Does Leasing A Vehicle Build Credit

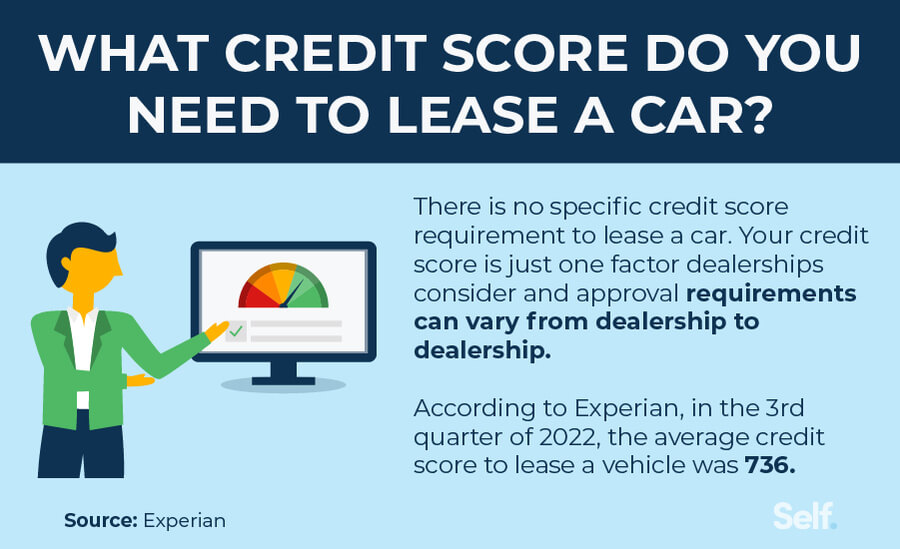

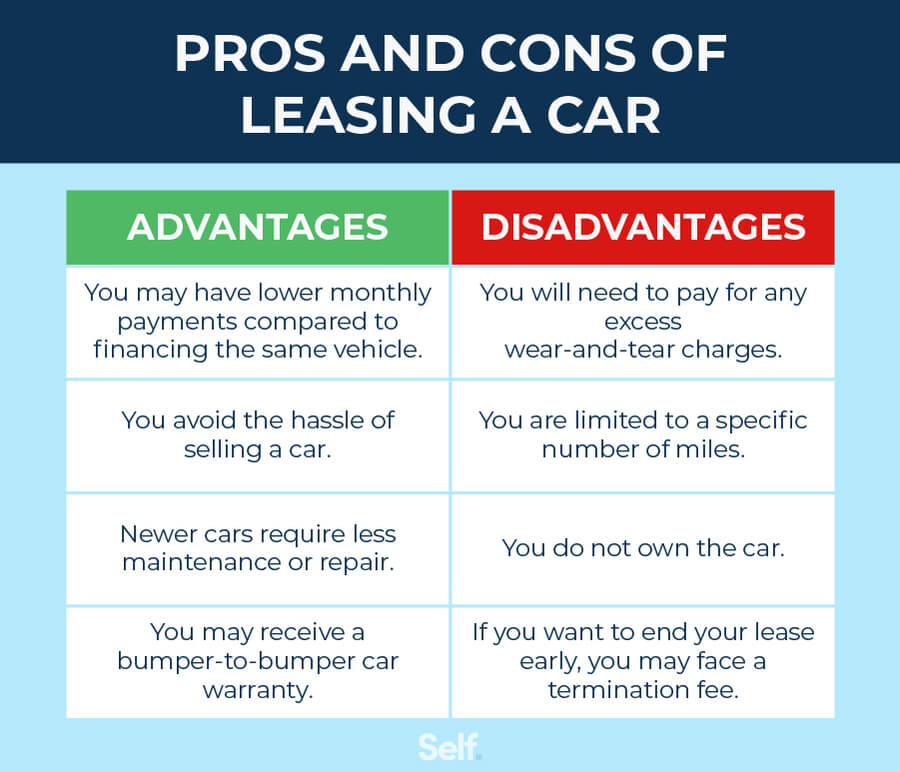

Does Leasing A Vehicle Build Credit - Leasing a car gives you the opportunity to build credit. This is partially because you have opened a new account on your credit, but it might also be the result of a. But this will only be the case if the vehicle exceeds the leasing company’s. Your payment history has a big impact on your credit scores. As with new car leasing, it. Leasing companies qualify for the credit and are required to pass the savings on to the consumer leasing the motor vehicle. • good credit, often 670+, is needed for leasing. Please contact your leasing company for more information on when. Learn more about how leasing a car can affect your credit history. Financing a car can help you build credit, as long as you manage the loan responsibly and the loan’s activity is reported to one of the major credit bureaus. But this will only be the case if the vehicle exceeds the leasing company’s. What does it mean to lease a car? Finding the car of your. If you miss your lease payments or default on the lease itself, it can cause your credit score to drop. Yes, leasing a car does impact your credit, and in turn, your credit score. Leasing a car gives you the opportunity to build credit. Your payment history has a big impact on your credit scores. Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. How much does it cost to lease a used car? Leasing a car can help build your credit, but it also can hurt your credit score if you default on the loan. Timely payments and a diverse credit mix are key factors that contribute to an improved credit history. However, while auto loans are accessible to consumers across the credit spectrum, it can be difficult to get approved for a lease if your credit score is less than stellar. Leasing a car gives you the opportunity to build credit. Yes, leasing a. What does it mean to lease a car? Learn more about how leasing a car can affect your credit history. Leasing companies qualify for the credit and are required to pass the savings on to the consumer leasing the motor vehicle. It's actually very normal for your credit score to drop after leasing a new car. Your payment history is. The answer isn’t nearly as complicated as you might think. As with new car leasing, it. Timely payments and a diverse credit mix are key factors that contribute to an improved credit history. This is partially because you have opened a new account on your credit, but it might also be the result of a. What does it mean to. • good credit, often 670+, is needed for leasing. How much does it cost to lease a used car? Financing a car can help you build credit, as long as you manage the loan responsibly and the loan’s activity is reported to one of the major credit bureaus. What does it mean to lease a car? Having bad credit can. However, is it worth it? How much does it cost to lease a used car? The ev must have a battery with a capacity of at least 7 kwh to qualify for the clean vehicle credit. But this will only be the case if the vehicle exceeds the leasing company’s. The cost of leasing a used vehicle is likely to. But this will only be the case if the vehicle exceeds the leasing company’s. As with new car leasing, it. Leasing a car can help build your credit, but it also can hurt your credit score if you default on the loan. However, is it worth it? You make monthly payments based on the vehicle’s depreciation during. • buying with an auto loan is an. Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. Leasing a car can help you build credit just as an auto loan can. It requires you to make monthly payments, expanding your payment history. However, while auto loans are accessible to consumers across the credit spectrum, it can. Finding the car of your. You make monthly payments based on the vehicle’s depreciation during. In the quest to build credit, leasing a car can positively impact if managed responsibly. The answer isn’t nearly as complicated as you might think. The cost of leasing a used vehicle is likely to start around $100 a month and go up from there. • good credit, often 670+, is needed for leasing. To anyone asking, ”does leasing a car build credit?” the answer is that leasing a vehicle can positively impact your credit score and even help you rebuild your credit. Yes, leasing a car does impact your credit, and in turn, your credit score. It requires you to make monthly payments, expanding. Just as much as leasing a car can build credit, it can also hurt your credit. Leasing a car gives you the opportunity to build credit. It requires you to make monthly payments, expanding your payment history. This is partially because you have opened a new account on your credit, but it might also be the result of a. It's. Leasing companies qualify for the credit and are required to pass the savings on to the consumer leasing the motor vehicle. The cost of leasing a used vehicle is likely to start around $100 a month and go up from there. • buying with an auto loan is an. This is partially because you have opened a new account on your credit, but it might also be the result of a. How much does it cost to lease a used car? You make monthly payments based on the vehicle’s depreciation during. Financing a car can help you build credit, as long as you manage the loan responsibly and the loan’s activity is reported to one of the major credit bureaus. But will leasing a vehicle build your credit as financing does? But this will only be the case if the vehicle exceeds the leasing company’s. However, while auto loans are accessible to consumers across the credit spectrum, it can be difficult to get approved for a lease if your credit score is less than stellar. Having bad credit can impact your ability to qualify for a car lease, affecting your ability to be eligible for a car loan. Leasing a car can help you build credit just as an auto loan can. Yes, leasing a car does impact your credit, and in turn, your credit score. The answer isn’t nearly as complicated as you might think. Please contact your leasing company for more information on when. It requires you to make monthly payments, expanding your payment history.What Credit Score Do You Need to Lease A Car? Self. Credit Builder.

What Credit Score Do You Need to Lease A Car? Self. Credit Builder.

Does Leasing a Car Build Credit? Self. Credit Builder.

Does Leasing a Car Build Credit? Credello

Does Leasing a Car Build Credit? Chase

Does Leasing a Car Build Credit? The Answer Might Surprise You… — Grow

Does Leasing a Car Build Credit? The Answer Might Surprise You… — Grow

Does Leasing a Car Build Credit? The Answer Might Surprise You… — Grow

Does Leasing a Car Build Credit? Self. Credit Builder.

Does Leasing a Car Build Credit? Self. Credit Builder.

Leasing A Car Could Also Help You Build Your Credit If You Make Your Payments On Time.

Leasing A Car Is Similar To Renting It For A Fixed Period, Usually Between 2 To 4 Years.

Learn More About How Leasing A Car Can Affect Your Credit History.

It's Actually Very Normal For Your Credit Score To Drop After Leasing A New Car.

Related Post: