Does Albert Help Build Credit

Does Albert Help Build Credit - Taking control of your debt can reduce financial stress and set you up for lower interest payments, a better credit score, and greater. Albert instant transfers don’t require a credit check, and you’ll never pay a late fee. Albert helps users with countless financial topics, such as setting savings goals, investing strategies, budgeting needs, bill reduction, fraud protection, even getting trusted financial. Scroll down, and tap the “credit score” card. Brigit instant cash — great for building credit history and budgeting; Albert offers instant cash advances up to $250, with no interest or fees, perfect for emergencies or bridging paychecks. With a genius subscription, albert analyzes your income, bills and spending habits, then sets aside small amounts of money to help you save toward all your goals. Managing debt is a critical step toward financial stability. Users receive updates on their credit score status and insights into factors affecting it. Users can get their paycheck up to two days early, and can access fee. With a genius subscription, albert analyzes your income, bills and spending habits, then sets aside small amounts of money to help you save toward all your goals. Get money instantly for a small fee, or within two to three days for no fee. Albert is best for someone living paycheck to paycheck and looking for tools to help them get ahead. The genius assistance feature lets you. Albert instant transfers don’t require a credit check, and you’ll never pay a late fee. Add authorized userspick your payment date24/7 customer serviceaccount monitoring Cash advances through albert are more convoluted than competitors—and really is more of an overdraft protection feature. Missed payment penalties can be higher than those for a. You don’t even have to remember to repay — albert handles that automatically when you get. Users can get their paycheck up to two days early, and can access fee. The albert app can be. Managing debt is a critical step toward financial stability. Follow the steps to set up your credit score. Albert allows users to monitor their credit scores through its integrated credit monitoring feature. Compare top 10 brandsreviewed by 1,000sconsumervoice.org picks Get money instantly for a small fee, or within two to three days for no fee. With a genius subscription, albert analyzes your income, bills and spending habits, then sets aside small amounts of money to help you save toward all your goals. The albert app can be. Users can get their paycheck up to two days early, and can. Get money instantly for a small fee, or within two to three days for no fee. Brigit instant cash — great for building credit history and budgeting; With a genius subscription, albert analyzes your income, bills and spending habits, then sets aside small amounts of money to help you save toward all your goals. Users receive updates on their credit. Albert instant transfers don’t require a credit check, and you’ll never pay a late fee. Missed payment penalties can be higher than those for a. Managing debt is a critical step toward financial stability. Albert offers three financial features that require the paid membership: Personal loans can raise your credit score over time by lowering your credit card utilization rate. Prices range from $19,200 to $33,600, depending on your location, the garage size, height,. Scroll down, and tap the “credit score” card. The account even comes with a card to help you build credit with everyday purchases and earn points on. Albert allows users to monitor their credit scores through its integrated credit monitoring feature. Taking control of your debt. Add authorized userspick your payment date24/7 customer serviceaccount monitoring The genius assistance feature lets you. Prices range from $19,200 to $33,600, depending on your location, the garage size, height,. Compare top 10 brandsreviewed by 1,000sconsumervoice.org picks Users can get their paycheck up to two days early, and can access fee. Genius assistance chat, albert investing and smart money. Users receive updates on their credit score status and insights into factors affecting it. Cash advances through albert are more convoluted than competitors—and really is more of an overdraft protection feature. With a genius subscription, albert analyzes your income, bills and spending habits, then sets aside small amounts of money to help. Albert is best for someone living paycheck to paycheck and looking for tools to help them get ahead. Follow the steps to set up your credit score. Missed payment penalties can be higher than those for a. The account even comes with a card to help you build credit with everyday purchases and earn points on. Albert offers three financial. You don’t even have to remember to repay — albert handles that automatically when you get. Taking control of your debt can reduce financial stress and set you up for lower interest payments, a better credit score, and greater. Follow the steps to set up your credit score. Albert is best for someone living paycheck to paycheck and looking for. You don’t even have to remember to repay — albert handles that automatically when you get. Genius assistance chat, albert investing and smart money. Compare top 10 brandsreviewed by 1,000sconsumervoice.org picks The account even comes with a card to help you build credit with everyday purchases and earn points on. Who’s eligible to use albert? The account even comes with a card to help you build credit with everyday purchases and earn points on. Albert instant transfers don’t require a credit check, and you’ll never pay a late fee. Albert allows users to monitor their credit scores through its integrated credit monitoring feature. Its instant feature lets you overdraft your albert. Who’s eligible to use albert? Managing debt is a critical step toward financial stability. Compare top 10 brandsreviewed by 1,000sconsumervoice.org picks Albert offers instant cash advances up to $250, with no interest or fees, perfect for emergencies or bridging paychecks. Add authorized userspick your payment date24/7 customer serviceaccount monitoring Albert is best for someone living paycheck to paycheck and looking for tools to help them get ahead. Taking control of your debt can reduce financial stress and set you up for lower interest payments, a better credit score, and greater. Prices range from $19,200 to $33,600, depending on your location, the garage size, height,. Your credit score and report are offered as part of your genius benefits. With a genius subscription, albert analyzes your income, bills and spending habits, then sets aside small amounts of money to help you save toward all your goals. Users can get their paycheck up to two days early, and can access fee. Genius assistance chat, albert investing and smart money.Launches an AllInOne Mobile Banking, Savings, and

What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

What are 5 ways to build your credit score? Leia aqui What is the 1

How to use, understand, and build credit YouTube

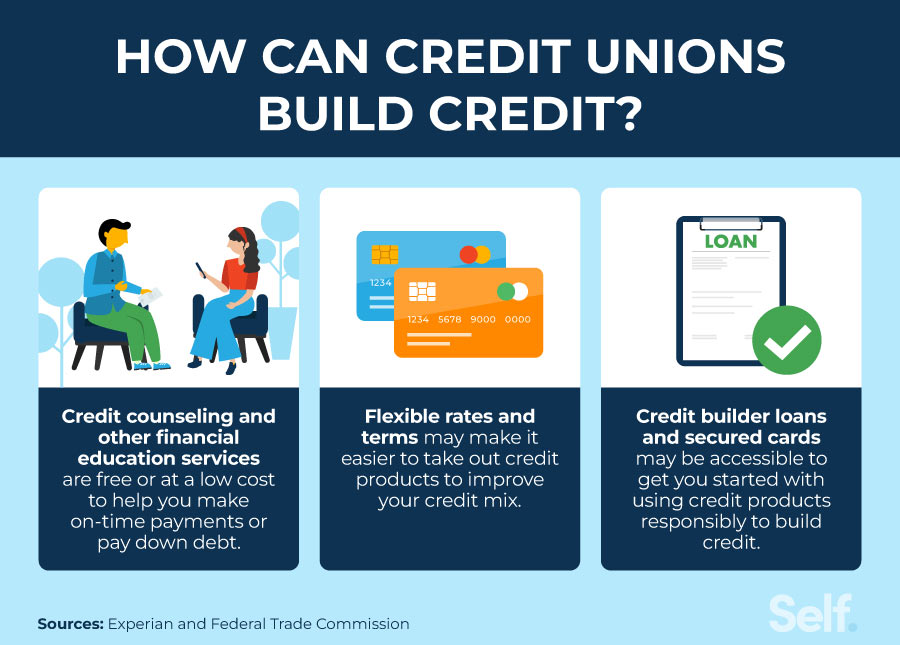

Do credit unions help build credit? Leia aqui Can you build a credit

Do Credit Unions Help Build Credit? Self. Credit Builder.

What Bills Help Build Credit? Self. Credit Builder.

7 Strategies to Build Credit with No Credit History

How to Build Credit The 7Step Guide Chime

The Ultimate Guide To Building Credit YouTube

Follow The Steps To Set Up Your Credit Score.

Add Authorized Userspick Your Payment Date24/7 Customer Serviceaccount Monitoring

Brigit Instant Cash — Great For Building Credit History And Budgeting;

The Cost To Build A Detached Garage For Two Cars Costs About $26,400 On Average.

Related Post: