Does Leasing A Car Build Credit

Does Leasing A Car Build Credit - This is important if you only have one other type of credit, such as. Yes, leasing a car does impact your credit, and in turn, your credit score. Edmunds lease calculator will help you estimate your monthly car payment on a new car or truck lease. Enter the vin of the vehicle the dealer quoted you. Where do i get the vin? There's no minimum credit score needed to get approved for a lease. Learn more about how leasing a car can affect your credit history. Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. The cost of leasing a used vehicle is likely to start around $100 a month and go up from there. A car lease is adding an installment loan to your credit mix. A car lease is adding an installment loan to your credit mix. Yes, leasing a car does impact your credit, and in turn, your credit score. As with new car leasing, it. Even with less than ideal credit, there are options that can allow you to lease a vehicle. This is important if you only have one other type of credit, such as. Where do i get the vin? Leasing a car can help you build credit just as an auto loan can. If you're thinking about a lease but don't have. Understanding the differences between buying and leasing is key to making an informed vehicle purchasing decision that makes the most sense for your finances, lifestyle, driving routine, and. Applicants with poor credit may be required to provide more money upfront in order to. Enter the vin of the vehicle the dealer quoted you. Understand the benefits, considerations, and best practices for using car leases as a tool for enhancing your creditworthiness. Learn more about how leasing a car can affect your credit history. Even with less than ideal credit, there are options that can allow you to lease a vehicle. This may help. Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. Leasing a car can help build your credit, but it also can hurt your credit score if you default on the loan. As with new car leasing, it. The cost of leasing a used vehicle is likely to start around $100 a month and go up from. Enter the vin of the vehicle the dealer quoted you. Every lender has its own credit score requirements. Edmunds lease calculator will help you estimate your monthly car payment on a new car or truck lease. Understanding the differences between buying and leasing is key to making an informed vehicle purchasing decision that makes the most sense for your finances,. Understand the benefits, considerations, and best practices for using car leases as a tool for enhancing your creditworthiness. Applicants with poor credit may be required to provide more money upfront in order to. This is important if you only have one other type of credit, such as. Every lender has its own credit score requirements. Yes, leasing a car does. If you're thinking about a lease but don't have. Leasing a car can help you build credit just as an auto loan can. How much does it cost to lease a used car? Even with less than ideal credit, there are options that can allow you to lease a vehicle. Learn more about how leasing a car can affect your. How much does it cost to lease a used car? Understanding the differences between buying and leasing is key to making an informed vehicle purchasing decision that makes the most sense for your finances, lifestyle, driving routine, and. If you're thinking about a lease but don't have. Edmunds lease calculator will help you estimate your monthly car payment on a. Yes, leasing a car does impact your credit, and in turn, your credit score. Leasing a car can help you build credit just as an auto loan can. Leasing a car can help build your credit, but it also can hurt your credit score if you default on the loan. Applicants with poor credit may be required to provide more. Applicants with poor credit may be required to provide more money upfront in order to. As with new car leasing, it. Yes, leasing a car does impact your credit, and in turn, your credit score. However, while auto loans are accessible to consumers across the credit spectrum, it can be difficult to get approved for a lease if your credit. Leasing a car can help build your credit, but it also can hurt your credit score if you default on the loan. As long as your leasing company reports to all three credit bureaus—experian, equifax and transunion—and all your payments are made in a timely manner, an auto lease can certainly. As with new car leasing, it. There's no minimum. However, while auto loans are accessible to consumers across the credit spectrum, it can be difficult to get approved for a lease if your credit score is less than stellar. Where do i get the vin? Enter the vin of the vehicle the dealer quoted you. How much does it cost to lease a used car? Even with less than ideal credit, there are options that can allow you to lease a vehicle. The cost of leasing a used vehicle is likely to start around $100 a month and go up from there. Understand the benefits, considerations, and best practices for using car leases as a tool for enhancing your creditworthiness. This is important if you only have one other type of credit, such as. There's no minimum credit score needed to get approved for a lease. Every lender has its own credit score requirements. A car lease is adding an installment loan to your credit mix. Edmunds lease calculator will help you estimate your monthly car payment on a new car or truck lease. If you're thinking about a lease but don't have. This may help you improve your credit scores in the long run. As with new car leasing, it. Understanding the differences between buying and leasing is key to making an informed vehicle purchasing decision that makes the most sense for your finances, lifestyle, driving routine, and.Does Leasing a Car Build Credit? Self. Credit Builder.

Does Leasing a Car Build Credit? The Answer Might Surprise You… — Grow

Does Leasing a Car Build Credit? Credello

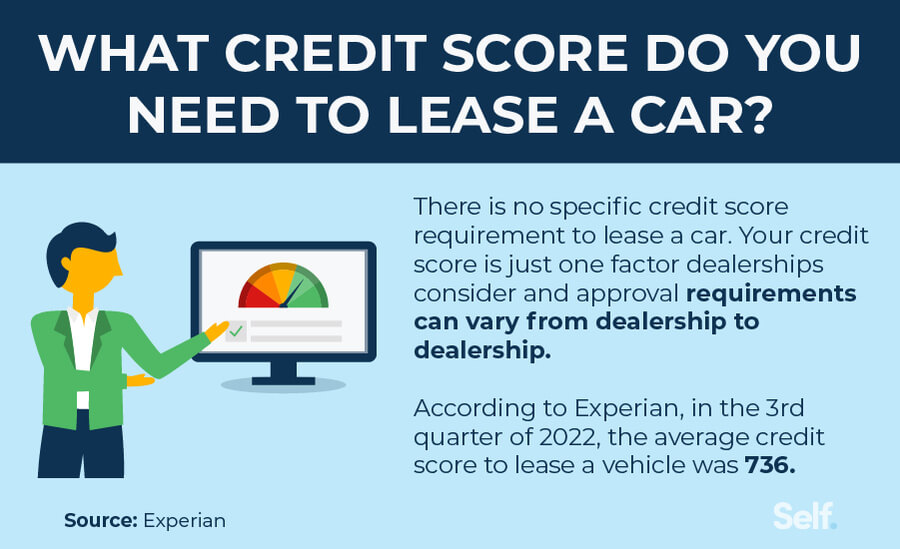

What Credit Score Do You Need to Lease A Car? Self. Credit Builder.

Does Leasing a Car Build Credit? Self. Credit Builder.

[Guide] Does Leasing a New Car Help Build Your Credit?

Does Leasing a Car Build Credit? Self. Credit Builder.

PPT What credit score do you need to lease a car? PowerPoint

Does Leasing a Car Build Credit? The Answer Might Surprise You… — Grow

Leasing A Car Can Help Build Your Credit, But It Also Can Hurt Your Credit Score If You Default On The Loan.

As Long As Your Leasing Company Reports To All Three Credit Bureaus—Experian, Equifax And Transunion—And All Your Payments Are Made In A Timely Manner, An Auto Lease Can Certainly.

Applicants With Poor Credit May Be Required To Provide More Money Upfront In Order To.

Learn More About How Leasing A Car Can Affect Your Credit History.

Related Post:

![[Guide] Does Leasing a New Car Help Build Your Credit?](https://creditbuildingtips.com/wp-content/uploads/2022/03/Does-Buying-a-Car-Impact-Credit.jpg)