Does Cash App Build Credit

Does Cash App Build Credit - Cash app might check your credit report when you apply for a loan. Cashapp borrow does not report timely payments to credit bureaus, so it doesn't directly improve credit scores. The answer is no, borrowing money from cash app does not build credit. Cash app borrow is better than getting a payday loan, which can have up to a 400% apr, or even a bad credit personal loan with high aprs and origination fees. If you can’t trust yourself with a credit card, maybe try a prepaid credit card? Credit builder loans, unlike cashapp borrow, help build or. Cash app borrow is not a traditional loan, and it is not reported to the three major credit reporting. Since cash app does not report to credit bureaus, it does not directly influence your credit score. If you don’t pay back the loan on time, it could hurt your. Using a linked credit card to send payments costs you 3%. Cashapp borrow does not report timely payments to credit bureaus, so it doesn't directly improve credit scores. I have never had a credit score as a 19 year old and i'm looking for simple ways to build credit. Unlike some competitors, cash app doesn't offer options trading or ira investments. Cash app borrow is better than getting a payday loan, which can have up to a 400% apr, or even a bad credit personal loan with high aprs and origination fees. Does using cash app affect credit score? It will help you build. Looking to diversify and have multiple cards to increase my credit score, just wondering if the cash card will have an effect on my fico credit score. Cash app supports most major credit and debit cards, including visa, american express, mastercard and discover. It’s a debit card so you would still need money to “drain” in cash app so you can buy dvds. The answer is no, borrowing money from cash app does not build credit. Cashapp borrow does not report timely payments to credit bureaus, so it doesn't directly improve credit scores. Since cash app does not report to credit bureaus, it does not directly influence your credit score. Credit builder loans, unlike cashapp borrow, help build or. So, does cash app borrow build credit? It will help you build. One notable advantage of cash app loans is that they generally do not impact your credit score. No, cash app transactions do not have any direct influence on your credit score. Building credit requires using credit products that report your activity to. How does borrowing from cash app affect my credit score? The answer is no, borrowing money from cash. Unlike some competitors, cash app doesn't offer options trading or ira investments. Building credit requires using credit products that report your activity to. Looking to diversify and have multiple cards to increase my credit score, just wondering if the cash card will have an effect on my fico credit score. Credit builder loans, unlike cashapp borrow, help build or. Cashapp. Cash app supports most major credit and debit cards, including visa, american express, mastercard and discover. Cash app offers a feature called cash app credit , which allows users to borrow a. One notable advantage of cash app loans is that they generally do not impact your credit score. The short answer is yes, but with some conditions. If you. Cash app borrow is better than getting a payday loan, which can have up to a 400% apr, or even a bad credit personal loan with high aprs and origination fees. The short answer is yes. If you're working on building credit and. If you can’t trust yourself with a credit card, maybe try a prepaid credit card? Does using. If you don’t pay back the loan on time, it could hurt your. One notable advantage of cash app loans is that they generally do not impact your credit score. If you're working on building credit and. Cashapp borrow does not report timely payments to credit bureaus, so it doesn't directly improve credit scores. It’s a debit card so you. Using a linked credit card to send payments costs you 3%. I get paid 2.4k a month into cashapp and i'm hoping this borrow feature would boost my credit. If you're working on building credit and. It will help you build. How does borrowing from cash app affect my credit score? One notable advantage of cash app loans is that they generally do not impact your credit score. The answer is a resounding no. Cash app borrow is not a traditional credit product, and it does not report to the major credit bureaus. I get paid 2.4k a month into cashapp and i'm hoping this borrow feature would boost my credit.. If you can’t trust yourself with a credit card, maybe try a prepaid credit card? Credit builder loans, unlike cashapp borrow, help build or. If you don’t pay back the loan on time, it could hurt your. Since cash app does not report to credit bureaus, it does not directly influence your credit score. Cash app did not charge the. The answer is no, borrowing money from cash app does not build credit. Cash app supports most major credit and debit cards, including visa, american express, mastercard and discover. So, does cash app borrow build credit? I have never had a credit score as a 19 year old and i'm looking for simple ways to build credit. It will help. Building credit requires using credit products that report your activity to. If you're working on building credit and. Cash app might check your credit report when you apply for a loan. Cash app borrow is not a traditional credit product, and it does not report to the major credit bureaus. Looking to diversify and have multiple cards to increase my credit score, just wondering if the cash card will have an effect on my fico credit score. The short answer is yes, but with some conditions. Using a linked credit card to send payments costs you 3%. I get paid 2.4k a month into cashapp and i'm hoping this borrow feature would boost my credit. Cash app did not charge the transaction as a cash advance;. Unlike some competitors, cash app doesn't offer options trading or ira investments. Cash app borrow is not a traditional loan, and it is not reported to the three major credit reporting. Cashapp borrow does not report timely payments to credit bureaus, so it doesn't directly improve credit scores. The app does not report your payments or activities. How does borrowing from cash app affect my credit score? Does using cash app affect credit score? If you don’t pay back the loan on time, it could hurt your.Does Cash App Borrow Build Credit? A Comprehensive Guide

Does Cash App Borrow Build Credit? A Comprehensive Guide

What Bank Does Cash App Use?

How Long Does Cash App Card Take To Deliver

Does Using a Cash App Card Impact Your Credit Score?

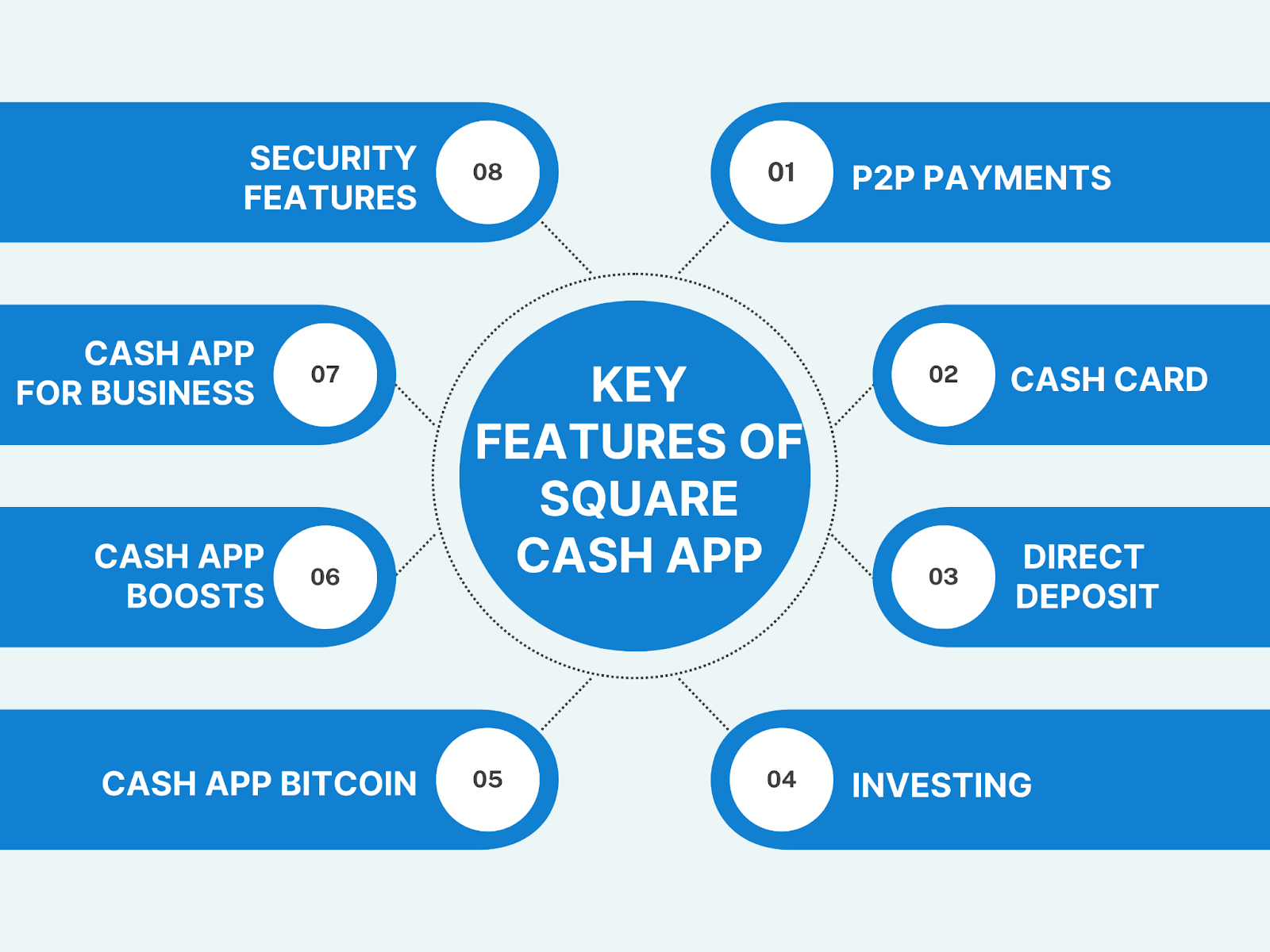

Square Cash App How Does Cash App Work?

Cashbuild

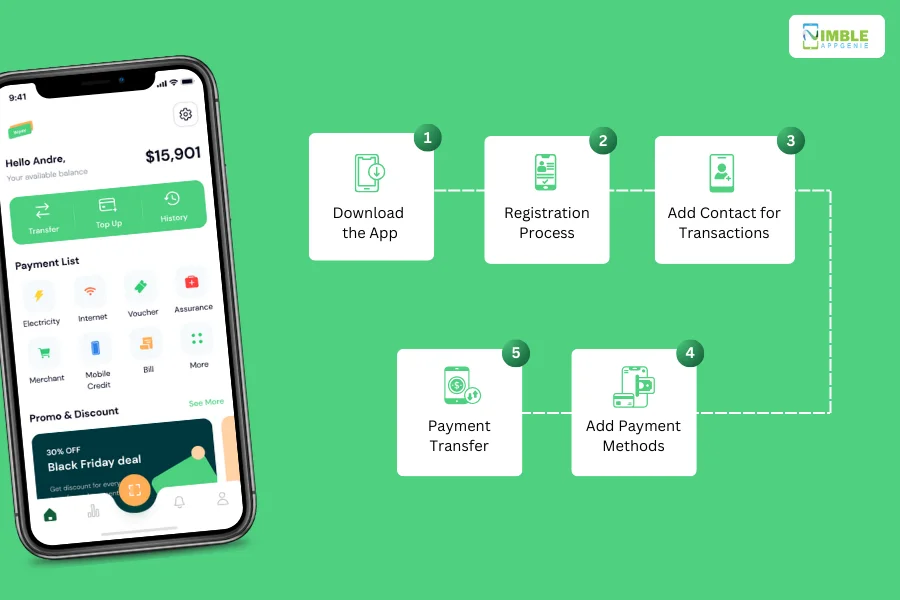

How to Build an App Like Cash App?

What Is Cash App and How Does It Work?

How Does Cash App Make Money? Its 5 Streams Revealed!

Cash App Offers A Feature Called Cash App Credit , Which Allows Users To Borrow A.

If You Can’t Trust Yourself With A Credit Card, Maybe Try A Prepaid Credit Card?

One Notable Advantage Of Cash App Loans Is That They Generally Do Not Impact Your Credit Score.

It’s A Debit Card So You Would Still Need Money To “Drain” In Cash App So You Can Buy Dvds.

Related Post: