Does Dave Build Credit

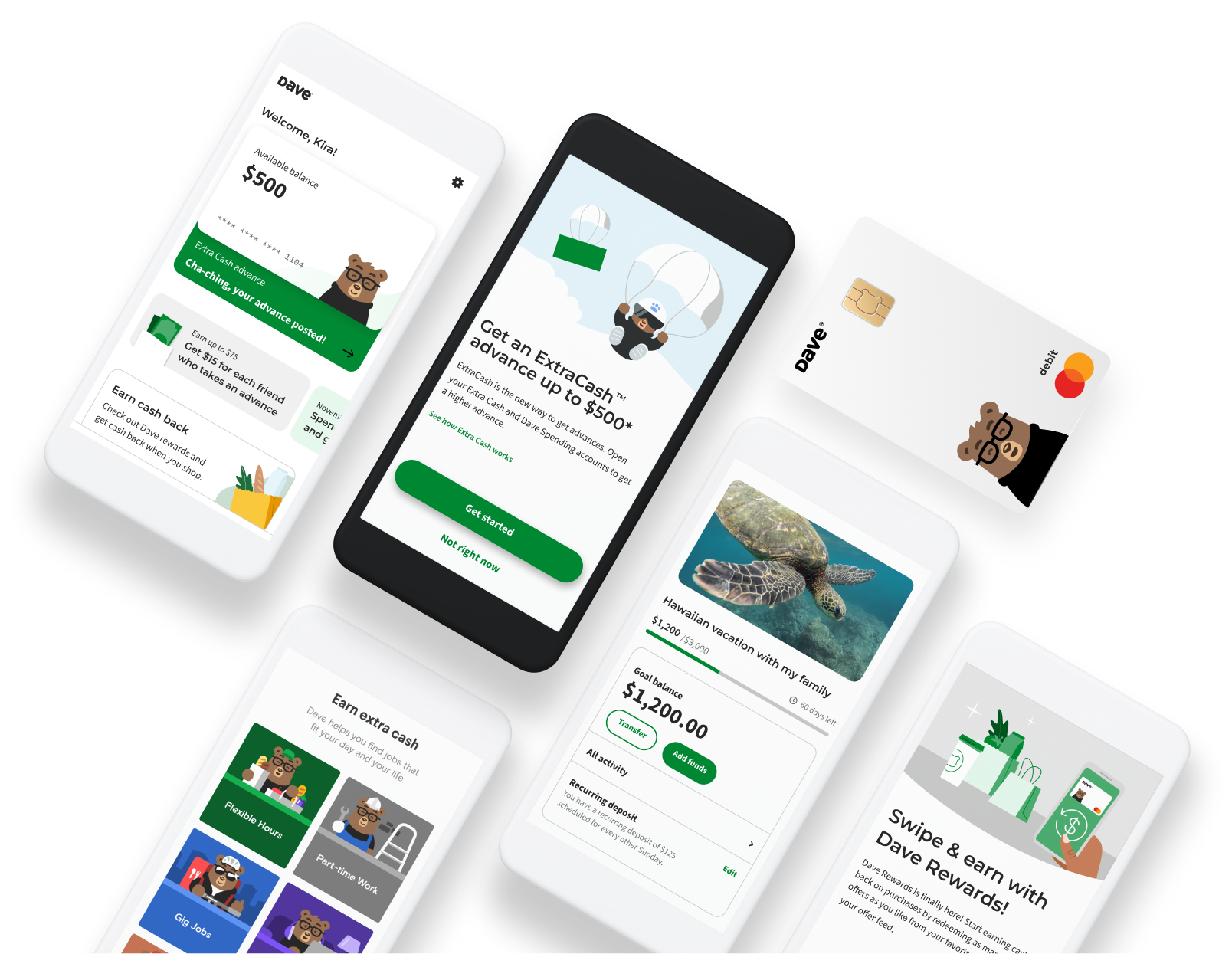

Does Dave Build Credit - Dave is a banking app designed to help its more than 7 million members ease their financial minds. Dave can actually help you build credit by reporting your rent and utility payments to the credit. Instead, you’ll need to link an. However, users do have to pay back the $75 loans after taking them out. Instead, it asks for tips. Dave also offers tools to help you build your credit. So, even if you’re late paying back a. In fact, this cash advance app doesn’t even check your credit. Dave doesn’t run a hard or soft credit check or report your activity to the three major credit bureaus. This is particularly useful for those. Dave can actually help you build credit by reporting your rent and utility payments to the credit. The service typically costs $100, but for dave. By reporting your rent payments to major credit bureaus, dave helps you improve your credit score. Instead, it asks for tips. Dave doesn’t run a hard or soft credit check or report your activity to the three major credit bureaus. You only pay $1 a month for $100 in overdraft fee. Instead, you’ll need to link an. Dave also offers tools to help you build your credit. You can get dave cash advance up to $500 without paying a fee. Dave lets you borrow between $5 and $500 without a minimum credit score. Nope, using dave won’t affect your credit score. However, users do have to pay back the $75 loans after taking them out. Dave doesn’t run a hard or soft credit check or report your activity to the three major credit bureaus. Dave can actually help you build credit by reporting your rent and utility payments to the credit. Dave is. Some benefits of signing up to the dave app include getting paid up to two days early,. In fact, this cash advance app doesn’t even check your credit. By reporting your rent payments to major credit bureaus, dave helps you improve your credit score. Instead, you’ll need to link an. This is particularly useful for those. Dave also offers tools to help you build your credit. This is particularly useful for those. Users can opt for instant transfers, ensuring quick access to. Dave can actually help you build credit by reporting your rent and utility payments to the credit. Dave doesn’t run a hard or soft credit check or report your activity to the three major. Dave can actually help you build credit by reporting your rent and utility payments to the credit. The app helps you to build your credit history. Users can opt for instant transfers, ensuring quick access to. However, users do have to pay back the $75 loans after taking them out. Nope, using dave won’t affect your credit score. Dave lets you borrow between $5 and $500 without a minimum credit score. The dave credit building app utilizes advanced technologies to track credit scores, monitor financial activities, and provide personalized recommendations for improving. A credit check isn’t required to open a dave account. Instead, it asks for tips. Dave doesn’t run a hard or soft credit check or report. Dave is a banking app designed to help its more than 7 million members ease their financial minds. Instead, it asks for tips. Dave lets you borrow between $5 and $500 without a minimum credit score. Does dave affect your credit? Instead, you’ll need to link an. So, even if you’re late paying back a. Dave is a banking app designed to help its more than 7 million members ease their financial minds. The app helps you to build your credit history. A credit check isn’t required to open a dave account. You can get dave cash advance up to $500 without paying a fee. The service typically costs $100, but for dave. Nope, using dave won’t affect your credit score. Instead, you’ll need to link an. Does dave affect your credit? The app helps you to build your credit history. Does dave affect your credit? Dave can actually help you build credit by reporting your rent and utility payments to the credit. Instead, it asks for tips. You can get dave cash advance up to $500 without paying a fee. A credit check isn’t required to open a dave account. Other features include a checking account with a debit card, a savings. This is particularly useful for those. Instead, you’ll need to link an. Dave also offers tools to help you build your credit. Dave doesn’t run a hard or soft credit check or report your activity to the three major credit bureaus. You can get dave cash advance up to $500 without paying a fee. Instead, you’ll need to link an. So, even if you’re late paying back a. Some benefits of signing up to the dave app include getting paid up to two days early,. Users can opt for instant transfers, ensuring quick access to. You only pay $1 a month for $100 in overdraft fee. However, users do have to pay back the $75 loans after taking them out. Dave also offers tools to help you build your credit. Dave can actually help you build credit by reporting your rent and utility payments to the credit. Dave is a banking app designed to help its more than 7 million members ease their financial minds. The dave credit building app utilizes advanced technologies to track credit scores, monitor financial activities, and provide personalized recommendations for improving. This is particularly useful for those. A credit check isn’t required to open a dave account. By reporting your rent payments to major credit bureaus, dave helps you improve your credit score. In fact, this cash advance app doesn’t even check your credit. Dave doesn’t run a hard or soft credit check or report your activity to the three major credit bureaus.Banking For Humans™ Dave Raises 110M, Launches CreditBuilding

Does Afterpay build credit? YouTube

The Ultimate Guide To Building Credit YouTube

BEST WAY TO BUILD CREDIT! (WHY IT'S SO IMPORTANT) YouTube

Dave Mobile Banking App Cash Advance, Budget, Build Credit

Building Credit Worksheets

How to use, understand, and build credit YouTube

How Long Does it Take To Build Credit Build Credit Fast YouTube

does dave app work with prepaid cards cabidoroegner99

How To Build Credit YouTube

Nope, Using Dave Won’t Affect Your Credit Score.

Does Dave Affect Your Credit?

The Service Typically Costs $100, But For Dave.

The App Helps You To Build Your Credit History.

Related Post: