Does Having Your Name On A Lease Build Credit

Does Having Your Name On A Lease Build Credit - This is because a car lease is like a loan, and your credit history plays a major role in determining your eligibility. Leasing a car can help build your credit, but it also can hurt your credit score if you default on the loan. Breaking a lease doesn’t directly appear on your credit report, but unpaid rent or fees may lead to collections, which could harm your credit score. Learn more about how leasing a car can affect your credit history. A car lease is adding an installment loan to your credit mix. Leasing a car does affect your credit score and usually it can help you build credit. The answer is yes, leasing a car does affect your credit score. When considering whether leasing a car can build credit, it's important to understand how the payments are reported to credit bureaus. A score between 620 and 679 is. It will only affect your credit if you don’t pay your rent on time, and you get evicted. Building credit is a crucial aspect of financial health, influencing everything from loan approvals to interest rates. Breaking a lease doesn’t directly appear on your credit report, but unpaid rent or fees may lead to collections, which could harm your credit score. Statement date = the day that the cycle closed meaning what gets reported to credit bureaus that month. The answer is yes, leasing a car does affect your credit score. Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. Find out how to use autolease as a tool to help build credit. Can leasing a car help build credit? The typical minimum for most dealerships is 620. Yes, however, it can also ruin your credit score. Most leasing companies report the monthly lease. According to nerdwallet, the exact credit score you need to lease a car varies from dealership to dealership. This is because a car lease is like a loan, and your credit history plays a major role in determining your eligibility. Learn more about how leasing a car can affect your credit history. Building credit is a crucial aspect of financial. Learn more about how leasing a car can affect your credit history. Many people wonder whether having their name on a lease can contribute positively to their credit score, as rent payments are often one of the largest. Find out how to use autolease as a tool to help build credit. However, if you miss payments, it can be detrimental. Can leasing a car help build credit? The typical minimum for most dealerships is 620. Many people wonder whether having their name on a lease can contribute positively to their credit score, as rent payments are often one of the largest. Most leasing companies report the monthly lease. Car leasing agreements are reported to credit bureaus similarly to traditional auto. Leasing a car does affect your credit score and usually it can help you build credit. Leasing a car may have a positive impact on your credit scores, as long as you make all your monthly payments on time. It will only affect your credit if you don’t pay your rent on time, and you get evicted. Statement date =. A score between 620 and 679 is. Leasing a car may have a positive impact on your credit scores, as long as you make all your monthly payments on time. According to nerdwallet, the exact credit score you need to lease a car varies from dealership to dealership. Can leasing a car help build credit? A car lease is adding. The typical minimum for most dealerships is 620. According to nerdwallet, the exact credit score you need to lease a car varies from dealership to dealership. Yes, leasing a car does impact your credit, and in turn, your credit score. Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. Find out how to use autolease as. Can leasing a car help build credit? Breaking a lease doesn’t directly appear on your credit report, but unpaid rent or fees may lead to collections, which could harm your credit score. The answer is yes, leasing a car does affect your credit score. Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. A car lease. A score between 620 and 679 is. Breaking a lease doesn’t directly appear on your credit report, but unpaid rent or fees may lead to collections, which could harm your credit score. Can leasing a car help build credit? It will only affect your credit if you don’t pay your rent on time, and you get evicted. Many people wonder. According to nerdwallet, the exact credit score you need to lease a car varies from dealership to dealership. Building credit is a crucial aspect of financial health, influencing everything from loan approvals to interest rates. When considering whether leasing a car can build credit, it's important to understand how the payments are reported to credit bureaus. A car lease is. Learn more about how leasing a car can affect your credit history. Leasing a car may have a positive impact on your credit scores, as long as you make all your monthly payments on time. Yes, however, it can also ruin your credit score. Leasing a car can help build your credit, but it also can hurt your credit score. The answer is yes, leasing a car does affect your credit score. It will only affect your credit if you don’t pay your rent on time, and you get evicted. Many people wonder whether having their name on a lease can contribute positively to their credit score, as rent payments are often one of the largest. Leasing a car does affect your credit score and usually it can help you build credit. Yes, leasing a car does impact your credit, and in turn, your credit score. A score between 620 and 679 is. Building credit is a crucial aspect of financial health, influencing everything from loan approvals to interest rates. Leasing a car can help build your credit, but it also can hurt your credit score if you default on the loan. This is because a car lease is like a loan, and your credit history plays a major role in determining your eligibility. A car lease is adding an installment loan to your credit mix. Statement date = the day that the cycle closed meaning what gets reported to credit bureaus that month. Leasing a car may have a positive impact on your credit scores, as long as you make all your monthly payments on time. The typical minimum for most dealerships is 620. Find out how to use autolease as a tool to help build credit. According to nerdwallet, the exact credit score you need to lease a car varies from dealership to dealership. Learn more about how leasing a car can affect your credit history.Housing Guide The Basics of Interpreting and Signing a Lease Agreement

Does My Lease Need My Legal Name On It Online

Does Leasing a Car Build Credit? Self. Credit Builder.

Does Leasing a Car Build Credit? Self. Credit Builder.

Does Leasing a Car Build Credit? Credello

Does Leasing a Car Build Credit? The Answer Might Surprise You… — Grow

What Credit Score Do You Need to Lease A Car? Self. Credit Builder.

Leasehacking 101 A Guide to Reading a Lease Contract — LEASEHACKR

Does Leasing a Car Build Credit? Self. Credit Builder.

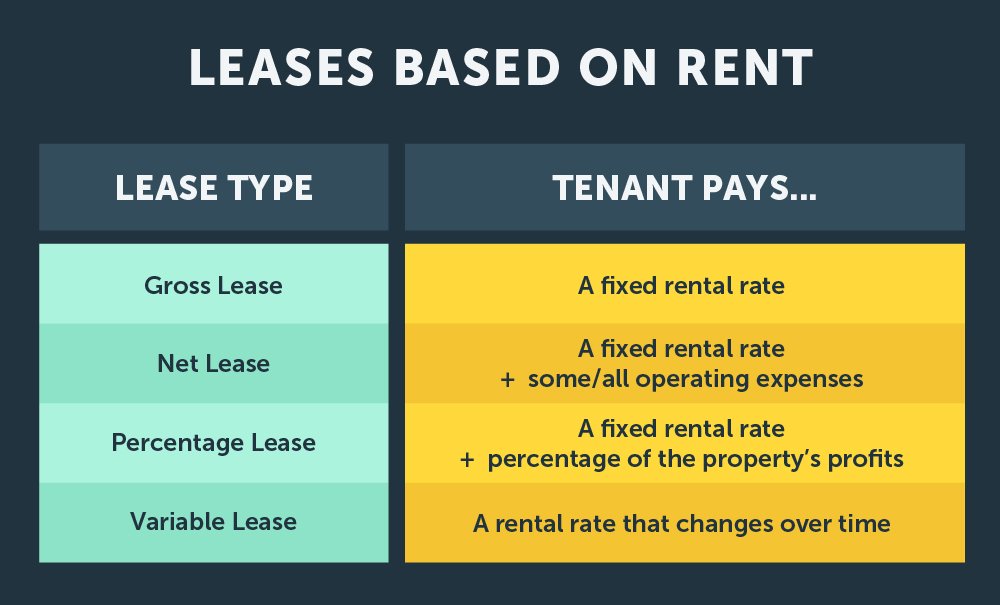

Which Type of Credit Is Used to Lease a Building DesiraehasFisher

Car Leasing Agreements Are Reported To Credit Bureaus Similarly To Traditional Auto Loans.

Breaking A Lease Doesn’t Directly Appear On Your Credit Report, But Unpaid Rent Or Fees May Lead To Collections, Which Could Harm Your Credit Score.

However, If You Miss Payments, It Can Be Detrimental To Your Credit.

Most Leasing Companies Report The Monthly Lease.

Related Post: