Does Greenlight Card Build Credit

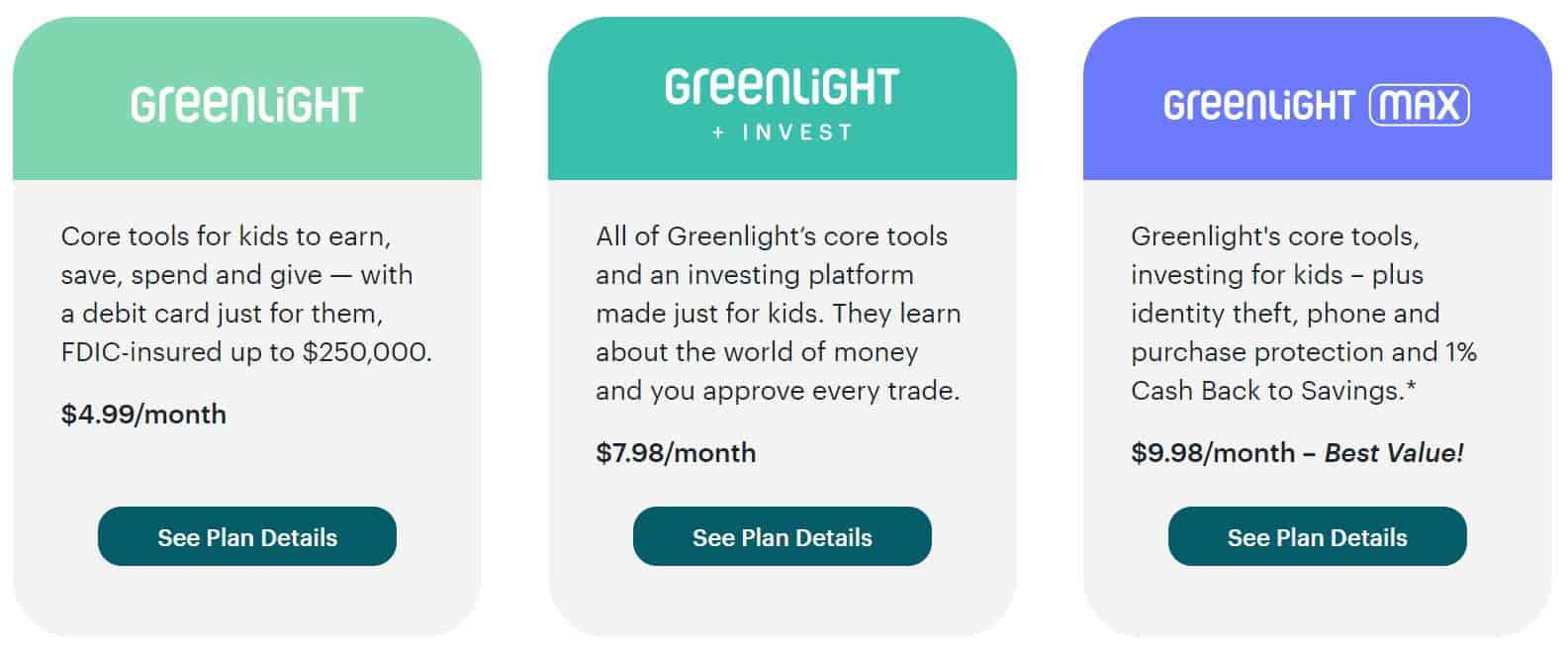

Does Greenlight Card Build Credit - One shortcoming of the greenlight debit card is its inability to contribute to building credit. Discover essential tips for using credit responsibly and choosing the right card for you. Our insights will help your family navigate the world of credit with confidence. To apply for your own credit card, you need to be 18 since it requires signing a legal contract. Unlock the secrets of building and maintaining good credit from an early age. Find out how to build your child’s credit so they’ll have a head start when they want to get a credit card of their own or apply for a school or car loan. Learn how credit cards work, from interest rates to rewards programs. Simply put, the greenlight card is a prepaid debit card for kids that connects directly to your bank account. Greenlight requires a monthly subscription fee and offers three paid plans. Greenlight may be for you. When teens are ready to buy a car or rent an apartment, good credit unlocks better interest rates, lower monthly payments, and more. Greenlight requires a monthly subscription fee and offers three paid plans. Find out how to build your child’s credit so they’ll have a head start when they want to get a credit card of their own or apply for a school or car loan. But that just scratches the surface! Simply put, the greenlight card is a prepaid debit card for kids that connects directly to your bank account. Developing responsible spending and saving habits from a young age is key to building good credit. Our greenlight card [1] review offers a closer look at how the card works. Plus, you'll even earn some cash. One shortcoming of the greenlight debit card is its inability to contribute to building credit. Discover essential tips for using credit responsibly and choosing the right card for you. Plus, you'll even earn some cash. One shortcoming of the greenlight debit card is its inability to contribute to building credit. Unlock the secrets of building and maintaining good credit from an early age. Our greenlight card [1] review offers a closer look at how the card works. Find out how to build your child’s credit so they’ll have a. Greenlight requires a monthly subscription fee and offers three paid plans. Designed to help teens build credit, the greenlight family cash card is a solid card that can give kids a head start on establishing credit. Learn how credit cards work, from interest rates to rewards programs. If you’re under 18, you can be added to a parent’s credit card. Greenlight requires a monthly subscription fee and offers three paid plans. Learn the pros, cons, fees, and more in this review. With the greenlight card, kids can spend, save and even invest securely all in one place. Developing responsible spending and saving habits from a young age is key to building good credit. Learn how credit cards work, from interest. The card allows children to earn,. Plus, you'll even earn some cash. Simply put, the greenlight card is a prepaid debit card for kids that connects directly to your bank account. With the greenlight card, kids can spend, save and even invest securely all in one place. But that just scratches the surface! Looking to teach your kids or tweens how banks and debit cards really work? Find out how to build your child’s credit so they’ll have a head start when they want to get a credit card of their own or apply for a school or car loan. Simply put, the greenlight card is a prepaid debit card for kids that. Greenlight may be for you. Looking to teach your kids or tweens how banks and debit cards really work? If you’re under 18, you can be added to a parent’s credit card as an authorized. Designed to help teens build credit, the greenlight family cash card is a solid card that can give kids a head start on establishing credit.. Looking to teach your kids or tweens how banks and debit cards really work? With the greenlight card, kids can spend, save and even invest securely all in one place. Our greenlight card [1] review offers a closer look at how the card works. Open bright opportunities by building credit. The card allows children to earn,. Designed to help teens build credit, the greenlight family cash card is a solid card that can give kids a head start on establishing credit. When teens are ready to buy a car or rent an apartment, good credit unlocks better interest rates, lower monthly payments, and more. Open bright opportunities by building credit. Our insights will help your family. When teens are ready to buy a car or rent an apartment, good credit unlocks better interest rates, lower monthly payments, and more. One shortcoming of the greenlight debit card is its inability to contribute to building credit. With the greenlight card, kids can spend, save and even invest securely all in one place. Learn how credit cards work, from. With the greenlight card, kids can spend, save and even invest securely all in one place. Unlock the secrets of building and maintaining good credit from an early age. Greenlight requires a monthly subscription fee and offers three paid plans. Open bright opportunities by building credit. Our greenlight card [1] review offers a closer look at how the card works. One shortcoming of the greenlight debit card is its inability to contribute to building credit. If you’re under 18, you can be added to a parent’s credit card as an authorized. Open bright opportunities by building credit. Simply put, the greenlight card is a prepaid debit card for kids that connects directly to your bank account. But that just scratches the surface! To apply for your own credit card, you need to be 18 since it requires signing a legal contract. Learn how credit cards work, from interest rates to rewards programs. Our greenlight card [1] review offers a closer look at how the card works. Developing responsible spending and saving habits from a young age is key to building good credit. Looking to teach your kids or tweens how banks and debit cards really work? Discover essential tips for using credit responsibly and choosing the right card for you. Find out how to build your child’s credit so they’ll have a head start when they want to get a credit card of their own or apply for a school or car loan. The greenlight app encourages this by allowing teens to set savings. With the greenlight card, kids can spend, save and even invest securely all in one place. Plus, you'll even earn some cash. The card allows children to earn,.Greenlight credit card with credit builder for teens

Does Greenlight build credit? Leia aqui What are the disadvantages of

Does Greenlight affect credit score? Leia aqui What are the

Greenlight Card Review Read This Before Signing Up! Arrest Your Debt

Greenlight’s new credit card helps teens, their parents build credit

Does Greenlight build credit? Leia aqui What are the disadvantages of

Does Greenlight build credit? Leia aqui What are the disadvantages of

Does Greenlight build credit? Leia aqui What are the disadvantages of

Greenlight Family Cash Card Lets Authorized Users Build Credit

Greenlight Launches Family Cash Card, The 3 Cash Back Credit Card For

When Teens Are Ready To Buy A Car Or Rent An Apartment, Good Credit Unlocks Better Interest Rates, Lower Monthly Payments, And More.

Designed To Help Teens Build Credit, The Greenlight Family Cash Card Is A Solid Card That Can Give Kids A Head Start On Establishing Credit.

Unlock The Secrets Of Building And Maintaining Good Credit From An Early Age.

Greenlight Offers Several Plans With Varying Features For $5.99, $9.98, And $14.98 Per Month That Allow Up To Five Authorized Users Of Any Age.

Related Post: