Does Earnin Build Credit

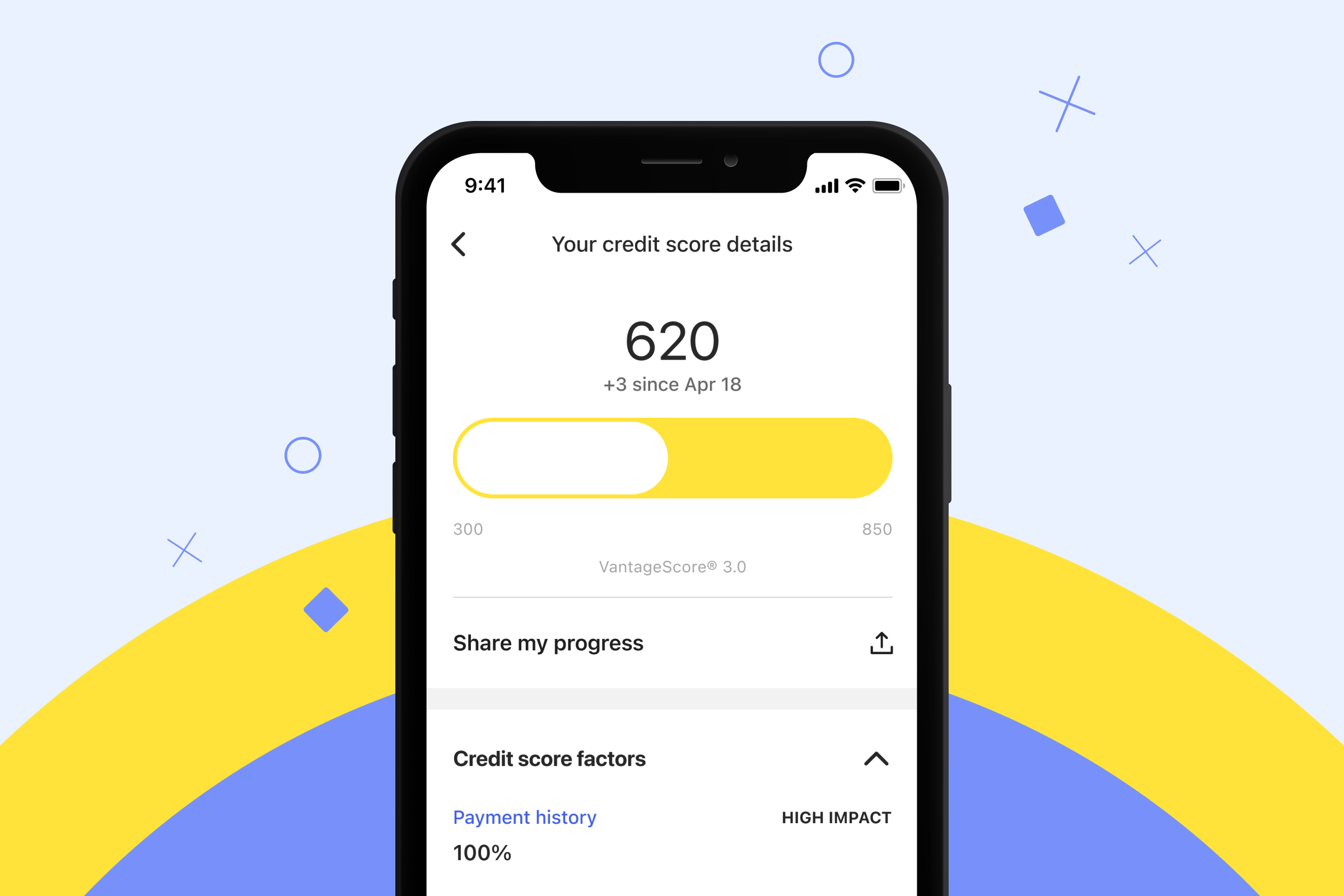

Does Earnin Build Credit - Earnin can deposit the borrowed funds directly into your cash app account for easy access. Using earnin also doesn’t help your credit score. How can earnin card help build my credit? We love this feature because earnin doesn't charge interest and there's no hard or soft credit check. According to the website, the company believes that “paychecks. Notably, this service doesn't involve hard or soft. Having good credit helps you secure loans with great terms and low interest rates, which can save you thousands of dollars. How does earnin card work? Earnin calculates the amount of money you can get by determining how often you work and what your salary is. Learn if the earnin app is right for you. According to the website, the company believes that “paychecks. Consider a personal credit card—that you use responsibly—to build your credit and boost your score. Earnin calculates the amount of money you can get by determining how often you work and what your salary is. Earnin also offers a credit monitoring feature at no cost. Earnin can deposit the borrowed funds directly into your cash app account for easy access. No credit score is required to qualify, but the lender does set an income minimum per pay period. Learn if the earnin app is right for you. How can earnin card help build my credit? How can earnin card help build my credit? Earnin is not a bank. Earnin calculates the amount of money you can get by determining how often you work and what your salary is. Get instant access to your vantage score 3.0® by. No credit score is required to qualify, but the lender does set an income minimum per pay period. Earnin is a free paycheck advance app that allows you to draw small. We love this feature because earnin doesn't charge interest and there's no hard or soft credit check. Earnin also offers a credit monitoring feature at no cost. But the perks of good credit go beyond loans,. Earnin’s credit monitoring tool lets you track your credit score 3 anytime, giving you access to your vantage score 3.0® by experian®. Consider a. As your payment history is reported to equifax over time, successful payments demonstrate creditworthiness and gradually improve your credit.** There's no interest, no credit check, and no mandatory fees. Brigit instant cash — great for building credit history and budgeting; Does earnin support cash app?. Instead, you connect the bank account where you receive your paychecks to earnin. Brigit instant cash — great for building credit history and budgeting; Does earnin support cash app?. Earnin calculates the amount of money you can get by determining how often you work and what your salary is. Earnin also offers a credit monitoring feature at no cost. Learn if the earnin app is right for you. Consider a personal credit card—that you use responsibly—to build your credit and boost your score. Notably, this service doesn't involve hard or soft. Whether you're just starting your credit journey, aiming to maintain your progress, or rebuilding after challenges, you can check your credit score any time with a single tap in the. We love this feature because earnin doesn't. Here’s a table outlining the pros and cons of the earnin app: Discover how to effectively build credit with a credit card through responsible use, selecting the right card, and understanding credit strategies. Earnin can deposit the borrowed funds directly into your cash app account for easy access. We love this feature because earnin doesn't charge interest and there's no. Earnin is not a bank. Using earnin also doesn’t help your credit score. We love this feature because earnin doesn't charge interest and there's no hard or soft credit check. When you monitor your credit with earnin,. How can earnin card help build my credit? How can earnin card help build my credit? Learn if the earnin app is right for you. Earnin calculates the amount of money you can get by determining how often you work and what your salary is. There's no interest, no credit check, and no mandatory fees. This sets it apart from traditional payday loans, which. This sets it apart from traditional payday loans, which. Earnin calculates the amount of money you can get by determining how often you work and what your salary is. Discover how to effectively build credit with a credit card through responsible use, selecting the right card, and understanding credit strategies. Notably, this service doesn't involve hard or soft. Brigit instant. Instead, you connect the bank account where you receive your paychecks to earnin. Earnin’s credit monitoring tool lets you track your credit score 3 anytime, giving you access to your vantage score 3.0® by experian®. How can earnin card help build my credit? According to the website, the company believes that “paychecks. Consider a personal credit card—that you use responsibly—to. According to the website, the company believes that “paychecks. But the perks of good credit go beyond loans,. We love this feature because earnin doesn't charge interest and there's no hard or soft credit check. Earnin’s credit monitoring tool lets you track your credit score 3 anytime, giving you access to your vantage score 3.0® by experian®. Here’s a table outlining the pros and cons of the earnin app: This sets it apart from traditional payday loans, which. Discover how to effectively build credit with a credit card through responsible use, selecting the right card, and understanding credit strategies. Does earnin support cash app?. When you monitor your credit with earnin,. Whether you're just starting your credit journey, aiming to maintain your progress, or rebuilding after challenges, you can check your credit score any time with a single tap in the. How can earnin card help build my credit? Earnin is not a bank. Learn if the earnin app is right for you. Notably, this service doesn't involve hard or soft. Brigit instant cash — great for building credit history and budgeting; There's no interest, no credit check, and no mandatory fees.2024 Earnin Review Pros, Cons, Features, Ratings & More Credit Summit

Does Earnin increase credit score? Leia aqui Does using Earnin help

How to Build Credit With a Credit Card 5 Steps EarnIn

Does Earnin increase credit score? Leia aqui Does using Earnin help

Track Your Credit Score for Free with EarnIn EarnIn

2024 Earnin Review Pros, Cons, Features, Ratings & More Credit Summit

What Are Tradelines, and How Do They Affect Your Credit? EarnIn

What Are Tradelines, and How Do They Affect Your Credit? EarnIn

Does Earnin hurt your credit? Leia aqui What is the downside of Earnin

How Does Earnin Make Money? Analyzing Its Business Model

Earnin Calculates The Amount Of Money You Can Get By Determining How Often You Work And What Your Salary Is.

How Does Earnin Card Work?

Earnin Also Offers A Credit Monitoring Feature At No Cost.

There Are No Mandatory Fees When Using Earnin.

Related Post: