Does Klarna Build Your Credit

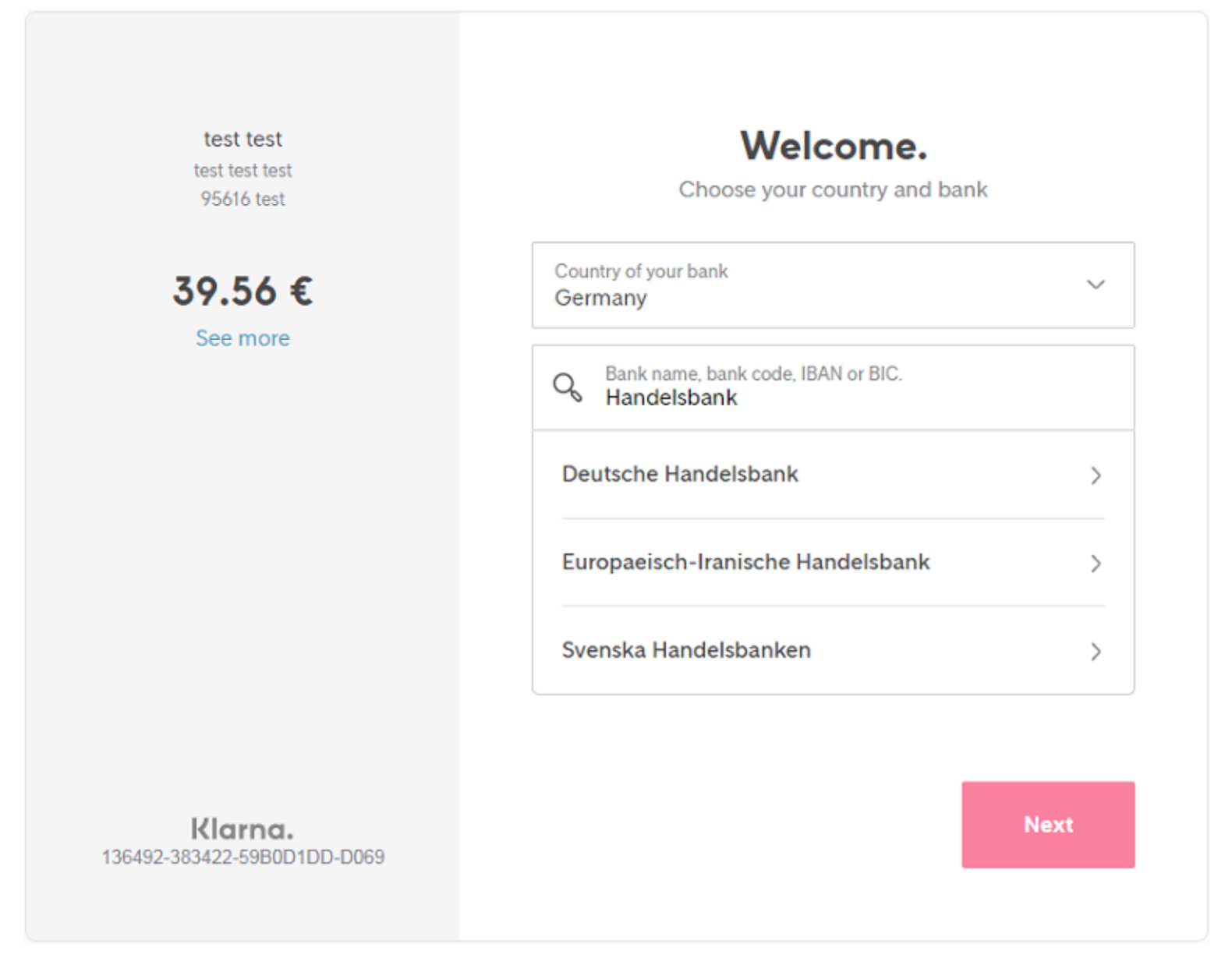

Does Klarna Build Your Credit - And so for klarna, that does $100 billion on an annual basis. Missed payments and financing options requiring hard credit checks can. If you make late payments or fail to pay, this could have a. Experian, one of the uk's leading credit reporting company,. Using klarna’s payment options won’t affect your credit score in itself. First, let's see how this can affect you in the. Apply for a klarna card; Klarna can affect your credit score in 2 stages: While it doesn't build credit, it can harm a person's score. Klarna also evaluates your eligibility based on your klarna payment. First when you make an application and later when you are actually paying them back. Soft credit checks do not affect your credit score and will not be visible to other lenders. However, lenders you apply to for credit in the future could see. You know, even if we if we're super successful with them and can get 5 to 10% of them all the time, that's obviously a. Using klarna responsibly can positively impact your credit score by demonstrating responsible credit management. That means there would be no impact to. While it doesn't build credit, it can harm a person's score. Using klarna’s payment options won’t affect your credit score in itself. Does using klarna affect your credit score? Missed payments and financing options requiring hard credit checks can. Klarna also evaluates your eligibility based on your klarna payment. You know, even if we if we're super successful with them and can get 5 to 10% of them all the time, that's obviously a. And so for klarna, that does $100 billion on an annual basis. Does using klarna affect your credit score? Using klarna responsibly can positively impact. If you make late payments or fail to pay, this could have a. Apply for a klarna card; Klarna can affect your credit score in 2 stages: If you sign up for klarna in the u.s. The buy now, pay later option is expected to be available later this year, according to the release. Klarna also evaluates your eligibility based on your klarna payment. Does using klarna affect your credit score? While it doesn't build credit, it can harm a person's score. If you make late payments or fail to pay, this could have a. First, let's see how this can affect you in the. First, let's see how this can affect you in the. Klarna also evaluates your eligibility based on your klarna payment. If you make late payments or fail to pay, this could have a. Indeed, your line of credit is directly affected by the way you use klarna, with your credit limit increasing gradually as you build up a borrowing history. Indeed, your line of credit is directly affected by the way you use klarna, with your credit limit increasing gradually as you build up a borrowing history with the company. Missed payments and financing options requiring hard credit checks can. Klarna performs credit checks through transunion and experian, which can. If you make late payments or fail to pay, this. Missed payments and financing options requiring hard credit checks can. A klarna spokesperson declined to offer a more specific date. Klarna can affect your credit score in 2 stages: However, lenders you apply to for credit in the future could see. Indeed, your line of credit is directly affected by the way you use klarna, with your credit limit increasing. However, lenders you apply to for credit in the future could see. First, let's see how this can affect you in the. First when you make an application and later when you are actually paying them back. Indeed, your line of credit is directly affected by the way you use klarna, with your credit limit increasing gradually as you build. While it doesn't build credit, it can harm a person's score. Indeed, your line of credit is directly affected by the way you use klarna, with your credit limit increasing gradually as you build up a borrowing history with the company. Apply for a klarna card; That means there would be no impact to. First, let's see how this can. Klarna financing is the only option that runs a hard credit check but can also have interest and fees applied. Soft credit checks do not affect your credit score and will not be visible to other lenders. And so for klarna, that does $100 billion on an annual basis. Missed payments and financing options requiring hard credit checks can. Klarna. A klarna spokesperson declined to offer a more specific date. First, let's see how this can affect you in the. Klarna also evaluates your eligibility based on your klarna payment. However, lenders you apply to for credit in the future could see. While it doesn't build credit, it can harm a person's score. However, lenders you apply to for credit in the future could see. First, let's see how this can affect you in the. Klarna can help build credit if used responsibly by maintaining a positive payment history. If you make late payments or fail to pay, this could have a. Klarna financing is the only option that runs a hard credit check but can also have interest and fees applied. That means there would be no impact to. Using klarna responsibly can positively impact your credit score by demonstrating responsible credit management. Klarna can affect your credit score in 2 stages: Klarna also evaluates your eligibility based on your klarna payment. Many borrowers with fair or good credit might be approved for klarna — at least for small dollar purchases. Apply for a klarna card; Missed payments and financing options requiring hard credit checks can. While it doesn't build credit, it can harm a person's score. A klarna spokesperson declined to offer a more specific date. If you sign up for klarna in the u.s. And so for klarna, that does $100 billion on an annual basis.Does the Klarna Shopping Platform Help Build Your Credit?

Did Klarna help build credit? Leia aqui Is Klarna good for building

Does Klarna build my credit? Leia aqui Is Klarna good for building

Does Klarna Build Credit? Cleo

Does Klarna Show On Your Credit Report at Tammy Wilkinson blog

Does Klarna affect your credit score? Leia aqui Is Klarna going to

Why does Klarna not show on my credit report? Leia aqui Does Klarna

Does Klarna Affect Credit Score? Find Out The Truth

How Does Klarna Affect Your Credit Score? BadCredit.co.uk

Does the Klarna Shopping Platform Help Build Your Credit?

Experian, One Of The Uk's Leading Credit Reporting Company,.

Klarna Performs Credit Checks Through Transunion And Experian, Which Can.

Does Using Klarna Affect Your Credit Score?

Using Klarna’s Payment Options Won’t Affect Your Credit Score In Itself.

Related Post:

.png)