Does Chime Credit Builder Give You Money

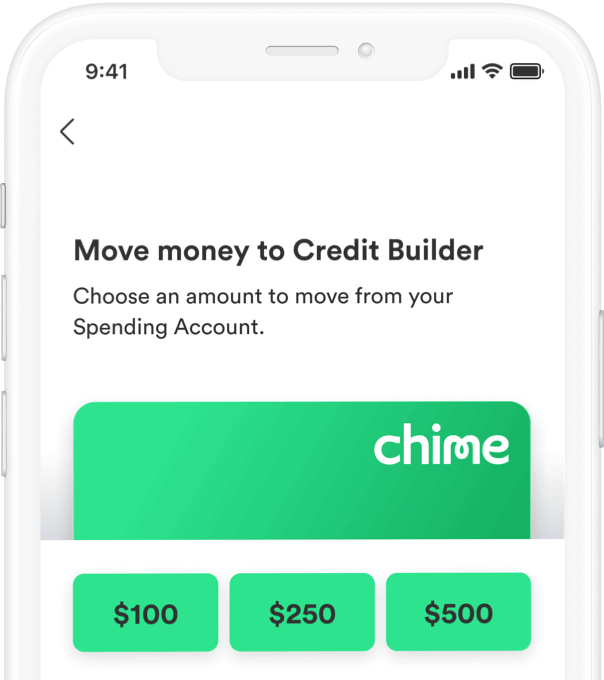

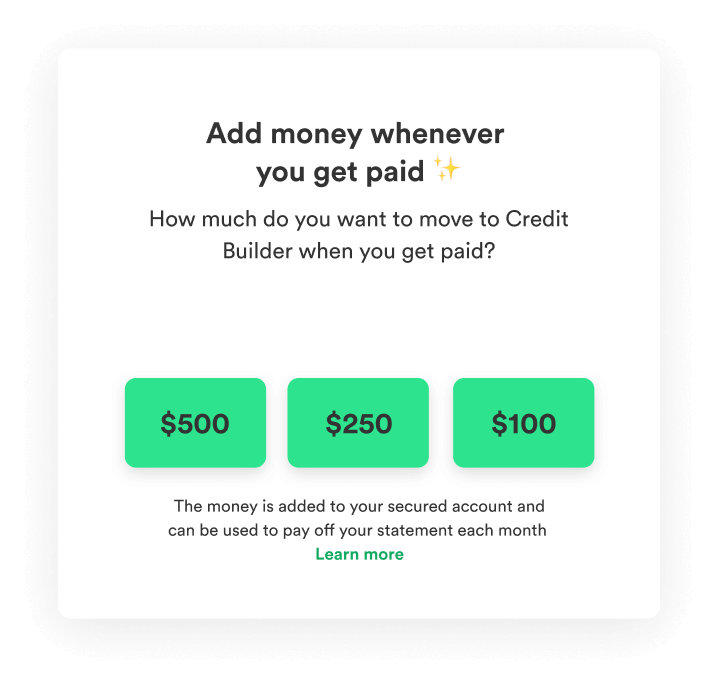

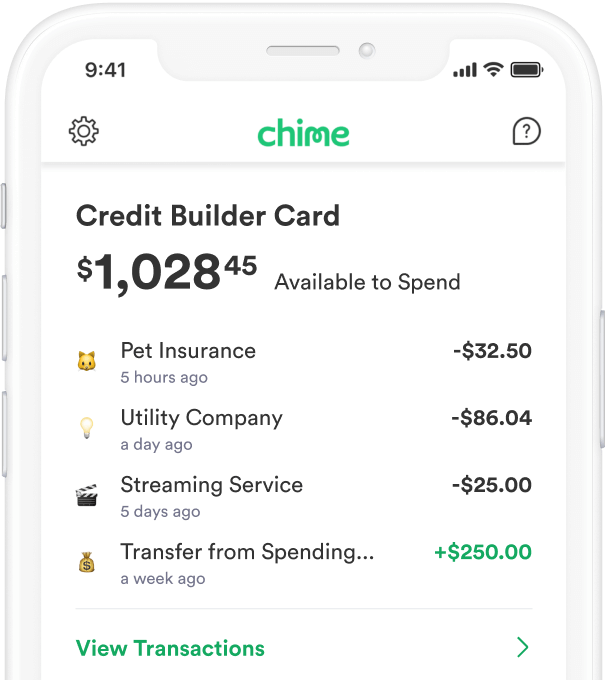

Does Chime Credit Builder Give You Money - This is truly a unique offer: Does chime charge any fees for using credit. 1 there’s also no credit check to apply! Chime credit builder is a secured credit card that helps build credit through everyday purchases. Just make sure you fund your credit builder secured deposit account, so you. Chime credit builder has a 0% apr, so if you carry a balance, you won’t have to pay anything in interest. Unlike traditional credit cards, credit builder is a secured card that helps you build credit history with no annual fees and no interest. You can do that right in the chime app. Unlike traditional unsecured credit cards, the secured chime credit builder visa® credit card requires you to deposit funds into the separate account. The money you move to your secured account is the. 1 there’s also no credit check to apply! With the secured chime credit builder visa® credit card, you could help raise your credit score by 30 points 1 on average — even if you don’t qualify for a typical credit card. Learn how long it takes to. This is truly a unique offer: It has no interest*, no annual fees*, and doesn’t need a credit check. When you open a chime credit builder account, you’ll need to deposit money into a savings account which will be used as collateral. You can use your credit builder card anywhere visa® is accepted and at the end of each month, you can use the money previously moved to pay for your monthly charges (we recommend. You can do that right in the chime app. Chime credit builder is a secured credit card that helps build credit through everyday purchases. The first step is to move money into your credit builder secured account. You can use your chime credit builder credit card anywhere visacards are accepted. Does chime charge any fees for using credit. This is truly a unique offer: Unlike traditional credit cards, credit builder is a secured card that helps you build credit history with no annual fees and no interest. Just make sure you fund your credit builder secured deposit. The first step is to move money into your credit builder secured account. Does chime charge any fees for using credit. Learn how long it takes to. It has no interest*, no annual fees*, and doesn’t need a credit check. Your credit limit will be equal to the amount. The balance in your chime credit builder account determines the credit limit on your chime credit builder card. 1 there’s also no credit check to apply! We designed credit builder to work with the chime checking account so that you can move money instantly — across your chime accounts! Does chime charge any fees for using credit. When you open. This is truly a unique offer: It has no interest*, no annual fees*, and doesn’t need a credit check. The first step is to move money into your credit builder secured account. Your credit limit will be equal to the amount. The money you move to your secured account is the. You can use your credit builder card anywhere visa® is accepted and at the end of each month, you can use the money previously moved to pay for your monthly charges (we recommend. While credit builder can help you build credit, stay on top of your financial activities and accounts you use outside of chime. Learn how long it takes. Unlike traditional unsecured credit cards, the secured chime credit builder visa® credit card requires you to deposit funds into the separate account. The money you move to your secured account is the. While credit builder can help you build credit, stay on top of your financial activities and accounts you use outside of chime. With the secured chime credit builder. The balance in your chime credit builder account determines the credit limit on your chime credit builder card. Unlike traditional credit cards, credit builder is a secured card that helps you build credit history with no annual fees and no interest. It has no interest*, no annual fees*, and doesn’t need a credit check. Your credit limit will be equal. Even 0% apr credit cards designed for. This is truly a unique offer: You can use your credit builder card anywhere visa® is accepted and at the end of each month, you can use the money previously moved to pay for your monthly charges (we recommend. Just make sure you fund your credit builder secured deposit account, so you. When. It has no interest*, no annual fees*, and doesn’t need a credit check. You can use your credit builder card anywhere visa® is accepted and at the end of each month, you can use the money previously moved to pay for your monthly charges (we recommend. We designed credit builder to work with the chime checking account so that you. Does chime charge any fees for using credit. You can do that right in the chime app. It has no interest*, no annual fees*, and doesn’t need a credit check. The money you move to your secured account is the. Unlike traditional unsecured credit cards, the secured chime credit builder visa® credit card requires you to deposit funds into the. The first step is to move money into your credit builder secured account. Just make sure you fund your credit builder secured deposit account, so you. The balance in your chime credit builder account determines the credit limit on your chime credit builder card. With the secured chime credit builder visa® credit card, you could help raise your credit score by 30 points 1 on average — even if you don’t qualify for a typical credit card. Unlike traditional credit cards, credit builder is a secured card that helps you build credit history with no annual fees and no interest. You can use your credit builder card anywhere visa® is accepted and at the end of each month, you can use the money previously moved to pay for your monthly charges (we recommend. This is truly a unique offer: Learn how long it takes to. Does chime charge any fees for using credit. It has no interest*, no annual fees*, and doesn’t need a credit check. When you open a chime credit builder account, you’ll need to deposit money into a savings account which will be used as collateral. You can do that right in the chime app. We designed credit builder to work with the chime checking account so that you can move money instantly — across your chime accounts! Chime credit builder has a 0% apr, so if you carry a balance, you won’t have to pay anything in interest. Chime credit builder is a secured credit card that helps build credit through everyday purchases. How much credit does chime credit builder give you?Chime Credit Builder Review Can It Really Improve Your Credit?

Credit Card To Build Credit Securely Chime

Chime Credit Builder Review How Does Chime Credit Builder Work? 2022

Chime Credit Builder Review 2023 Best Secured Credit Card?

How to build credit with Credit Builder Chime

How Does Chime Credit Builder Work

How Does Chime Credit Builder Work? Chime YouTube

Chime Credit Builder Review 2023 Best Secured Credit Card?

Credit Builder Card Chime

Credit Card To Build Credit Securely Chime

Your Credit Limit Will Be Equal To The Amount.

Even 0% Apr Credit Cards Designed For.

While Credit Builder Can Help You Build Credit, Stay On Top Of Your Financial Activities And Accounts You Use Outside Of Chime.

Unlike Traditional Unsecured Credit Cards, The Secured Chime Credit Builder Visa® Credit Card Requires You To Deposit Funds Into The Separate Account.

Related Post: