly. While not reporting your payment history to a credit bureau can be to your advantage if you miss a payment or two, it won’t help you build your credit if you're good about. Unlike other credit providers like personal loan and payday loan companies, afterpay doesn’t conduct any. Credit cards are convenient and secure, they help build credit, they make budgeting easier, and they earn rewards. Afterpay does not affect your credit score. As of february 2024, using afterpay doesn’t have any impact on your credit score. Using afterpay won’t have any effect on your credit rating. That said, though, it also means that they won’t report your monthly. Building credit is important because the better your credit score, the more likely you can qualify for other. Afterpay does not perform traditional credit checks when approving users. Bnpl borrowers were also more likely than other consumers to have higher balances on other unsecured credit lines such as credit cards. With afterpay, payment history isn’t reported, so you can’t build credit. Buy now, pay later (bnpl) options allow consumers to split purchases into manageable installments, often without interest. The company doesn’t pull your credit to approve you for payments either. Afterpay does not regularly report your payments to the credit bureaus, which means using this service will not help you build credit. The company does not have a minimum purchase requirement, but certain retailers. While this doesn’t provide as much information, it’s enough to let afterpay know if you meet their requirements or not.Can I build credit with Afterpay? Leia aqui Can Afterpay contribute to

Does Afterpay Help Your Credit?

Do Afterpay build your credit? Leia aqui How much credit does Afterpay

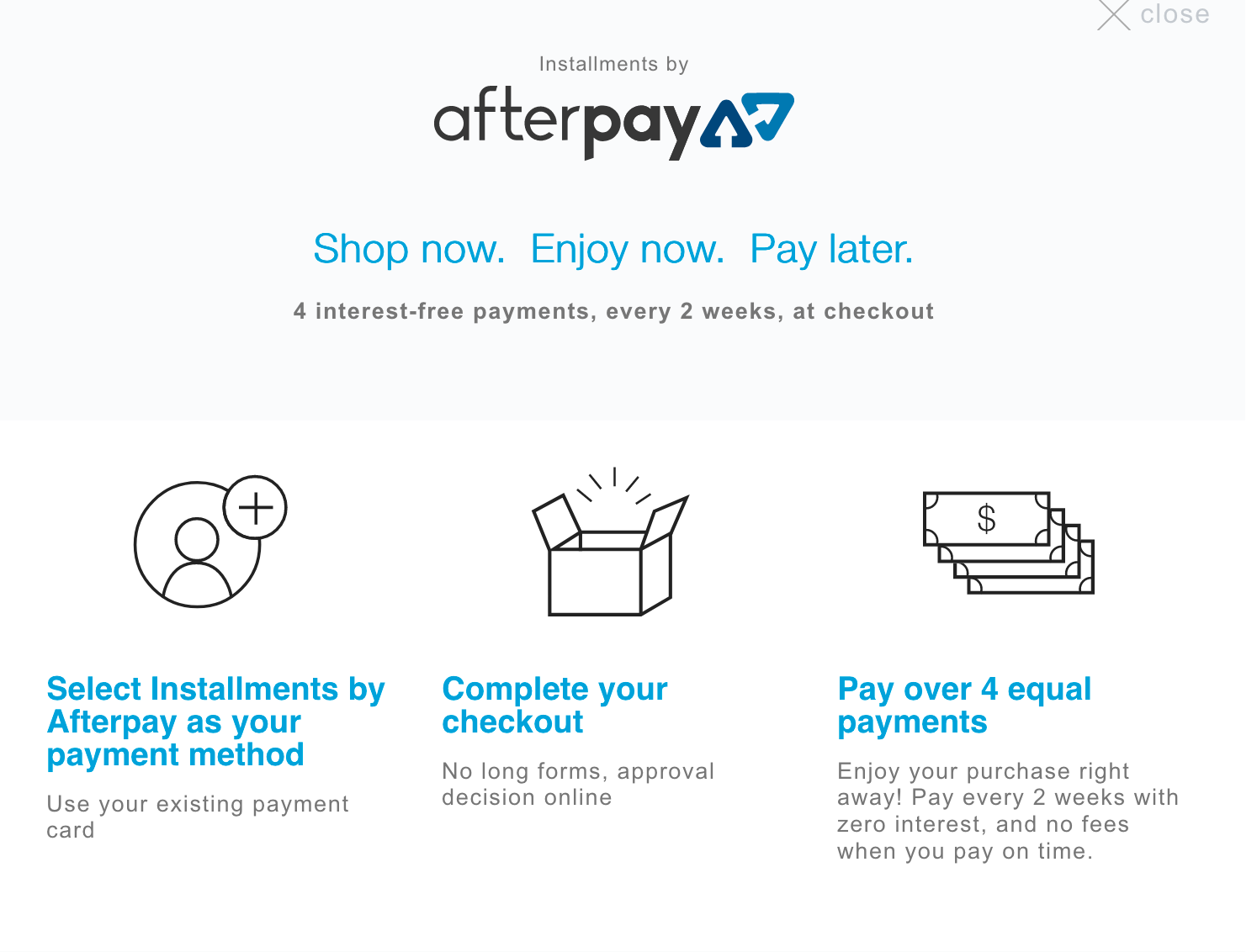

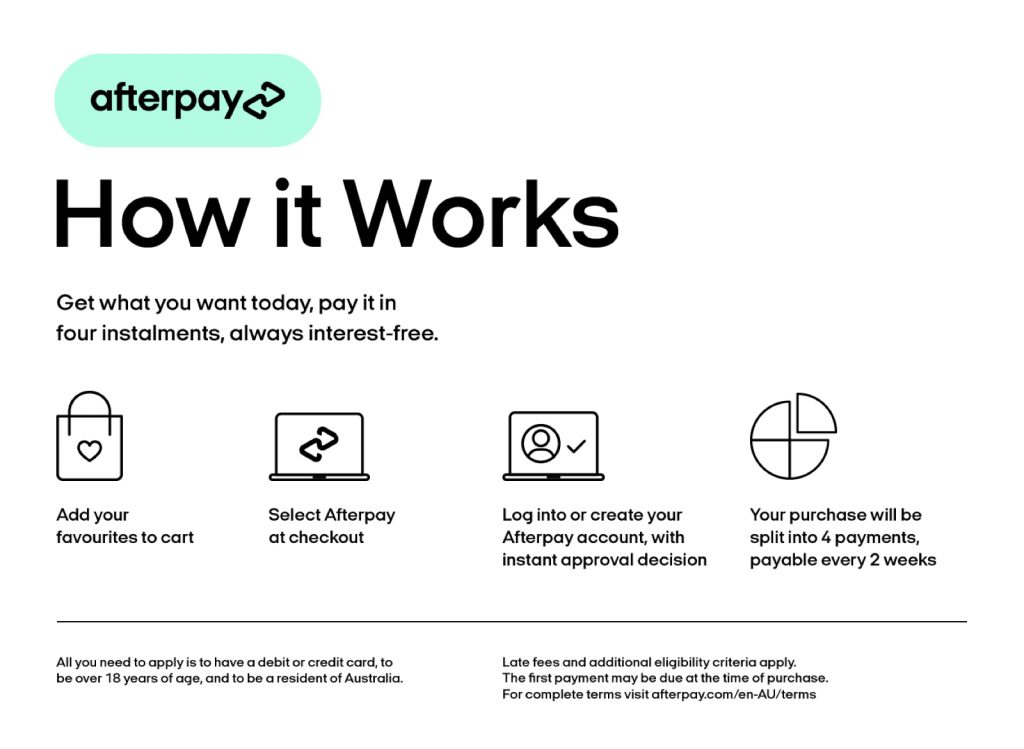

What Is Afterpay How Does Afterpay Work

Does Afterpay build credit? YouTube

Is Afterpay basically a credit card? Leia aqui Is Afterpay considered

How does the Afterpay credit work? Leia aqui How does Afterpay credit

Do Afterpay build your credit? Leia aqui How much credit does Afterpay

How does Afterpay work? USA Help Center

afterpay How it Works

We Don’t Believe That Missing An Installment.

And No, You Don't Have To Go Into Debt, And You Don't Have To.

The Short Answer Is No, Afterpay Itself Does Not Build Your Credit.

The Account Even Comes With A Card To Help You Build Credit With Everyday Purchases And Earn Points On Swipes For Cash Back.

Related Post: