Does Flex Build Credit

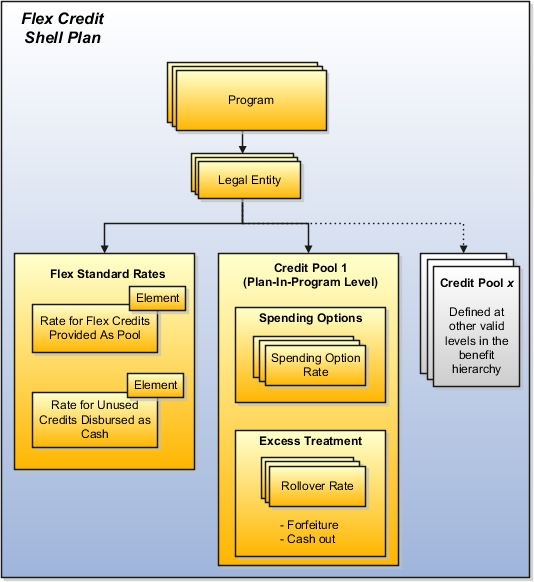

Does Flex Build Credit - Flex lets you split your rent into smaller payments, improving cash flow, and building your credit history with rent reporting. Credit builder is flex’s newest product designed to help you build your credit score. Hello , flex rent won’t help to build credit. How to find flex in your credit report: Flex allows you to pay over the month, better aligning your rent and finances. Flex establishes a line of credit for you and your line of credit is utilized to send your rent payment to your landlord. We’ll perform a soft credit. Monzo flex doesn’t even appear on my credit score. Flex rent reporting is an optional feature that is included in. If this were actually feasible, then flex would be of some use. Flex rent reporting is an optional feature that is included in. Credit builder helps improve your credit score by focusing on the four main parts that matter most: Benefits of flexible spending credit cards. Look for the “lead/flex credit builder” account. You pay a portion of the total rent upfront on the rent due date, and the remaining balance is financed. How to find flex in your credit report: Flex lets you split your rent into smaller payments, improving cash flow, and building your credit history with rent reporting. Your payment history, how much of your available credit you are using, how long you've had. Using and paying through the flex app can positively affect your credit score. You simply pay your regular monthly rent through credit builder. Every month, flex helps with paying your full rent directly to your property when it's due. Flexible rent uses an unsecured line of credit to defer a portion of your rent amount to later in the month. I don't think this does anything to build your credit. We then immediately pay it off using the rent payment you sent flex.. Credit builder uses a fully secured line of credit to pay your rent. Flex allows you to pay over the month, better aligning your rent and finances. Op wanted to know if they could use flex in a way to build their credit history by paying flex to pay their rent. By paying your rent through the line of credit. Flex is a monthly subscription that helps you pay rent on time, improve cash flow and build your credit history. Op wanted to know if they could use flex in a way to build their credit history by paying flex to pay their rent. Flexible rent uses an unsecured line of credit to defer a portion of your rent amount. Basically it's the same as having $1220 on a credit card and paying it off at the end of the month, only you're paying the equivalent of $15. I actually had searches from monzo for the past 3 weeks just for switching from premium to extra. I don't think this does anything to build your credit. You simply pay your. If this were actually feasible, then flex would be of some use. Feel free to safely and organically use 100% of your credit limit within a month and let whatever. Basically it's the same as having $1220 on a credit card and paying it off at the end of the month, only you're paying the equivalent of $15. Flex rent. Credit builder uses a fully secured line of credit to pay your rent. We’ll perform a soft credit. Benefits of flexible spending credit cards. Flexible rent uses an unsecured line of credit to defer a portion of your rent amount to later in the month. At no cost to you. Look for the “flexible finance” account under the subscriber “flex”. Flex lets you split your rent into smaller payments, improving cash flow, and building your credit history with rent reporting. At no cost to you. Every payment establishes your payment history, helping you build your future. Look for the “lead/flex credit builder” account. You pay a portion of the total rent upfront on the rent due date, and the remaining balance is financed. Basically it's the same as having $1220 on a credit card and paying it off at the end of the month, only you're paying the equivalent of $15. I actually had searches from monzo for the past 3 weeks just. Flex lets you split your rent into smaller payments, improving cash flow, and building your credit history with rent reporting. Using and paying through the flex app can positively affect your credit score. Credit builder uses a fully secured line of credit to pay your rent. It will show up on your credit report but not like a credit card. Every month, flex helps with paying your full rent directly to your property when it's due. Flex establishes a line of credit for you and your line of credit is utilized to send your rent payment to your landlord. You simply pay your regular monthly rent through credit builder. It will show up on your credit report but not like. Look for the “lead/flex credit builder” account. I actually had searches from monzo for the past 3 weeks just for switching from premium to extra. Look for the “flexible finance” account under the subscriber “flex”. If this were actually feasible, then flex would be of some use. Does flex rent build credit? If your property already utilizes another rent reporting service,. We’ll perform a soft credit. Flex lets you split your rent into smaller payments, improving cash flow, and building your credit history with rent reporting. I don't think this does anything to build your credit. These cards provide a safety net for large or unexpected purchases, reducing the risk of declined transactions. Hello , flex rent won’t help to build credit. You simply pay your regular monthly rent through credit builder. It acts as a revolving line of credit, just like a credit card, when it comes to your. It will show up on your credit report but not like a credit card or loan payments. Flexible rent uses an unsecured line of credit to defer a portion of your rent amount to later in the month. By paying your rent through the line of credit flex offers you, your on time payments will be reported to.Flex Credit Shell Plan Components

Flex HELOC Special 2024 Community 1st Credit Union

I like the look of my Nationwide FlexAccount card better than my old

Understanding Flex What Is Flex Credit On Pay Stub?

Supercharge Your Credit Union’s Lending with FLEX + Hart FLEX Credit

Flex Spending Account Limits 2024 Uk Zarla Kathryne

Cariere Team Manager FlexCredit

FLEX Completes Integration with CreditSnap FLEX Credit Union Technology

NEW Chase Freedom Flex Credit Card YouTube

Flex Spending Eligible Items 2024 Noni Thekla

Your Payment History, How Much Of Your Available Credit You Are Using, How Long You've Had.

Flex Allows You To Pay Over The Month, Better Aligning Your Rent And Finances.

Flex Rent Reporting Is An Optional Feature That Is Included In.

How To Find Flex In Your Credit Report:

Related Post: