Does Katapult Help Build Credit

Does Katapult Help Build Credit - We understand that things come up in life. Please contact us via our chat service. One of the key features of katapult financing is that it does not require a credit check. Katapult and affirm both provide a safe, fast, and convenient way to buy car parts on credit. No, katapult does not affect your credit score. If you need help fixing your. If you were to make a purchase with katapult they could report the new account. Katapult does not make a hard inquiry for approvals, so there would be no affect to your credit from applying. By opting for katapult financing, consumers can spread out their payments into manageable installments, making larger purchases more affordable and accessible. They are a lease purchase plan that does not require a credit check and therefore has no. We are so happy you chose katapult as your financing option for your purchase and the process was easy for you to complete. Affirm offers a conventional financing option that allows you to buy your parts now and pay later. Does katapult affect your credit? No, katapult does not affect your credit score. By opting for katapult financing, consumers can spread out their payments into manageable installments, making larger purchases more affordable and accessible. Katapult financing doesn’t require a good credit score, making it accessible to everyone. Katapult and affirm both provide a safe, fast, and convenient way to buy car parts on credit. Yes, katapult conducts a soft credit inquiry when reviewing lease applications. We help you convert customers that would not normally be able to pay for the item in full, or would not pass a prime lending option’s traditional credit check, by providing an extremely fast,. If you were to make a purchase with katapult they could report the new account. We understand that things come up in life. One of the key features of katapult financing is that it does not require a credit check. Affirm offers a conventional financing option that allows you to buy your parts now and pay later. Yes, katapult conducts a soft credit inquiry when reviewing lease applications. Katapult financing doesn’t require a good credit. Affirm offers a conventional financing option that allows you to buy your parts now and pay later. If you were to make a purchase with katapult they could report the new account. They are a lease purchase plan that does not require a credit check and therefore has no. Katapult and affirm both provide a safe, fast, and convenient way. If you need help fixing your. They are a lease purchase plan that does not require a credit check and therefore has no. Does katapult affect your credit? Applying with katapult takes less than a minute and it won’t impact your fico score. By opting for katapult financing, consumers can spread out their payments into manageable installments, making larger purchases. This kind of credit check also referred to as a soft pull or inquiry,. They are a lease purchase plan that does not require a credit check and therefore has no. We understand that things come up in life. Yes, katapult conducts a soft credit inquiry when reviewing lease applications. Applying with katapult takes less than a minute and it. If you were to make a purchase with katapult they could report the new account. Katapult financing doesn’t require a good credit score, making it accessible to everyone. They are a lease purchase plan that does not require a credit check and therefore has no. Yes, katapult conducts a soft credit inquiry when reviewing lease applications. Applying with katapult takes. If you were to make a purchase with katapult they could report the new account. Katapult and affirm both provide a safe, fast, and convenient way to buy car parts on credit. They are a lease purchase plan that does not require a credit check and therefore has no. By opting for katapult financing, consumers can spread out their payments. If you need help fixing your. One of the key features of katapult financing is that it does not require a credit check. Applying with katapult takes less than a minute and it won’t impact your fico score. Does katapult affect your credit? They are a lease purchase plan that does not require a credit check and therefore has no. Katapult and affirm both provide a safe, fast, and convenient way to buy car parts on credit. By opting for katapult financing, consumers can spread out their payments into manageable installments, making larger purchases more affordable and accessible. If you were to make a purchase with katapult they could report the new account. One of the key features of katapult. No, katapult does not affect your credit score. Applying with katapult takes less than a minute and it won’t impact your fico score. Does katapult affect your credit? They are a lease purchase plan that does not require a credit check and therefore has no. We help you convert customers that would not normally be able to pay for the. This kind of credit check also referred to as a soft pull or inquiry,. Does katapult affect your credit? By opting for katapult financing, consumers can spread out their payments into manageable installments, making larger purchases more affordable and accessible. We help you convert customers that would not normally be able to pay for the item in full, or would. Katapult does not make a hard inquiry for approvals, so there would be no affect to your credit from applying. Yes, katapult conducts a soft credit inquiry when reviewing lease applications. No, katapult does not affect your credit score. We understand that things come up in life. One of the key features of katapult financing is that it does not require a credit check. By opting for katapult financing, consumers can spread out their payments into manageable installments, making larger purchases more affordable and accessible. Please contact us via our chat service. We help you convert customers that would not normally be able to pay for the item in full, or would not pass a prime lending option’s traditional credit check, by providing an extremely fast,. Affirm offers a conventional financing option that allows you to buy your parts now and pay later. We are so happy you chose katapult as your financing option for your purchase and the process was easy for you to complete. Katapult and affirm both provide a safe, fast, and convenient way to buy car parts on credit. If you need help fixing your. Applying with katapult takes less than a minute and it won’t impact your fico score. This kind of credit check also referred to as a soft pull or inquiry,.Does Katapult Check Credit? A Comprehensive Guide

Is affirm and Katapult the same? Leia aqui What credit score do you

How Does Katapult Financing Work? A Comprehensive Guide The

Is using Katapult worth it? Leia aqui Does Katapult help build credit

Is using Katapult worth it? Leia aqui Does Katapult help build credit

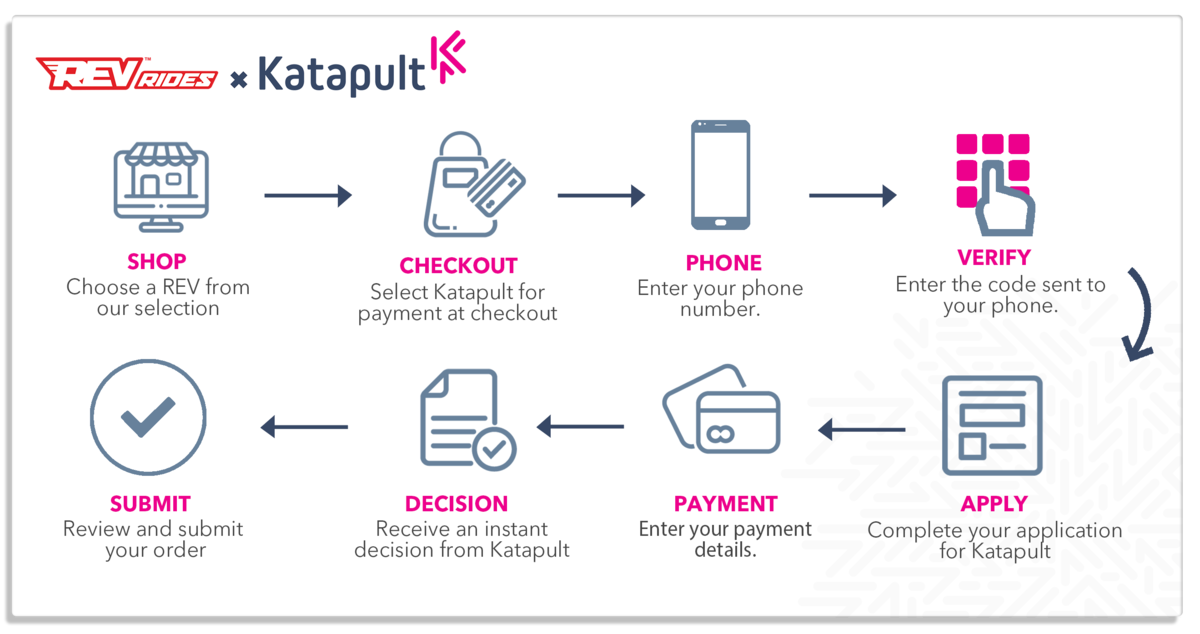

Finance with Katapult REVRides

Katapult Pay Virtual Card

Does Katapult Check Credit? A Comprehensive Guide

Is using Katapult worth it? Leia aqui Does Katapult help build credit

Is using Katapult worth it? Leia aqui Does Katapult help build credit

Does Katapult Affect Your Credit?

They Are A Lease Purchase Plan That Does Not Require A Credit Check And Therefore Has No.

Katapult Financing Doesn’t Require A Good Credit Score, Making It Accessible To Everyone.

If You Were To Make A Purchase With Katapult They Could Report The New Account.

Related Post: