Does Cashapp Build Credit

Does Cashapp Build Credit - But does borrowing money on cashapp build credit? I don’t think it will help build your credit. The card requires a $300 minimum security deposit that acts as your. Cashapp borrow does not report timely payments to credit bureaus, so it doesn't directly improve credit scores. Cash app borrow is not a traditional loan, and it is not reported to the three major credit reporting. Most loan amounts start around $20 but go up to $200 once you build history. Cash app's feature allows some users to borrow up to $200 for. Cash app does have a borrow feature. Cleo can also help you build credit with their credit builder product, which can improve your options in the future should you need to lean on your credit. Cash app doesn’t run a credit check when you sign up for the service, but when you request a loan and accept the terms of the loan, the app runs a hard credit check, which. Cash app borrow is an option when you need a quick loan to cover an immediate expense. Cash app doesn’t run a credit check when you sign up for the service, but when you request a loan and accept the terms of the loan, the app runs a hard credit check, which. The card requires a $300 minimum security deposit that acts as your. No, cash app loans will not help your credit score because positive payment history on these loans is not reported to the credit bureaus. But does borrowing money on cashapp build credit? Cash app does have a borrow feature. In this article, we’ll explore the answer to this question and provide insights on how borrowing on cashapp affects your credit. The answer is a resounding no. Borrowing money from cash app is convenient and easy, but it’s important to understand the eligibility criteria, fees, and repayment terms. So, does cash app borrow build credit? Borrowing money from cash app is convenient and easy, but it’s important to understand the eligibility criteria, fees, and repayment terms. Most loan amounts start around $20 but go up to $200 once you build history. Cash app's feature allows some users to borrow up to $200 for. Cash app does have a borrow feature. The card requires a $300. Cash app borrow is an option when you need a quick loan to cover an immediate expense. Cash app borrow is not a traditional loan, and it is not reported to the three major credit reporting. Cash app borrow is not a traditional credit product, and it does not report to the major credit bureaus. Cashapp borrow does not report. Cash app borrow is still in the testing phase, so it’s not available to most people. However, defaulting can hurt you (either debt reported to your credit bureau or banning your cashapp account). The answer is a resounding no. Cashapp borrow does not report timely payments to credit bureaus, so it doesn't directly improve credit scores. Cash app borrow is. The answer is a resounding no. Carefully read the terms and conditions of the loan before clicking that you agree. Cash app does have a borrow feature. But does borrowing money on cashapp build credit? Most loan amounts start around $20 but go up to $200 once you build history. Most loan amounts start around $20 but go up to $200 once you build history. Cash app borrow is not a traditional loan, and it is not reported to the three major credit reporting. Cash app's feature allows some users to borrow up to $200 for. The answer is no, borrowing money from cash app does not build credit. Cleo. The card requires a $300 minimum security deposit that acts as your. Cleo can also help you build credit with their credit builder product, which can improve your options in the future should you need to lean on your credit. Borrowing money from cash app is convenient and easy, but it’s important to understand the eligibility criteria, fees, and repayment. The answer is a resounding no. I don’t think it will help build your credit. Cash app borrow is still in the testing phase, so it’s not available to most people. Most loan amounts start around $20 but go up to $200 once you build history. Borrowing money from cash app is convenient and easy, but it’s important to understand. Cleo can also help you build credit with their credit builder product, which can improve your options in the future should you need to lean on your credit. Borrowing money from cash app is convenient and easy, but it’s important to understand the eligibility criteria, fees, and repayment terms. In this article, we’ll explore the answer to this question and. The answer is a resounding no. Cash app's feature allows some users to borrow up to $200 for. So, does cash app borrow build credit? Cashapp borrow does not report timely payments to credit bureaus, so it doesn't directly improve credit scores. Borrowing money from cash app is convenient and easy, but it’s important to understand the eligibility criteria, fees,. However, defaulting can hurt you (either debt reported to your credit bureau or banning your cashapp account). Cleo can also help you build credit with their credit builder product, which can improve your options in the future should you need to lean on your credit. So, does cash app borrow build credit? Cash app borrow is not a traditional loan,. However, defaulting can hurt you (either debt reported to your credit bureau or banning your cashapp account). Carefully read the terms and conditions of the loan before clicking that you agree. The answer is no, borrowing money from cash app does not build credit. But does borrowing money on cashapp build credit? Borrowing money from cash app is convenient and easy, but it’s important to understand the eligibility criteria, fees, and repayment terms. Cash app does have a borrow feature. So, does cash app borrow build credit? In this article, we’ll explore the answer to this question and provide insights on how borrowing on cashapp affects your credit. Cashapp borrow does not report timely payments to credit bureaus, so it doesn't directly improve credit scores. Cash app's feature allows some users to borrow up to $200 for. One notable advantage of cash app loans is that they generally do not impact your credit score. Cash app borrow is better than getting a payday loan, which can have up to a 400% apr, or even a bad credit personal loan with high aprs and origination fees. Cash app borrow is still in the testing phase, so it’s not available to most people. No, cash app loans will not help your credit score because positive payment history on these loans is not reported to the credit bureaus. Cleo can also help you build credit with their credit builder product, which can improve your options in the future should you need to lean on your credit. Cash app borrow is not a traditional loan, and it is not reported to the three major credit reporting.How to Pay Your Friend with a Credit Card FinanceBuzz

Cash App Review 2023 Pros and Cons

Does Using a Cash App Card Impact Your Credit Score?

Does Cash App Borrow Build Credit? A Comprehensive Guide

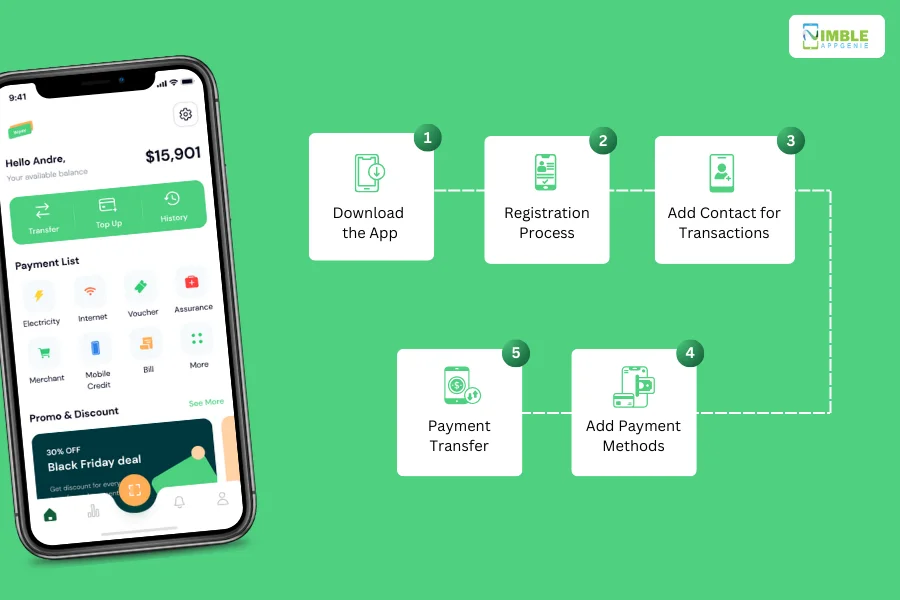

What Is Cash App and How Does It Work?

How To Link Credit Card To Cash App CashApp Tutorial YouTube

Cashapp 40,000 Credit Builder Loan (Primary) Tradeline Loans

Exploring How Does the Cash App Work A Comprehensive Guide The

How to Build an App Like Cash App?

Does Cash App Borrow Build Credit? A Comprehensive Guide

Credit Builder Loans, Unlike Cashapp Borrow, Help Build Or.

Cash App Borrow Is An Option When You Need A Quick Loan To Cover An Immediate Expense.

The Answer Is A Resounding No.

Cash App Doesn’t Run A Credit Check When You Sign Up For The Service, But When You Request A Loan And Accept The Terms Of The Loan, The App Runs A Hard Credit Check, Which.

Related Post: