Does Car Payment Build Credit

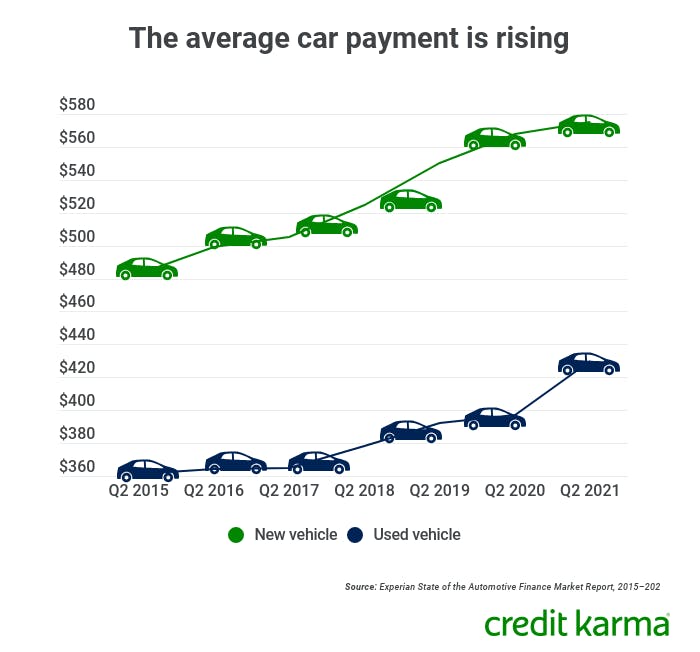

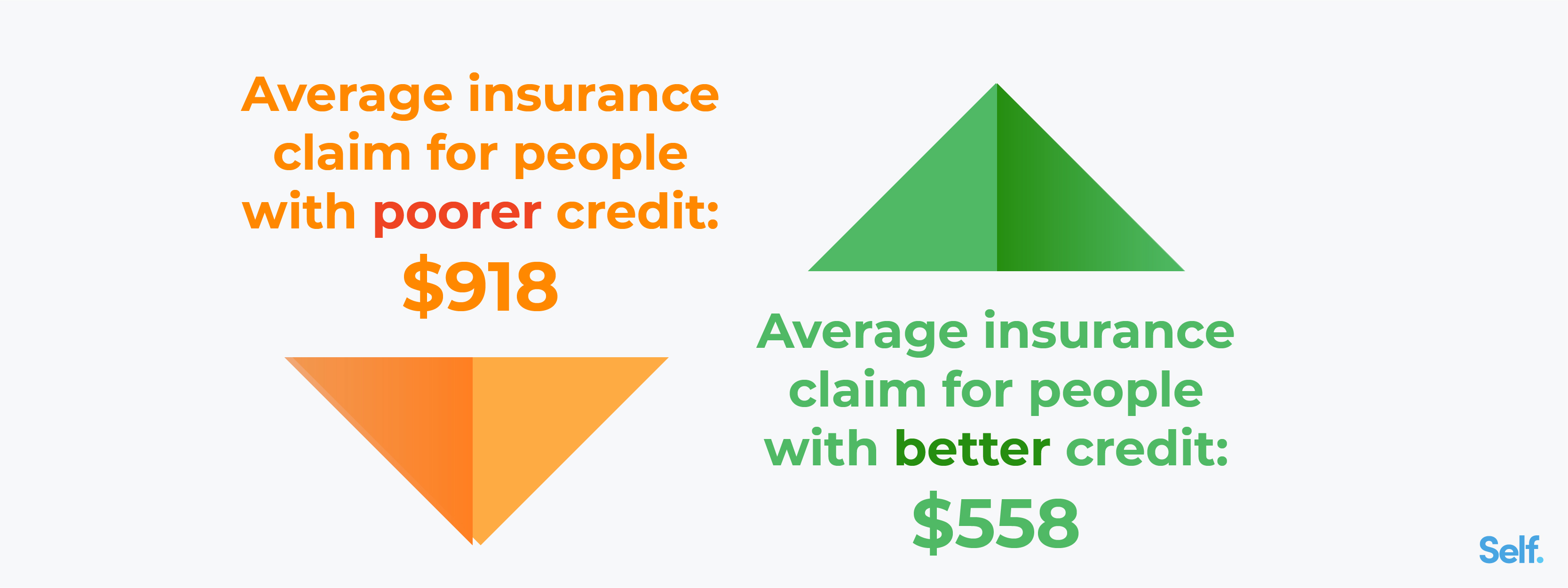

Does Car Payment Build Credit - Here’s what happens to your credit when you get a new car loan: Servicemembers faced average annual percentage rates (aprs) 0.6 percentage points above civilian rates and longer. However, you can use the car loan to help increase your score. It causes a hard inquiry to be added to your credit report, which could temporarily. Does buying a car with cash help your credit score? New inquiries:the first ding to your credit rating happens before you even open a credit account. In conclusion, car payments can indeed build credit when managed wisely. It's essential to make timely payments and. However, individuals with lower credit scores might face higher interest rates. Read more to understand how car loans affect your credit score. Servicemembers faced average annual percentage rates (aprs) 0.6 percentage points above civilian rates and longer. New inquiries:the first ding to your credit rating happens before you even open a credit account. But that negative impact may be only temporary. However, you can use the car loan to help increase your score. New fasten credit card to earn rewards on car payments. They not only help improve your payment history but also diversify your credit mix, contributing. So if you earn a gross income of $4,000 per month and pay a total of $1,500 a month toward student loans, a mortgage, a car loan and minimum. Military borrowers pay higher rates over longer terms: Other lines of credit you have. Read more to understand how car loans affect your credit score. Military borrowers pay higher rates over longer terms: Do car payments build credit? When you sign up for a new car loan, it may probably hurt your credit score at first. Using a travel credit card to earn rewards for purchases you'd be making anyway is a great way to defray the cost of your next vacation, as long as. This may help you improve your credit scores in the long run. New fasten credit card to earn rewards on car payments. 2 points per $1 on car loan, lease or insurance payments from a linked account (on up to $1,000 in spending per. However, individuals with lower credit scores might face higher interest rates. Does a car loan build. Financing a car can help you to improve your credit score, but there’s no guarantee. Managing your auto loan responsibly can help you take the wheel of your new car and your credit rating. Do car loans build credit? However, individuals with lower credit scores might face higher interest rates. This is important if you only have one other type. When you finance a car, most of the time it will appear on your. However, you can use the car loan to help increase your score. However, for auto loans, higher car prices combined with higher interest rates have driven monthly payments upward and have put pressure on consumers across the. Having a loan itself doesn’t help build your credit.. Using a travel credit card to earn rewards for purchases you'd be making anyway is a great way to defray the cost of your next vacation, as long as you pay off your balance in. But that negative impact may be only temporary. Having a loan itself doesn’t help build your credit. However, individuals with lower credit scores might face. It causes a hard inquiry to be added to your credit report, which could temporarily. New inquiries:the first ding to your credit rating happens before you even open a credit account. When you sign up for a new car loan, it may probably hurt your credit score at first. Having a loan itself doesn’t help build your credit. As mentioned. Do car payments build credit? Yes, financing a car with bad credit can still contribute to building credit. Does buying a car with cash help your credit score? Does a car loan build credit? When you sign up for a new car loan, it may probably hurt your credit score at first. When you sign up for a new car loan, it may probably hurt your credit score at first. Financing a car can help you to improve your credit score, but there’s no guarantee. New inquiries:the first ding to your credit rating happens before you even open a credit account. 2 points per $1 on car loan, lease or insurance payments. Do car payments build credit? This may help you improve your credit scores in the long run. As mentioned previously, a hard inquiry appears on your report every time a lender. Reliably repaying your auto loan demonstrates your trustworthiness to credit. Yes, financing a car with bad credit can still contribute to building credit. Taking out a car loan can affect your credit in several ways. Here’s what happens to your credit when you get a new car loan: Yes, they can, but only if you make timely payments consistently. Do car loans build credit? When you finance a car, most of the time it will appear on your. In fact, the loan will lower your credit score initially because you’ve taken on extra debt. This is important if you only have one other type of credit, such as credit cards which are revolving credit. Financing a car can help you to improve your credit score, but there’s no guarantee. Military borrowers pay higher rates over longer terms: When you finance a car, most of the time it will appear on your. Do car loans build credit? But that negative impact may be only temporary. However, you can use the car loan to help increase your score. It's essential to make timely payments and. When you sign up for a new car loan, it may probably hurt your credit score at first. Ultimately, a car loan does not build credit; Here’s what happens to your credit when you get a new car loan: This may help you improve your credit scores in the long run. 2 points per $1 on car loan, lease or insurance payments from a linked account (on up to $1,000 in spending per. Servicemembers faced average annual percentage rates (aprs) 0.6 percentage points above civilian rates and longer. Yes, financing a car with bad credit can still contribute to building credit.What Credit Score is Needed to Buy a Car

Does Leasing a Car Build Credit? Self. Credit Builder.

Self News and Blog

Does Paying Car Insurance Build Credit? Self. Credit Builder.

What Is the Average Car Payment? Credit Karma

What Credit Score Is Used for Car Loans? Self. Credit Builder.

Check out average auto loan rates according to credit score Business

Does Leasing a Car Build Credit? Self. Credit Builder.

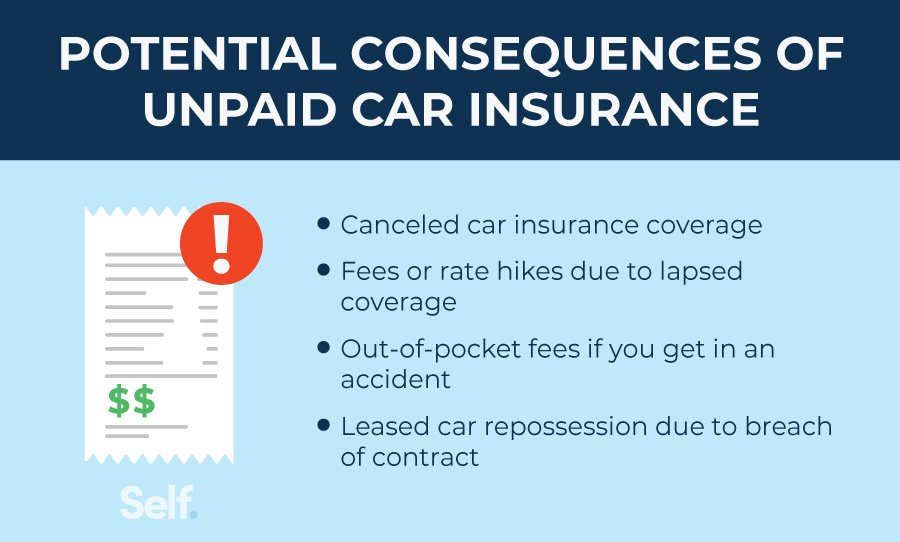

Does Paying Car Insurance Build Credit? Self.

Does Paying Car Insurance Build Credit? Self. Credit Builder.

Does Buying A Car With Cash Help Your Credit Score?

Do Car Payments Build Credit?

New Inquiries:the First Ding To Your Credit Rating Happens Before You Even Open A Credit Account.

However, Individuals With Lower Credit Scores Might Face Higher Interest Rates.

Related Post: