Does Cash App Help Build Credit

Does Cash App Help Build Credit - Brigit is an app that can help you manage your finances with various budgeting tools and financial wellness tips. However, if you make timely repayments on. If you qualify for the card, you’ll. When you request a loan and accept the terms, cash app runs a hard credit check, which can negatively affect your credit score. That said, strategic credit use can help build a business credit profile. Can cash app help improve my credit score? Although cash app itself does not affect your credit score, it’s essential to consider how using the app might impact your financial habits and, subsequently, your credit score. Keeping a net 30 account in good standing shows lenders and credit bureaus that a trucking business can. I don’t think it will help build your credit. Credit builder loans, unlike cashapp borrow, help build or. Cash app borrow is not a traditional credit product, and it does not report to the major credit bureaus. Here’s how it generally works: You're not spending borrowed money from cash app, so there's. You'll be spending your own money from your cash balance with your prepaid cash card. However, if you make timely repayments on. The answer is no, borrowing money from cash app does not build credit. The capital one savorone student cash rewards credit card is free of an annual fee and aimed at helping students build a good credit history. No, cash app loans will not help your credit score because positive payment history on these loans is not reported to the credit bureaus. Can cash app help improve my credit score? However, defaulting can hurt you (either debt reported to your credit bureau or banning your cashapp account). You'll be spending your own money from your cash balance with your prepaid cash card. However, defaulting can hurt you (either debt reported to your credit bureau or banning your cashapp account). The capital one savorone student cash rewards credit card is free of an annual fee and aimed at helping students build a good credit history. Cashapp borrow does. The answer is a resounding no. The answer is no, borrowing money from cash app does not build credit. If you qualify for the card, you’ll. However, defaulting can hurt you (either debt reported to your credit bureau or banning your cashapp account). I don’t think it will help build your credit. Since cash app does not report to credit bureaus, it does not directly influence your credit score. That said, strategic credit use can help build a business credit profile. So, does cash app borrow build credit? But does borrowing money on cashapp build credit? The answer is a resounding no. In this article, we’ll explore the answer to this question and provide insights on how borrowing on cashapp affects your credit. Using cash app borrow is quite simple. The answer is no, borrowing money from cash app does not build credit. That said, strategic credit use can help build a business credit profile. The difference between choosing the right or. The answer is no, borrowing money from cash app does not build credit. So, does cash app borrow build credit? If you're working on building credit and. To request a loan, go to cash app > money > borrow > unlock. Cash app borrow is better than getting a payday loan, which can have up to a 400% apr, or. The answer is a resounding no. Cash app borrow is not a traditional loan, and it is not reported to the three major credit reporting. The difference between choosing the right or wrong card can significantly impact your company's cash flow, operational efficiency, and ability to scale—making it crucial to understand the full. If you qualify for the card, you’ll.. Brigit is an app that can help you manage your finances with various budgeting tools and financial wellness tips. To request a loan, go to cash app > money > borrow > unlock. Cash app borrow is not a traditional loan, and it is not reported to the three major credit reporting. If you qualify for the card, you’ll. I. Select the amount, choose a repayment option, hit next, review the details, and select borrow instantly. Cash app borrow is not a traditional credit product, and it does not report to the major credit bureaus. In this article, we’ll explore the answer to this question and provide insights on how borrowing on cashapp affects your credit. The difference between choosing. In this article, we’ll explore the answer to this question and provide insights on how borrowing on cashapp affects your credit. Once you’re eligible, you can request a loan by tapping the borrow button in the app. Select the amount, choose a repayment option, hit next, review the details, and select borrow instantly. I don’t think it will help build. Cash app doesn’t run a credit check when you sign up for the service, but when you request a loan and accept the terms of the loan, the app runs a hard credit check, which. Since cash app does not report to credit bureaus, it does not directly influence your credit score. That said, strategic credit use can help build. I don’t think it will help build your credit. No, cash app loans will not help your credit score because positive payment history on these loans is not reported to the credit bureaus. Once you’re eligible, you can request a loan by tapping the borrow button in the app. The difference between choosing the right or wrong card can significantly impact your company's cash flow, operational efficiency, and ability to scale—making it crucial to understand the full. But does borrowing money on cashapp build credit? Since cash app does not report to credit bureaus, it does not directly influence your credit score. That said, strategic credit use can help build a business credit profile. In this article, we’ll explore the answer to this question and provide insights on how borrowing on cashapp affects your credit. Cash app borrow is not a traditional credit product, and it does not report to the major credit bureaus. So, does cash app borrow build credit? Credit builder loans, unlike cashapp borrow, help build or. Cash app borrow is better than getting a payday loan, which can have up to a 400% apr, or even a bad credit personal loan with high aprs and origination fees. Brigit is an app that can help you manage your finances with various budgeting tools and financial wellness tips. Here’s how it generally works: You're not spending borrowed money from cash app, so there's. The capital one savorone student cash rewards credit card is free of an annual fee and aimed at helping students build a good credit history.Does Cash App Borrow Build Credit? A Comprehensive Guide

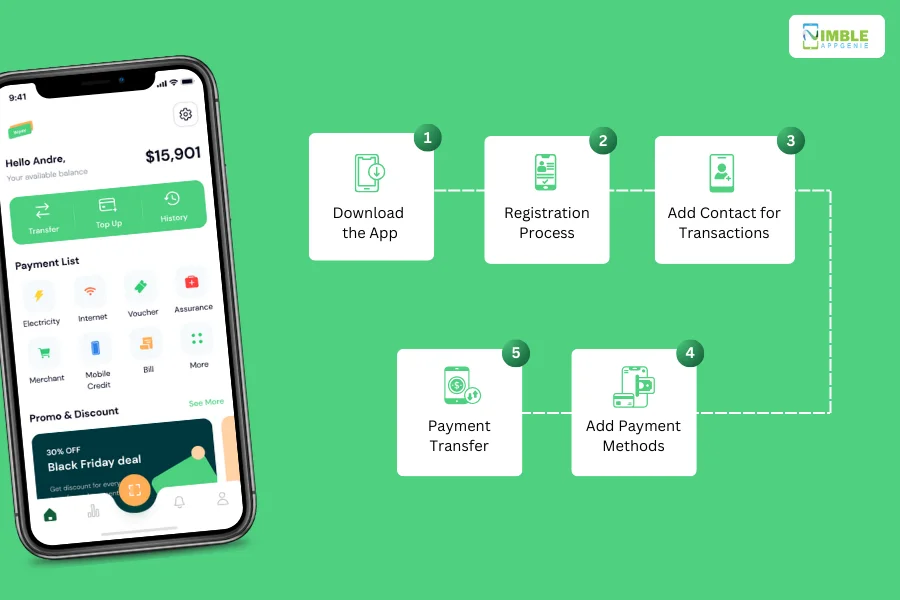

How Does Cash App Work? A StepbyStep Guide to Using the Mobile

Does Cash App Borrow Build Credit? A Comprehensive Guide

Does Cash App Borrow Build Credit? A Comprehensive Guide

What Bank Does Cash App Use?

How To Add Your Credit/Debit Card To Cash App YouTube

Does Using a Cash App Card Impact Your Credit Score?

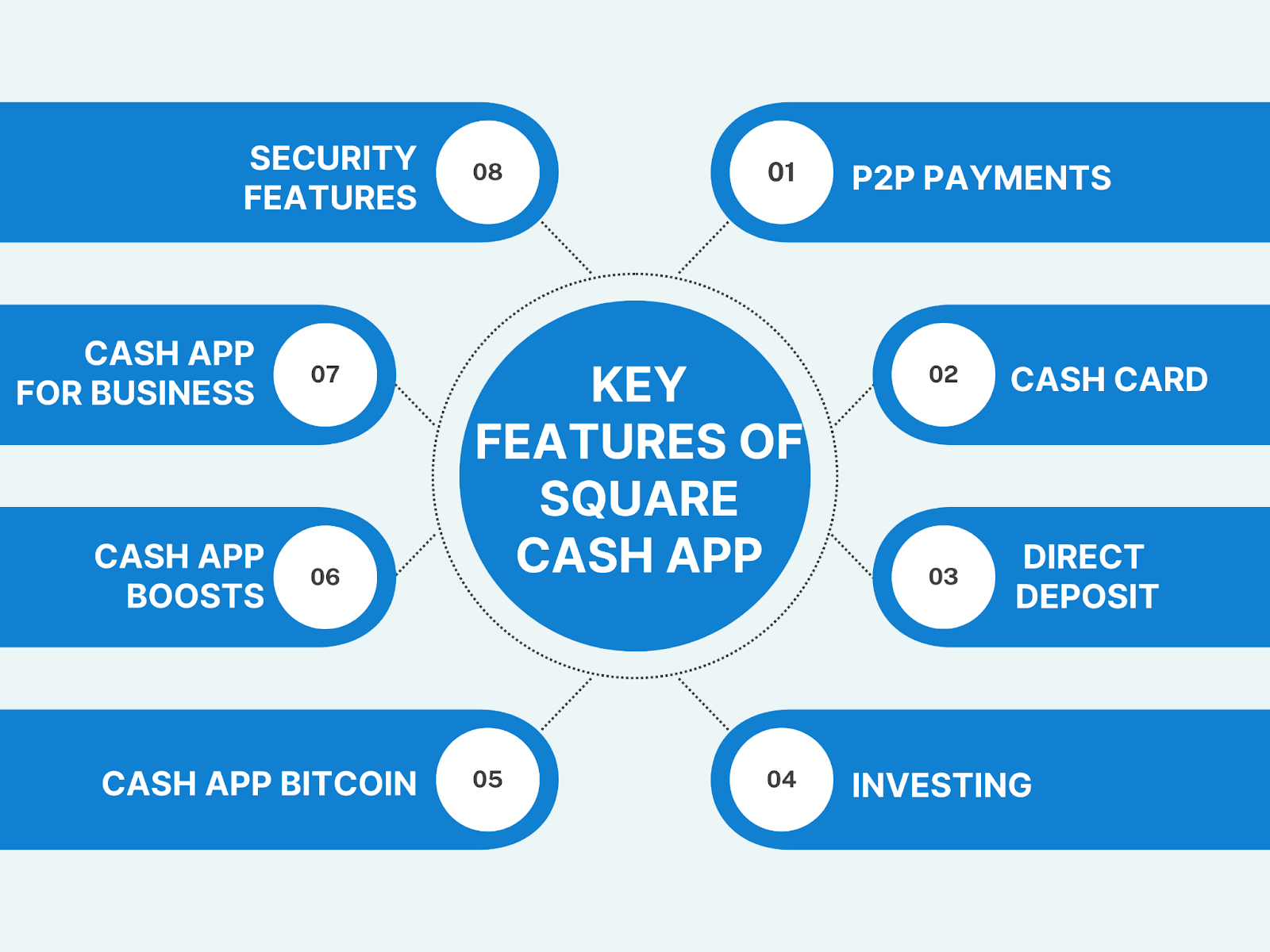

Square Cash App How Does Cash App Work?

How to Build an App Like Cash App?

What Is Cash App and How Does It Work?

The Answer Is A Resounding No.

Keeping A Net 30 Account In Good Standing Shows Lenders And Credit Bureaus That A Trucking Business Can.

However, Defaulting Can Hurt You (Either Debt Reported To Your Credit Bureau Or Banning Your Cashapp Account).

Using Cash App Borrow Is Quite Simple.

Related Post: